- Funds seek to provide active management of digital asset

exposures to capitalize on market inefficiencies and evolving

trends in a rapidly transforming ecosystem

State Street Global Advisors, the asset management business of

State Street Corporation (NYSE: STT) today announced the

introduction of three actively managed digital asset and disruptive

technology focused ETFs sub-advised by Galaxy Asset Management, an

affiliate of Galaxy Digital Holdings Ltd. (TSX: GLXY) and one of

the world’s largest investment managers of digital assets and

blockchain exposures.

The SPDR® Galaxy Digital Asset Ecosystem ETF (DECO), SPDR®

Galaxy Hedged Digital Asset Ecosystem ETF (HECO) and SPDR® Galaxy

Transformative Tech Accelerators ETF (TEKX) seek to bring active

management to digital asset exposures to capitalize on market

inefficiencies and evolving trends in a rapidly changing digital

landscape.

“Digital assets and blockchain technology have the power to

transform financial markets as well as the economy over the next

decade, and a number of companies will grow and flourish thanks to

their contribution to this transformative technology,” said Anna

Paglia, chief business officer for State Street Global Advisors.

“Some investors are not comfortable with the short-term, volatile

price swings of single-currency crypto. We believe the next

evolution of this market is the introduction of actively managed

digital asset portfolios that help investors tap into the benefits

of diversification, which is appealing to a wider range of

investors, and why we are excited to bring these three products to

market.”

We believe an active approach to digital asset investing is

essential in order to fully capture the potential of this rapidly

changing technology. An active manager can help gain exposure to

cryptocurrencies as well as firms at the forefront of this

transformational technological change, all the while managing the

volatility profile of the strategy based on market trends.

“State Street Global Advisors’ strength in delivering ETF

solutions to investors coupled with Galaxy’s expertise in digital

assets is a compelling combination for investors looking to

navigate this rapidly changing digital asset market - an ecosystem

that extends beyond just cryptocurrencies themselves,” Paglia

added.

With the future of digital assets embodying cryptocurrencies,

tokens and the companies that operate in the blockchain and

surrounding ecosystem, such as semi-conductors, data warehouses and

miners, we are introducing three actively managed funds that will

focus on these markets:

The SPDR® Galaxy Digital Asset Ecosystem ETF (DECO) seeks to

provide long-term capital appreciation through an actively managed

portfolio of companies that are well positioned to benefit from the

growing adoption of the blockchain and digital asset industries, as

well as cryptocurrency exposures through ETFs and futures. DECO is

designed to help investors pursue potential growth from further

adoption of digital assets.

The SPDR® Galaxy Hedged Digital Asset Ecosystem ETF (HECO) seeks

to provide long-term capital appreciation through an actively

managed portfolio of companies that are well positioned to benefit

from the growing adoption of the blockchain and digital asset

industries as well as cryptocurrency exposures through ETFs and

futures. HECO is designed to manage volatility through the

incorporation of covered call options and protective put options on

investments held in the portfolio.

The SPDR® Galaxy Transformative Tech Accelerators ETF (TEKX)

seeks to provide long-term capital appreciation to investors

through an actively managed portfolio of companies within the value

chain supporting new disruptive technologies, which include but are

not limited to blockchain and artificial intelligence (AI). TEKX is

designed to help investors pursue a potential long-term secular

growth opportunity driven by the potential economic benefits from

new innovations.

"With the rapid evolution of digital assets and blockchain

technology, it’s crucial to have a dynamic approach to investing in

this asset class. Our new suite of actively managed ETFs allows

investors to capitalize on the opportunities within this

transformative space while managing the inherent volatility,” said

Chris Rhine, Head of Liquid Active Strategies at Galaxy and lead

portfolio manager of the three ETFs. “By integrating Galaxy's deep

expertise in digital assets with State Street's robust ETF

infrastructure, we're positioned to deliver long-term value in a

market that is reshaping the future of finance."

For more information on these SPDR ETFs visit www.ssga.com.

About State Street Global Advisors

For four decades, State Street Global Advisors has served the

world’s governments, institutions, and financial advisors. With a

rigorous, risk-aware approach built on research, analysis, and

market-tested experience, we build from a breadth of index and

active strategies to create cost-effective solutions. As pioneers

in index and ETF investing, we are always inventing new ways to

invest. As a result, we have become the world’s fourth-largest

asset manager* with US $4.37 trillion† under our care.

*Pensions & Investments Research Center, as of 12/31/23.

†This figure is presented as of June 30, 2024 and includes ETF

AUM of $1,393.92 billion USD of which approximately $69.35 billion

USD is in gold assets with respect to SPDR products for which State

Street Global Advisors Funds Distributors, LLC (SSGA FD) acts

solely as the marketing agent. SSGA FD and State Street Global

Advisors are affiliated. Please note all AUM is unaudited.

Important Risk Information

Investing involves risk including the risk of loss of

principal.

The information provided does not constitute investment advice

and it should not be relied on as such. It should not be considered

a solicitation to buy or an offer to sell a security. It does not

take into account any investor's particular investment objectives,

strategies, tax status or investment horizon. You should consult

your tax and financial advisor.

The whole or any part of this work may not be reproduced, copied

or transmitted or any of its contents disclosed to third parties

without SSGA’s express written consent.

All information is from SSGA unless otherwise noted and has been

obtained from sources believed to be reliable, but its accuracy is

not guaranteed. There is no representation or warranty as to the

current accuracy, reliability or completeness of, nor liability

for, decisions based on such information and it should not be

relied on as such.

