Filed by Regal Beloit Corporation

(SEC File No. 001-07283) pursuant to Rule 425

under the Securities Act of 1933, as amended,

and deemed filed pursuant to

Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Subject Company: Regal Beloit Corporation

(SEC File No. 001-07283)

Talking Points/FAQ for L1 and L2 Leaders to Use with Associates

|

PLEASE READ FIRST: Guidelines for Using This Document

Overview:

· This document is intended to support conversations with your team regarding Regal’s agreement to combine with Rexnord’s Process & Motion Control (PMC) segment and address questions they may have.

· As Regal leaders, you set the tone and direction in guiding your teams.

· The objective of your conversations is to provide clear and consistent messages to all associates. It is critical that we speak with one voice.

Do:

· Stick to the guidelines and talking points provided.

· Resist the urge to over-communicate.

· Emphasize the importance of staying focused and maintaining business as usual.

· Refer any questions you are unable to answer to Jerry Morton.

· Be positive!

Don’t:

· Do not speculate or make up an answer if you are asked a question that is not covered in this document. If you are asked a question not covered in this document, refer it to Jerry Morton and respond with the following:

“I am not sure how to answer your question and I don’t want to provide any information that may not be accurate. I am happy to pass your question along and get back to you if I have any additional information to share.”

· To that end, refrain from elaborating beyond messages included in the announcement press release and materials below.

· Do not distribute this document.

|

Talking Points

· Regal announced an agreement to combine with Rexnord’s Process & Motion Control (PMC) segment. PMC will combine with our PTS segment, creating a premier global provider of industrial power transmission and motion control solutions.

· As you may know, Rexnord is a global industrials leader based in Milwaukee, Wisconsin composed of two strategic platforms: PMC and Water Management.

o The PMC business is highly complementary to our PTS segment and will help Regal broaden our portfolio of highly engineered mechanical components.

· Our combination with PMC marks an important milestone in our ongoing business transformation, builds on the meaningful progress we’ve made over the last two years, and accelerates our strategic priorities – in particular, driving more valuable growth for Regal.

· Together, we will create a nearly $2 billion power transmission business with improved end-market and geographic diversity, reduced cyclicality, and significantly enhanced digital capabilities.

o This combination will also create opportunities to optimize our combined global operating model to better support investments in technology, IIoT, and new products across all of Regal.

o This transaction is focused on driving growth and we remain focused on building our talent and capabilities at Regal.

· PMC is a terrific cultural fit with Regal. We both prioritize integrity, customer success, continuous improvement, and a passion to win.

o We share a commitment to teamwork, belief in the power of diversity & inclusion, and focus on being valued members of the communities in which we operate.

o PMC also adheres to 80/20 principals and a strong LEAN culture.

· It is important to keep in mind that today’s announcement is just the first step in that process.

o We expect the transaction to close in the fourth quarter of 2021. The closing of the transaction is subject to the receipt of shareholder and regulatory approvals, and other closing conditions.

o Until then, both companies will continue to operate independently as we do today.

· Today’s announcement does not have any immediate impact on your role, responsibilities, or reporting structure.

o Until the transaction closes, it’s business as usual.

· It is essential that everyone remains focused on executing our strategy to deliver high-value, differentiated products and solutions that will provide meaningful benefits to our customers, shareholders, and Regal associates.

· Once the transaction has closed, our combined mechanical power transmission business will be renamed, “Rexnord, a Regal Company,” and be headquartered in Milwaukee.

o We expect to continue to maintain, invest in, and grow our existing presence in Florence, Kentucky, which will remain a strategic site.

o This transaction does not change our corporate name, executive leadership team or headquarters—they will all remain as they are today. Nor does this transaction impact our commitment to the Commercial, Industrial, and Climate segments.

· An experienced team comprised of individuals from both companies will develop a detailed plan for how PMC will be integrated into our PTS segment.

· We still have a lot of work ahead of us to complete this process. We are committed to honest and transparent communication as the process unfolds.

· Thank you for your hard work and commitment to Regal.

