Spirit AeroSystems Buys Bombardier Wing-Making Unit -- Update

31 Oktober 2019 - 11:17PM

Dow Jones News

By Doug Cameron

Spirit AeroSystems Holdings Inc. agreed to buy an aircraft

components business from Bombardier Inc., as the supplier works to

expand its customer base beyond Boeing Co.'s troubled 737 MAX.

Spirit is paying $1.1 billion for Bombardier facilities in

Northern Ireland, Morocco and Texas that make parts for the Airbus

SE A320 and A220 jets, helping cushion the disruption from the

grounding and slowed production of the MAX.

Spirit is the largest supplier on the Boeing jet. The company is

making parts and fuselages for 52 MAX aircraft each month, even

though Boeing has cut its production level for the MAX back to 42 a

month.

Chief Executive Tom Gentile told analysts it could remain at

that rate next year -- and maybe into 2021 -- but would prefer

Boeing to freeze output rather than slow production if delays in

securing regulatory approval pushed back the return of the MAX.

Boeing is storing finished jets while it works with regulators

in the U.S. and around the world to approve changes to the

plane.

The MAX was grounded globally in March after the second of two

fatal crashes in some five months. Most MAX suppliers have

continued to provide parts at Boeing's current 42-a-month assembly

rate, even as the company builds up a backlog of more than 300

undelivered planes.

The MAX accounts for an estimated 50% of Spirit's annual sales.

A former Boeing unit, Spirit was spun off in 2006 and remains

heavily tied to work on the workhorse jet and the 787

Dreamliner.

Buying the Bombardier assets, part of the Canadian company's

breakup of its aerospace business, is part of a three-pronged

strategy at Spirit to secure more business at Airbus, expand work

on military aircraft and helicopters and build up non-U.S.

operations.

The purchase of the wing-making facility in Belfast gives Spirit

access to the Airbus A220 program bought from Bombardier as well as

the potential for work on the next generation of single-aisle

jets.

The company said it would continue making fuselages and other

parts for the MAX at the same rate of 52 a month, but the grounding

derailed plans to boost monthly output to 57 in the summer,

weighing on costs and profits.

Spirit said its profit fell to $131 million from $169 million

for the latest quarter, shy of analysts' expectations. Sales rose

6% to $1.92 billion.

Spirit shares closed Thursday up 3.5% at $81.82.

--Colin Kellaher contributed to this article.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

October 31, 2019 18:02 ET (22:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

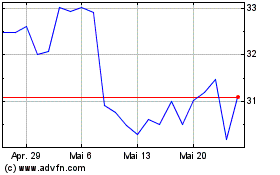

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024