- 2008 Net Sales, Net Income and EPS Reach Record Levels BELOIT,

Wis., Feb. 4 /PRNewswire-FirstCall/ -- Regal Beloit Corporation

(NYSE:RBC) today reported financial results for the fourth quarter

and fiscal year ended December 27, 2008. Net sales of $483.0

million increased 1.7% as compared to the $474.7 million reported

for the fourth quarter of 2007. Diluted earnings per share were

$0.67 as compared to $0.71 for the fourth quarter of 2007. For the

full year of 2008, sales reached a record $2.246 billion as

compared to $1.802 billion for 2007. Full year diluted earnings per

share were $3.87 per share as compared to $3.49 per share for 2007.

"We are very pleased to report another record year for the Company.

This is clearly proof of our ability to adapt to a changing

environment through improved operating efficiencies and the

introduction of a record number of new products in 2008," commented

Henry Knueppel, Chairman and Chief Executive Officer, "Our results

were achieved despite unprecedented raw material inflation, a

depressed HVAC market throughout the year, and deteriorating

industrial and commercial markets late in 2008." Sales for the

fourth quarter of $483.0 million were 1.7% above the $474.7 million

reported for the fourth quarter of 2007. Sales for the fourth

quarter included $38.2 million of sales attributable to the Hwada

acquisition completed in April of 2008, the Dutchi acquisition

completed in October of 2008 and the Alstom acquisition completed

in November 2007. Sales for the Electrical segment increased 2.6%

as compared to the comparable period of 2007, including the results

from the acquisitions mentioned above. Sales for the HVACR products

decreased 7.8% for the quarter. Sales of commercial and industrial

motors decreased 5.6% and sales of electric generators increased

13.2%. Sales in the Mechanical segment decreased 4.1%. From a

geographic perspective, sales outside the United States were 28.9%

of total sales for the quarter as compared to 25.2% in the fourth

quarter of 2007. The negative impact of foreign currency exchange

rate changes decreased total sales by 2.2%. From an energy

efficiency standpoint, sales of high efficiency products increased

12.8% from the fourth quarter of 2007 and represented 11.7% of

total sales for the quarter. The gross profit margin for the fourth

quarter of 2008 was 23.7%, which was 150 basis points above the

gross profit margin in the fourth quarter of 2007, primarily driven

by our focus on Lean Six Sigma, other productivity improvements and

the margin gain from the higher mix of more energy efficient

products. While material inflation exceeded the impact of price

increases, strong productivity results more than offset the price

-- inflation shortfall. Income from operations was $39.6 million or

8.2% of sales as compared to the $45.3 million or 9.5% of sales

reported for the fourth quarter of 2007. The operating margins were

impacted by the businesses acquired in 2008, which operated at

lower margins and an increase in operating expenses. Included in

operating expense was approximately $5.0 million of additional

expense related to reserves for certain discrete customer

receivables and impairment of certain fixed assets. Operating

expenses increased approximately $5.2 million as a result of the

2007 Alstom and 2008 acquisitions. Net income in the fourth quarter

of 2008 was $21.4 million as compared to the $24.0 million reported

in the fourth quarter of 2007. Diluted earnings per share were

$0.67 versus the $0.71 reported in the fourth quarter of 2007. For

the full year ended December 27, 2008, net sales increased 24.6% to

a record $2.246 billion from $1.802 billion in 2007. Full year 2008

sales included $404.5 million of incremental sales from the

businesses acquired in 2007 and 2008. The gross profit margin

decreased 60 basis points to 22.3% for the full year. While margins

were favorably impacted by the Company's Lean Six Sigma and

productivity initiatives, the impact of raw material inflation net

of product price actions decreased margins on an overall basis.

Income from operations was $230.4 million or 10.3% of sales as

compared to the $206.1 million or 11.4% of sales reported for

fiscal year 2007, reflecting the impact of the price-inflation gap

and the lower overall margin contribution from the acquired

businesses. Net income for fiscal 2008 was $128.6 million as

compared to $118.3 million reported for fiscal 2007. Diluted

earnings per share were $3.87, an increase of 10.9% over the $3.49

reported in 2007. The Company ended the year with total debt of

$576.5 million as compared to $564.3 million at the end of 2007.

The primary debt covenant for the Company is Debt-to-EBITDA which

ended the year at approximately 2.0, which is well within the limit

of 3.75. "While the fourth quarter started on a positive note with

a relatively strong sales performance in October, the global

economic issues became apparent as we moved into November and

December. Although we will be facing significant business

challenges in 2009, we are well positioned with our strong balance

sheet and our adherence to maintaining operational efficiency to

meet those challenges. These will continue to serve as powerful

drivers in the Company's long-term growth and profitability goals,"

continued Henry Knueppel, Chairman and Chief Executive Officer.

