false000093023600009302362023-10-302023-10-300000930236us-gaap:CommonStockMember2023-10-302023-10-300000930236us-gaap:SeriesAPreferredStockMember2023-10-302023-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2023

REDWOOD TRUST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Maryland | | 001-13759 | | 68-0329422 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

One Belvedere Place

Suite 300

Mill Valley, California 94941

(Address of principal executive offices and Zip Code)

(415) 389-7373

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | RWT | New York Stock Exchange |

| 10% Series A Fixed-Rate Reset Cumulative Redeemable Preferred Stock, par value $0.01 per share | RWT PRA | New York Stock Exchange |

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition; |

| | | | | |

| Item 7.01. | Regulation FD Disclosure. |

On October 30, 2023, Redwood Trust, Inc. (the "Company") issued a press release announcing its financial results for the quarter ended September 30, 2023, the Redwood Trust Shareholder Letter - 3rd Quarter 2023 and The Redwood Review - 3rd Quarter 2023, copies of which are attached as Exhibit 99.1, Exhibit 99.2 and Exhibit 99.3, respectively, to this current report on Form 8-K.

In addition, on October 30, 2023, the Company made available Supplemental Financial Tables presenting certain financial results for the quarter ended September 30, 2023. A link to the Supplemental Financial Tables is available at the Company’s website at http://www.redwoodtrust.com, in the Investor Relations section of the website under “Financials.”

The information contained in this Item 2.02 and Item 7.01 and the attached Exhibits 99.1, 99.2 and 99.3 is furnished to and not filed with the SEC, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

| | | | | | | | |

| (d) | | Exhibits |

| |

| Exhibit 99.1 | | |

| Exhibit 99.2 | | |

| Exhibit 99.3 | | |

| Exhibit 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | | |

| Date: October 30, 2023 | | | REDWOOD TRUST, INC. |

| | | | | |

| | | | | |

| | | By: | | /s/ BROOKE E. CARILLO |

| | | | | |

| | | | | Name: Brooke E. Carillo |

| | | | | Title: Chief Financial Officer |

Exhibit Index

| | | | | | | | | | | |

| | | |

| Exhibit No. | | Exhibit Title | |

| | | |

| Exhibit 99.1 | | | |

| Exhibit 99.2 | | | |

| Exhibit 99.3 | | | |

| Exhibit 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) | |

REDWOOD TRUST REPORTS THIRD QUARTER 2023 FINANCIAL RESULTS

MILL VALLEY, CA – Redwood Trust, Inc. (NYSE:RWT; "Redwood" or the "Company"), a leader in expanding access to housing for homebuyers and renters, today reported its financial results for the quarter ended September 30, 2023.

Key Q3 2023 Financial Results and Metrics

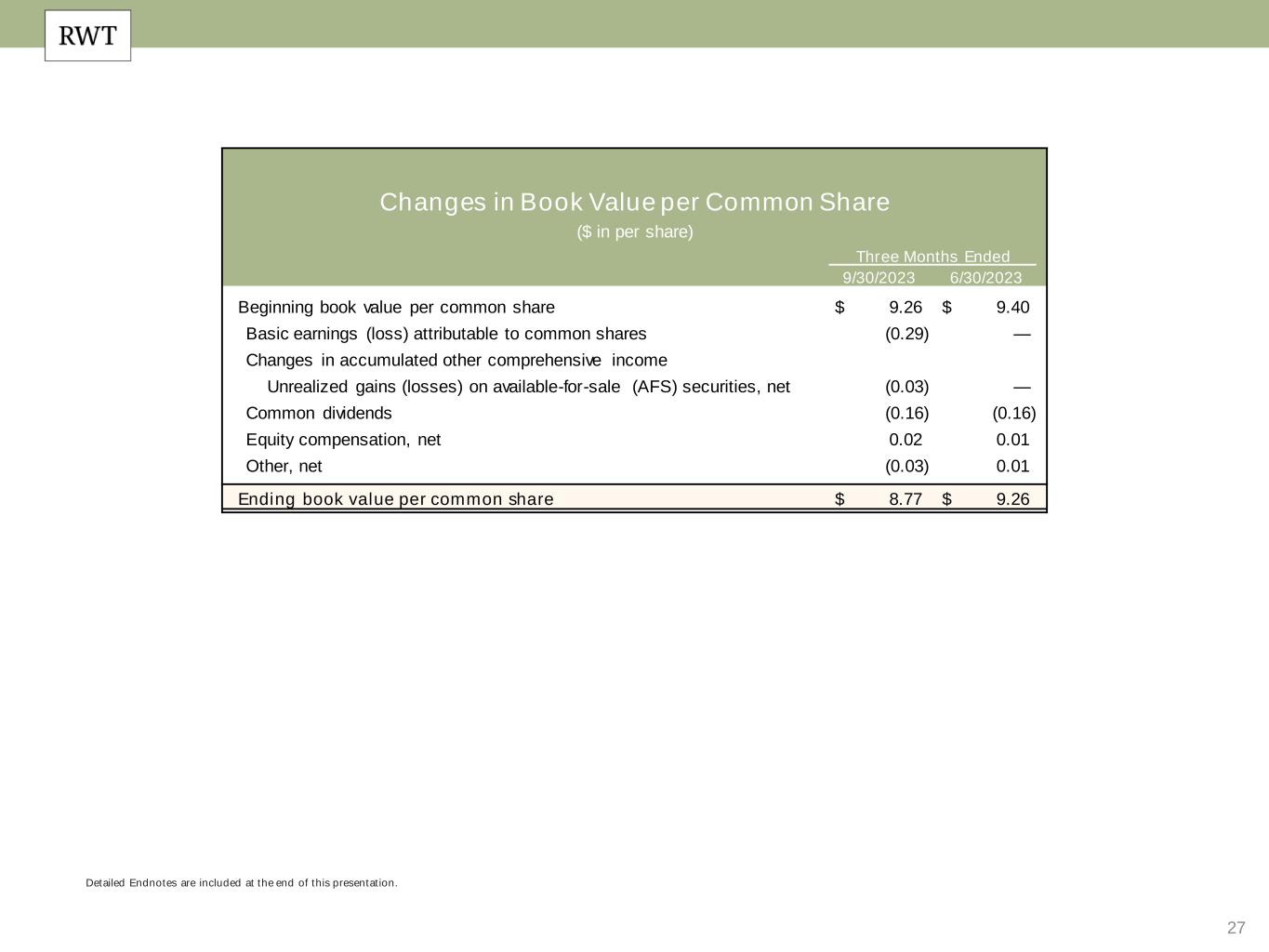

•GAAP book value per common share was $8.77 at September 30, 2023, a 5.3% decrease from $9.26 per share at June 30, 2023

◦Economic return on book value of (3.6)%(1)

•GAAP net loss related to common stockholders of $(33) million or $(0.29) per diluted common share

•Non-GAAP Earnings Available for Distribution ("EAD") of $11 million or $0.09 per basic common share(2)

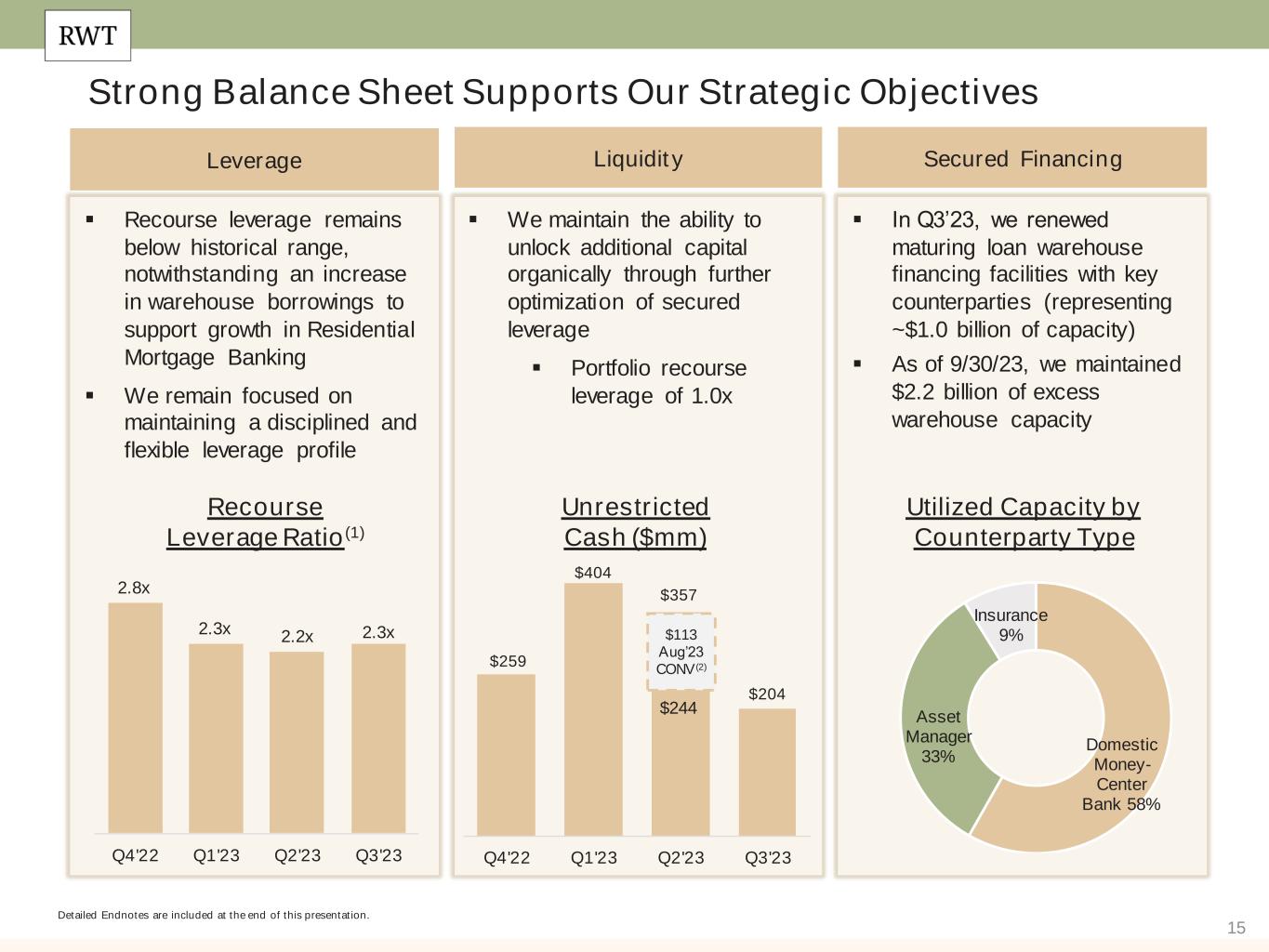

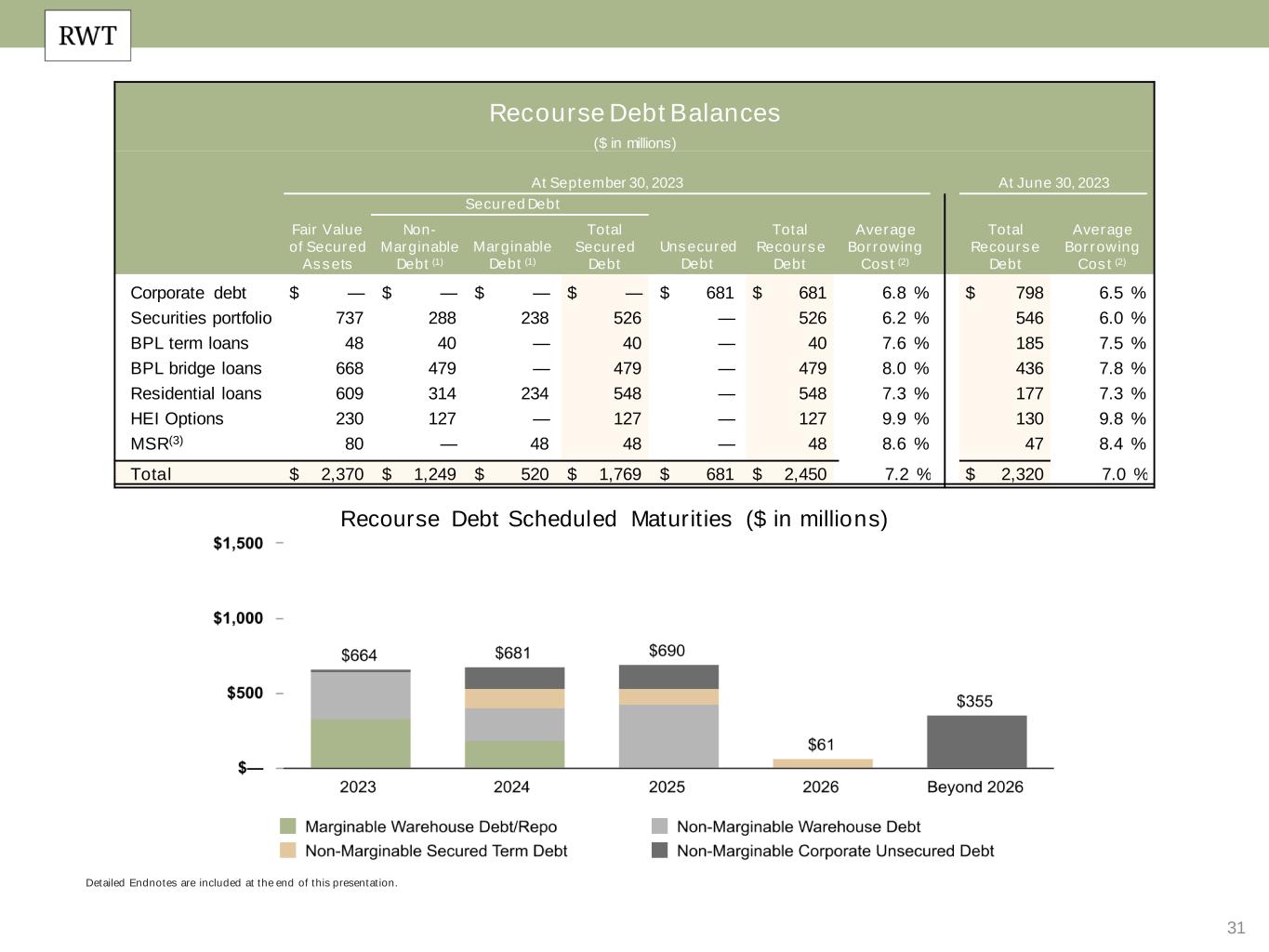

•Recourse leverage ratio of 2.3x at September 30, 2023, compared to 2.2x at June 30, 2023(3)

•Declared and paid a regular quarterly dividend of $0.16 per common share

Operational Business Highlights

Residential Mortgage Banking

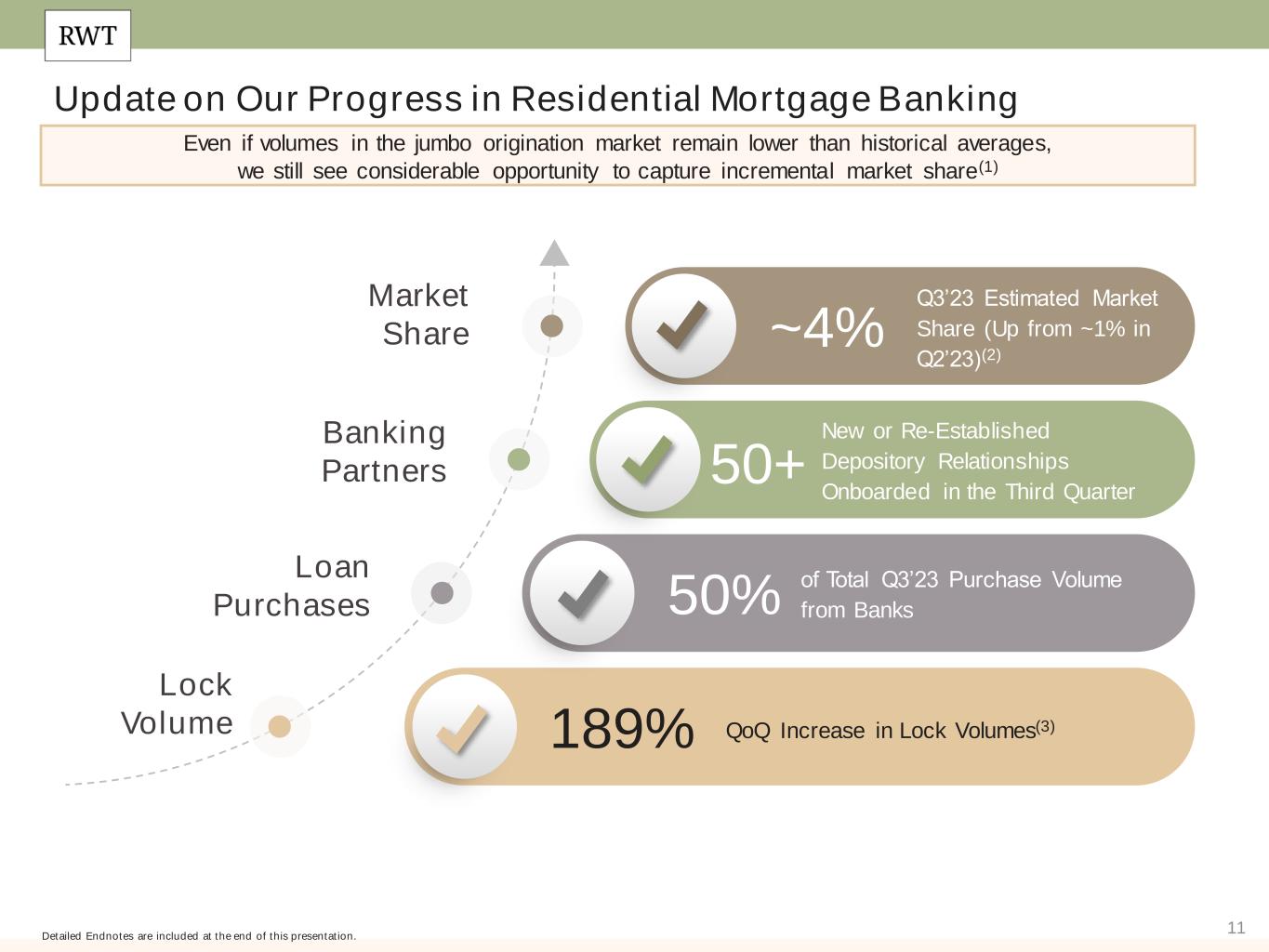

•Locked $1.6 billion of jumbo loans(4), up from $567 million in the second quarter 2023, and purchased $815 million of jumbo loans, up from $184 million in the second quarter 2023

◦50% of purchase volume in the third quarter 2023 was from depository institutions, up from 10% in the second quarter 2023

◦Achieved gross margins of 80bps during the quarter, within our historical 75bps to 100bps range

•Significantly grew jumbo loan seller network, including over 50 new or re-established relationships with depository institutions

•Distributed $391 million of jumbo loans through securitization ($338 million) and whole loan sales ($54 million)

