RBC Raises Debt to Fund Acquisition - Analyst Blog

15 Juli 2011 - 8:30PM

Zacks

Regal Beloit

Corporation (RBC) recently issued senior unsecured notes

worth $423 million in a private placement. In addition, the company

expects to issue senior unsecured notes of $77 million in the near

term.

The company will divide the issue

into seven portions, with maturity ranging from seven to twelve

years and fixed interest rates ranging from 4.09% to 5.09%.

Regal Beloit intends to utilize the

proceeds to fund the acquisition of Electrical Products Company

("EPC") from A.O. Smith Corporation (AOS).

Last year, the company agreed to

acquire 100% of the stock and assets of EPC from A.O. Smith for

approximately $875 million. Of the total consideration, $700

million will be paid in cash and balance in shares of Regal Beloit

common stock.

Based in Tipp City, Ohio, EPC

manufactures and sells a full line of motors for hermetic, pump,

distribution, heating, ventilation and air conditioning (HVAC) and

general industrial applications.

Management believes that EPC's

product portfolio is complementary to Regal Beloit's and has

targeted synergies of $30 million–$40 million, spanning over three

to four years from this acquisition.

As a consequence of the merger, the

company expects to add approximately $700 million to the top line

and increase earnings per share (excluding one-time items) in the

first full year following the acquisition.

Regal Beloit continues acquiring

businesses with its focus on energy efficiency technology,

strengthening its geographic footprint and offering a synergistic

fit.

Headquartered in Beloit, Wisconsin,

Regal Beloit manufactures mechanical and electrical motion control

and power generation products.

SMITH (AO) CORP (AOS): Free Stock Analysis Report

REGAL BELOIT (RBC): Free Stock Analysis Report

Zacks Investment Research

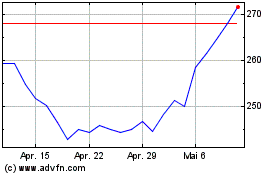

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

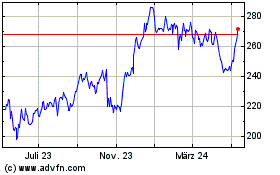

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024