Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

30 Mai 2023 - 11:31PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-263192

Final Term Sheet

May 30,

2023

U.S.$2,750,000,000

AT&T Inc.

U.S.$2,750,000,000

5.400% GLOBAL NOTES DUE 2034

|

|

|

| ISSUER: |

|

AT&T Inc. (“AT&T”) |

|

|

| TITLE OF SECURITIES: |

|

5.400% Global Notes due 2034 (the “Notes”) |

|

|

| TRADE DATE: |

|

May 30, 2023 |

|

|

| SETTLEMENT DATE (T+3)*: |

|

June 2, 2023 |

|

|

| MATURITY DATE: |

|

February 15, 2034, at par |

|

|

| AGGREGATE PRINCIPAL AMOUNT OFFERED: |

|

$2,750,000,000 |

|

|

| PRICE TO PUBLIC (ISSUE PRICE): |

|

99.671% |

|

|

| GROSS SPREAD: |

|

0.400% |

|

|

| PRICE TO AT&T: |

|

99.271% |

|

|

| NET PROCEEDS: |

|

$2,729,952,500 |

|

|

| USE OF PROCEEDS: |

|

AT&T intends to use the net proceeds from this offering to fund an early redemption of all of the $750,000,000 aggregate amount outstanding of Floating Rate Global Notes due 2024 issued by AT&T and to repay, together with

cash on hand, AT&T’s outstanding 0.900% Global Notes due 2024 on or prior to their maturity date. |

A-1

|

|

|

|

|

| UNDERWRITERS’ REIMBURSEMENT OF AT&T’S EXPENSES: |

|

Underwriters to reimburse $1,300,000 of AT&T’s expenses. |

|

|

| INTEREST RATE: |

|

5.400% per annum |

|

|

| INTEREST PAYMENT DATES: |

|

Semiannually on each February 15 and August 15, commencing on August 15, 2023. |

|

|

| DENOMINATIONS: |

|

Minimum of $2,000 and integral multiples of $1,000 thereafter. |

|

|

| OPTIONAL REDEMPTION: |

|

The Notes may be redeemed at any time prior to November 15, 2033 as a whole or in part, at AT&T’s option, at any time and from time to time on at least 5 days’, but not more than 40 days’, prior notice at a

make-whole call equal to the greater of (i) 100% of the principal amount of the Notes to be redeemed or (ii) the sum of the present values of the remaining scheduled payments of principal and interest assuming the applicable Notes matured on

November 15, 2033 (not including any portion of payments of interest accrued as of the redemption date) discounted to the redemption date, on a semiannual basis (assuming a 360-day year consisting of

twelve 30-day months), at a rate equal to the sum of the Treasury rate plus 30 basis points, as calculated by AT&T. The Notes may be redeemed at any time on or after November 15, 2033 as a whole or in

part, at AT&T’s option, at any time and from time to time on at least 5 days’, but not more than 40 days’, prior notice at a redemption price equal to 100% of the principal amount of the Notes to be redeemed. Accrued interest but

unpaid will be payable to, but excluding, the redemption date. |

|

|

| TAX GROSS UP: |

|

Comparable to prior AT&T transactions. |

|

|

| TAX CALL: |

|

Comparable to prior AT&T transactions. |

IV-2

|

|

|

| INDENTURE AND RANKING: |

|

The Notes will be issued under an indenture, dated as of May 15, 2013, between AT&T and The Bank of New York Mellon Trust Company, N.A., as trustee. The Notes will be AT&T’s unsecured and unsubordinated obligations

and will rank pari passu with all other indebtedness issued under the indenture. |

|

|

| RATINGS: |

|

Moody’s: Baa2 (Stable) S&P: BBB

(Stable) Fitch: BBB+ (Stable) |

|

|

| JOINT BOOKRUNNERS: |

|

BNP Paribas Securities Corp. J.P. Morgan

Securities LLC Santander US Capital Markets LLC TD Securities

(USA) LLC Citigroup Global Markets Inc. BofA Securities,

Inc. Goldman Sachs & Co. LLC Morgan Stanley & Co.

LLC RBC Capital Markets, LLC Wells Fargo Securities,

LLC |

|

|

| SENIOR CO-MANAGERS: |

|

BNY Mellon Capital Markets, LLC CIBC World

Markets Corp. Regions Securities LLC Standard Chartered

Bank Truist Securities, Inc. U.S. Bancorp Investments,

Inc. |

|

|

| CO-MANAGERS: |

|

CastleOak Securities, L.P. Loop Capital Markets

LLC Drexel Hamilton, LLC MFR Securities, Inc.

AmeriVet Securities, Inc. Apto Partners, LLC

C.L. King & Associates, Inc. Roberts & Ryan

Inc. |

|

|

| CUSIP NUMBER: |

|

00206R MT6 |

|

|

| ISIN NUMBER: |

|

US00206RMT67 |

|

|

| REFERENCE DOCUMENT: |

|

Prospectus Supplement, dated May 30, 2023; and Prospectus, dated March 2, 2022 |

| * |

Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended,

trades in the secondary market generally are required to settle in two business days, unless the parties to the trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes on the date of pricing will be required, by virtue

of the fact that the Notes initially will settle in T+3, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement and should consult their own advisors. |

THE ISSUER HAS FILED A REGISTRATION STATEMENT (INCLUDING A PROSPECTUS) WITH THE SECURITIES AND EXCHANGE COMMISSION FOR THE OFFERING TO WHICH THIS

COMMUNICATION RELATES. BEFORE YOU INVEST, YOU SHOULD READ THE PROSPECTUS IN THAT REGISTRATION STATEMENT AND OTHER DOCUMENTS THE ISSUER HAS FILED WITH THE SEC FOR MORE COMPLETE INFORMATION ABOUT THE ISSUER AND THIS OFFERING. YOU MAY GET THESE

DOCUMENTS FOR FREE BY VISITING EDGAR ON THE SEC WEB SITE AT

IV-3

WWW.SEC.GOV. ALTERNATIVELY, THE ISSUER, ANY UNDERWRITER OR ANY DEALER PARTICIPATING IN THE OFFERING WILL ARRANGE TO SEND YOU THE PROSPECTUS IF YOU REQUEST IT BY CALLING BNP PARIBAS SECURITIES

CORP. AT 1-800-854-5674 (TOLL-FREE); J.P. MORGAN SECURITIES LLC AT

1-212-834-4533 (COLLECT), SANTANDER US CAPITAL MARKETS LLC AT 1-855-403-3636 (TOLL-FREE) AND TD SECURITIES (USA) LLC AT 1-855-495-9846

(TOLL-FREE).

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS

OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM. A SECURITIES RATING IS NOT A RECOMMENDATION TO BUY, SELL OR HOLD SECURITIES AND MAY BE REVISED OR WITHDRAWN AT ANY

TIME.

IV-4

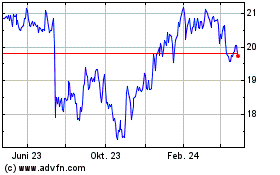

AT&T (NYSE:T-C)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

AT&T (NYSE:T-C)

Historical Stock Chart

Von Dez 2023 bis Dez 2024