Form 424B3 - Prospectus [Rule 424(b)(3)]

29 November 2024 - 8:04PM

Edgar (US Regulatory)

|

Registration

Statement No. 333-275898

Filed Pursuant to Rule 424(b)(3) |

| |

| |

|

|

|

Pricing Supplement Amendment

Amendment No. 1 dated November 29, 2024 to Pricing

Supplement dated November 22, 2024 to the Prospectus dated December 20, 2023, the Prospectus Supplement dated December 20, 2023 and the

Product Supplement No. 1A dated May 16, 2024 |

|

Return Notes with Variable Coupons

Linked to a Basket of Closed-End Funds,

Due November 27, 2026

Royal Bank of Canada |

| |

|

|

This document supplements the accompanying pricing

supplement (CUSIP: 78015QNY3). The Initial Basket Underlier Value for each Basket Underlier has been determined in the manner set forth

in the accompanying pricing supplement and is set forth in the table below:

| Basket Underlier |

Bloomberg Ticker |

Initial Basket Underlier Value |

| Virtus Artificial Intelligence & Technology Opportunities Fund |

AIO UN |

$23.83 |

| BlackRock Health Sciences Trust |

BME UN |

$39.28 |

| BlackRock Science and Technology Trust |

BST UN |

$36.69 |

| John Hancock Financial Opportunities Fund |

BTO UN |

$39.22 |

| BlackRock Utilities, Infrastructure & Power Opportunities Trust |

BUI UN |

$23.59 |

| John Hancock Tax-Advantaged Dividend Income Fund |

HTD UN |

$23.45 |

| NYLI CBRE Global Infrastructure Megatrends Term Fund |

MEGI UN |

$13.51 |

| Cohen & Steers REIT and Preferred and Income Fund, Inc. |

RNP UN |

$22.89 |

| Cohen & Steers Quality Income Realty Fund, Inc. |

RQI UN |

$13.65 |

| Columbia Seligman Premium Technology Growth Fund, Inc. |

STK UN |

$33.83 |

| abrdn Healthcare Opportunities Fund |

THQ UN |

$20.15 |

| Reaves Utility Income Fund |

UTG UN |

$34.59 |

Investing in the Notes involves a number of

risks. See “Selected Risk Considerations” beginning on page P-8 of the accompanying pricing supplement and “Risk Factors”

in the accompanying prospectus, prospectus supplement and product supplement.

The Notes will not be listed on any securities

exchange. None of the Securities and Exchange Commission (the “SEC”), any state securities commission or any other regulatory

body has approved or disapproved of the Notes or passed upon the adequacy or accuracy of this document. Any representation to the contrary

is a criminal offense. The Notes will not constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit

Insurance Corporation or any other Canadian or U.S. governmental agency or instrumentality.

RBC Capital Markets, LLC

| |

|

| |

Return Notes with Variable Coupons Linked to a Basket of Closed-End Funds |

ADDITIONAL TERMS OF YOUR NOTES

You should read this document together with

the prospectus dated December 20, 2023, as supplemented by the prospectus supplement dated December 20, 2023, relating to our Senior Global

Medium-Term Notes, Series J, of which the Notes are a part, the product supplement no. 1A dated May 16, 2024 and the accompanying pricing

supplement referred to below. This document, together with these documents, contains the terms of the Notes and supersedes all other prior

or contemporaneous oral statements as well as any other written materials, including preliminary or indicative pricing terms, correspondence,

trade ideas, structures for implementation, sample structures, fact sheets, brochures or other educational materials of ours.

We have not authorized anyone to provide any

information or to make any representations other than those contained or incorporated by reference in this document and the documents

listed below. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others

may give you. These documents are an offer to sell only the Notes offered hereby, but only under circumstances and in jurisdictions where

it is lawful to do so. The information contained in each such document is current only as of its date.

If the information in this document differs

from the information contained in the documents listed below, you should rely on the information in this document.

You should carefully consider, among other things,

the matters set forth in “Selected Risk Considerations” in the accompanying pricing supplement and “Risk Factors”

in the documents listed below, as the Notes involve risks not associated with conventional debt securities. We urge you to consult your

investment, legal, tax, accounting and other advisers before you invest in the Notes.

You may access these documents on the SEC website

at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| · | Prospectus dated December 20, 2023: |

https://www.sec.gov/Archives/edgar/data/1000275/000119312523299520/d645671d424b3.htm

| · | Prospectus Supplement dated December 20, 2023: |

https://www.sec.gov/Archives/edgar/data/1000275/000119312523299523/d638227d424b3.htm

| · | Product Supplement No. 1A dated May 16, 2024: |

https://www.sec.gov/Archives/edgar/data/1000275/000095010324006777/dp211286_424b2-ps1a.htm

| · | Pricing Supplement dated November 22, 2024: |

https://www.sec.gov/Archives/edgar/data/1000275/000095010324016754/dp221156_424b2-rjeln157dlo.htm

Our Central Index Key, or CIK, on the SEC website

is 1000275. As used in this document, “Royal Bank of Canada,” the “Bank,” “we,” “our”

and “us” mean only Royal Bank of Canada. Capitalized terms used in this document without definition are as defined in the

accompanying pricing supplement.

| P-2 | RBC Capital Markets, LLC |

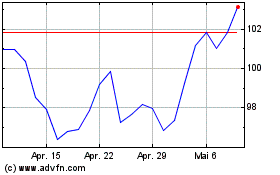

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

Von Dez 2023 bis Dez 2024