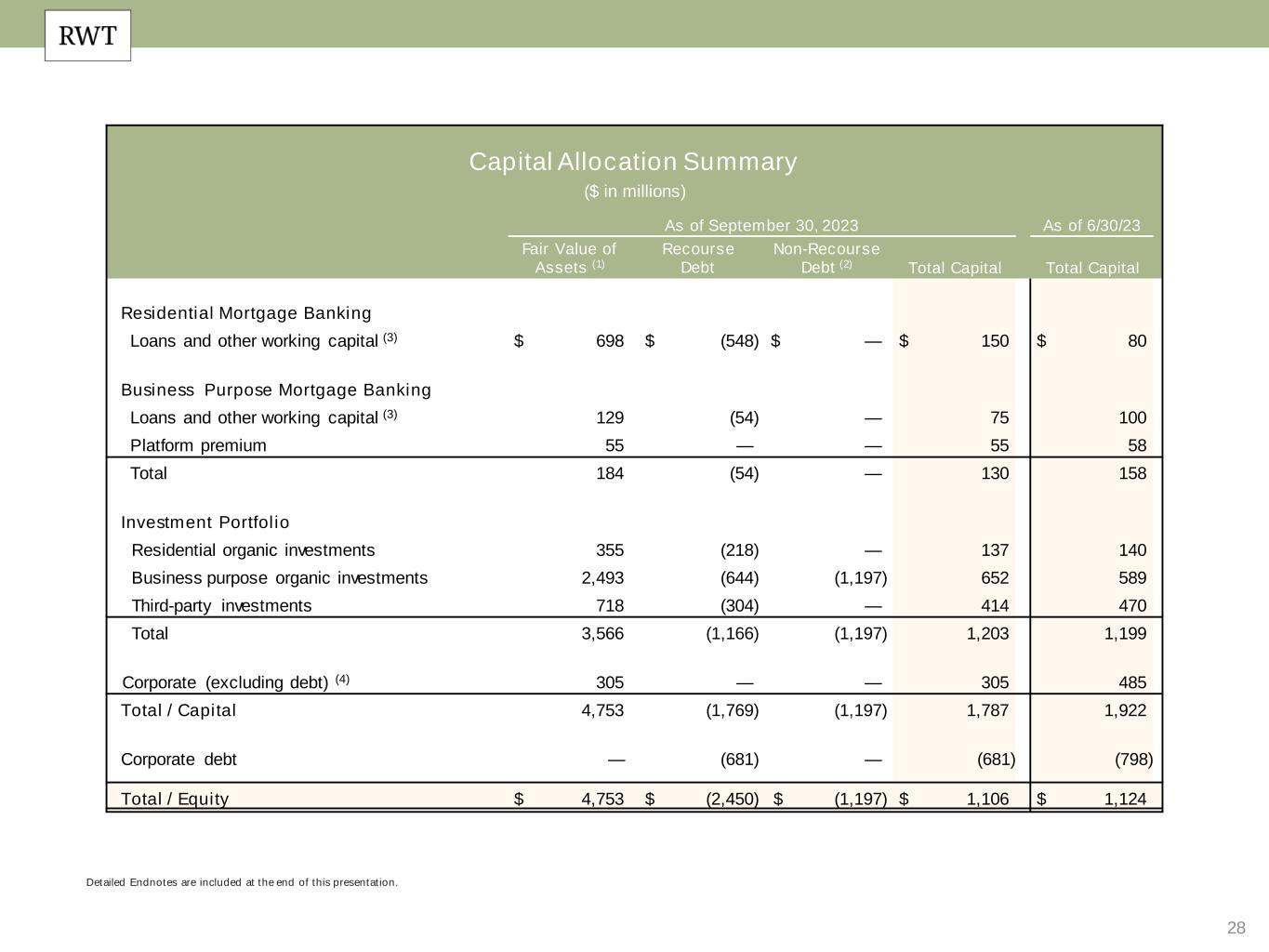

•Increased capital allocated to Residential Mortgage Banking segment to $150 million at September 30, 2023, up from $80 million at June 30, 2023

Business Purpose Mortgage Banking

•Funded $411 million of business purpose lending ("BPL") loans in the third quarter 2023 (74% bridge and 26% term), up from $406 million in the second quarter 2023

•Distributed $340 million of BPL loans through securitization ($278 million) and whole loan sales ($62 million)

•Began selling BPL bridge loans into joint venture ("JV") with Oaktree Capital Management, L.P. ("Oaktree") and established new dedicated financing line for the JV

Investment Portfolio

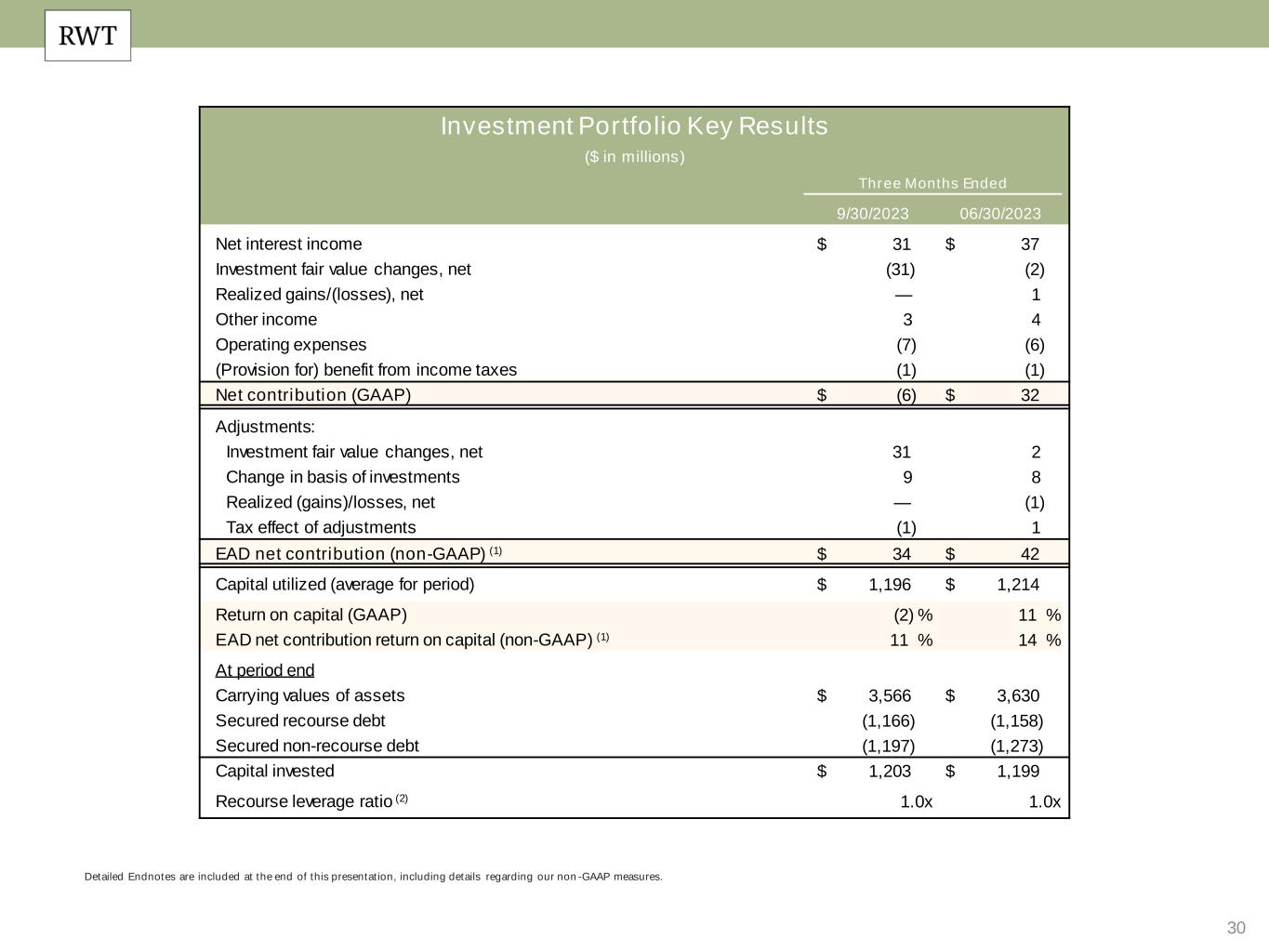

•Deployed approximately $70 million of capital into internally sourced investments, while generating incremental capital from sales of non-strategic third-party assets

•RPL and jumbo securities saw continued declines in 90 day+ delinquencies to 8.6% and 0.9%, respectively; 90 days+ delinquencies for our combined CAFL securities and bridge loan portfolio declined to 4.0% from, aided in part by successful loss mitigation resolutions completed during the quarter(5)

•Secured recourse leverage ratio of 1.0x at September 30, 2023(6)

Financing Highlights

•Unrestricted cash and cash equivalents of $204 million at September 30, 2023

•Successfully renewed two maturing loan warehouse financing facilities with key counterparties

•Maintained $2.2 billion of excess financing capacity across warehouse facilities at September 30, 2023

Other Corporate Highlights

•Commenced origination efforts and officially launched in-house home equity investment ("HEI") origination platform, Aspire

•Completed two RWT Horizons investments, including one follow-on investment in an existing RWT Horizons portfolio company

•Published second annual environmental, social and governance ("ESG") report in accordance with Sustainability Accounting Standards Board ("SASB"), demonstrating Redwood's continued progress on ESG disclosure

Q4 2023 Highlights to Date(7)

•Closed SEMT 2023-4 securitization, backed by $369 million of jumbo loans

•Priced securitization backed by Home Equity Investments (“HEI”), with approximately $139 million of securities expected to be issued through a co-sponsored deal(8)

•Sold $44 million of BPL term loans

•Repurchased approximately $5 million of convertible debt due in July 2024(9)

"The mortgage market is in a state of significant transition on the heels of an evolving bank regulatory backdrop," said Christopher Abate, Chief Executive Officer of Redwood. "In the third quarter, we saw continued progress in our Residential Mortgage Banking business, where we've driven volume higher through onboarding new sellers and deepening our overall wallet share. Importantly, despite choppy markets, we were successful during the quarter efficiently securitizing and selling our production across both of our operating businesses. As we look ahead, we expect to formalize other partnerships complementary to our traditional distribution channels, driven by significant interest in our asset creation and sourcing abilities."

_____________________

1.Economic return on book value is based on the period change in GAAP book value per common share plus dividends declared per common share in the period.

2.Earnings available for distribution is a non-GAAP measure. See Non-GAAP Disclosures section that follows for additional information on this measure.

3.Recourse leverage ratio is defined as recourse debt at Redwood divided by tangible stockholders' equity. Recourse debt excludes $9.3 billion of consolidated securitization debt (ABS issued and servicer advance financing) and other debt that is non-recourse to Redwood, and tangible stockholders' equity excludes $55 million of goodwill and intangible assets.

4.Lock volume does not account for potential fallout from pipeline that typically occurs through the lending process.

5.Calculated as BPL loans in our consolidated CAFL securitizations, bridge loans held for investment, and bridge and term loans held-for-sale with a delinquent payment greater than 90 days divided by the total notional balance of consolidated CAFL securitizations, bridge loans held for investment, and bridge and term loans held for sale.

6.Secured recourse leverage ratio for our Investment Portfolio is defined as secured recourse debt financing our investment portfolio assets divided by capital allocated to our investment portfolio.

7.Represents Q4'23 activity through October 27, 2023.

8.This securitization priced on October 23, 2023 and is expected to close on October 31, 2023.

9.Represents repurchase activity that settled after September 30, 2023.

Third Quarter 2023 Redwood Review and Supplemental Tables Available Online

A further discussion of Redwood's business and financial results is included in the third quarter 2023 Shareholder Letter and Redwood Review which are available under "Financial Info" within the Investor Relations section of the Company’s website at redwoodtrust.com/investor-relations. Additional supplemental financial tables can also be found within this section of the Company's website.

Conference Call and Webcast

Redwood will host an earnings call today, October 30, 2023, at 2:00 p.m. Pacific Time / 5:00 p.m. Eastern Time to discuss its third quarter 2023 financial results. The number to dial in order to listen to the conference call is 1-877-423-9813 in the U.S. and Canada. International callers must dial 1-201-689-8573. A replay of the call will be available through midnight on Monday, November 13, 2023, and can be accessed by dialing 1-844-512-2921 in the U.S. and Canada or 1-412-317-6671 internationally and entering access code #13741257.

The conference call will be webcast live in listen-only mode through the News & Events section of Redwood’s Investor Relations website at https://www.redwoodtrust.com/investor-relations/news-events/events. To listen to the webcast, please go to Redwood's website at least 15 minutes before the call to register and to download and install any needed audio software. An audio replay of the call will also be available on Redwood's website following the call. Redwood plans to file its Quarterly Report on Form 10-Q with the Securities and Exchange Commission by Thursday November 9, 2023, and also make it available on Redwood’s website.

About Redwood

Redwood Trust, Inc. (NYSE: RWT) is a specialty finance company focused on several distinct areas of housing credit. Our operating platforms occupy a unique position in the housing finance value chain, providing liquidity to growing segments of the U.S. housing market not well served by government programs. We deliver customized housing credit investments to a diverse mix of investors, through our best-in-class securitization platforms; whole-loan distribution activities; and our publicly traded shares. Our aggregation, origination and investment activities have evolved to incorporate a diverse mix of residential and business purpose housing credit assets. Our goal is to provide attractive returns to shareholders through a stable and growing stream of earnings and dividends, capital appreciation, and a commitment to technological innovation that facilitates risk-minded scale. We operate our business in three segments: Residential Mortgage Banking, Business Purpose Mortgage Banking and Investment Portfolio. Additionally, through RWT Horizons, our venture investing initiative, we invest in early-stage companies strategically aligned with our business across the lending, real estate, and financial technology sectors to drive innovations across our residential and business-purpose lending platforms. Since going public in 1994, we have managed our business through several cycles, built a track record of innovation, and established a best-in-class reputation for service and a common-sense approach to credit investing. Redwood Trust is internally managed and structured as a real estate investment trust ("REIT") for tax purposes. For more information about Redwood, please visit our website at www.redwoodtrust.com or connect with us on LinkedIn.

Cautionary Statement; Forward-Looking Statements:

This press release and the related conference call contain forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements related to the amount of residential mortgage loans that we identified for purchase during the third quarter of 2023, expected fallout and the corresponding volume of residential mortgage loans expected to be available for purchase, and the expected timing for the filing of Redwood's Quarterly Report on Form 10-Q. Forward-looking statements involve numerous risks and uncertainties. Redwood's actual results may differ from Redwood's beliefs, expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan” and similar expressions or their negative forms, or by references to strategy, plans, opportunities, or intentions. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2022 under the caption “Risk Factors”. Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected may be described from time to time in reports we file with the Securities and Exchange Commission, including reports on Forms 10-Q and 8-K. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

REDWOOD TRUST, INC.

| | | | | | | | | | | | | | |

| ($ in millions, except per share data) | Three Months Ended | | | |

| 9/30/2023 | | 6/30/2023 | | | |

| Financial Performance | | | | | | |

| Net income (loss) per diluted common share | $ | (0.29) | | | $ | — | | | | |

| Net income (loss) per basic common share | $ | (0.29) | | | $ | — | | | | |

| EAD per basic common share (non-GAAP) | $ | 0.09 | | | $ | 0.14 | | | | |

| | | | | | |

| Return on Common Equity ("ROE") (annualized) | (12.3) | % | | 0.4 | % | | | |

| EAD Return on Common Equity ("EAD ROE") (annualized, non-GAAP) | 4.3 | % | | 6.2 | % | | | |

| | | | | | |

| Book Value per Common Share | $ | 8.77 | | | $ | 9.26 | | | | |

| Dividend per Common Share | $ | 0.16 | | | $ | 0.16 | | | | |

Economic Return on Book Value (1) | (3.6) | % | | 0.2 | % | | | |

| | | | | | |

Recourse Leverage Ratio (2) | 2.3x | | 2.2x | | | |

| Operating Metrics |

| Business Purpose Loans | | | | | | |

| Term fundings | $ | 106 | | | $ | 129 | | | | |

| Bridge fundings | 305 | | | 278 | | | | |

| Term securitized | 278 | | | — | | | | |

| | | | | | |

| Term sold | 27 | | | 180 | | | | |

| Bridge sold | 34 | | | 19 | | | | |

| Residential Jumbo Loans | | | | | | |

| Locks | $ | 1,637 | | | $ | 567 | | | | |

| Purchases | 815 | | | 184 | | | | |

| Securitized | 338 | | | — | | | | |

| Sold | 54 | | | 9 | | | | |

| | | | | | |

(1) Economic return on book value is based on the periodic change in GAAP book value per common share plus dividends declared per common share during the period.

(2) Recourse leverage ratio is defined as recourse debt at Redwood divided by tangible stockholders' equity. At September 30, 2023, and June 30, 2023, recourse debt excluded $9.3 billion and $9.1 billion, respectively, of consolidated securitization debt (ABS issued and servicer advance financing) and other debt that is non-recourse to Redwood, and tangible stockholders' equity excluded $55 million and $58 million, respectively, of goodwill and intangible assets.

REDWOOD TRUST, INC. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Consolidated Income Statements (1) | | Three Months Ended |

| ($ in millions, except share and per share data) | | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 |

| | | | | | | | | | |

| Interest income | | $ | 177 | | | $ | 179 | | | $ | 179 | | | $ | 173 | | | $ | 178 | |

| Interest expense | | (157) | | | (153) | | | (152) | | | (146) | | | (143) | |

| Net interest income | | 20 | | | 26 | | | 26 | | | 27 | | | 35 | |

| Non-interest income (loss) | | | | | | | | | | |

| Residential mortgage banking activities, net | | 9 | | | 7 | | | 3 | | | (14) | | | 2 | |

| Business purpose mortgage banking activities, net | | 10 | | | 9 | | | 13 | | | (3) | | | 14 | |

| Investment fair value changes, net | | (31) | | | (5) | | | — | | | (24) | | | (58) | |

| Other income, net | | 2 | | | 4 | | | 5 | | | 4 | | | 4 | |

| Realized gains, net | | — | | | 1 | | | — | | | 3 | | | — | |

| Total non-interest income (loss), net | | (10) | | | 17 | | | 21 | | | (33) | | | (37) | |

| General and administrative expenses | | (30) | | | (31) | | | (36) | | | (39) | | | (38) | |

| Portfolio management costs | | (4) | | | (3) | | | (4) | | | (3) | | | (2) | |

| Loan acquisition costs | | (2) | | | (1) | | | (1) | | | (1) | | | (2) | |

| Other expenses | | (5) | | | (5) | | | (4) | | | (4) | | | (4) | |

| (Provision for) benefit from income taxes | | (2) | | | — | | | 1 | | | 9 | | | (1) | |

| Net income (loss) | | $ | (31) | | | $ | 3 | | | $ | 5 | | | $ | (44) | | | $ | (50) | |

| Dividends on preferred stock | | (2) | | | (2) | | | (1) | | | — | | | — | |

| Net income (loss) available (related) to common stockholders | | $ | (33) | | | $ | 1 | | | $ | 3 | | | $ | (44) | | | $ | (50) | |

| | | | | | | | | | |

| Weighted average basic common shares (thousands) | | 115,466 | | | 114,051 | | | 113,679 | | | 113,363 | | | 116,088 | |

Weighted average diluted common shares (thousands) (2) | | 115,466 | | | 114,445 | | | 114,135 | | | 113,363 | | | 116,088 | |

| Earnings (loss) per basic common share | | $ | (0.29) | | | $ | — | | | $ | 0.02 | | | $ | (0.40) | | | $ | (0.44) | |

| Earnings (loss) per diluted common share | | $ | (0.29) | | | $ | — | | | $ | 0.02 | | | $ | (0.40) | | | $ | (0.44) | |

| Regular dividends declared per common share | | $ | 0.16 | | | $ | 0.16 | | | $ | 0.23 | | | $ | 0.23 | | | $ | 0.23 | |

| | | | | | | | | | |

(1)Certain totals may not foot due to rounding.

(2)Actual shares outstanding (in thousands) at September 30, 2023, June 30, 2023, March 31, 2023, December 31, 2022, and September 30, 2022, were 118,504, 114,178, 113,864, 113,485, and 113,343, respectively.