"Due to the impending headwinds in the sales environment, we are

continuing to aggressively address our production rates, cost

structure and inventory levels. We are adjusting our workforce and

are accelerating productivity and plant restructuring projects. Raw

material costs will provide some relief as the year progresses;

however, this will be substantially muted in the first half as a

result of commodity hedges. Given these situations and the normal

seasonality of our business, we are estimating first quarter

earnings per share to be in the range of $0.38 to $0.46 and

sequential improvement as we move through the year," concluded

Henry Knueppel, Chairman and Chief Executive Officer. The guidance

for the first quarter includes the impact of the change in

accounting for the Company's convertible senior subordinated notes

as prescribed in APB 14-1. This impact will be a non-cash interest

charge in the amount of $1.4 million. The comparable amount for

2008 would have been $1.6 million. This will be further highlighted

in the Company's annual report on Form 10-K when filed with the

Securities and Exchange Commission. Regal Beloit will be holding a

conference call pertaining to this news release at 10:30 AM CT

(11:30 AM ET) on Thursday, February 5. Interested parties should

call 866-394-7807, referencing Regal Beloit conference ID 83558992.

International callers should call 763-488-9117 using the same

conference ID. A replay of the call will be available through

February 19, 2009 at 800-642-1687, conference ID 83558992.

International callers should call 706-645-9291 using the same

conference ID. Regal Beloit Corporation is a leading manufacturer

of mechanical and electrical motion control and power generation

products serving markets throughout the world. Regal Beloit

Corporation is headquartered in Beloit, Wisconsin, and has

manufacturing, sales, and service facilities throughout the United

States, Canada, Mexico, Europe and Asia. CAUTIONARY STATEMENT This

Quarterly Report contains "forward-looking statements" as defined

in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements represent our management's judgment

regarding future events. In many cases, you can identify

forward-looking statements by terminology such as "may," "will,"

"plan," "expect," "anticipate," "estimate," "believe," or

"continue" or the negative of these terms or other similar words.

Actual results and events could differ materially and adversely

from those contained in the forward-looking statements due to a

number of factors, including: -- economic changes in global markets

where we do business, such as reduced demand for the products we

sell, currency exchange rates, inflation rates, interest rates,

recession, foreign government policies and other external factors

that we cannot control; -- unanticipated fluctuations in commodity

prices and raw material costs; -- cyclical downturns affecting the

global market for capital goods; -- unexpected issues and costs

arising from the integration of acquired companies and businesses;

-- marketplace acceptance of new and existing products including

the loss of, or a decline in business from, any significant

customers; -- the impact of capital market transactions that we may

effect; -- the availability and effectiveness of our information

technology systems; -- unanticipated costs associated with

litigation matters; -- actions taken by our competitors; --

difficulties in staffing and managing foreign operations; and --

other risks and uncertainties including but not limited to those

described in Item 1A-Risk Factors of the Company's Annual Report on

Form 10-K filed on February 27, 2008 and from time to time in our

reports filed with U.S. Securities and Exchange Commission. All

subsequent written and oral forward-looking statements attributable

to us or to persons acting on our behalf are expressly qualified in

their entirety by the applicable cautionary statements. The

forward-looking statements included in this Form 10-K are made only

as of their respective dates, and we undertake no obligation to

update these statements to reflect subsequent events or

circumstances. See also Item 1A - Risk Factors in the Company's

Annual Report on Form10-K filed on February 27, 2008. STATEMENTS OF

INCOME In Thousands of Dollars (Unaudited) Three Months Ended

Fiscal Year Ended December 27, December 29, December 27, December

29, 2008 2007 2008 2007 Net Sales $482,983 $474,682 $2,246,249

$1,802,497 Cost of Sales 368,376 369,146 1,745,569 1,389,144 Gross

Profit 114,607 105,536 500,680 413,353 Operating Expenses 75,016

60,237 270,249 207,293 Income From Operations 39,591 45,299 230,431

206,060 Interest Expense 6,260 7,449 27,709 22,056 Interest Income

146 238 1,479 933 Income Before Taxes & Minority Interest

33,477 38,088 204,201 184,937 Provision For Income Taxes 11,399

13,382 72,225 63,683 Income Before Minority Interest 22,078 24,706

131,976 121,254 Minority Interest in Income, Net of Tax 640 664

3,389 2,907 Net Income $21,438 $24,042 $128,587 $118,347 Earnings

Per Share of Common Stock: Basic $0.68 $0.77 $4.10 $3.79 Assuming

Dilution $0.67 $0.71 $3.87 $3.49 Weighted Average Number of Shares

Outstanding: Basic 31,393,295 31,326,459 31,343,330 31,252,145

Assuming Dilution 32,623,311 33,840,176 33,250,689 33,920,886

CONDENSED BALANCE SHEETS In Thousands of Dollars (Unaudited)