FAQ

Strategy

1. How does the transaction fit with our existing strategy?

· Over the past two years, we have made meaningful progress transforming the way we run Regal: including improving our organizational and cost structure, making investments to better serve our customers, developing differentiated products and solutions, and driving more sustainable growth.

· This transaction builds on that foundation and accelerates our strategic priorities. In particular, further improving our cost structure and creating new opportunities to drive more valuable growth.

· We believe the combination also improves our end-market and geographic diversity, reduces cyclicality, and significantly enhances our digital capabilities.

· By combining with PMC, Regal will become a premier global provider of industrial power transmission and motion control solutions poised to deliver enhanced value for our customers, associates, and shareholders.

2. Who is Rexnord/PMC? Are they a good cultural fit?

· Rexnord is a global industrial leader based in Milwaukee, Wisconsin. Their business is composed of two strategic platforms: PMC and Water Management.

· PMC designs, manufactures, markets, and services specified, highly engineered mechanical components used within complex systems.

· The PMC business is complementary to our PTS segment and provides us with the opportunity to broaden our portfolio of highly-engineered mechanical components.

· The PMC brands – including Rexnord™ and Falk™, among others – are highly-regarded in the marketplace and have a strong reputation for quality, technology, and reliability.

· Regal and PMC are a terrific cultural fit with similar values. Both prioritize integrity, customer success, continuous improvement, and a passion to win.

· We also share a commitment to teamwork, belief in the power of diversity and inclusion, and focus on being valued members of the communities in which we operate.

3. What does this mean for the non-PTS segments? Will Regal seek to transition away from those businesses? How does this transaction benefit the non-PTS segments?

· This transaction does not change our corporate name, executive leadership team, or headquarters, which will all remain as they are today.

· This transaction also does not impact our commitment to the Commercial, Industrial, and Climate segments of our business.

· Over time, our combination with PMC provides opportunities to better support investments in technology, IIoT, and new products across Regal.

· We have great momentum across our entire organization and remain focused on executing our strategy to deliver high-value, differentiated product solutions that will provide meaningful benefits to our customers, shareholders, and Regal associates.

4. How will this transaction impact our customers? What should we tell them?

· We are in the process of communicating with customers and arming customer-facing associates with the tools they need to communicate about this transaction.

· Those materials reiterate that customers will benefit from access to a broader portfolio of highly-engineered mechanical components that solve their needs.

· Our combination with PMC will also provide opportunities to optimize our R&D efforts, while supporting investments in technology and IIoT.

· We anticipate significant customer benefits by bringing more new products to market and being able to do so more rapidly post-merger.

· Importantly, this announcement is just the first step in the process. Until the transaction closes, which is expected in the fourth quarter of 2021, both Regal and PMC will continue to operate independently as we do today. The closing of the transaction is subject to the receipt of shareholder and regulatory approvals, and other closing conditions.

· We remain committed to communicating with customers throughout the transaction process as appropriate.

Job and Benefits

5. What does this mean for me? Does it affect my role/responsibilities?

· By creating a premier global provider of industrial power transmission and motion control solutions, and building upon our recent momentum across the business, we expect this combination will provide meaningful benefits to our customers, shareholders, and Regal associates.

· We believe that an improved cost structure, and more robust new product development activities post-close will result in a faster-growing Regal, which funds additional growth investment – including in high-performance associates.

· Importantly, this announcement is just the first step in the process. Until the transaction closes, which is expected in the fourth quarter of 2021, both Regal and PMC will continue to operate independently as we do today – business as usual. The closing of the transaction is subject to the receipt of shareholder and regulatory approvals, and other closing conditions.

· Today’s announcement does not have any immediate impact on your role/responsibilities.

6. Does this change who I report to?

· No – your reporting structure is not impacted by today’s announcement.

· Until the transaction closes, both Regal and PMC will continue to operate independently as we do today.

7. Will there be any leadership changes at Regal as a result of this?

· This transaction does not change our corporate name, executive leadership team, or headquarters, which will all remain as they are today.