Analysis of Income Statement - Changes from Second Quarter 2023 to Third Quarter 2023

•Net interest income decreased from the second quarter primarily due to lower interest income from our bridge loans, resulting from a higher balance of non-accrual bridge loans that became 90 days+ delinquent in the third quarter. This decrease was partially offset by higher net interest income from our Residential Mortgage Banking operations resulting from higher volume and average balances in the third quarter.

•Income from Residential Mortgage Banking activities increased from the second quarter, as loan purchase commitments nearly tripled to $1.3 billion during the quarter and margins of 80 basis points were within our historical range of 75 to 100 basis points.

•Income from Business Purpose Mortgage Banking activities increased from the second quarter, as spreads on term loans tightened during the third quarter. Overall volume remained steady with a rise in bridge fundings offset by a decline in term production. With rates increasing materially in the third quarter of 2023, borrowers preferred the short-term financing inherent in our bridge offerings.

•Net negative fair value changes on our Investment Portfolio in the third quarter primarily reflected the impact of rising rates to valuations on our re-performing loan (“RPL”) securities, and reductions of value on our bridge loan portfolio associated with delinquent and modified loans. The negative fair value changes were partially offset by fair value increases for HEI assets, as well as servicing assets which benefited from an increase in rates.

•Other income declined from the second quarter primarily due to market valuation changes for mortgage servicing rights, which increased in the second quarter as a result of rising interest rates and stabilized in the third quarter.

•General and administrative (G&A) expenses declined from the second quarter, as we continued our firm-wide initiatives to contain costs while supporting the recent growth in our Residential Mortgage Banking volumes. Additionally, expenses associated with performance-based long-term incentive compensation declined in the third quarter of 2023.

•Portfolio management costs increased from the second quarter, primarily due to higher workout costs on our bridge loan portfolio.

•Loan acquisition costs increased in the third quarter as Residential Mortgage Banking production volume increased significantly from the second quarter.

•Other expenses were primarily comprised of acquisition-related intangible amortization expenses.

•Our provision for income taxes in the third quarter reflected net income earned at our taxable REIT subsidiary, driven primarily by mortgage banking income and servicing investments.

| | | | | | | | | | | | | | |

| | | | |

| REDWOOD TRUST, INC. | | | | |

Consolidated Income Statements (1) | | Nine Months ended September 30, |

| ($ in millions, except share and per share data) | | 2023 | | 2022 |

| | | | |

| Interest income | | $ | 535 | | | $ | 535 | |

| Interest expense | | (462) | | | (406) | |

| Net interest income | | 73 | | | 129 | |

| Non-interest income (loss) | | | | |

| Residential mortgage banking activities, net | | 19 | | | (8) | |

| Business purpose mortgage banking activities, net | | 33 | | | 11 | |

| Investment fair value changes, net | | (36) | | | (152) | |

| Other income | | 11 | | | 17 | |

| Realized gains, net | | 1 | | | 3 | |

| Total non-interest income (loss), net | | 29 | | | (129) | |

| General and administrative expenses | | (96) | | | (102) | |

| Portfolio management costs | | (10) | | | (5) | |

| Loan acquisition costs | | (5) | | | (10) | |

| Other expenses | | (13) | | | (12) | |

| Benefit from income taxes | | (1) | | | 10 | |

| Net income (loss) | | $ | (23) | | | $ | (119) | |

| Dividends on preferred stock | | (5) | | | — | |

| Net income (loss) available (related) to common stockholders | | $ | (28) | | | $ | (119) | |

| | | | |

| Weighted average basic common shares (thousands) | | 114,382 | | | 118,530 | |

| Weighted average diluted common shares (thousands) | | 114,382 | | | 118,530 | |

| Earnings (loss) per basic common share | | $ | (0.27) | | | $ | (1.04) | |

| Earnings (loss) per diluted common share | | $ | (0.27) | | | $ | (1.04) | |

| Regular dividends declared per common share | | $ | 0.55 | | | $ | 0.69 | |

| | | | |

(1)Certain totals may not foot due to rounding.

REDWOOD TRUST, INC.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

Consolidated Balance Sheets (1) | | | | | | | | | | | |

| ($ in millions, except share and per share data) | | 9/30/23 | | 6/30/23 | | 3/31/23 | | 12/31/22 | | 9/30/22 | |

| | | | | | | | | | | |

| Residential loans | | $ | 5,847 | | | $ | 5,456 | | | $ | 5,493 | | | $ | 5,613 | | | $ | 5,753 | | |

| Business purpose loans | | 5,249 | | | 5,227 | | | 5,365 | | | 5,333 | | | 5,257 | | |

| Consolidated Agency multifamily loans | | 421 | | | 420 | | | 427 | | | 425 | | | 427 | | |

| Real estate securities | | 129 | | | 167 | | | 243 | | | 240 | | | 259 | | |

| Home equity investments (HEI) | | 431 | | | 427 | | | 417 | | | 403 | | | 340 | | |

| Other investments | | 340 | | | 356 | | | 382 | | | 391 | | | 413 | | |

| Cash and cash equivalents | | 204 | | | 357 | | | 404 | | | 259 | | | 297 | | |

| Other assets | | 399 | | | 387 | | | 391 | | | 367 | | | 399 | | |

| Total assets | | $ | 13,021 | | | $ | 12,797 | | | $ | 13,121 | | | $ | 13,031 | | | $ | 13,146 | | |

| | | | | | | | | | | |

| Short-term debt, net | | $ | 1,477 | | | $ | 1,457 | | | $ | 1,616 | | | $ | 2,030 | | | $ | 2,110 | | |

| Other liabilities | | 217 | | | 230 | | | 187 | | | 197 | | | 208 | | |

| Asset-backed securities issued, net | | 8,392 | | | 8,183 | | | 8,447 | | | 7,987 | | | 8,139 | | |

| Long-term debt, net | | 1,830 | | | 1,802 | | | 1,733 | | | 1,733 | | | 1,534 | | |

| Total liabilities | | 11,915 | | | 11,673 | | | 11,984 | | | 11,947 | | | 11,992 | | |

| | | | | | | | | | | |

| Stockholders' equity | | 1,106 | | | 1,124 | | | 1,138 | | | 1,084 | | | 1,154 | | |

| | | | | | | | | | | |

| Total liabilities and equity | | $ | 13,021 | | | $ | 12,797 | | | $ | 13,121 | | | $ | 13,031 | | | $ | 13,146 | | |

| | | | | | | | | | | |

| Common shares outstanding at period end (thousands) | | 118,504 | | | 114,178 | | | 113,864 | | | 113,485 | | | 113,343 | | |

| GAAP book value per common share | | $ | 8.77 | | | $ | 9.26 | | | $ | 9.40 | | | $ | 9.55 | | | $ | 10.18 | | |

| | | | | | | | | | | |

(1)Certain totals may not foot due to rounding.

Non-GAAP Disclosures

| | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

Reconciliation of GAAP Net Income (Loss) Available (Related) to Common Stockholders to non-GAAP Earnings Available for Distribution(1)(2) | | Three Months Ended |

| ($ in millions, except share and per share data) | | 9/30/23 | | 6/30/23 | | | |

| | | | | | | |

| GAAP Net income (loss) available (related) to common stockholders | | $ | (33) | | | $ | 1 | | | | |

| | | | | | | |

| Adjustments: | | | | | | | |

Investment fair value changes, net(3) | | 31 | | | 5 | | | | |

Change in economic basis of investments(4) | | 9 | | | 8 | | | | |

Realized (gains)/losses, net(5) | | — | | | (1) | | | | |

Acquisition related expenses(6) | | 3 | | | 3 | | | | |

Organizational restructuring charges(7) | | — | | | 1 | | | | |

Tax effect of adjustments(8) | | — | | | — | | | | |

| | | | | | | |

| Earnings Available for Distribution (non-GAAP) | | $ | 11 | | | $ | 16 | | | | |

| | | | | | | |

| Earnings (loss) per basic common share | | $ | (0.29) | | | $ | — | | | | |

| EAD per basic common share (non-GAAP) | | $ | 0.09 | | | $ | 0.14 | | | | |

| | | | | | | |

| GAAP Return on Common Equity (annualized) | | (12.3) | % | | 0.4 | % | | | |

EAD Return on Common Equity (non-GAAP, annualized)(9) | | 4.3 | % | | 6.2 | % | | | |

| | | | | | | |

1.Certain totals may not foot due to rounding.

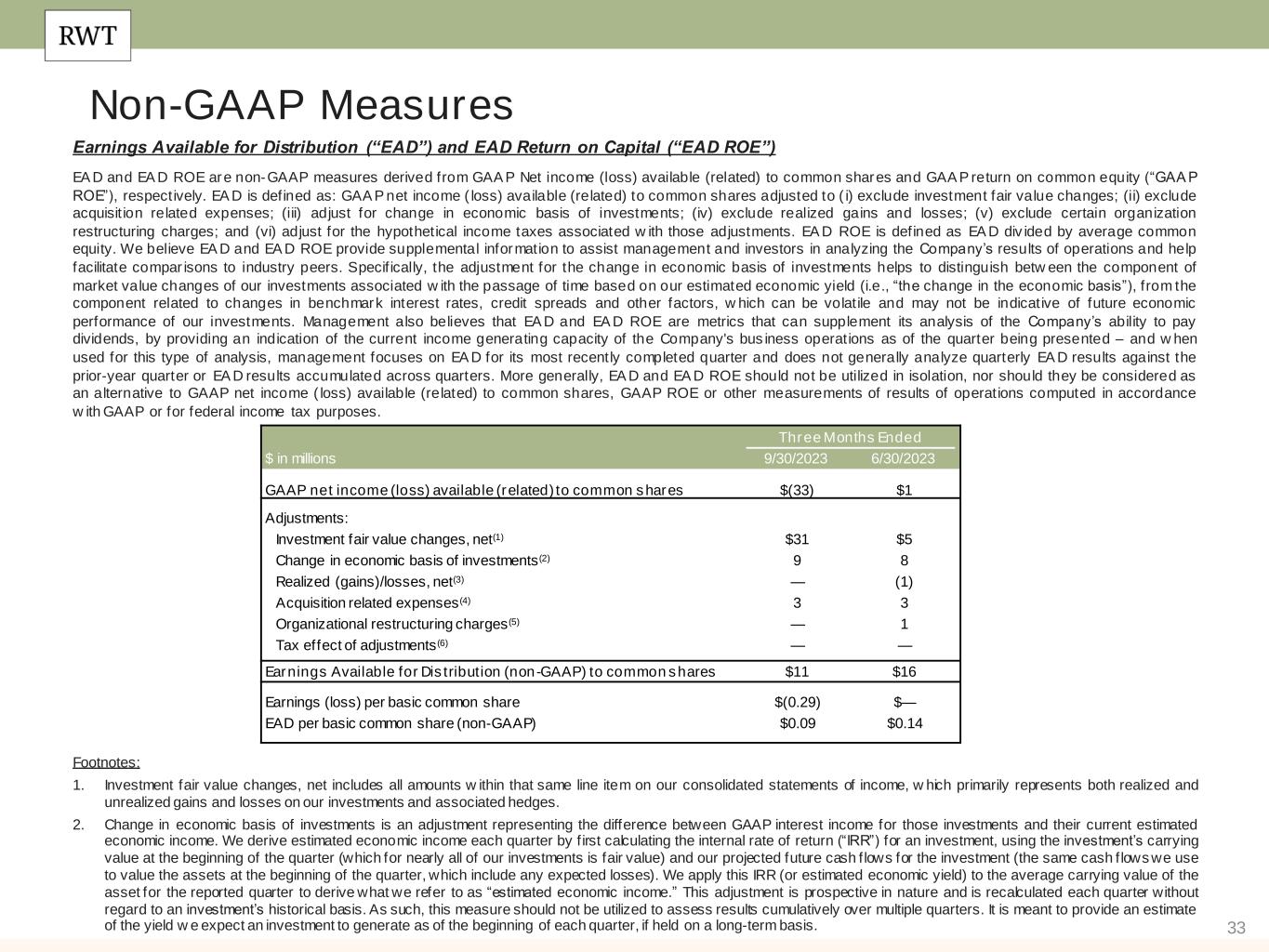

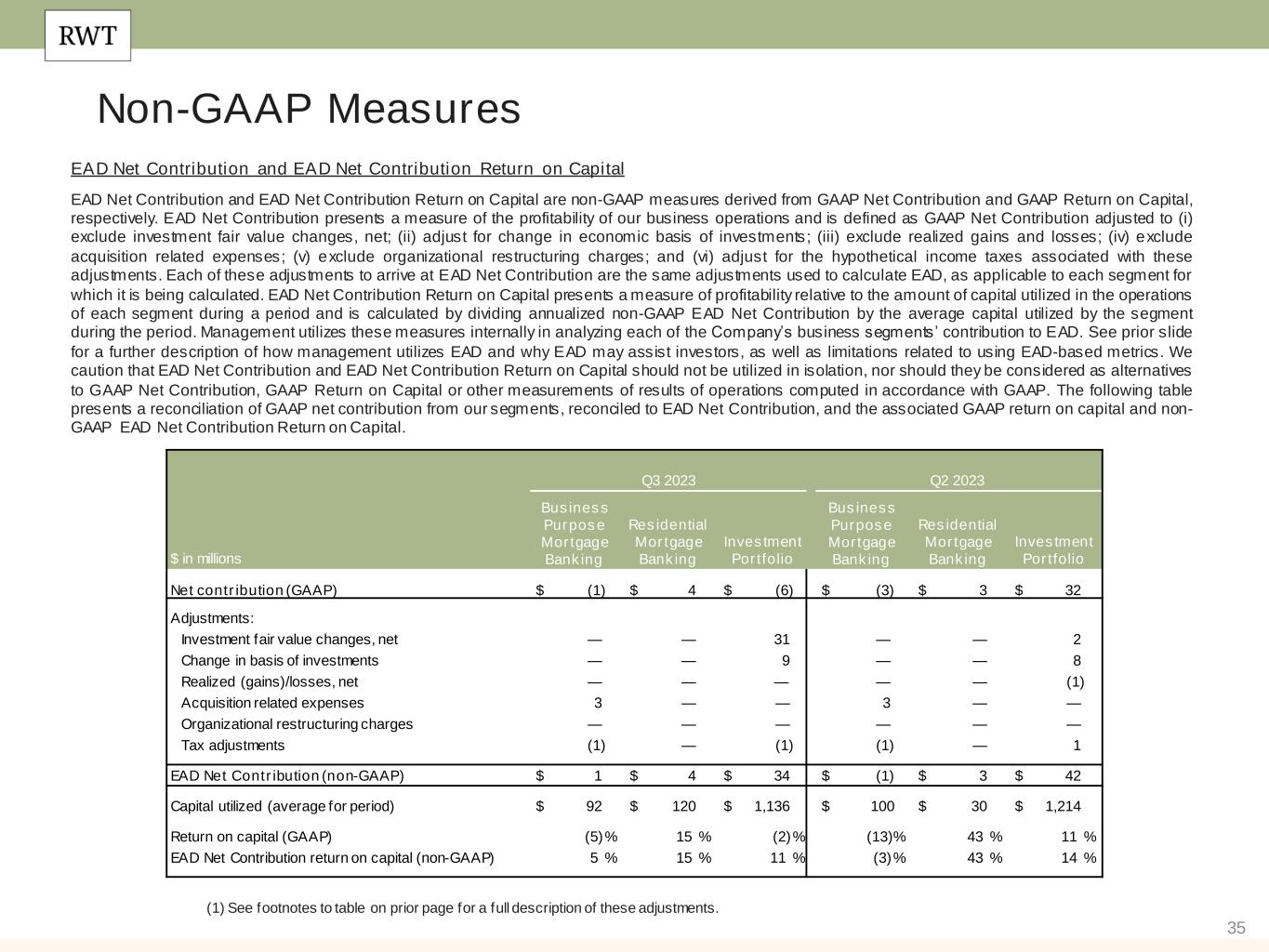

2.EAD and EAD ROE are non-GAAP measures derived from GAAP Net income (loss) available (related) to common stockholders and GAAP ROE, respectively. EAD is defined as: GAAP net income (loss) available (related) to common stockholders adjusted to (i) exclude investment fair value changes, net; (ii) adjust for change in economic basis of investments; (iii) exclude realized gains and losses; (iv) exclude acquisition related expenses; (v) exclude organizational restructuring charges; and (vi) adjust for the hypothetical income taxes associated with these adjustments. EAD ROE is defined as EAD divided by average common equity. We believe EAD and EAD ROE provide supplemental information to assist management and investors in analyzing the Company’s results of operations and help facilitate comparisons to industry peers. Specifically, the adjustment for the change in economic basis of investments helps to distinguish between the component of market value changes of our investments associated with the passage of time based on our estimated economic yield (i.e., “the change in the economic basis”), from the component related to changes in benchmark interest rates, credit spreads and other factors, which can be volatile and may not be indicative of future economic performance of our investments. Management also believes that EAD and EAD ROE are metrics that can supplement its analysis of the Company’s ability to pay dividends, by providing an indication of the current income generating capacity of the Company's business operations as of the quarter being presented – and when used for this type of analysis, management focuses on EAD for its most recently completed quarter and does not generally analyze quarterly EAD results against the prior-year quarter or EAD results accumulated across quarters. More generally, EAD and EAD ROE should not be utilized in isolation, nor should they be considered as an alternative to GAAP net income (loss) available (related) to common stockholders, GAAP ROE or other measurements of results of operations computed in accordance with GAAP or for federal income tax purposes.

3.Investment fair value changes, net includes all amounts within that same line item on our consolidated statements of income, which primarily represents both realized and unrealized gains and losses on our investments and associated hedges.

4.Change in economic basis of investments is an adjustment representing the difference between GAAP interest income for those investments and their current estimated economic income for the quarter presented. We derive estimated economic income each quarter by first calculating the internal rate of return (“IRR”) for an investment, using the investment’s carrying value at the beginning of the quarter (which for nearly all of our investments is fair value) and our projected future cash flows for the investment (the same cash flows we use to value the assets at the beginning of the quarter, which include any expected losses). We apply this IRR (or estimated economic yield) to the average carrying value of the asset for the reported quarter to derive what we refer to as “estimated economic income.” This adjustment is prospective in nature and is recalculated each quarter without regard to an investment's historical basis. As such, this measure should

not be utilized to assess results cumulatively over multiple quarters. It is meant to provide an estimate of the yield we expect an investment to generate as of the beginning of each quarter, if held on a long-term basis.

5.Realized (gains)/losses, net includes all amounts within that line item on our consolidated statements of income.

6.Acquisition related expenses include ongoing amortization of intangible assets related to the Riverbend, CoreVest and 5Arches acquisitions and any changes in the contingent consideration liability related to the potential earnout consideration for the acquisition of Riverbend.

7.In response to business and market developments in 2022, Redwood reduced its workforce – with effective dates for employee departures spanning the third quarter of 2022 through the second quarter of 2023. Organizational restructuring charges represent employee severance and related transition expenses associated with this reduction in force.

8.Tax effect of adjustments represents the hypothetical income taxes associated with all adjustments used to calculate EAD.

