STERIS plc (NYSE: STE) (“STERIS” or the “Company”) announced

today that it will host a conference call to discuss its fiscal

2025 first quarter financial results at 9:00 a.m. ET on August 7,

2024. The conference call can be heard live at www.steris-ir.com or

via phone by dialing 1-833-535-2199 in the United States or

1-412-902-6776 internationally, then asking to join the conference

call for STERIS plc.

A press release detailing financial results will be issued after

the U.S. market closes on August 6, 2024.

For those unable to listen to the conference call live, a replay

will be available beginning at 12:00 p.m. ET on August 7, 2024,

either at www.steris-ir.com or via phone. To access the replay of

the call, please use the access code 5644736 and dial

1-877-344-7529 in the United States or 1-412-317-0088

internationally.

About STERIS

STERIS is a leading global provider of products and services

that support patient care with an emphasis on infection prevention.

WE HELP OUR CUSTOMERS CREATE A HEALTHIER AND SAFER WORLD by

providing innovative healthcare and life sciences products and

services. For more information, visit

www.steris.com.

Company Contact:

Julie Winter, Vice President, Investor Relations and Corporate

Communications

Julie_Winter@steris.com

+1.440.392.7245

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION

This release and the referenced conference call may contain

statements concerning certain trends, expectations, forecasts,

estimates, or other forward-looking information affecting or

relating to STERIS or its industry, products or activities that are

intended to qualify for the protections afforded “forward-looking

statements” under the Private Securities Litigation Reform Act of

1995 and other laws and regulations. Forward-looking statements

speak only as to the date the statement is made and may be

identified by the use of forward-looking terms such as “may,”

“will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,”

“projects,” “targets,” “forecasts,” “outlook,” “impact,”

“potential,” “confidence,” “improve,” “optimistic,” “deliver,”

