Tri-Continental Corporation Declares Second Quarter Distribution

18 Mai 2023 - 3:00PM

Business Wire

Tri-Continental Corporation (the “Corporation”) (NYSE:

TY) today declared a second quarter ordinary income

distribution of $0.2864 per share of Common Stock and $0.6250 per

share of Preferred Stock. In addition, the Corporation declared a

total long-term capital gain distribution of $0.0434 per share of

Common Stock. Distributions on Common Stock will be paid on June

21, 2023 to Common Stockholders of record on June 12, 2023 and

dividends on Preferred Stock will be paid on July 3, 2023 to

Preferred Stockholders of record on June 12, 2023. The ex-dividend

date for both the Common Stock and the Preferred Stock is June 9,

2023. The $0.2864 per share ordinary income distribution and the

$0.0434 per share capital gain distribution on the Common Stock is

in accordance with the Corporation’s distribution policy. The

capital gain distribution, being a special distribution, will be

paid in stock except that any stockholder of record as of June 12,

2023, may elect to receive such distribution as follows: 75% in

shares and 25% in cash; 50% in shares and 50% in cash; or 100% in

cash.

The Corporation has paid dividends on its common stock for 79

consecutive years. The Corporation’s investment manager is Columbia

Management Investment Advisers, LLC, a wholly-owned subsidiary of

Ameriprise Financial, Inc.

The Corporation’s distributions on common stock will vary. The

Corporation’s current distributions (as estimated by the

Corporation based on current information) are from the earnings and

profits of the Corporation. No amount of the Corporation’s current

distribution consists of a return of capital (i.e., a return of

some or all of your original investment in the Corporation).

The net asset value of the Corporation’s common shares may not

always correspond to the market price of such shares. Shares of

many closed-end funds frequently trade at a discount from their net

asset value. An investment in the Corporation is subject to stock

market risk, which is the risk that market prices for the

Corporation’s common shares may decline over short or long periods,

adversely affecting the value of an investment in the

Corporation.

Securities selected for the Corporation using quantitative

methods may perform differently from the market as a whole, and

there can be no assurance that this methodology will enable it to

achieve its objective. The Corporation’s portfolio investments are

subject to market risk, which may affect a single issuer, sector of

the economy, industry or the market as a whole. Fixed-income

investments, including convertible securities, are subject to

credit risk, interest rate risk, and prepayment and extension risk.

These risks may be more pronounced for longer-term securities and

high-yield securities (“junk bonds”). In general, bond prices rise

when interest rates fall and vice versa. Convertible securities are

subject to both the risks of their security type prior to

conversion as well as their security type after conversion. The

Corporation’s use of leverage, including through its preferred

stock, exposes it to greater risks due to unanticipated market

movements, which may magnify losses and increase volatility of

returns.

You should consider the investment objectives, risks, charges,

and expenses of the Corporation carefully before investing. A

prospectus containing information about the Corporation (including

its investment objectives, risks, charges, expenses, and other

information) may be obtained by contacting your financial advisor

or Columbia Management Investment Services Corp. at 800-345-6611.

The prospectus can also be found on the Securities and Exchange

Commission’s EDGAR database. The prospectus should be read

carefully before investing in the Corporation. There is no

guarantee that the Corporation’s investment goals/objectives will

be met or that distributions will be made, and you could lose

money.

Tri-Continental Corporation is managed by Columbia Management

Investment Advisers, LLC. This material is distributed by Columbia

Management Investment Distributors, Inc., member FINRA.

Columbia Threadneedle Investments is the global brand name of

the Columbia and Threadneedle group of companies.

Past performance does not guarantee future results.

The Corporation is not insured by the FDIC, NCUA or any federal

agency, is not a deposit or obligation of, or guaranteed by any

financial institution, and involves investment risks including

possible loss of principal and fluctuation in value.

© 2023 Columbia Management Investment Advisers, LLC. All rights

reserved.

columbiathreadneedleus.com

Adtrax #5686252

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230518005509/en/

Stockholder contact: 800-345-6611, option 3 Media contact:

Carlos Melville 617-897-9384

carlos.melville@columbiathreadneedle.com

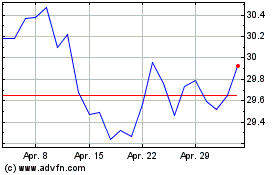

Tri Continental (NYSE:TY)

Historical Stock Chart

Von Dez 2024 bis Dez 2024

Tri Continental (NYSE:TY)

Historical Stock Chart

Von Dez 2023 bis Dez 2024