9.EAD ROE is calculated by dividing EAD by average common equity for each respective period.

| | |

| CONTACTS |

| Investor Relations |

| Kaitlyn Mauritz |

| SVP, Head of Investor Relations |

| Phone: 866-269-4976 |

| Email: investorrelations@redwoodtrust.com |

| | | | | | | | | | | | | | |

| Exhibit 99.2 |

S H A R E H O L D E R L E T T E R T H I R D Q U A R T E R 2 0 2 3 |

R E D W O O D T R U S T |

| | | | |

|

| | | | |

Dear Fellow Shareholders:

Our second quarter earnings call took place on July 27th, just a few hours after the Board of Governors of the Federal Reserve released newly proposed risk-based capital rules for the U.S. banking system. Our thesis at the time was that, while the rules would likely evolve before being finalized, bank management teams would follow early adoption, driving a fundamental shift in how financial assets are funded, both reminiscent of our Company’s original value proposition and a nod to the future of how the market will distribute 30-year mortgage risk. Three months later, and in an otherwise persistently unpredictable market, our thinking thus far has been validated and our march forward continues, largely ahead of plan. This progress has been well-timed with the emergence of fresh demand for our products from pockets of capital complementary to our traditional distribution channels.

Banks’ appreciation for our partnership has become more tangible in the last few months as business models are reconciled with a future of higher capital requirements and more expensive interest rate risk management. And their response to these forthcoming regulatory changes reflects the urgency of the moment. Since March, our Residential team has engaged with depositories from coast to coast, securing and onboarding new partners. We now have active relationships with 185 active loan sellers, including over 70 banks, many of which have commenced lock activity with us in recent weeks. This includes a group of the nation’s largest regional banks and large financial institutions, a significant number with over $200 billion in assets and extensive mortgage origination footprints. As we always have, Redwood offers these partners the ability to sustain operating activities without diluting the overall customer relationship.

The results have followed. Total Residential Mortgage Banking lock volume for the third quarter was $1.6 billion, up close to 200% from the second quarter despite significantly higher mortgage rates and an overall slowdown in market originations. Purchase volume was over $800 million, up 340% from the second quarter. Bank sellers accounted for 50% of total quarterly purchase activity, up from just 10% in the second quarter and a de minimis amount in the first quarter. Of note, bulk pool activity was a key driver of third quarter purchase volume, much of it seasoned loans acquired at a significant discount to par, a profile that pairs well with newer production. Notwithstanding the persistent rise in rates, we continue to evaluate bulk pools coming to market, more evidence of the scarcity of shelf space for many banks seeking to balance pressures on capital, liquidity and net interest margins.

Near-term headwinds to growth – namely, mortgage rates at 20-year highs and very low overall transaction activity in housing – have us focused on leading indicators over the next few quarters as we position our Residential Mortgage Banking business to scale volume significantly as the market sees the Fed’s rate hike cycle easing, a viable outcome by mid-2024 depending on a variety of complex factors. Those indicators include the quality of our new loan seller relationships and a deeper wallet share with existing partners. As the market transitions, the true value of our 30-year-old franchise is very much on

______________________

This Shareholder Letter contains time-sensitive information and may contain forward-looking statements. The information contained herein is only accurate as of October 30, 2023. We undertake no obligation to update or revise the information contained herein, including forward-looking statements, whether as a result of new information, future events, or otherwise. Additional detail regarding the forward-looking statements in this Shareholder Letter and the important factors that may affect our actual results in 2023 are described at the end of this Shareholder Letter under the heading “Forward-Looking Statements.”

1

display. While many of our competitors have pulled back from the prime jumbo space, we completed our third Sequoia securitization of 2023 in the third quarter, followed closely by our fourth Sequoia deal early in the fourth quarter. Both deals generated strong margins and were distributed to a broad base of investors. In a market that is defined by significant volatility, we managed to execute our dispositions within our target gain on sale range. In keeping with the momentum we see for the business, we nearly doubled our capital allocation to Residential Mortgage Banking in the third quarter and expect that allocation to grow further in 2024.

CoreVest – our business-purpose lending (“BPL”) platform – is beginning to benefit as well from the broader changes afoot. Borrowers who have historically sought funding from banks now frequent our pipeline discussions, and while the overall credit environment calls for continued caution and selectivity, demand from capital partners remains strong for well-underwritten BPL loans to quality sponsors. While this transition is moving more slowly than in our Residential business, the early indicators are unmistakable. We have been engaged in dialogue with several banks on partnership opportunities that would allow us to access their existing loan pipelines with an eye toward mutually beneficial outcomes. With a life-cycle lending platform that offers both bridge and stabilized term financing, we are well-positioned to capture incremental market share that will continue shifting to private lenders. Our deep capital markets presence remains a key advantage, which in the third quarter allowed us to complete a highly accretive term loan securitization and two bulk whole loan sales.

The BPL sector overall continues to manage through macro crosswinds that have impacted sponsor sentiment and reduced transaction volumes across the industry. Our asset management team has been proactively working with borrowers well in advance of their loan maturities to assess project plans and ensure they manage towards successful completions. While 90+ day delinquencies across the bridge and term books declined slightly to 4.0% at September 30, 2023, we continue to manage through pockets of stress, particularly in our bridge portfolio, where certain sponsors have required loan modifications or an infusion of fresh equity from existing or new sponsorship to ease the burden of rapidly rising rates. Though bridge lending continues to be one of our strongest drivers of net interest income, the lumpiness of the portfolio and intermittent nature of workout activity have contributed to recent volatility in our quarterly GAAP earnings.

Overall, we funded $411 million of BPL loans in the third quarter, a slight increase from second quarter volumes. Within bridge, our build-for-rent (“BFR”) aggregation product has seen increased demand from borrowers and carries a favorable risk profile given the turnkey nature of the homes being financed. While we expect volumes for our fixed-rate term loans to remain influenced by benchmark rates, our bridge portfolio remains fertile ground for refinances into term loans as borrowers progress with projects.

We were also excited in the third quarter to formally launch our in-house home equity investment (“HEI”) platform, Aspire. After years of investing in and financing HEI, this development was a natural next step in the progression of our support for this nascent but growing sector. Since 2019, Redwood has been a leading participant in the HEI market, purchasing approximately $350 million in assets, co-sponsoring the first-ever securitization backed entirely by HEI, and subsequently procuring a dedicated financing facility for the asset class. With our track record of supporting housing accessibility, we believe we have a unique opportunity to help scale and institutionalize HEI in a way that will benefit consumers. As we have noted many times, the opportunity to help homeowners access the equity in their homes remains the largest addressable market in housing finance. Through Aspire, we now directly serve this market by originating HEI in partnership with our nationwide correspondent network of loan officers, which we believe will be a significant advantage over more traditional, high-cost marketing campaigns.

As we think more holistically about the overall Redwood platform and the significant market opportunities we see ahead, evolving our capital structure and procuring long-term private capital partnerships will be a top priority. We continue to observe a secular transition occurring in our markets, with the roles of banks, private credit institutions, and specialty finance companies such as Redwood rapidly evolving. In particular, regulatory crosscurrents are redefining the most efficient holders of real estate-related assets, as well as those who finance and service them. As evidenced by our Oaktree BPL bridge joint venture that we announced during the summer, the value proposition that platforms like ours offer institutional private credit investors has grown dramatically over the past few years. These investors include the likes of pension funds, life insurance companies, sovereign wealth funds, and other non-publics who have accretive capital and a strong demand for our products, but lack the origination or sourcing capabilities that we are able to achieve. Recently, we’ve engaged with a handful of large private credit investors who are deeply familiar with our franchise and track record, and who have shown interest in forging strategic partnerships that we believe could be very beneficial to our shareholders.

In keeping with these trends, our long-term strategic focus will be to position our mortgage banking businesses to meet this unprecedented market opportunity, with ample working capital and access to a varied and complementary set of products. Our investment strategy will naturally evolve in kind, with a continued focus on deployment side by side with capital partners, in lieu of traditional direct investing. As we did in the third quarter, we also expect to continue de-emphasizing third-party investments and further reduce our exposure to this lower-yielding portion of our investment portfolio to further optimize overall returns for our shareholders.

As we head towards year-end, we are already starting to see a diminution of market activity consistent with a year ago when market participants, from homebuyers to bond investors, took stock of a volatile

landscape and decided to save their dry powder for the year ahead. If anything, the market is in a more challenging spot today than it was a year ago, factoring in a strong probability of a U.S government shutdown, along with a geopolitical backdrop that has deteriorated significantly. We remain saddened to have witnessed the inexcusable and horrific attack on Israel in the Middle East, as we remain focused as well on those resisting the aggression that began last year in Eastern Europe with the invasion of Ukraine. Though paling in relevance to the human toll, the additional volatility these exogenous tragedies have caused will likely continue to pressure our near-term GAAP results – particularly the market valuations of our portfolio assets. And while the resiliency of the U.S. economy has surprised even the most ardent optimists, the prospect of a rate-driven recession in 2024 still remains a likelihood, in our view. As such, we will continue to prioritize liquidity and exercise caution as we work to ensure our franchise is positioned for the generational opportunity we see ahead.

Thank you for your continued support,

| | | | | | | | |

| | |

| Christopher J. Abate | | Dashiell I. Robinson |

| Chief Executive Officer | | President |

Note to Readers

We file annual reports (on Form 10-K) and quarterly reports (on Form 10-Q) with the Securities and Exchange Commission. These filings, our Redwood Review presentation and our earnings press releases provide information about Redwood and our financial results in accordance with generally accepted accounting principles (GAAP). These documents, as well as information about our business and a glossary of terms we use in this and other publications, are available through our website, www.redwoodtrust.com. We encourage you to review these documents. Within this document, in addition to our GAAP results, we may also present certain non-GAAP measures. When we present a non-GAAP measure, we provide a description of that measure and a reconciliation to the comparable GAAP measure within the Non-GAAP Measurement section of the Endnotes to the Redwood Review, which can be found on our website, www.redwoodtrust.com, under “Financials” within the “Investor Relations” section. References herein to “Redwood,” the “company,” “we,” “us,” and “our” include Redwood Trust, Inc. and its consolidated subsidiaries. Note that because we generally round numbers in the tables to millions, except per share amounts, some numbers may not foot due to rounding. References to the “third quarter” refer to the quarter ended September 30, 2023, references to the “second quarter” refer to the quarter ended June 30, 2023, unless otherwise specified.

Cautionary Statement; Forward-Looking Statements

This shareholder letter may contain forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan,” "could" and similar expressions or their negative forms, or by references to strategy, plans, goals, or intentions. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K under the caption “Risk Factors.” Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected are described below and may be described from time to time in reports we file with the Securities and Exchange Commission, including reports on Forms 10-K, 10-Q, and 8-K. We undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise. Statements regarding the following subjects, among others, are forward-looking by their nature: statements we make regarding Redwood’s business strategy and strategic focus, statements related to our financial outlook and expectations for 2023 and future years, statements related to opportunities for our residential and BPL mortgage banking businesses, including our positioning to increase market share and wallet share, opportunities to help scale and institutionalize HEI, opportunities to procure private capital partnerships that we believe could be beneficial to shareholders, and our expectations to continue de-emphasizing third-party investments and reducing our exposure to this portion of our investment portfolio to optimize overall returns. Additional detail regarding the forward-looking statements in this shareholder letter and the important factors that may affect our actual results in 2023 are described in the Redwood Review under the heading “Forward-Looking Statements,” which can be found on our website, www.redwoodtrust.com, under “Financials” within the “Investor Relations” section.

1 Q3 2023 Redwood Review October 30, 2023 Exhibit 99.3

2 Cautionary Statement; Forward-Looking Statements This presentation contains forward-looking statements, including statements regarding our 2023 forward outlook, current illustrative returns on assets that are either distributed through our various channels or retained on our balance sheet, estimates of upside and potential earnings in our investment port folio from embedded discounts to par value on securities, outlook on jumbo residential loan purchase opportunities, and opportunities to capture jumbo residential mortgagee banking market share. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our beliefs, expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will, ” “should,” “expect,” “believe,” “intend,” “seek,” “plan” and similar expressions or their negative forms, or by references to strategy, plans, opportunities, or intentions. These forward- looking statements are subject to risks and uncertainties, including, among other things, those described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and any subsequent Quarterly Reports on Form 10-Q under the caption “Risk Factors.” Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected may be described from time to time in reports the Company files with the Securities and Exchange Commission, including Current Reports on Form 8-K. Additionally, this presentation contains estimates and information concerning our industry, including market size and growth rates of the markets in which we participate, that are based on industry publications and reports. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those referred to above, that could cause results to differ materially from those expressed in these publications and reports.

3 Redwood’s mission is to make quality housing, whether rented or owned, accessible to all American households Detailed Endnotes are included at the end of this presentation. 29-Year Track Record of Strong Performance and Earnings Generation Diversified Product Set with Balanced Earnings Streams Industry Leading Operating Platforms Best-in-Class Securitization Platforms and Distribution Channels Control Credit through Disciplined Underwriting Ability to Organically Create Assets for Balance Sheet Innovative Technology Organically and Through Partnerships Deep and Experienced Management Team O UR D I F F ERENTI ATO RS IN TEGRATED BUSI NESS M ODEL ®

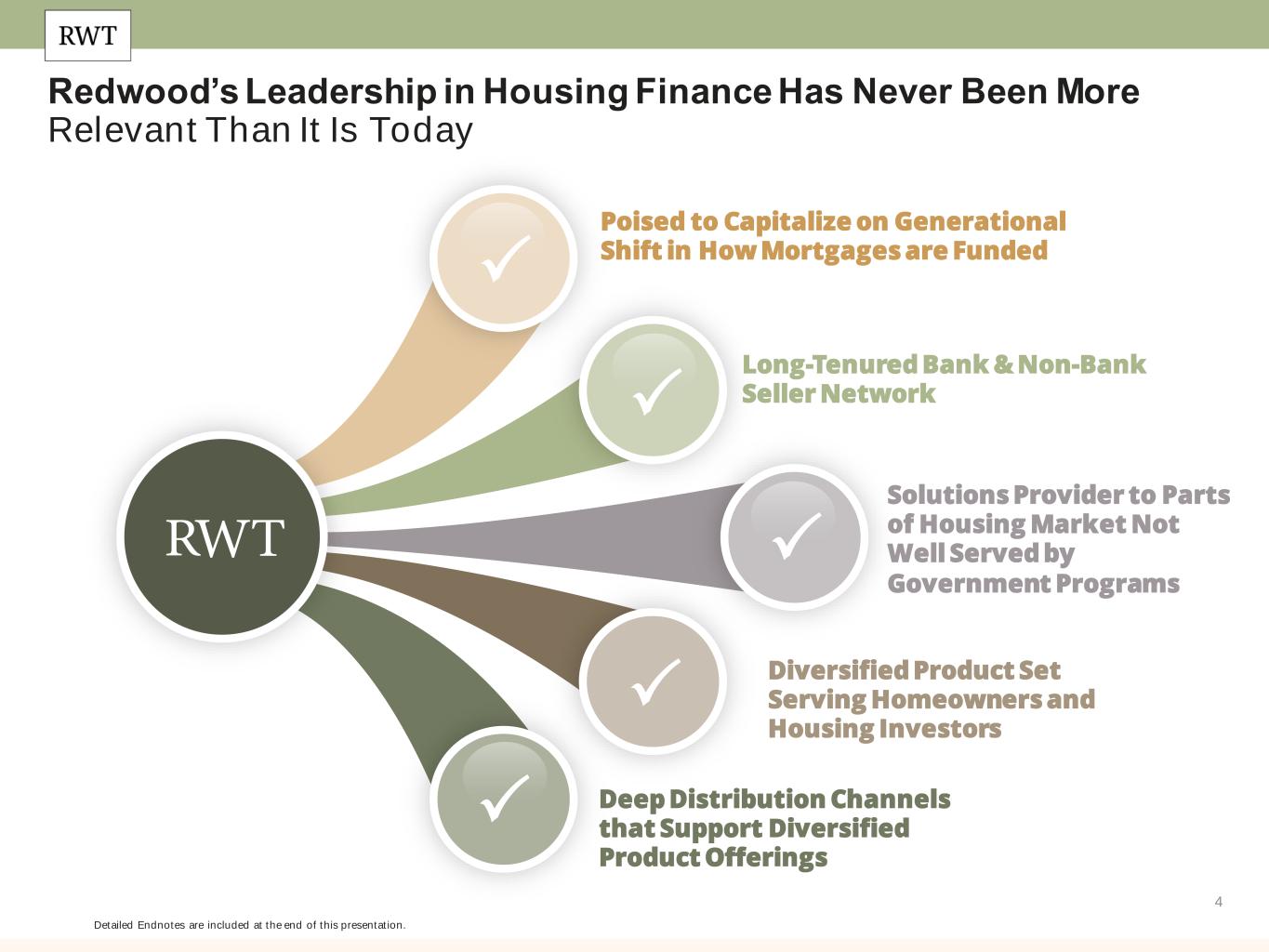

4 Poised to Capitalize on Generational Shift in How Mortgages are Funded Long-Tenured Bank & Non-Bank Seller Network Solutions Provider to Parts of Housing Market Not Well Served by Government Programs Diversified Product Set Serving Homeowners and Housing Investors Deep Distribution Channels that Support Diversified Product Offerings Redwood’s Leadership in Housing Finance Has Never Been More Relevant Than It Is Today Detailed Endnotes are included at the end of this presentation.