December 27, December 29, 2008 2007 ASSETS Current Assets: Cash and

Cash Equivalents $65,250 $42,574 Receivables and Other Current

Assets 438,140 367,717 Inventories 357,550 318,200 Total Current

Assets 860,940 728,491 Net Property, Plant and Equipment 358,372

339,343 Other Noncurrent Assets 803,862 794,413 Total Assets

$2,023,174 $1,862,247 LIABILITIES AND SHAREHOLDERS' INVESTMENT

Accounts Payable $204,790 $183,215 Other Current Liabilities

230,229 128,705 Long-Term Debt 561,190 558,918 Deferred Income

Taxes 72,907 75,055 Other Noncurrent Liabilities 130,124 58,325

Total Liabilities 1,199,240 1,004,218 Shareholders' Investment

823,934 858,029 Total Liabilities and Shareholders' Investment

$2,023,174 $1,862,247 SEGMENT INFORMATION In Thousands of Dollars

(Unaudited) Mechanical Segment Three Months Ended Fiscal Year Ended

Dec. 27, Dec. 29, Dec. 27, Dec. 29, 2008 2007 2008 2007 Net Sales

$55,718 $58,120 $247,607 $243,534 Income from Operations $10,115

$7,636 $38,899 $36,371 (Unaudited) Electrical Segment Three Months

Ended Fiscal Year Ended Dec. 27, Dec. 29, Dec. 27, Dec. 29, 2008

2007 2008 2007 Net Sales $427,265 $416,562 $1,998,642 $1,558,963

Income from Operations $29,476 $37,663 $191,532 $169,689 CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS In Thousands of Dollars

(Unaudited) For the Year Ended December 27, December 29, December

30, 2008 2007 2006 CASH FLOWS FROM OPERATING ACTIVITIES: Net Income

$128,587 $118,347 $109,806 Adjustments to Reconcile Net Income to

Net Cash Provided from Operating Activities: Depreciation and

amortization 61,457 46,619 37,682 Stock-based Compensation 4,580

3,841 3,572 Minority Interest in Earnings of Subsidiaries 3,389

2,907 2,985 Excess Tax Benefits from Stock-based Compensation

(2,463) (6,712) (3,949) Losses (Gains) on Sales of Property, Plant

and Equipment 124 564 (1,889) Changes in Assets and Liabilities,

Net of Acquisitions (41,475) 35,060 (54,659) Net Cash Provided from

Operating Activities 154,199 200,626 93,548 CASH FLOW FROM

INVESTING ACTIVITIES: Additions to Property, Plant and Equipment

(52,209) (36,628) (52,545) Business Acquisitions, Net of Cash

Acquired (49,702) (337,643) (10,962) Sale of Property, Plant and

Equipment 2,238 637 20,189 Net Cash Used in Investing Activities

(99,673) (373,634) (43,318) CASH FLOWS FROM FINANCING ACTIVITIES:

Long-Term Debt Proceeds 165,200 250,000 8,500 Net (Payments)

Proceeds Short-Term Borrowings (11,820) 5,000 - Payments of

Long-Term Debt (324) (382) (1,294) Net (Repayments) Proceeds from

Commercial Paper Borrowings - (49,000) 24,000 Net Repayments Under

Revolving Credit Facility (162,700) (14,500) (69,900) Proceeds from

the Exercise of Stock Options 2,880 2,190 6,942 Excess Tax Benefits

from Stock-based Compensation 2,463 6,712 3,949 Financing Fees Paid

(454) (1,706) - Distributions to Minority Partners (3,044) (2,741)

(2,538) Purchases of Treasury Stock (4,191) - - Dividends Paid to

Shareholders (19,426) (18,099) (16,627) Net Cash Provided from

(Used in) Financing Activities (31,416) 177,474 (46,968) EFFECT OF

EXCHANGE RATE ON CASH: (434) 1,588 511 Net Increase in Cash and

Cash Equivalents 22,676 6,054 3,773 Cash and Cash Equivalents at

Beginning of Year 42,574 36,520 32,747 Cash and Cash Equivalents at

End of Year $65,250 $42,574 $36,520 DATASOURCE: Regal Beloit

Corporation CONTACT: David A. Barta, Vice President, Chief

Financial Officer of Regal Beloit Corporation, +1-608-361-7405

Copyright

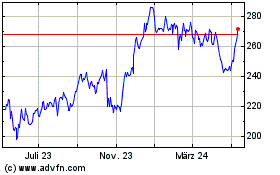

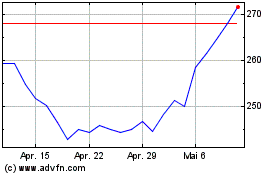

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024