Current Report Filing (8-k)

07 August 2014 - 11:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2014

Spirit AeroSystems Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-33160 |

|

20-2436320 |

|

(State or other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

3801 South Oliver, Wichita, Kansas |

|

67210 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (316) 526-9000

N/A

(Former name or former address if changed since last

report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01 Other Events.

On August 7, 2014, Spirit AeroSystems Holdings, Inc. issued a press release announcing a secondary offering of its class A common stock by certain selling stockholders. A copy of the press release is attached as Exhibit 99.1 to this report.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number |

|

Description of Exhibit |

|

|

|

|

|

99.1 |

|

Press Release of Spirit AeroSystems Holdings, Inc., dated August 7, 2014. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SPIRIT AEROSYSTEMS HOLDINGS, INC. |

|

|

|

|

|

|

|

Date: August 7, 2014 |

/s/ Jon D. Lammers |

|

|

Jon D. Lammers |

|

|

Senior Vice President, General Counsel and Secretary |

3

Exhibit 99.1

Spirit AeroSystems Announces Public Stock Offering by Existing Equity Holders

WICHITA, Kan., August 7, 2014 — Spirit AeroSystems Holdings, Inc. [NYSE: SPR] (the “Company”) today announced that it intends to commence a public secondary offering of 8,557,155 shares of class A common stock. The Company will not receive any proceeds from the offering. The shares are being offered by affiliates of Onex Corporation (“Onex”) and current and former members of management of the Company. Following completion of the offering, Onex will no longer own any shares of the Company. The shares are being offered pursuant to an automatic shelf registration statement on Form S-3 filed on June 4, 2014 with the U.S. Securities and Exchange Commission (“SEC”).

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities law of any such jurisdiction. Morgan Stanley and Barclays are acting as underwriters for the offering. The offering will be made only by means of a prospectus supplement and accompanying base prospectus, copies of which may be obtained from Morgan Stanley & Co. LLC, Attn: Prospectus department: 180 Varick Street, 2nd Floor, New York, NY 10014 or Barclays Capital Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, Barclaysprospectus@broadridge.com, (888) 603-5847, and from the SEC’s website at www.sec.gov, when available.

“Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995: This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements include, but are not limited to, statements related to the secondary offering of shares of class A common stock and the repurchase of shares of class A common stock. These forward-looking statements involve known and unknown risks, uncertainties and other factors discussed in the Company’s filings with the SEC. Any forward-looking statements speak only as of the date of this press release and, except to the extent required by applicable securities laws, Spirit AeroSystems Holdings, Inc. expressly disclaims any obligation to update or revise any of them to reflect actual results, any changes in expectations or any change in events. If Spirit AeroSystems Holdings, Inc. does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements. For additional information concerning risks, uncertainties and other factors that may cause actual results to differ from those anticipated in the forward-looking statements, and risks to Spirit AeroSystems Holdings, Inc.’s business in general, please refer to the Company’s SEC filings.

On the web: http://www.spiritaero.com

###

Contact: Coleen Tabor, Investor Relations, (316) 523-7040

Ken Evans, Corporate Communications, (316) 523-4070

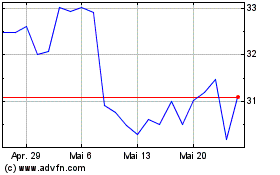

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024