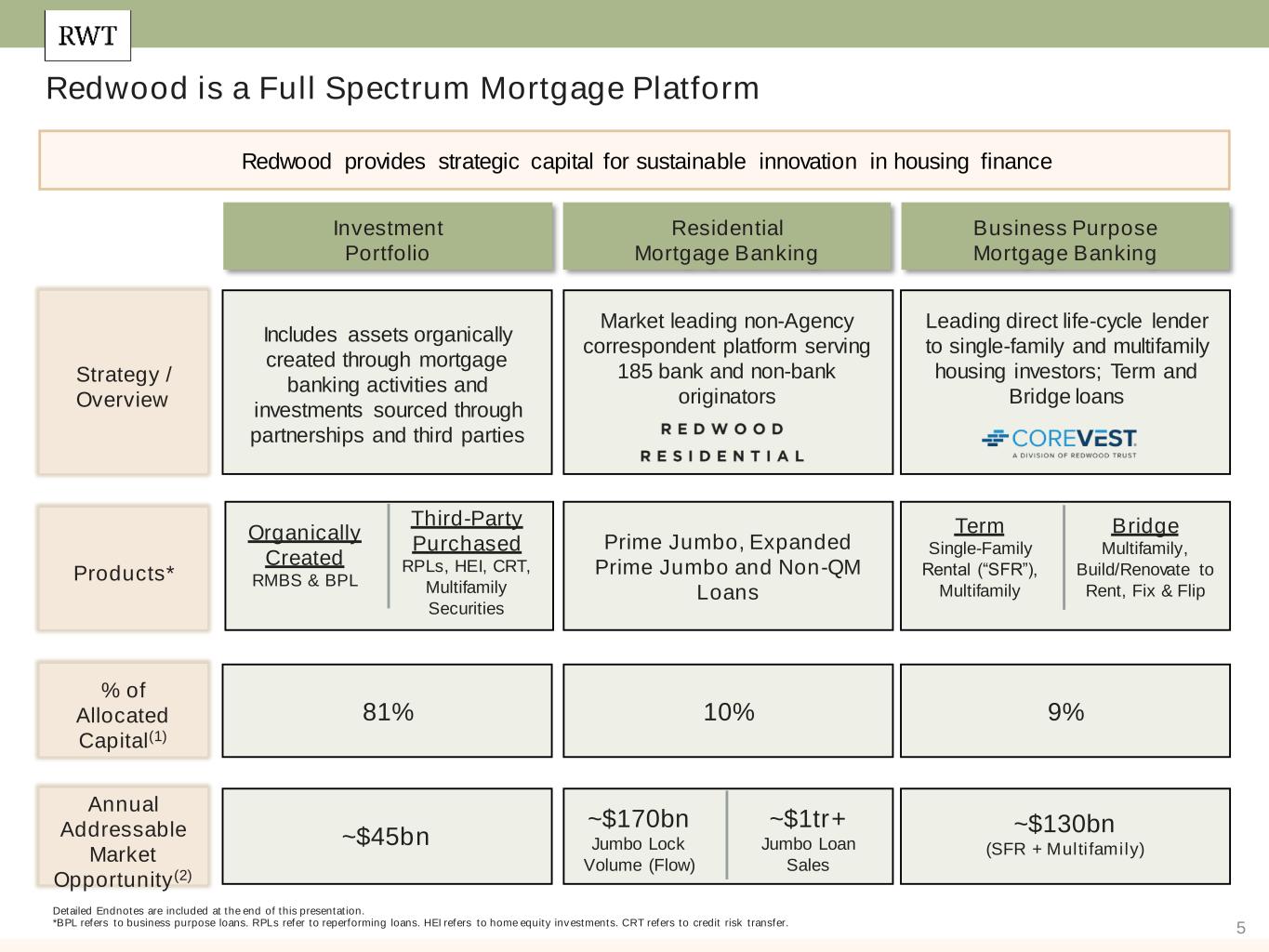

5 ~$1tr+ Jumbo Loan Sales Detailed Endnotes are included at the end of this presentation. *BPL refers to business purpose loans. RPLs refer to reperforming loans. HEI refers to home equity investments. CRT refers to credit risk transfer. Redwood is a Full Spectrum Mortgage Platform Redwood provides strategic capital for sustainable innovation in housing finance Residential Mortgage Banking Business Purpose Mortgage Banking Strategy / Overview ~$130bn (SFR + Multifamily) 10% 9% % of Allocated Capital(1) Annual Addressable Market Opportunity(2) Products* Market leading non-Agency correspondent platform serving 185 bank and non-bank originators Leading direct life-cycle lender to single-family and multifamily housing investors; Term and Bridge loans Investment Portfolio ~$45bn 81% Includes assets organically created through mortgage banking activities and investments sourced through partnerships and third parties Prime Jumbo, Expanded Prime Jumbo and Non-QM Loans Term Single-Family Rental (“SFR”), Multifamily Bridge Multifamily, Build/Renovate to Rent, Fix & Flip Organically Created RMBS & BPL Third-Party Purchased RPLs, HEI, CRT, Multifamily Securities ~$170bn Jumbo Lock Volume (Flow)

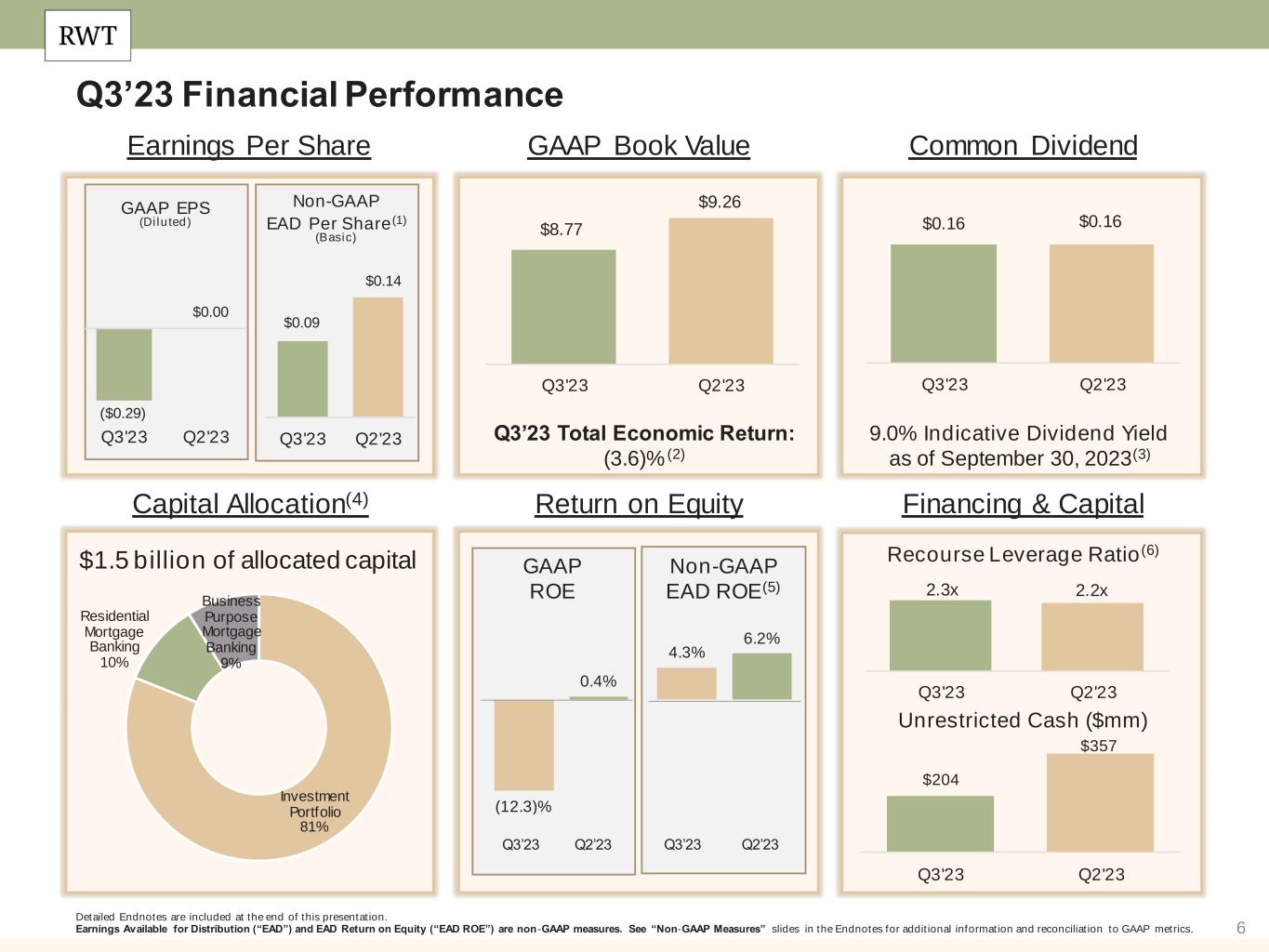

6 Q3’23 Financial Performance $1.5 billion of allocated capital Detailed Endnotes are included at the end of this presentation. Earnings Available for Distribution (“EAD”) and EAD Return on Equity (“EAD ROE”) are non -GAAP measures. See “Non-GAAP Measures” slides in the Endnotes for additional information and reconciliation to GAAP metrics. Earnings Per Share GAAP Book Value Common Dividend Capital Allocation(4) Return on Equity Financing & Capital Recourse Leverage Ratio(6) Unrestricted Cash ($mm) Q3’23 Total Economic Return: (3.6)% (2) 9.0% Indicative Dividend Yield as of September 30, 2023(3) GAAP ROE Non-GAAP EAD ROE(5) GAAP EPS (Diluted) Non-GAAP EAD Per Share (1) (Basic) Q3’23 Q2’23 Q3’23 Q2’23 $8.77 $9.26 Q3'23 Q2'23 $0.09 $0.14 Q3'23 Q2'23 $0.16 $0.16 Q3'23 Q2'23 $204 $357 Q3'23 Q2'23 2.3x 2.2x Q3'23 Q2'23 Investment Portfolio 81% Residential Mortgage Banking 10% Business Purpose Mortgage Banking 9% ($0.29) $0.00 Q3'23 Q2'23 (12.3)% 4.3% 0.4% 6.2%

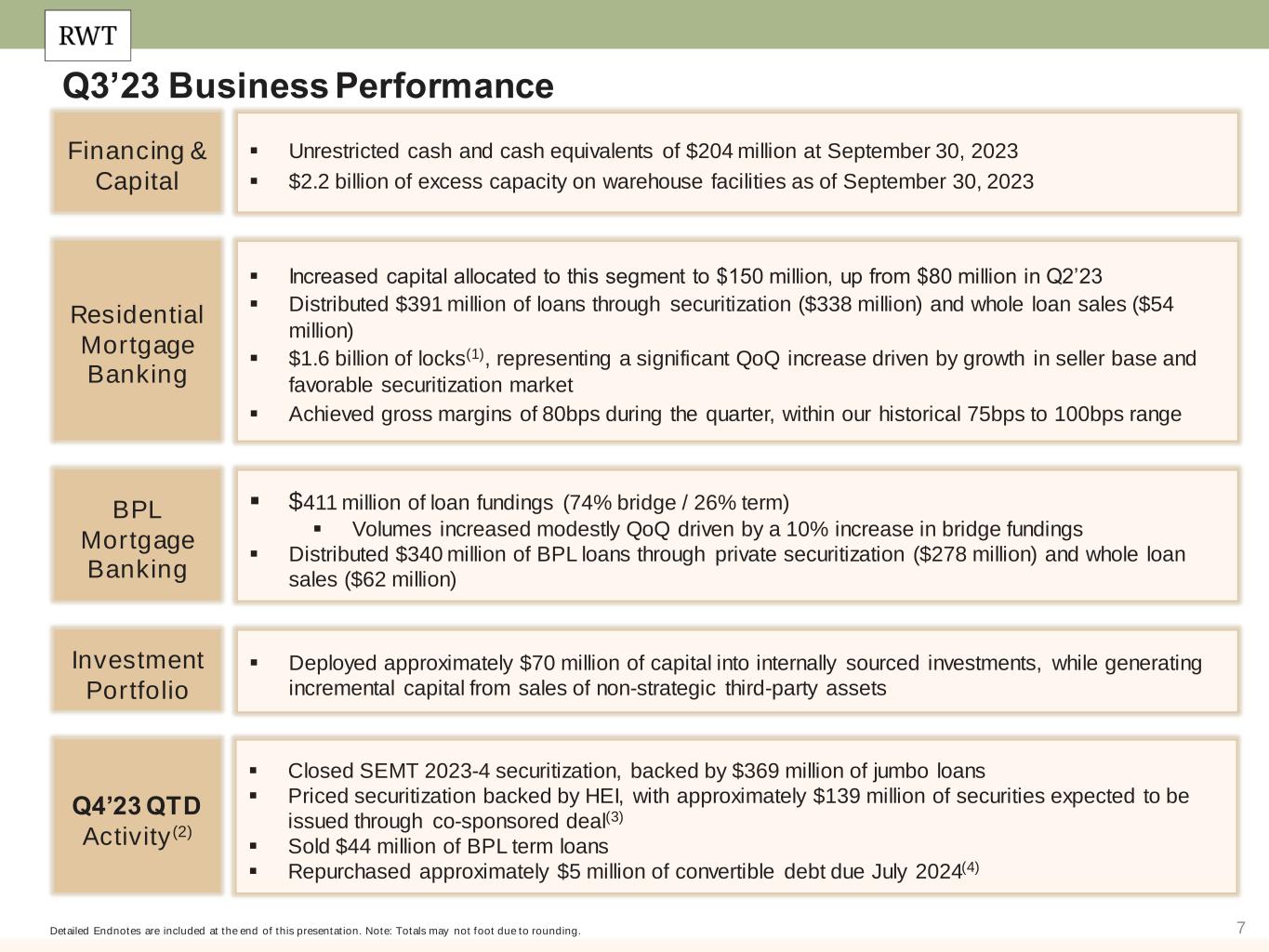

7 Q3’23 Business Performance Detailed Endnotes are included at the end of this presentation. Note: Totals may not foot due to rounding. ▪ Increased capital allocated to this segment to $150 million, up from $80 million in Q2’23 ▪ Distributed $391 million of loans through securitization ($338 million) and whole loan sales ($54 million) ▪ $1.6 billion of locks(1), representing a significant QoQ increase driven by growth in seller base and favorable securitization market ▪ Achieved gross margins of 80bps during the quarter, within our historical 75bps to 100bps range Residential Mortgage Banking ▪ Deployed approximately $70 million of capital into internally sourced investments, while generating incremental capital from sales of non-strategic third-party assets Investment Portfolio ▪ Unrestricted cash and cash equivalents of $204 million at September 30, 2023 ▪ $2.2 billion of excess capacity on warehouse facilities as of September 30, 2023 Financing & Capital ▪ $411 million of loan fundings (74% bridge / 26% term) ▪ Volumes increased modestly QoQ driven by a 10% increase in bridge fundings ▪ Distributed $340 million of BPL loans through private securitization ($278 million) and whole loan sales ($62 million) BPL Mortgage Banking ▪ Closed SEMT 2023-4 securitization, backed by $369 million of jumbo loans ▪ Priced securitization backed by HEI, with approximately $139 million of securities expected to be issued through co-sponsored deal(3) ▪ Sold $44 million of BPL term loans ▪ Repurchased approximately $5 million of convertible debt due July 2024(4) Q4’23 QTD Activity(2)

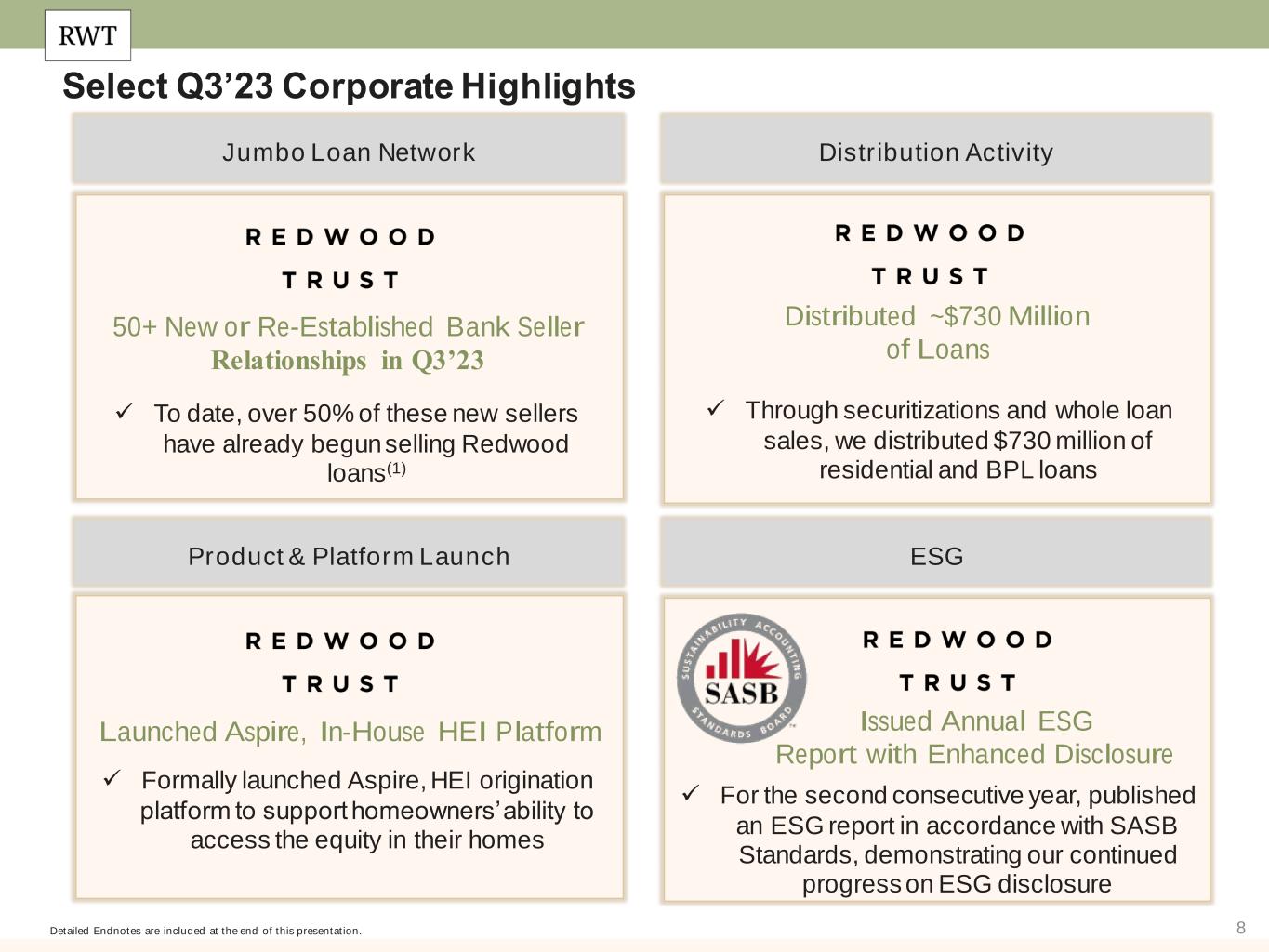

8 Select Q3’23 Corporate Highlights Detailed Endnotes are included at the end of this presentation. ESG Distribution Activity Product & Platform Launch Launched Aspire, In-House HEI Platform Distributed ~$730 Million of Loans Issued Annual ESG Report with Enhanced Disclosure ✓ For the second consecutive year, published an ESG report in accordance with SASB Standards, demonstrating our continued progress on ESG disclosure ✓ Through securitizations and whole loan sales, we distributed $730 million of residential and BPL loans ✓ Formally launched Aspire, HEI origination platform to support homeowners’ ability to access the equity in their homes Jumbo Loan Network 50+ New or Re-Established Bank Seller Relationships in Q3’23 ✓ To date, over 50% of these new sellers have already begun selling Redwood loans(1)

