Statement of Changes in Beneficial Ownership (4)

08 November 2019 - 10:11PM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Schlemmer Jonathan J |

2. Issuer Name and Ticker or Trading Symbol

REGAL BELOIT CORP

[

RBC

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chief Operating Officer

|

|

(Last)

(First)

(Middle)

200 STATE STREET |

3. Date of Earliest Transaction

(MM/DD/YYYY)

11/7/2019

|

|

(Street)

BELOIT, WI 53511

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Common Stock

|

11/7/2019

|

|

M

|

|

16500

|

A

|

$72.29

|

78963

|

D

|

|

|

Common Stock

|

11/7/2019

|

|

M

|

|

26000

|

A

|

$63.56

|

104963

|

D

|

|

|

Common Stock

|

11/7/2019

|

|

F

|

|

38020

|

D

|

$82.58

|

66943

|

D

|

|

|

Common Stock

|

11/7/2019

|

|

S

|

|

4480

|

D

|

$82.74

|

62463

|

D

|

|

|

Common Stock

|

|

|

|

|

|

|

|

1585 (1)

|

I

|

Retirement Savings Plan

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Stock Appreciation Rights

|

$72.29

|

11/7/2019

|

|

M

|

|

|

16500

|

5/4/2013 (2)

|

5/4/2021

|

Common Stock

|

16500.0

|

$0

|

0

|

D

|

|

|

Stock Appreciation Rights

|

$63.56

|

11/7/2019

|

|

M

|

|

|

26000

|

5/3/2014 (2)

|

5/3/2022

|

Common Stock

|

26000.0

|

$0

|

0

|

D

|

|

|

Stock Appreciation Rights

|

$64.99

|

|

|

|

|

|

|

5/2/2015 (3)

|

5/2/2023

|

Common Stock

|

16200.0

|

|

16200

|

D

|

|

|

Stock Appreciation Rights

|

$75.76

|

|

|

|

|

|

|

5/7/2016 (3)

|

5/7/2024

|

Common Stock

|

14800.0

|

|

14800

|

D

|

|

|

Stock Appreciation Rights

|

$78.15

|

|

|

|

|

|

|

5/12/2017 (3)

|

5/12/2025

|

Common Stock

|

17675.0

|

|

17675

|

D

|

|

|

Stock Appreciation Rights

|

$57.43

|

|

|

|

|

|

|

5/11/2018 (3)

|

5/11/2026

|

Common Stock

|

27500.0

|

|

27500

|

D

|

|

|

Stock Appreciation Rights

|

$80.7

|

|

|

|

|

|

|

5/10/2019 (3)

|

5/10/2027

|

Common Stock

|

17950.0

|

|

17950

|

D

|

|

|

Stock Appreciation Rights

|

$77.6

|

|

|

|

|

|

|

5/9/2020 (4)

|

5/9/2028

|

Common Stock

|

18125.0

|

|

18125

|

D

|

|

|

Stock Appreciation Rights

|

$81.81

|

|

|

|

|

|

|

5/8/2021 (4)

|

5/8/2029

|

Common Stock

|

21200.0

|

|

21200

|

D

|

|

|

Explanation of Responses:

|

| (1)

|

Balance reflects the most current data available with regard to holdings in the Regal Beloit Corporation Retirement Savings Plan.

|

| (2)

|

Granted as stock-settled Stock Appreciation Rights (SARs) under the 2007 Equity Incentive Plan. The SARs vest and become exercisable 40% on the second anniversary of the date of grant, 60% on the third anniversary, 80% on the fourth anniversary and 100% on the fifth anniversary.

|

| (3)

|

Granted as stock-settled SARs under the 2013 Equity Incentive Plan. The SARs vest and become exercisable 40% on the second anniversary, 60% on the third anniversary, 80% on the fourth anniversary and 100% on the fifth anniversary of the date of the grant.

|

| (4)

|

Granted as stock-settled SARs under the 2018 Equity Incentive Plan. The SARs vest and become exercisable 40% on the second anniversary, 60% on the third anniversary, 80% on the fourth anniversary and 100% on the fifth anniversary of the date of the grant.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Schlemmer Jonathan J

200 STATE STREET

BELOIT, WI 53511

|

|

|

Chief Operating Officer

|

|

Signatures

|

|

/s/ Thomas E. Valentyn, as Power of Attorney

|

|

11/8/2019

|

|

**Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person, see Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

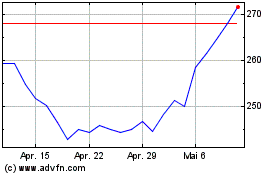

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

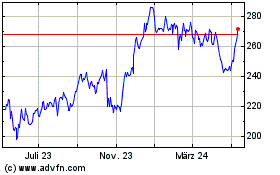

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024

Die zuletzt besuchten Aktien werden in diesem Feld angezeigt, so dass Sie leicht zu den Aktien zurückkehren können, die Sie zuvor angesehen haben.