ETFs trade like stocks, are subject to investment risk,

fluctuate in market value and may trade at prices above or below

the ETFs’ net asset value. Brokerage commissions and ETF expenses

will reduce returns.

Frequent trading of ETFs could significantly increase

commissions and other costs such that they may offset any savings

from low fees or costs.

Equity securities may fluctuate in value and can decline

significantly in response to the activities of individual companies

and general market and economic conditions.

Non-diversified funds that focus on a relatively small number of

securities tend to be more volatile than diversified funds and the

market as a whole.

The Fund may invest in companies within the cryptocurrency,

digital asset and blockchain industries that use digital asset

technologies or provide products or services involved in the

operation of the technology. The technology relating to digital

assets, including blockchains and cryptocurrency, is new and

developing and the risks associated with digital assets may not

fully emerge until the technology is widely used. The effectiveness

of the Fund’s strategy may be limited given that the operations of

companies in the cryptocurrency, digital asset and blockchain

industries are expected to be significantly affected by the overall

sentiment related to the technology and digital assets, and that

the companies’ stock prices and the prices of digital assets could

be highly correlated. Certain features of digital asset

technologies, such as decentralization, open source protocol, and

reliance on peer-to-peer connectivity, may increase the risk of

fraud or cyber-attack. Restrictions imposed by governments on

digital asset related activities may adversely impact blockchain

companies and, in turn, the Fund. Companies within the

cryptocurrency, digital asset and blockchain industries may also be

impacted by the risks associated with digital asset markets

generally.

The Fund may invest in companies that rely on technologies such

as the Internet and depend on computer systems to perform business

and operational functions, and therefore may be prone to

operational and information security risks resulting from

cyber-attacks and/or technological malfunctions. Successful

cyber-attacks against, or security breakdowns of, a company

included in the Fund’s portfolio may result in material adverse

consequences for such company, as well as other companies included

in the portfolio, and may cause the Fund’s investments to lose

value.

Concentrated investments in a particular industry tend to be

more volatile than the overall market and increases risk that

events negatively affecting such industries could reduce returns,

potentially causing the value of the Fund’s shares to decrease.

The value of certain of the Fund’s investments in cryptocurrency

ETFs and ETPs that invest in crypto assets and in publicly traded

securities of companies engaged in digital asset-related businesses

and activities are subject to fluctuations in the value of the

crypto asset, which may be highly volatile. The market for crypto

asset futures contracts may be less developed, and potentially less

liquid and more volatile, than more established futures

markets.

The Fund’s use of options involves speculation and can lead to

losses because of adverse movements in the price or value of the

underlying stock, index, ETF, ETP or other asset, which may be

magnified by certain features of the options. The Fund’s successful

use of options depends on the ability of the Adviser to forecast

market movements correctly.

Companies that provide products or services that are supporting

or accelerating the disruptive potential of novel technologies

(“Transformative Tech Accelerators”) are engaged in emerging

industries and/or new technologies that may be unproven.

Transformative Tech Accelerators are vulnerable to rapid changes in

product cycles, and may have limited product lines, markets,

financial resources or personnel. Companies that rely heavily on

technology tend to be more volatile than the overall market and are

subject to additional risks specific to their industries.

The Fund is actively managed. The sub-adviser’s judgments about

the attractiveness, relative value, or potential appreciation of a

particular sector, security, commodity or investment strategy may

prove to be incorrect, and may cause the Fund to incur losses.

There can be no assurance that the sub-adviser’s investment

techniques and decisions will produce the desired results.

Distributor: State Street Global Advisors Funds

Distributors, LLC, member FINRA, SIPC, an indirect wholly owned

subsidiary of State Street Corporation. References to State Street

may include State Street Corporation and its affiliates. Certain

State Street affiliates provide services and receive fees from the

SPDR ETFs. State Street Global Advisors Funds Distributors, LLC is

the distributor for certain registered products on behalf of the

advisor. SSGA Funds Management has retained Galaxy Digital Capital

Management LP (“Galaxy Digital”) as the sub-adviser. State Street

Global Advisors Funds Distributors, LLC is not affiliated with

Galaxy Digital.

Before investing, consider the funds’ investment objectives,

risks, charges and expenses. To obtain a prospectus or summary

prospectus which contains this and other information, call

1-866-787-2257 or visit ssga.com. Read it carefully.

Not FDIC Insured - No Bank Guarantee - May Lose Value

State Street Global Advisors Fund Distributors, LLC,

member FINRA, SIPC

© 2024 State Street Corporation. All Rights Reserved. State

Street Global Advisors Funds Distributors, LLC, One Iron Street,

Boston, MA 02210

6769490.2.1.AM.RTL Exp. Date: 09/30/2025

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240906344607/en/

Deborah Heindel 617-662-9927 dheindel@statestreet.com

Galaxy Michael Wursthorn +1 917 371 2132 media@galaxy.com

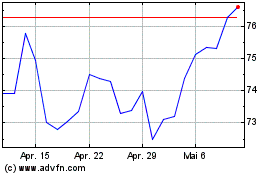

State Street (NYSE:STT)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

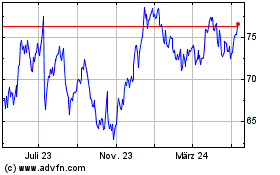

State Street (NYSE:STT)

Historical Stock Chart

Von Nov 2023 bis Nov 2024