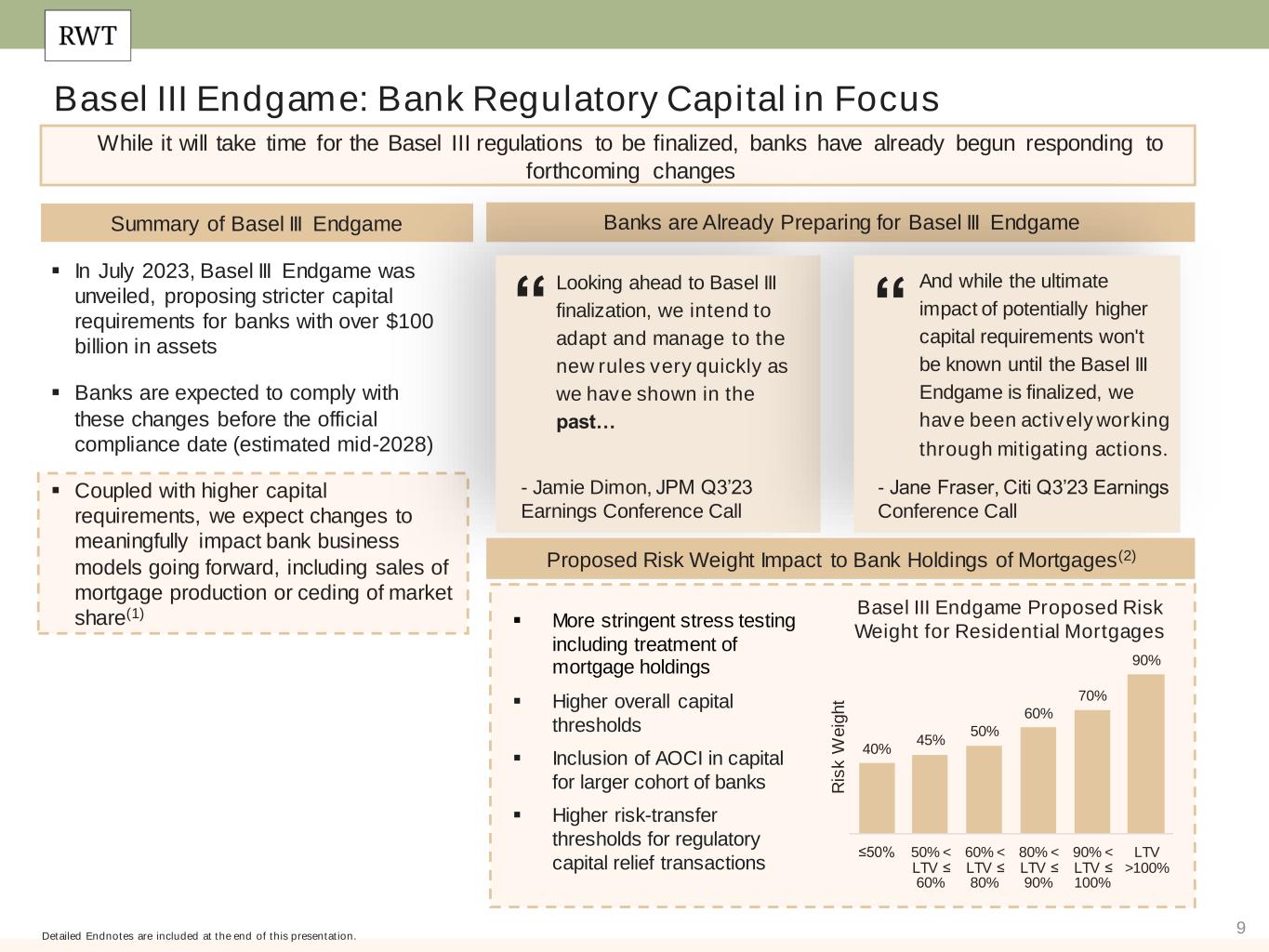

9 Basel III Endgame: Bank Regulatory Capital in Focus Detailed Endnotes are included at the end of this presentation. While it will take time for the Basel III regulations to be finalized, banks have already begun responding to forthcoming changes Summary of Basel III Endgame Banks are Already Preparing for Basel III Endgame Looking ahead to Basel III finalization, we intend to adapt and manage to the new rules very quickly as we have shown in the past… “ - Jamie Dimon, JPM Q3’23 Earnings Conference Call And while the ultimate impact of potentially higher capital requirements won't be known until the Basel III Endgame is finalized, we have been actively working through mitigating actions. “ - Jane Fraser, Citi Q3’23 Earnings Conference Call Proposed Risk Weight Impact to Bank Holdings of Mortgages(2) ▪ More stringent stress testing including treatment of mortgage holdings ▪ Higher overall capital thresholds ▪ Inclusion of AOCI in capital for larger cohort of banks ▪ Higher risk-transfer thresholds for regulatory capital relief transactions 40% 45% 50% 60% 70% 90% ≤50% 50% < LTV ≤ 60% 60% < LTV ≤ 80% 80% < LTV ≤ 90% 90% < LTV ≤ 100% LTV >100% R is k W e ig h t Basel III Endgame Proposed Risk Weight for Residential Mortgages ▪ In July 2023, Basel III Endgame was unveiled, proposing stricter capital requirements for banks with over $100 billion in assets ▪ Banks are expected to comply with these changes before the official compliance date (estimated mid-2028) ▪ Coupled with higher capital requirements, we expect changes to meaningfully impact bank business models going forward, including sales of mortgage production or ceding of market share(1)

10 Substantial Opportunity for Redwood Residential Detailed Endnotes are included at the end of this presentation. Shifting regulatory landscape could result in massive opportunity for our Residential Mortgage Banking platform(1) Jumbo Market Share by Lender Type(3) A significant portion of this market share could change hands Holdings of Jumbo Loans by Bank Portfolios(2) We have seen an increase in pools for sale from banks, a trend that we expect to continue(1) We see an opportunity to unlock market and wallet share as depositories pivot to an “originate to sell” model $900 $1,100 $1,300 $1,500 2018 2019 2020 2021 2022 2023 $ B ill io n s o f Ju m b o L o a n s H e ld o n B a n k B a la n c e S h e e ts Of the $2.8 trillion of residential assets held on bank balance sheets, $1.4 trillion are jumbo loans 2021 – Q2’2023 Jumbo Market Share Others, 17% Regional Banks, 28% Non-Banks, 12% Money-Center Banks, 43%

11 Update on Our Progress in Residential Mortgage Banking Detailed Endnotes are included at the end of this presentation. Even if volumes in the jumbo origination market remain lower than historical averages, we still see considerable opportunity to capture incremental market share(1) Market Share Banking Partners Loan Purchases Lock Volume 189% 50% 50+ ~4% Q3’23 Estimated Market Share (Up from ~1% in Q2’23)(2) New or Re-Established Depository Relationships Onboarded in the Third Quarter of Total Q3’23 Purchase Volume from Banks QoQ Increase in Lock Volumes(3)

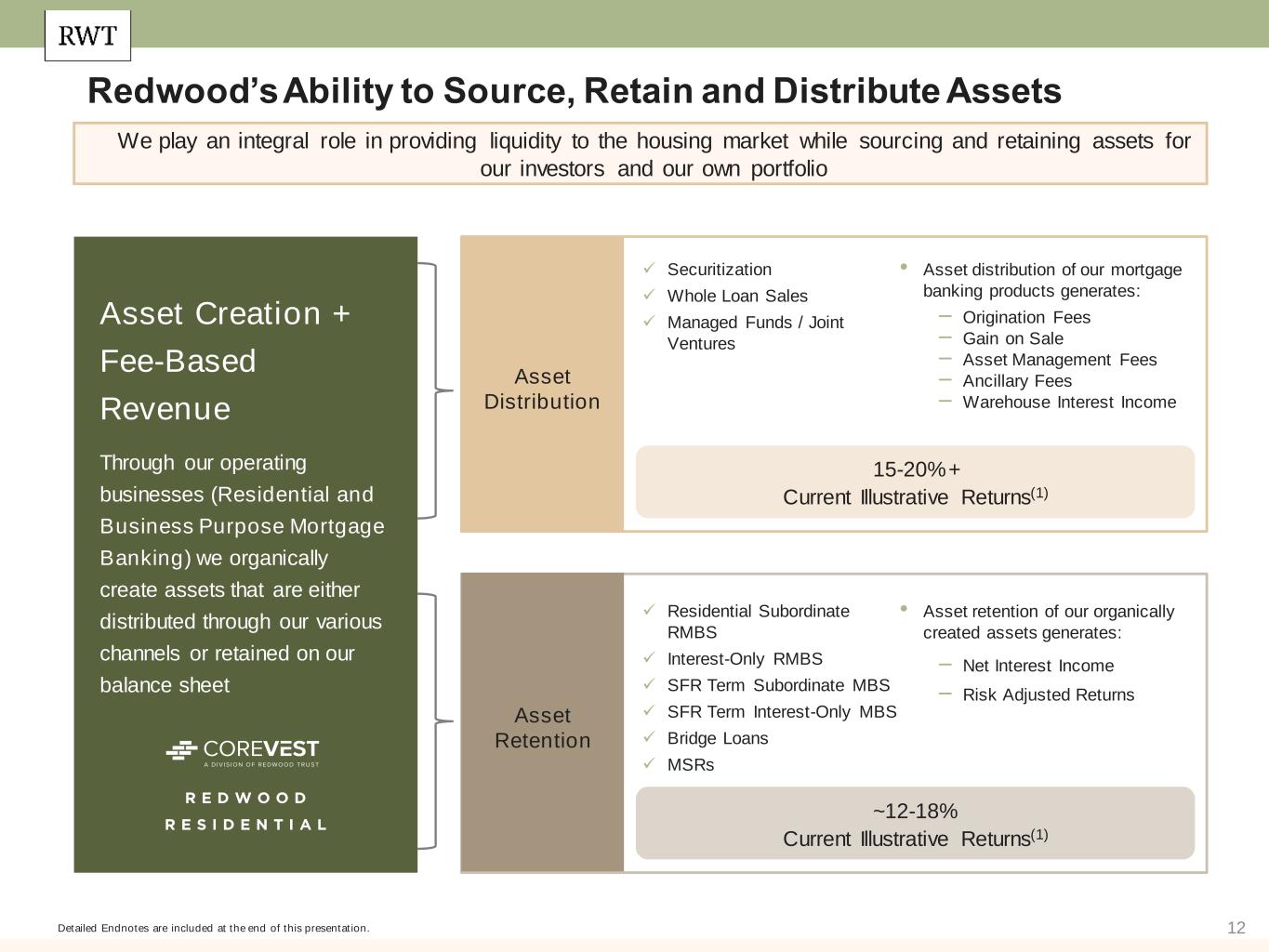

12 Asset Creation + Fee-Based Revenue Through our operating businesses (Residential and Business Purpose Mortgage Banking) we organically create assets that are either distributed through our various channels or retained on our balance sheet Redwood’s Ability to Source, Retain and Distribute Assets Detailed Endnotes are included at the end of this presentation. We play an integral role in providing liquidity to the housing market while sourcing and retaining assets for our investors and our own portfolio Asset Distribution Asset Retention • Asset distribution of our mortgage banking products generates: – Origination Fees – Gain on Sale – Asset Management Fees – Ancillary Fees – Warehouse Interest Income 15-20%+ Current Illustrative Returns(1) ✓ Securitization ✓ Whole Loan Sales ✓ Managed Funds / Joint Ventures • Asset retention of our organically created assets generates: – Net Interest Income – Risk Adjusted Returns ~12-18% Current Illustrative Returns(1) ✓ Residential Subordinate RMBS ✓ Interest-Only RMBS ✓ SFR Term Subordinate MBS ✓ SFR Term Interest-Only MBS ✓ Bridge Loans ✓ MSRs

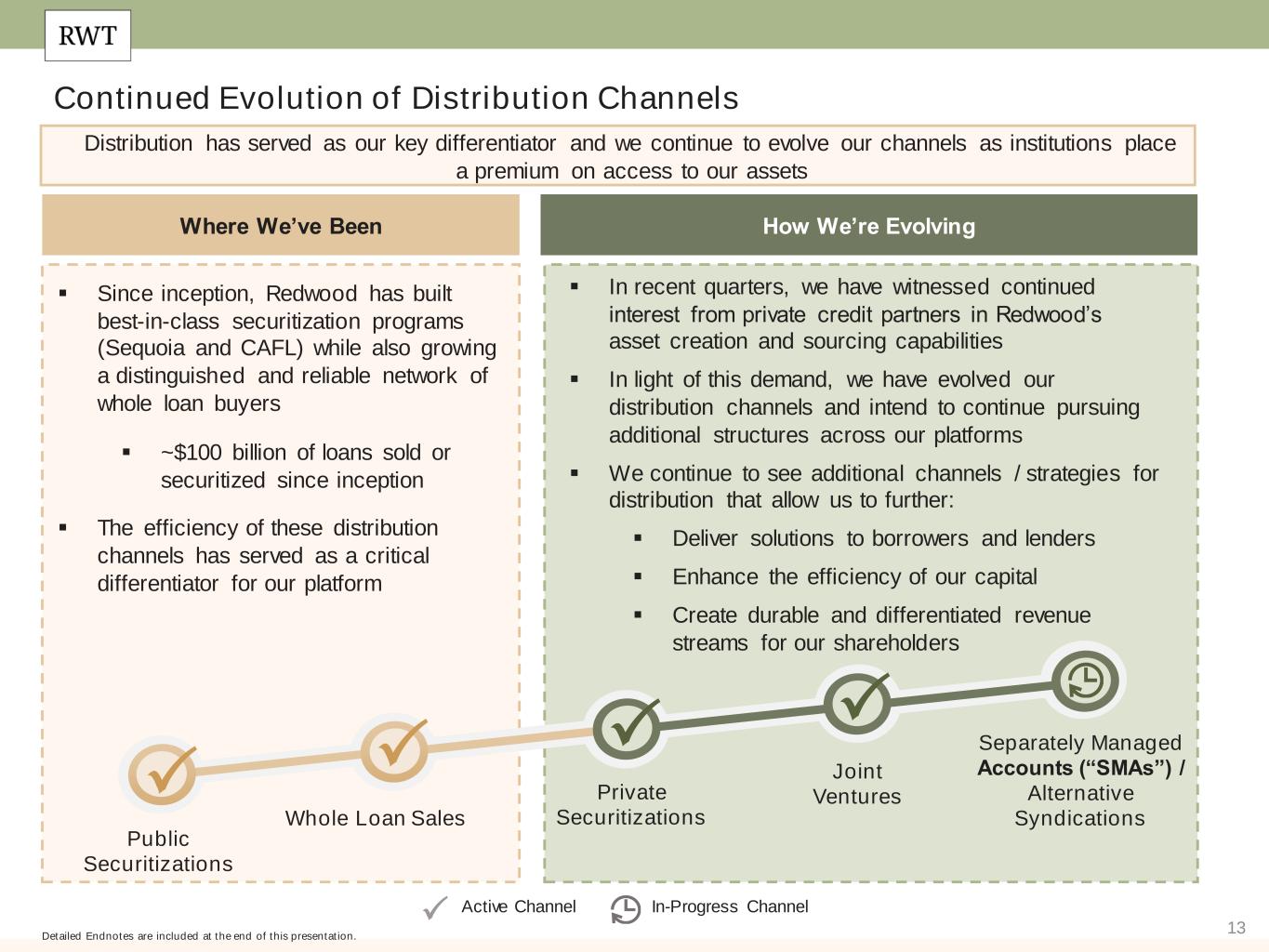

13 Continued Evolution of Distribution Channels Detailed Endnotes are included at the end of this presentation. Distribution has served as our key differentiator and we continue to evolve our channels as institutions place a premium on access to our assets ▪ Since inception, Redwood has built best-in-class securitization programs (Sequoia and CAFL) while also growing a distinguished and reliable network of whole loan buyers ▪ ~$100 billion of loans sold or securitized since inception ▪ The efficiency of these distribution channels has served as a critical differentiator for our platform Public Securitizations Where We’ve Been How We’re Evolving ▪ In recent quarters, we have witnessed continued interest from private credit partners in Redwood’s asset creation and sourcing capabilities ▪ In light of this demand, we have evolved our distribution channels and intend to continue pursuing additional structures across our platforms ▪ We continue to see additional channels / strategies for distribution that allow us to further: ▪ Deliver solutions to borrowers and lenders ▪ Enhance the efficiency of our capital ▪ Create durable and differentiated revenue streams for our shareholders Whole Loan Sales Private Securitizations Joint Ventures Separately Managed Accounts (“SMAs”) / Alternative Syndications Active Channel In-Progress Channel

14 Launch of Home Equity Investment (“HEI”) Platform Detailed Endnotes are included at the end of this presentation. In Q3’23, we formally launched our in-house HEI platform, Aspire, to support homeowners’ ability to access the equity in their homes ▪ After nearly five years of investing in third-party originated HEI, Redwood formally launched Aspire, our own in-house HEI origination platform ▪ Aspire’s competitive strengths include: ▪ Leverages Redwood’s existing operating infrastructure ▪ Robust access to financing and capital markets ▪ Differentiated and efficient customer acquisition strategy ▪ Quality products and solutions ▪ Regulatory expertise and credibility ▪ Mission alignment ▪ Our in-house platform can help support the scale and institutionalization of this growing product Why Invest in Home Equity Now? Record Levels of Home Equity(1) U.S. home equity has continued to trend near record highs for years, creating a significant addressable market for HEI Home equity remains elevated as low housing inventory and high mortgage rates reduce turnover $30 Trillion 2013 2018 2023 Source: Federal Reserve; Piper Sandler. Supply Technicals Support Home Prices(2) Home ownership is at multi-decade highs while available listings are at historical lows, providing support to overall home prices 1983 20232003 Source: John Burns Research and Consulting, LLC. Data subject to revisions. 0 10 20 30 40 50 60 70 80 90 100 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 O w n e r O c c u p ie d H o u s in g U n it s (m m ) L is ti n g s ( m m ) Listings Owner-Occupied Housing Units

15 Strong Balance Sheet Supports Our Strategic Objectives Detailed Endnotes are included at the end of this presentation. Leverage Secured FinancingLiquidity ▪ Recourse leverage remains below historical range, notwithstanding an increase in warehouse borrowings to support growth in Residential Mortgage Banking ▪ We remain focused on maintaining a disciplined and flexible leverage profile ▪ We maintain the ability to unlock additional capital organically through further optimization of secured leverage ▪ Portfolio recourse leverage of 1.0x ▪ In Q3’23, we renewed maturing loan warehouse financing facilities with key counterparties (representing ~$1.0 billion of capacity) ▪ As of 9/30/23, we maintained $2.2 billion of excess warehouse capacity Utilized Capacity by Counterparty Type Recourse Leverage Ratio(1) Unrestricted Cash ($mm) Domestic Money- Center Bank 58% Asset Manager 33% Insurance 9% $259 $404 $357 $204 Q4'22 Q1'23 Q2'23 Q3'23 $113 Aug’23 CONV(2) $244 2.8x 2.3x 2.2x 2.3x Q4'22 Q1'23 Q2'23 Q3'23

16 Operating Businesses & Investment Portfolio

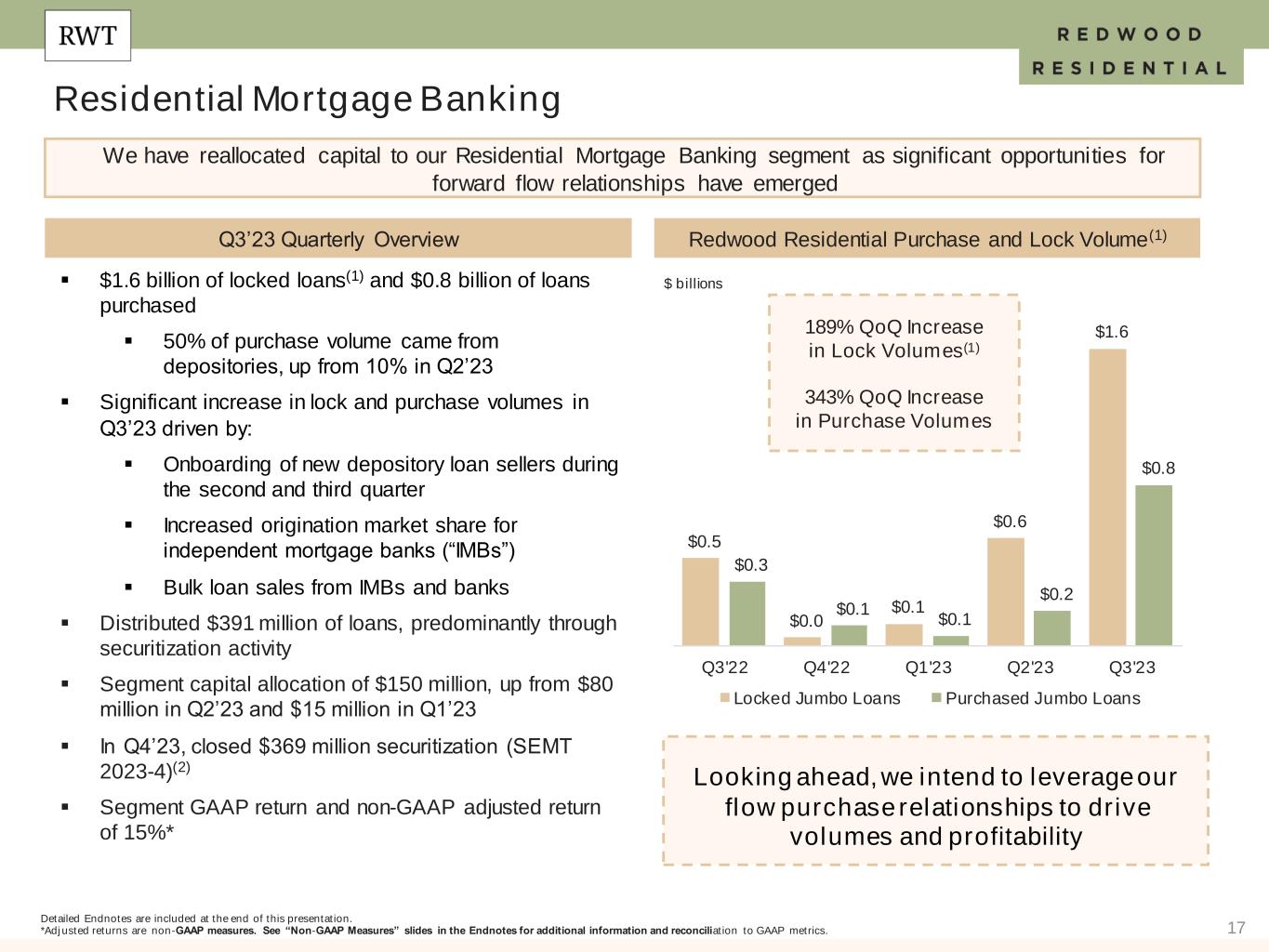

17 ▪ $1.6 billion of locked loans(1) and $0.8 billion of loans purchased ▪ 50% of purchase volume came from depositories, up from 10% in Q2’23 ▪ Significant increase in lock and purchase volumes in Q3’23 driven by: ▪ Onboarding of new depository loan sellers during the second and third quarter ▪ Increased origination market share for independent mortgage banks (“IMBs”) ▪ Bulk loan sales from IMBs and banks ▪ Distributed $391 million of loans, predominantly through securitization activity ▪ Segment capital allocation of $150 million, up from $80 million in Q2’23 and $15 million in Q1’23 ▪ In Q4’23, closed $369 million securitization (SEMT 2023-4)(2) ▪ Segment GAAP return and non-GAAP adjusted return of 15%* Residential Mortgage Banking Q3’23 Quarterly Overview We have reallocated capital to our Residential Mortgage Banking segment as significant opportunities for forward flow relationships have emerged $ billions Looking ahead, we intend to leverage our flow purchase relationships to drive volumes and profitability Redwood Residential Purchase and Lock Volume(1) Detailed Endnotes are included at the end of this presentation. *Adjusted returns are non-GAAP measures. See “Non-GAAP Measures” slides in the Endnotes for additional information and reconciliation to GAAP metrics. $0.5 $0.0 $0.1 $0.6 $1.6 $0.3 $0.1 $0.1 $0.2 $0.8 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Locked Jumbo Loans Purchased Jumbo Loans 189% QoQ Increase in Lock Volumes(1) 343% QoQ Increase in Purchase Volumes

