Spirit Beats Est in 4Q - Analyst Blog

13 Februar 2013 - 10:00AM

Zacks

Spirit AeroSystems

Holdings, Inc. (SPR), one of the leading aerospace/defense

products and service providers, reported its financial results for

the fourth quarter and year 2012 on Feb 12, 2013. Earnings per

share in the quarter were 43 cents, up 2% year over year.

Adjusting for 19 cents of forward

loss charges and 6 cents of one-time gain, earnings per share in

the quarter were 56 cents, above the Zacks Consensus Estimate of 44

cents.

For 2012, earnings came in at 24

cents per share, way below the year-ago earnings of $1.35 while

adjusted earnings per share were $2.30, above $1.85 earned in 2011

and the Zacks Consensus Estimate of 21 cents.

Revenue in the fourth quarter was

up 17% at $1,425.6 million on the back of higher production

deliveries. Backlog exiting the quarter were solid and stood at $35

billion, up 4% year over year.

All four segments of the company

performed well registering solid double-digit growth. Segmental

details are as follows:

Revenue from Fuselage Systems grew

16.8% to $680.2 million and accounted for 47.7% of total revenue.

Propulsion Systems revenue (25.8%) expanded 14.4% to $368.1 million

while revenue from Wing Systems (26.3%) increased 19.7 to $375.3

million. Revenue from All Others (0.2%) segment was $2.0 million,

up 53.8% year over year.

For 2012, revenue was $5,398

million, up 11% on a year-over-year basis.

Adjusted operating income in 2012

was $556.1 million, up 20.9% year over year, while margin was at

10.3% versus 9.5% in 2011.

Exiting the fourth quarter, cash

and cash equivalents stood at $440.7 million, up 98.8%

sequentially. Long-term debt was at $1,165.9 million, down 0.2%

sequentially. Cash generated from operating activities in the

fourth quarter was $309 million, up 141.1% year over year. Capital

spending during the quarter totaled $79 million, down from $86

million in the year-ago quarter.

For 2013, management guided

earnings per share, excluding severe weather adjustments, in the

range of $2.20-$2.40. Revenue is expected to be within the

$5.8-$6.0 billion range, tax rate is likely to be about 31%, cash

flow from operations is expected within $300-$400 million and

capital expenditures would be around $350 million.

Spirit AeroSystems Holdings

currently has a Zacks Rank #3 (Hold). Other stocks to watch out for

in the industry are BAE Systems plc (BAESY) and

Rolls Royce Holdings plc (RYCEY), both carrying a

Zacks Rank #1 (Strong Buy) and Alliant Techsystems

Inc. (ATK), bearing a Zacks Rank #2 (Buy).

ALLIANT TECHSYS (ATK): Free Stock Analysis Report

(BAESY): ETF Research Reports

(RYCEY): ETF Research Reports

SPIRIT AEROSYS (SPR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

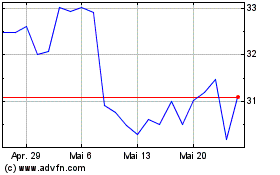

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024