“orders,” “backlog,” “comfortable,” “trend,” and “seeks,” or the

negative of such terms or other variations on such terms or

comparable terminology. Many important factors could cause actual

results to differ materially from those in the forward-looking

statements including, without limitation, statements related to the

expected benefits of and timing of completion of the Restructuring

Plan, disruption of production or supplies, changes in market

conditions, political events, pending or future claims or

litigation, competitive factors, technology advances, actions of

regulatory agencies, and changes in laws, government regulations,

labeling or product approvals or the application or interpretation

thereof. Many of these important factors are outside of STERIS’s

control. No assurances can be provided as to any result or the

timing of any outcome regarding matters described in STERIS’s

securities filings or otherwise with respect to any regulatory

action, administrative proceedings, government investigations,

litigation, warning letters, cost reductions, business strategies,

earnings or revenue trends or future financial results. References

to products are summaries only and should not be considered the

specific terms of the product clearance or literature. Unless

legally required, STERIS does not undertake to update or revise any

forward-looking statements even if events make clear that any

projected results, express or implied, will not be realized. Other

potential risks and uncertainties that could cause actual results

to differ materially from those in the forward-looking statements

include, without limitation, (a) the impact of public health crises

on STERIS’s operations, supply chain, material and labor costs,

performance, results, prospects, or value, (b) STERIS's ability to

achieve the expected benefits regarding the accounting and tax

treatments of the redomiciliation to Ireland, (c) operating costs,

Customer loss and business disruption (including, without

limitation, difficulties in maintaining relationships with

employees, Customers, clients or suppliers) being greater than

expected, (d) STERIS’s ability to successfully integrate acquired

businesses into its existing businesses, including unknown or

inestimable liabilities, impairments, or increases in expected

integration costs or difficulties in connection with the

integration of such businesses, (e) uncertainties related to tax

treatments under the TCJA and the IRA, (f) the possibility that

Pillar Two Model Rules could increase tax uncertainty and adversely

impact STERIS's provision for income taxes and effective tax rate

and subject STERIS to additional income tax in jurisdictions who

adopt Pillar Two Model Rules, (g) STERIS's ability to continue to

qualify for benefits under certain income tax treaties in light of

ratification of more strict income tax treaty rules (through the

MLI) in many jurisdictions where STERIS has operations, (h) changes

in tax laws or interpretations that could increase our consolidated

tax liabilities, including changes in tax laws that would result in

STERIS being treated as a domestic corporation for United States

federal tax purposes, (i) the potential for increased pressure on

pricing or costs that leads to erosion of profit margins, including

as a result of inflation, (j) the possibility that market demand

will not develop for new technologies, products or applications or

services, or business initiatives will take longer, cost more or

produce lower benefits than anticipated, (k) the possibility that

application of or compliance with laws, court rulings,

certifications, regulations, or regulatory actions, including

without limitation any of the same relating to FDA, EPA or other

regulatory authorities, government investigations, the outcome of

any pending or threatened FDA, EPA or other regulatory warning

notices, actions, requests, inspections or submissions, the outcome

of any pending or threatened litigation brought by private parties,

or other requirements or standards may delay, limit or prevent new

product or service introductions, affect the production, supply

and/or marketing of existing products or services, result in costs

to STERIS that may not be covered by insurance, or otherwise affect

STERIS’s performance, results, prospects or value, (l) the

potential of international unrest, including the Russia-Ukraine or

Israel-Hamas military conflicts, economic downturn or effects of

currencies, tax assessments, tariffs and/or other trade barriers,

adjustments or anticipated rates, raw material costs or

availability, benefit or retirement plan costs, or other regulatory

compliance costs, (m) the possibility of reduced demand, or

reductions in the rate of growth in demand, for STERIS’s products

and services, (n) the possibility of delays in receipt of orders,

order cancellations, or delays in the manufacture or shipment of

ordered products, due to supply chain issues or otherwise, or in

the provision of services, (o) the possibility that anticipated

growth, cost savings, new product acceptance, performance or

approvals, or other results may not be achieved, or that

transition, labor, competition, timing, execution, impairments,

regulatory, governmental, or other issues or risks associated with

STERIS’s businesses, industry or initiatives including, without

limitation, those matters described in STERIS's various securities

filings, may adversely impact STERIS’s performance, results,

prospects or value, (p) the impact on STERIS and its operations, or

tax liabilities, of Brexit or the exit of other member countries

from the EU, and the Company’s ability to respond to such impacts,

(q) the impact on STERIS and its operations of any legislation,

regulations or orders, including but not limited to any new trade

or tax legislation (including CAMT and excise tax on stock

buybacks), regulations or orders, that may be implemented by the

U.S. administration or Congress, or of any responses thereto, (r)

the possibility that anticipated financial results or benefits of

recent acquisitions, of STERIS’s restructuring efforts, or of

recent divestitures, including anticipated revenue, productivity

improvement, cost savings, growth synergies and other anticipated

benefits, will not be realized or will be other than anticipated,

(s) the level of STERIS’s indebtedness limiting financial

flexibility or increasing future borrowing costs, (t) rating agency

actions or other occurrences that could affect STERIS’s existing

debt or future ability to borrow funds at rates favorable to STERIS

or at all, (u) the effects of changes in credit availability and

pricing, as well as the ability of STERIS’s Customers and suppliers

to adequately access the credit markets, on favorable terms or at

all, when needed, and (v) the possibility that our expectations

about the pre-tax savings resulting from the Restructuring Plan,

the number of positions eliminated pursuant to the Restructuring

Plan and the costs, charges and cash expenditures associated with

the announced restructuring plan may not be realized on the

timeline or timelines we expect, or at all.

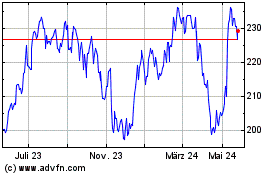

STERIS (NYSE:STE)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

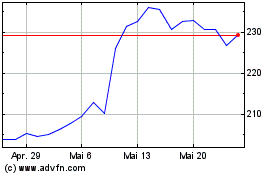

STERIS (NYSE:STE)

Historical Stock Chart

Von Dez 2023 bis Dez 2024