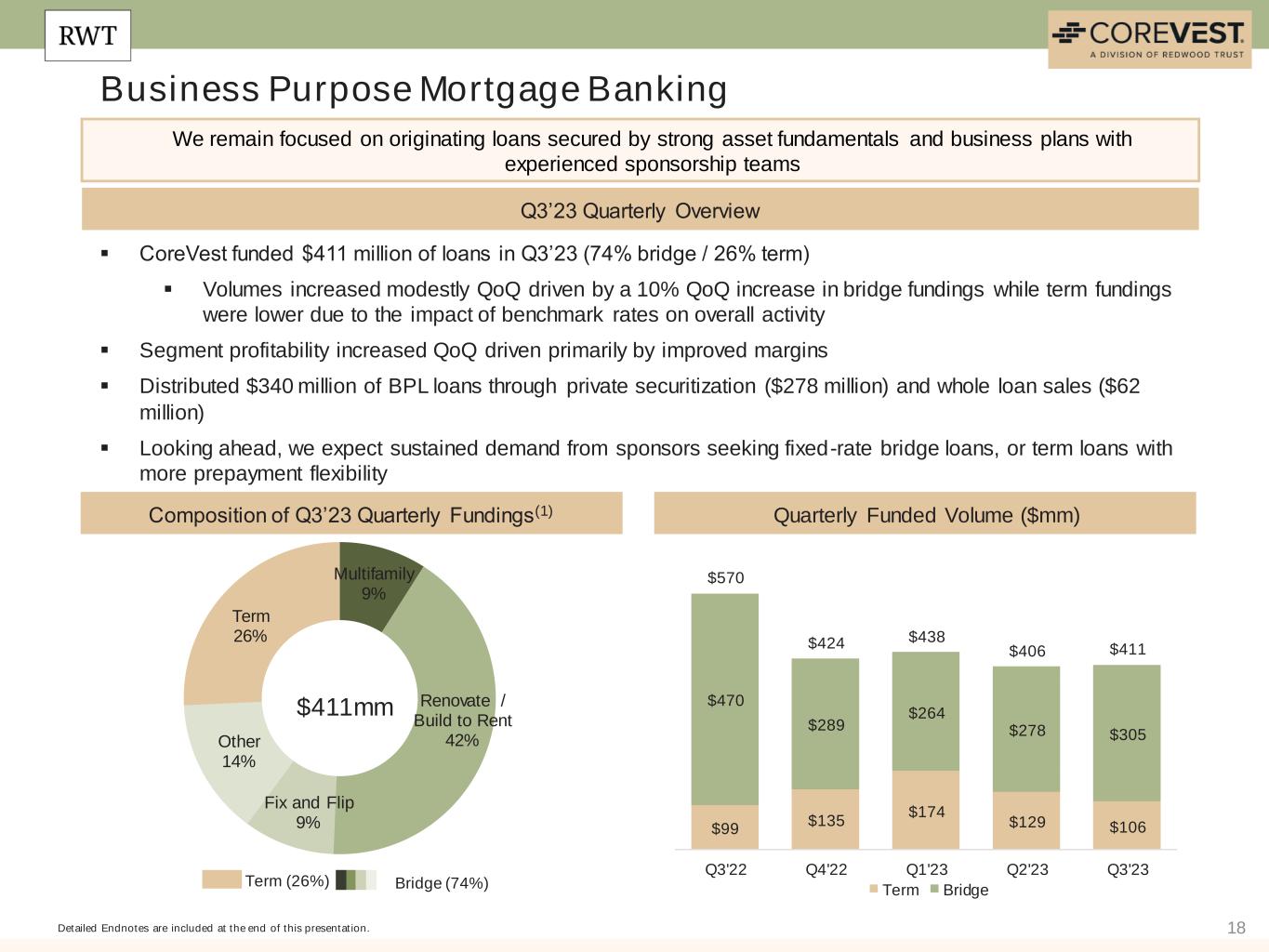

18 Business Purpose Mortgage Banking Q3’23 Quarterly Overview Composition of Q3’23 Quarterly Fundings(1) Detailed Endnotes are included at the end of this presentation. We remain focused on originating loans secured by strong asset fundamentals and business plans with experienced sponsorship teams Quarterly Funded Volume ($mm) Term (26%) Bridge (74%) ▪ CoreVest funded $411 million of loans in Q3’23 (74% bridge / 26% term) ▪ Volumes increased modestly QoQ driven by a 10% QoQ increase in bridge fundings while term fundings were lower due to the impact of benchmark rates on overall activity ▪ Segment profitability increased QoQ driven primarily by improved margins ▪ Distributed $340 million of BPL loans through private securitization ($278 million) and whole loan sales ($62 million) ▪ Looking ahead, we expect sustained demand from sponsors seeking fixed-rate bridge loans, or term loans with more prepayment flexibility $411mm $99 $135 $174 $129 $106 $470 $289 $264 $278 $305 $570 $424 $438 $406 $411 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Term Bridge Multifamily 9% Renovate / Build to Rent 42% Fix and Flip 9% Other 14% Term 26%

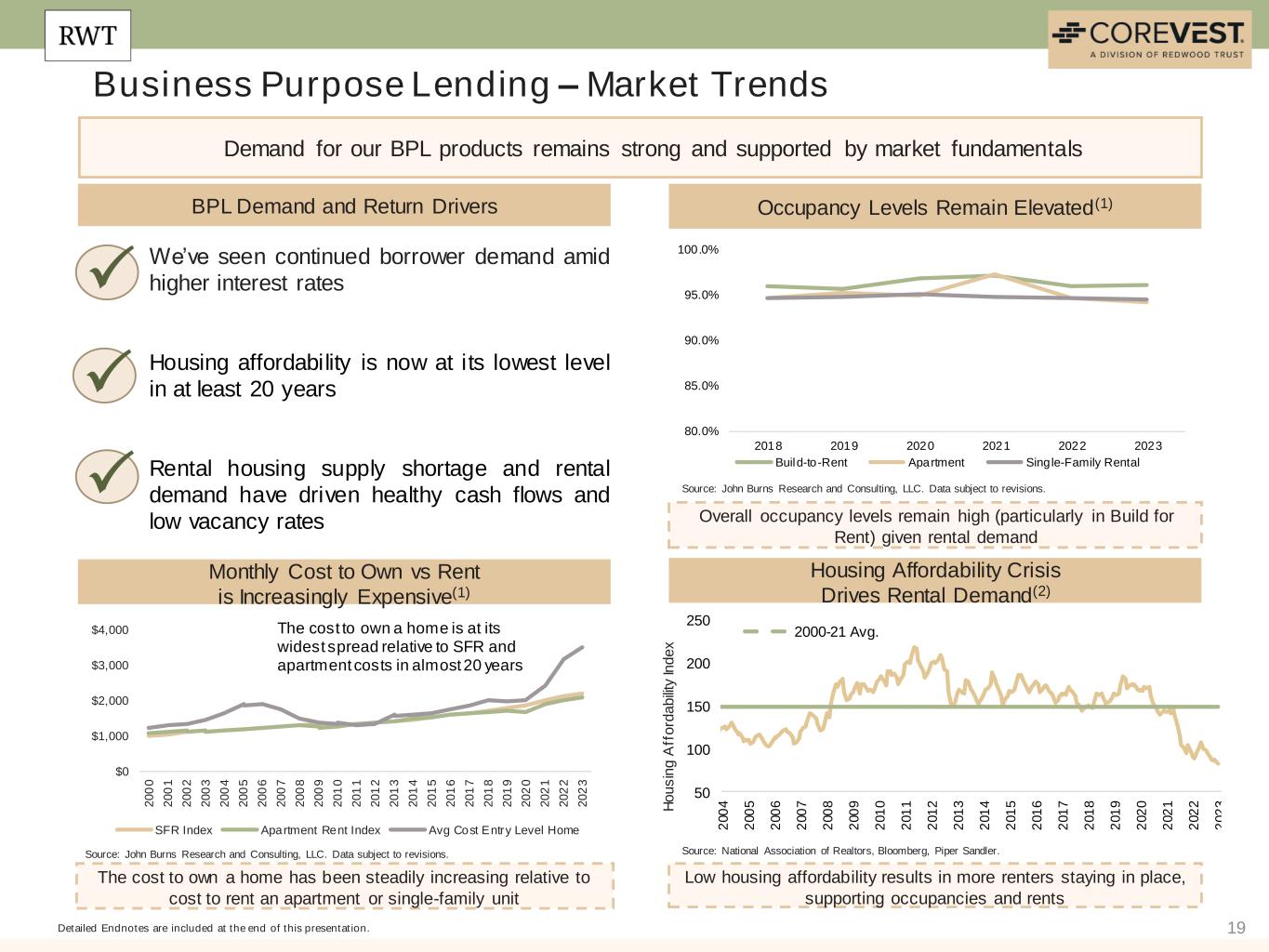

19 Business Purpose Lending – Market Trends Detailed Endnotes are included at the end of this presentation. Demand for our BPL products remains strong and supported by market fundamentals BPL Demand and Return Drivers Housing Affordability Crisis Drives Rental Demand(2) Occupancy Levels Remain Elevated(1) Monthly Cost to Own vs Rent is Increasingly Expensive(1) Overall occupancy levels remain high (particularly in Build for Rent) given rental demand Low housing affordability results in more renters staying in place, supporting occupancies and rents The cost to own a home has been steadily increasing relative to cost to rent an apartment or single-family unit H o u s in g A ff o rd a b ili ty In d e x The cost to own a home is at its widest spread relative to SFR and apartment costs in almost 20 years Source: John Burns Research and Consulting, LLC. Data subject to revisions. Source: John Burns Research and Consulting, LLC. Data subject to revisions. Source: National Association of Realtors, Bloomberg, Piper Sandler. We’ve seen continued borrower demand amid higher interest rates Housing affordability is now at its lowest level in at least 20 years Rental housing supply shortage and rental demand have driven healthy cash flows and low vacancy rates 50 100 150 200 250 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 2 0 2 1 2 0 2 2 2 0 2 3 2000-21 Avg. $0 $1,000 $2,000 $3,000 $4,000 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 2 0 2 1 2 0 2 2 2 0 2 3 SFR Index Apartment Rent Index Avg Cost Entry Level Home 80.0% 85.0% 90.0% 95.0% 100.0% 2018 2019 2020 2021 2022 2023 Build-to-Rent Apartment Single-Family Rental

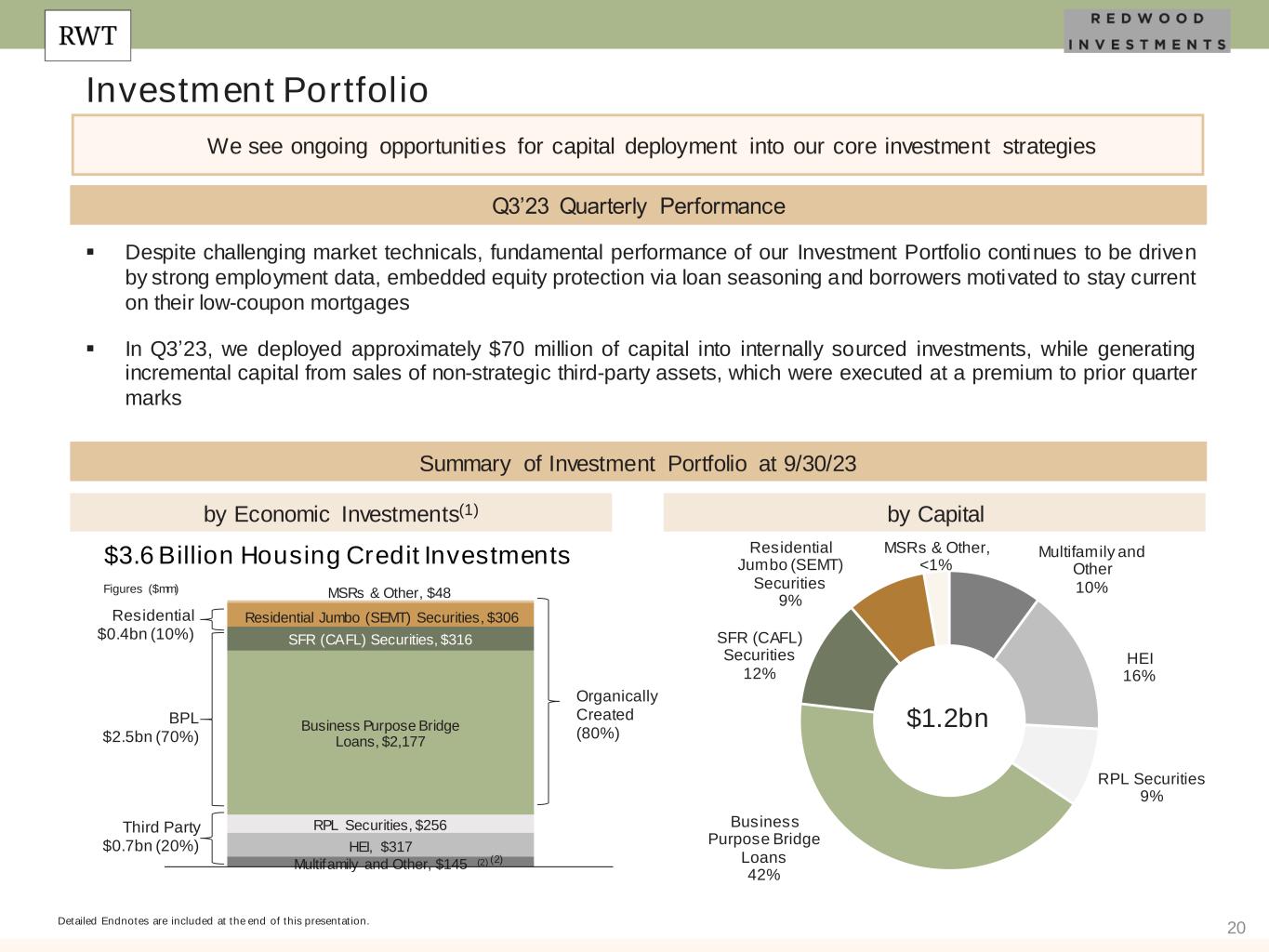

20 Multifamily and Other, $145 HEI, $317 RPL Securities, $256 Business Purpose Bridge Loans, $2,177 SFR (CAFL) Securities, $316 Residential Jumbo (SEMT) Securities, $306 MSRs & Other, $48 Investment Portfolio Q3’23 Quarterly Performance $3.6 Billion Housing Credit Investments Organically Created (80%) Detailed Endnotes are included at the end of this presentation. We see ongoing opportunities for capital deployment into our core investment strategies $1.2bn Third Party $0.7bn (20%) BPL $2.5bn (70%) Residential $0.4bn (10%) Figures ($mm) Summary of Investment Portfolio at 9/30/23 by Economic Investments(1) by Capital (2) ▪ Despite challenging market technicals, fundamental performance of our Investment Portfolio continues to be driven by strong employment data, embedded equity protection via loan seasoning and borrowers motivated to stay current on their low-coupon mortgages ▪ In Q3’23, we deployed approximately $70 million of capital into internally sourced investments, while generating incremental capital from sales of non-strategic third-party assets, which were executed at a premium to prior quarter marks Multifamily and Other 10% HEI 16% RPL Securities 9% Business Purpose Bridge Loans 42% SFR (CAFL) Securities 12% Residential Jumbo (SEMT) Securities 9% MSRs & Other, <1% (2)

