Northrop Gets $59.6M DoD Contract - Analyst Blog

17 Juli 2013 - 6:00PM

Zacks

Northrop Grumman

Corporation (NOC) has won a modification contract, worth

$59.6 million, from the U.S. Department of Defense (DoD). The

company’s business unit Northrop Grumman Technical Services will be

responsible for this contract.

Per the deal, Northrop Grumman will offer operation and maintenance

services to the U.S. Navy’s combined tactical training ranges.

These services will be required at land-based test amenities, shore

locations and aboard ships in ports and at ocean.

Northrop Grumman will provide the services from its facilities in

Oceana, Va., Yuma, Ariz., Fallon, Nev., Cherry Point, N.C., Key

West, Fla. and San Diego, Calif. The contract is expected to be

completed by Jul 2014.

It is evident from past records that Northrop Grumman gets orders

from the U.S. defense establishments at regular intervals.

Recently, the company managed to get a few significant contracts.

In Jun 2013, Northrop Grumman received two back-to-back contracts,

worth $522.3 million, from the U.S. DoD. As per the contracts, the

company will offer follow-on support on interoperability of

dissimilar training systems and supply spares to five E-2D Advanced

Hawkeye Full Rate Production Lot 1 Aircraft. Recently, the company

received another contract, worth $555.6 million, from the U.S. DoD

to upgrade Global Hawk.

We know that the performance of U.S. defense majors primarily

depends on the orders coming from the national and international

defense establishments.

Despite the U.S. defense budget cuts due to the ongoing sequester,

Northrop Grumman’s continued efforts to introduce new technological

applications and improve existing processes in military and

aerospace programs will enable it to get orders at regular

intervals and maintain a steady revenue flow.

Northrop Grumman is slated to release its second-quarter 2013

earnings on Jul 24, 2013. The Zacks Consensus Estimate for

second-quarter 2013 is currently pegged at $1.71 per share.

Northrop Grumman currently has a Zacks Rank #3 (Hold). Other stocks

from the sector that are presently performing well include

The Boeing Company (BA), Spirit

AeroSystems Holdings, Inc. (SPR) and Hexcel

Corporation (HXL). All of them carry a Zacks Rank #2

(Buy).

BOEING CO (BA): Free Stock Analysis Report

HEXCEL CORP (HXL): Free Stock Analysis Report

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

SPIRIT AEROSYS (SPR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

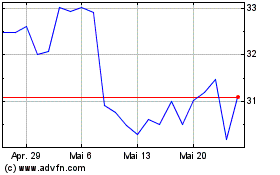

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024