· An experienced team comprised of individuals from both companies will develop a detailed plan for how PMC will be integrated into our PTS segment, including how our leadership will come together.

· Our expectation is that an experienced team comprised of individuals from both companies will lead the combined business going forward.

· We are committed to honest and transparent communication and will keep you informed throughout the process.

8. The press release details that there cost synergies associated with this transaction. Are there plans to reduce headcount? On what timeline?

· At this time, there are no changes to current Regal associate headcount as a result of this announcement. This transaction is focused on driving growth and we remain focused on building our talent and capabilities at Regal.

· As with any combination of this nature, there will be areas where changes may be required as we integrate our organizations.

· It’s too early to speculate on specifics. We still have a lot of work ahead of us to complete this process, and we are committed to honest and transparent communication as the process unfolds.

· While we may not have all the answers today, we will keep you informed throughout this process.

9. What does this mean for Regal’s headquarters?

· This transaction does not change Regal’s Beloit, Wisconsin corporate headquarters.

· Once the transaction has closed, our combined mechanical power transmission business will be headquartered in Milwaukee. This was determined based on the deep, 100+ year roots the PMC business has in that area.

· We expect to continue to maintain, invest in, and grow our existing presence in Florence, Kentucky, which will remain a strategic site.

10. Will I need to relocate? Will any Regal PTS associates need to move to Milwaukee?

· It’s too early to speculate on specifics. We still have a lot of work ahead of us to complete this process, and we are committed to honest and transparent communication.

· We expect to continue to maintain, invest in, and grow our presence in Florence, Kentucky, which will remain a strategic site.

· That said, it is possible that some roles will relocate across the combined company based on business needs.

· We are committed to communicating with you in an open and timely manner about any potential changes.

11. Will any Regal engineering centers, manufacturing facilities, distribution or service centers (footprint) be closing?

· Until the transaction closes, nothing changes.

· As with any combination of this nature, there will be areas where changes may be required as we integrate our organizations.

· It’s too early to speculate on specifics. We still have a lot of work ahead of us to complete this process, and we are committed to honest and transparent communication.

· While we may not have all the answers today, we will keep you informed throughout this process.

12. Will there be any changes to my salary/benefits/pension?

· There are no planned changes at this time as a result of the transaction.

· We will remain a performance-based organization and will continue to offer competitive compensation packages to hire and retain the best talent available.

· We are committed to communicating with you in an open and timely manner about any potential changes.

Transaction Details

13. What does Reverse Morris Trust/RMT mean? Who is acquiring who? Is this a merger with Regal or PTS?

· From a practical standpoint it’s useful to think of the transaction as a merger between PMC and Regal. Once the transaction closes, PMC will be integrated with Regal’s PTS business.

· Technically, the RMT structure means that Rexnord will spin off its PMC segment, which will be immediately followed by a merger with Regal. This results in Rexnord shareholders acquiring shares of Regal common stock.

· By utilizing a “Reverse Morris Trust” structure, the transaction is expected to be tax-efficient to shareholders of both Regal and Rexnord for U.S. federal income tax purposes.

14. Will Rexnord be a separate segment of Regal or combined with PTS?

· Rexnord’s PMC business will combine with Regal’s PTS segment.

15. Why are we using Rexnord name for the PTS business?

· The PMC brands – including Rexnord™ and Falk™, among others – are highly-regarded in the marketplace and have a strong reputation for quality, technology, and reliability.

· We see growth opportunities tied to the Rexnord brand.

· Regal will remain our corporate name.

16. I own Regal stock. Will this transaction have any impact on my shares?

· Until the transaction closes, there will be no changes to your current stock ownership.

· Regal shareholders are expected to receive a dividend prior to the closing of the transaction.

· After closing, current Rexnord and Regal shareholders will become owners in the new Regal, which will continue to be called Regal and trade under Regal’s existing ticker (NYSE: RBC).

Next Steps

17. What happens between now and closing?

· Today’s announcement is just the first step in the process.