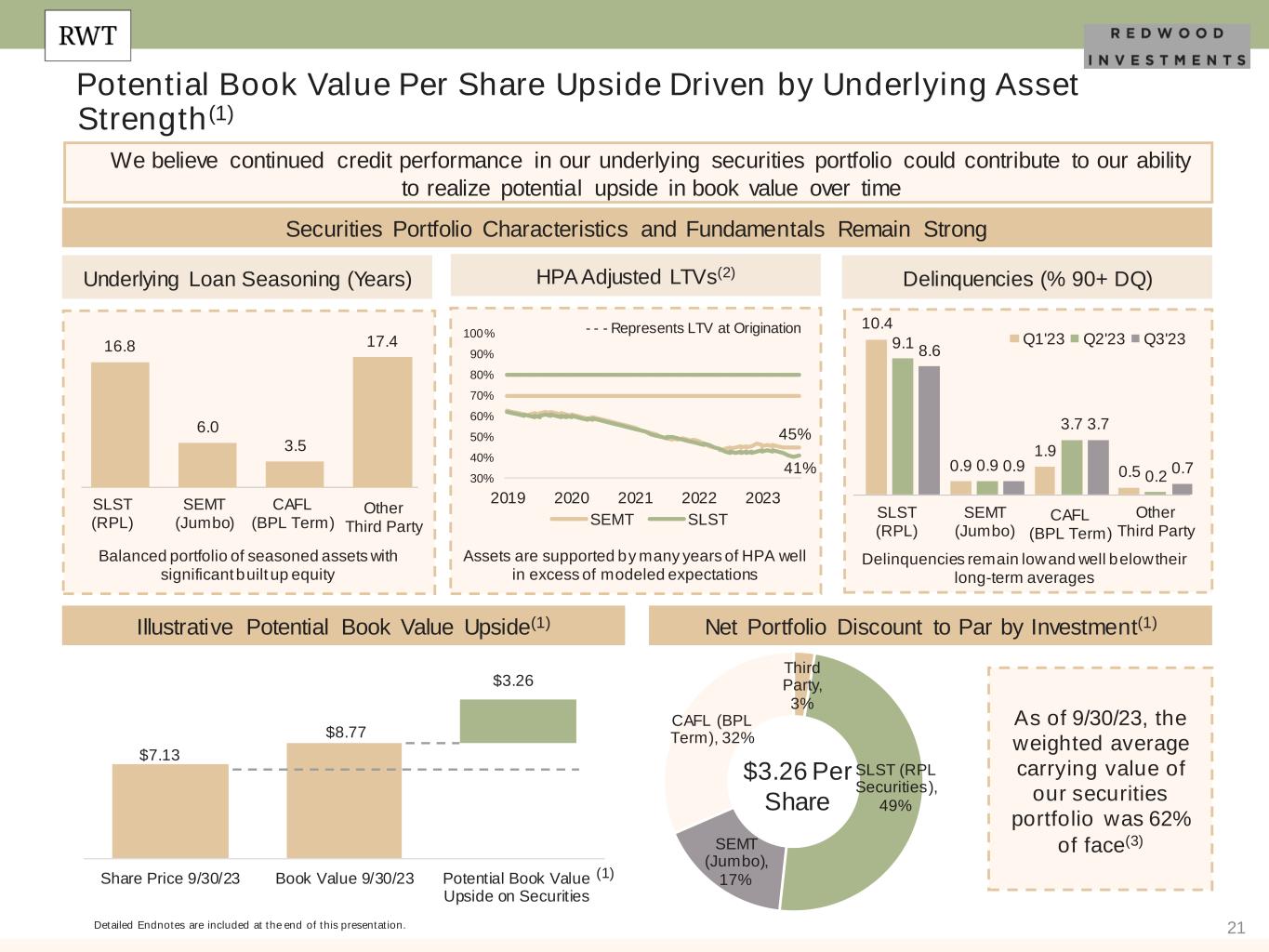

21 $7.13 $8.77 $3.26 Share Price 9/30/23 Book Value 9/30/23 Potential Book Value Upside on Securities (1) Net Portfolio Discount to Par by Investment(1) $3.26 Per Share Illustrative Potential Book Value Upside(1) Detailed Endnotes are included at the end of this presentation. Potential Book Value Per Share Upside Driven by Underlying Asset Strength(1) As of 9/30/23, the weighted average carrying value of our securities portfolio was 62% of face(3) We believe continued credit performance in our underlying securities portfolio could contribute to our ability to realize potential upside in book value over time Delinquencies (% 90+ DQ)HPA Adjusted LTVs(2) Securities Portfolio Characteristics and Fundamentals Remain Strong SLST (RPL) SEMT (Jumbo) CAFL (BPL Term) Other Third Party Underlying Loan Seasoning (Years) Assets are supported by many years of HPA well in excess of modeled expectations Delinquencies remain low and well below their long-term averages Balanced portfolio of seasoned assets with significant built up equity SLST (RPL) SEMT (Jumbo) CAFL (BPL Term) Other Third Party - - - Represents LTV at Origination 16.8 6.0 3.5 17.4 10.4 0.9 1.9 0.5 9.1 0.9 3.7 0.2 8.6 0.9 3.7 0.7 Q1'23 Q2'23 Q3'23 Third Party, 3% SLST (RPL Securities), 49% SEMT (Jumbo), 17% CAFL (BPL Term), 32% 45% 41% 30% 40% 50% 60% 70% 80% 90% 100% 2019 2020 2021 2022 2023 SEMT SLST

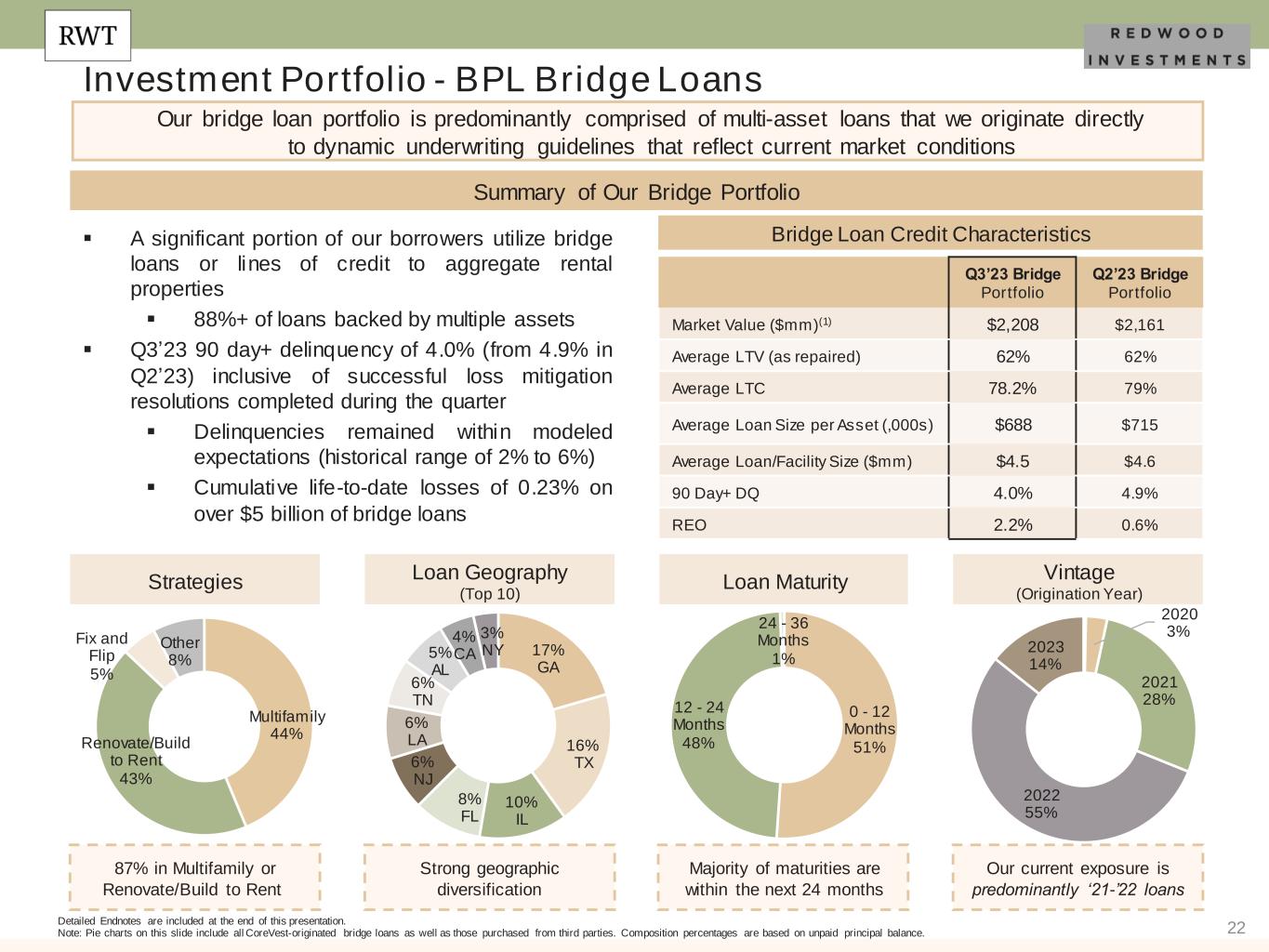

22 Investment Portfolio - BPL Bridge Loans Detailed Endnotes are included at the end of this presentation. Note: Pie charts on this slide include all CoreVest-originated bridge loans as well as those purchased from third parties. Composition percentages are based on unpaid principal balance. Our bridge loan portfolio is predominantly comprised of multi-asset loans that we originate directly to dynamic underwriting guidelines that reflect current market conditions ▪ A significant portion of our borrowers utilize bridge loans or lines of credit to aggregate rental properties ▪ 88%+ of loans backed by multiple assets ▪ Q3’23 90 day+ delinquency of 4.0% (from 4.9% in Q2’23) inclusive of successful loss mitigation resolutions completed during the quarter ▪ Delinquencies remained within modeled expectations (historical range of 2% to 6%) ▪ Cumulative life-to-date losses of 0.23% on over $5 billion of bridge loans Vintage (Origination Year) Our current exposure is predominantly ‘21-’22 loans Loan Maturity Majority of maturities are within the next 24 months Summary of Our Bridge Portfolio Bridge Loan Credit Characteristics Q3’23 Bridge Portfolio Q2’23 Bridge Portfolio Market Value ($mm)(1) $2,208 $2,161 Average LTV (as repaired) 62% 62% Average LTC 78.2% 79% Average Loan Size per Asset (,000s) $688 $715 Average Loan/Facility Size ($mm) $4.5 $4.6 90 Day+ DQ 4.0% 4.9% REO 2.2% 0.6% Strategies Loan Geography (Top 10) Strong geographic diversification 87% in Multifamily or Renovate/Build to Rent Multifamily 44% Renovate/Build to Rent 43% Fix and Flip 5% Other 8% 17% GA 16% TX 10% IL 8% FL 6% NJ 6% LA 6% TN 5% AL 4% CA 3% NY 0 - 12 Months 51% 12 - 24 Months 48% 24 - 36 Months 1% 2020 3% 2021 28% 2022 55% 2023 14%

23 R W T H O R I Z O N S RWT Horizons by the Numbers Detailed Endnotes are included at the end of this presentation. Invests primarily in early-stage companies that drive innovation in financial and real estate technology RWT Horizons Opportunity Thesis Enhance efficiency and scale in Redwood businesses Early-stage companies with opportunity for valuation upside Partnerships drive growth and technological enhancements Alignment with Redwood’s mission, values and goals $28mm+ of Investment Commitments 35 Total Investments 28 Portfolio Companies Q3’23 Portfolio Composition 2 New Investments in Q3’23 Blockchain/Web3 16% Alternative Financing Solutions 14% Lending Infrastructure 12% Marketing/LeadGen 11% Construction Technology 11% Real Estate Technology 12% Other 24% 6 portfolio companies are artificial intelligence (“AI”) companies or have AI as an extension of their core product offering

24 Financial Results

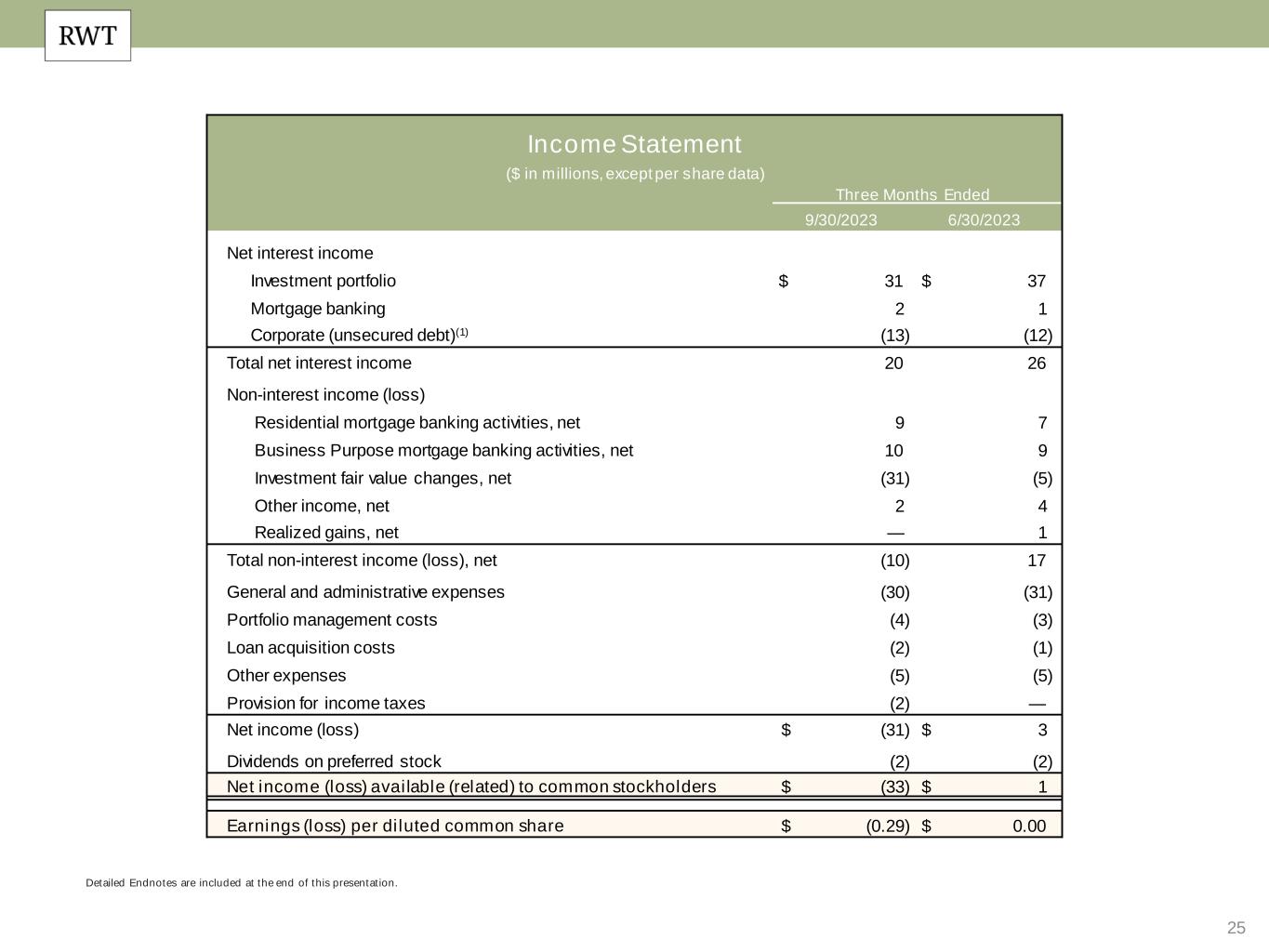

25 Detailed Endnotes are included at the end of this presentation. Income Statement ($ in millions, except per share data) Three Months Ended 9/30/2023 6/30/2023 Net interest income Investment portfolio $ 31 $ 37 Mortgage banking 2 1 Corporate (unsecured debt)(1) (13) (12) Total net interest income 20 26 Non-interest income (loss) Residential mortgage banking activities, net 9 7 Business Purpose mortgage banking activities, net 10 9 Investment fair value changes, net (31) (5) Other income, net 2 4 Realized gains, net — 1 Total non-interest income (loss), net (10) 17 General and administrative expenses (30) (31) Portfolio management costs (4) (3) Loan acquisition costs (2) (1) Other expenses (5) (5) Provision for income taxes (2) — Net income (loss) $ (31) $ 3 Dividends on preferred stock (2) (2) Net income (loss) available (related) to common stockholders $ (33) $ 1 Earnings (loss) per diluted common share $ (0.29) $ 0.00

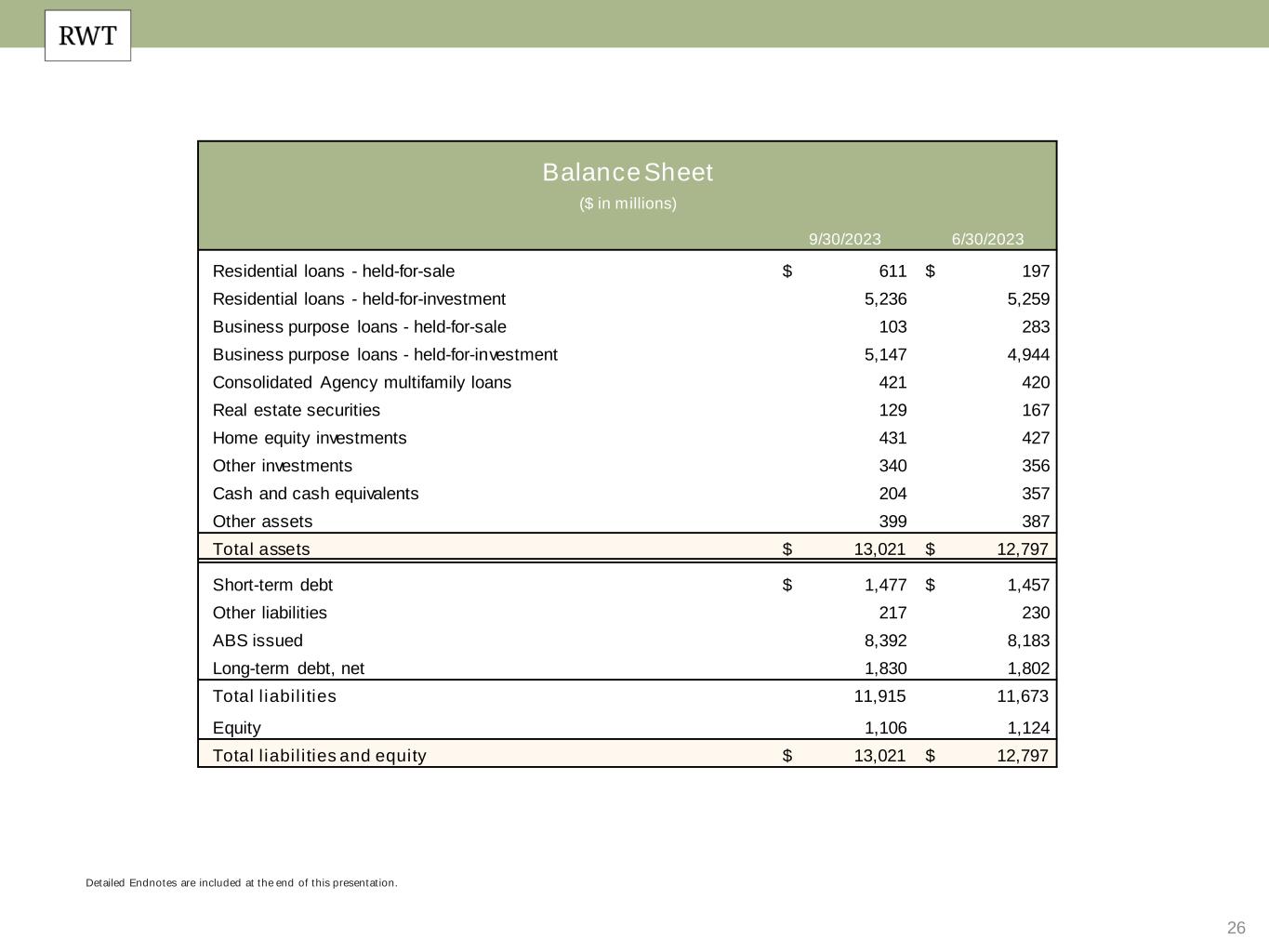

26 Detailed Endnotes are included at the end of this presentation. Balance Sheet ($ in millions) 9/30/2023 6/30/2023 Residential loans - held-for-sale $ 611 $ 197 Residential loans - held-for-investment 5,236 5,259 Business purpose loans - held-for-sale 103 283 Business purpose loans - held-for-investment 5,147 4,944 Consolidated Agency multifamily loans 421 420 Real estate securities 129 167 Home equity investments 431 427 Other investments 340 356 Cash and cash equivalents 204 357 Other assets 399 387 Total assets $ 13,021 $ 12,797 Short-term debt $ 1,477 $ 1,457 Other liabilities 217 230 ABS issued 8,392 8,183 Long-term debt, net 1,830 1,802 Total liabilities 11,915 11,673 Equity 1,106 1,124 Total liabilities and equity $ 13,021 $ 12,797