Regal Beloit 2Q Beats Estimate - Analyst Blog

05 August 2011 - 10:37AM

Zacks

Regal Beloit Corporation (RBC) posted its

earnings per share (excluding the incremental warranty accrual) of

$1.32 in the second quarter of fiscal 2011 compared with $10.7 per

share in the year-earlier quarter, ahead of management’s guidance

range of $1.22 - $1.28 and the Zacks Consensus Estimates of

$1.25.

Including the impact of incremental warranty accrual, the

company’s earnings per share were 88 cents.

Revenues

The company generated net sales of $681.8 million, up 16.7% from

the year-earlier quarter; missed the Zacks Consensus Estimate of

$715 million. The growth was powered by a rise in demand for North

American commercial and industrial motors, generators, and

mechanical products.

Of the total sales, $60 million was attributed to the businesses

acquired in 2010.

On a segmental basis, revenues from Electrical segment sales

improved 16.9% from the year-earlier quarter to $611.3 million, led

by a growth in North American commercial and industrial businesses

partially offset by a decrease in revenues from North American

residential HVAC (Heating, Ventilation, and Air Conditioning).

Mechanical segment sales were up 14.8% from the year-earlier

quarter to $70.5 million, reflecting improvement in later cycle end

markets.

Regal Beloit’s international operations continued to grow, which

led to an increase in international sales to 36.6% of total sales

from 31.7% of total sales in the year-earlier quarter.

Margins

Gross margin declined to 22.1%, from 24.6% in the year- earlier

quarter, due to an incremental warranty expense, which in turn

contracted gross margin of the Electrical segment.

Operating margin also fell 340 basis points from the

year-earlier quarter to 6.9%, due to an expense pertaining to the

acquired businesses and lower gross margins.

Balance Sheet and Cash flows

Regal Beloit ended the year with cash, cash equivalents and

investments of $275.3 million, up from $259.5 million at the end of

the previous quarter. As of July 2, 2011, long-term debt was $428

million, down from $430.8 million at the end of the previous

quarter.

During the quarter, the company generated $53.4 million of cash

from operating activities and used $10.8 million for capital

expenditure.

Acquisition

During the quarter, Regal Beloit Corporation acquired Australian

Fan and Motor Company, which manufactures and distributes an

extensive range of direct drive blowers, fan decks, axial fans and

sub fractional motors.

The company also acquired Virginia-based Ramu Inc., a motor and

control technology company controlled by the venture capital firm

Khosla Ventures.

Guidance

With expectations of improvement in its commercial and

industrial and mechanical businesses and considering its weakness

in the HVAC business, Regal Beloit projected earnings per share in

the range of $1.11 to $1.17 for the third quarter of fiscal

2011.

Management stated that the company expects to close the

acquisition of Electrical Products Company from A.O. Smith

Corporation (AOS) in the month of August.

Headquartered in Beloit, Wisconsin, Regal Beloit is a leading

manufacturer of electrical and mechanical motion control products,

with manufacturing, sales, and service facilities throughout the

U.S., Canada, Mexico, Europe, and Asia.

We are encouraged by the company’s strategic acquisition

activities, but remain concerned about the pressure on margins. We

continue to maintain a Neutral recommendation on Regal Beloit,

supported by Zacks #3 Rank (short-term Hold rating).

SMITH (AO) CORP (AOS): Free Stock Analysis Report

REGAL BELOIT (RBC): Free Stock Analysis Report

Zacks Investment Research

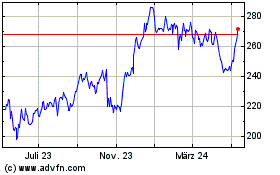

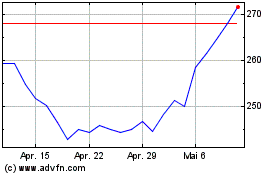

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024