· The closing of the transaction is subject to the receipt of shareholder and regulatory approvals, and other closing conditions, each of which takes some time to complete.

· Until the transaction closes, which is expected in the fourth quarter of 2021, both Regal and PMC will continue to operate independently as we do today.

· It is essential that everyone remains focused on executing our strategy to deliver high-value, differentiated products and solutions that will provide meaningful benefits to our customers, shareholders, and Regal associates.

18. What is the path to integration? Have you established an integration team?

· An experienced team comprised of individuals from both companies will develop a detailed plan for how PMC will be integrated into our PTS segment.

· The integration team will be working on a wide range of initiatives that will ensure PMC is effectively merged with Regal.

· This will be an ongoing process, which will continue for many months, including after the transaction has closed.

· We will keep you updated as we have more to share. We are committed to honest and transparent communication.

Additional Information

This communication does not constitute an offer to buy, or a solicitation of an offer to sell, any securities of Regal Beloit Corporation (the “Company”), Rexnord Corporation (“Rexnord”) or Land Newco, Inc. (“Land”) In connection with the proposed transaction, the Company and Land will file registration statements with the SEC registering shares of Company common stock and Land common stock in connection with the proposed transaction. The Company’s registration statement will also include a joint proxy statement and prospectus relating to the proposed transaction. Rexnord shareholders are urged to read the joint proxy statement/prospectus-information statement that will be included in the registration statements and any other relevant documents when they become available, and Company shareholders are urged to read the joint proxy statement/prospectus-information statement and any other relevant documents when they become available, because they will contain important information about the Company, Rexnord, Land and the proposed transaction. The joint proxy statement/prospectus-information statement and other documents relating to the proposed transaction (when they become available) can also be obtained free of charge from the SEC’s website at www.sec.gov. The joint proxy statement/prospectus-information statement and other documents (when they are available) can also be obtained free of charge from Rexnord upon written request to Rexnord Corporation, Investor Relations, 511 Freshwater Way, Milwaukee, WI 53204, or by calling (414) 643-3739 or upon written request to Regal Beloit Corporation, Investor Relations, 200 State Street, Beloit, WI 53511 or by calling (608) 364-8800.

Forward Looking Statements

This communication contains forward-looking statements, within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, which reflect the Company’s current estimates, expectations and projections about the Company’s future results, performance, prospects and opportunities. Such forward-looking statements may include, among other things, statements about the proposed acquisition of Rexnord’s PMC business (the “PMC Business”), the benefits and synergies of the proposed transaction, future opportunities for the Company, the PMC Business and the combined company, and any other statements regarding the Company’s, the PMC Business’s or the combined company’s future operations, anticipated business levels, future earnings, planned activities, anticipated growth, market opportunities, strategies, competition and other expectations and estimates for future periods. Forward-looking statements include statements that are not historical facts and can be identified by forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “plan,” “may,” “should,” “will,” “would,” “project,” “forecast,” and similar expressions. These forward-looking statements are based upon information currently

available to the Company and are subject to a number of risks, uncertainties, and other factors that could cause the Company’s, the PMC Business’s or the combined company’s actual results, performance, prospects, or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. Important factors that could cause the Company’s, the PMC Business’s or the combined company’s actual results to differ materially from the results referred to in the forward-looking statements the Company makes in this communication include: the possibility that the conditions to the consummation of the transaction will not be satisfied; failure to obtain, delays in obtaining or adverse conditions related to obtaining shareholder or regulatory approvals or the IRS ruling to be sought in connection with the proposed transaction; changes in the extent and characteristics of the common shareholders of Rexnord and the Company and its effect pursuant to the merger agreement for the transaction on the number of shares of Company common stock issuable pursuant to the transaction, magnitude of the dividend payable to Company shareholders pursuant to the transaction and the extent of indebtedness to be incurred by the Company in connection with the transaction; the ability to obtain the anticipated tax treatment of the transaction and related transactions; risks relating to any unforeseen changes to or the effects on liabilities, future capital expenditures, revenue, expenses, synergies, indebtedness, financial condition, losses and future prospects; the possibility that the Company may be unable to achieve expected synergies and operating efficiencies in connection with the transaction within the expected time-frames or at all and to successfully integrate the PMC Business; expected or targeted future financial and operating performance and results; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintain relationships with employees, customers, clients or suppliers) being greater than expected following the transaction; failure to consummate or delay in consummating the transaction for other reasons; the Company’s ability to retain key executives and employees; risks associated with litigation related to the transaction; the continued financial and operational impacts of and uncertainties relating to the COVID-19 pandemic on customers and suppliers and the geographies in which they operate; uncertainties regarding the ability to execute restructuring plans within expected costs and timing; actions taken by competitors and their ability to effectively compete in the increasingly competitive global electric motor, drives and controls, power generation and power transmission industries; the ability to develop new products based on technological innovation, such as the Internet of Things, and marketplace acceptance of new and existing products, including products related to technology not yet adopted or utilized in geographic locations in which we do business; fluctuations in commodity prices and raw material costs; dependence on significant customers; risks associated with global manufacturing, including risks associated with public health crises; issues and costs arising from the integration of acquired companies and businesses and the timing and impact of purchase accounting adjustments; the Company’s overall debt levels and its ability to repay principal and interest on its outstanding debt, including debt assumed or incurred in connection with the proposed transaction; prolonged declines in one or more markets, such as heating, ventilation, air conditioning, refrigeration, power generation, oil and gas, unit material handling or water heating; economic changes in global markets, such as reduced demand for products, currency exchange rates, inflation rates, interest rates, recession, government policies, including policy changes affecting taxation, trade, tariffs, immigration, customs, border actions and the like, and other external factors that the Company cannot control; product liability and other litigation, or claims by end users, government agencies or others that products or customers’ applications failed to perform as anticipated, particularly in high volume applications or where such failures are alleged to be the cause of property or casualty claims; unanticipated liabilities of acquired businesses; unanticipated adverse effects or liabilities from business exits or divestitures; unanticipated costs or expenses that may be incurred related to product warranty issues; dependence on key suppliers and the potential effects of supply disruptions; infringement of intellectual property by third parties, challenges to intellectual property, and claims of infringement on third party technologies; effects on earnings of any significant impairment of goodwill or intangible assets; losses from failures, breaches, attacks or disclosures involving information technology infrastructure and data; cyclical downturns affecting the global market for capital goods; and other risks and uncertainties including, but not limited, to those described in the Company’s Annual Report on Form 10-K on file with the Securities and Exchange Commission and from time to time in other filed reports including the Company’s Quarterly Reports on Form 10-Q. For a more detailed description of the risk factors associated with the Company, please refer to the Company’s Annual Report on Form 10-K for the fiscal year ended December 28, 2019 on file with the Securities and Exchange Commission and its Quarterly Report on Form 10-Q for the period ended

September 26, 2020 and subsequent SEC filings. Shareholders, potential investors, and other readers are urged to consider these factors in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included in this communication are made only as of the date of this communication, and the Company undertakes no obligation to update any forward-looking information contained in this communication or with respect to the announcements described herein to reflect subsequent events or circumstances.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security holder of the Company. However, Rexnord, the Company and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from shareholders of Rexnord and the Company in connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Rexnord may be found in its Annual Report on Form 10-K filed with the SEC on May 12, 2020 and its definitive proxy statement relating to its 2020 Annual Meeting filed with the SEC on June 5, 2020. Information about the directors and executive officers of the Company may be found in its Annual Report on Form 10-K filed with the SEC on February 26, 2020, and its definitive proxy statement relating to its 2020 Annual Meeting filed with the SEC on March 19, 2020.

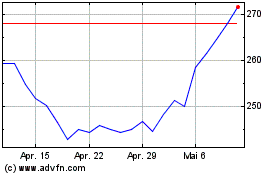

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

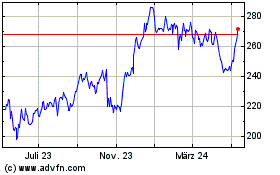

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024