BELOIT, Wis., Nov. 1 /PRNewswire-FirstCall/ -- Regal Beloit

Corporation (NYSE:RBC) today reported record financial results for

the third quarter ended September 29, 2007. The strength of the

power generation and industrial motor markets offset the impact of

a continued weak residential HVAC market and cost pressures from

raw material inflation. The successful execution of the Company's

strategic initiatives continues to have a significant positive

impact on performance. Specifically, globalization, acquisitions

and innovation drove sales growth, while Lean Six Sigma and

productivity projects contributed to operating margins. Net sales

increased 7.2% to $449.4 million from $419.3 million in the third

quarter of 2006. Net sales include $28.3 million resulting from the

acquisitions of the FASCO and Jakel businesses that were acquired

on August 31, 2007. Sales for the Electrical Segment, increased

7.7% as non-HVAC motor and generator sales increased 8.9% and 33.6%

respectively, offset by a 16.8% decline in residential HVAC

revenues. Segment sales included the sales attributed to the

acquisitions of Jakel and FASCO that are operated as a single

business unit within the Electrical Segment. Sales in the

Mechanical Segment increased 3.5% from the prior year period. The

gross profit margin for the third quarter of 2007 was 23.7% as

compared to 24.6% reported for the third quarter of 2006. The

reduction was a result of raw material inflation and the effect of

the acquired businesses. These factors were partially offset by

higher selling prices and productivity improvements. Income from

operations was $53.4 million or 11.9% of sales, an increase over

the $53.0 million or 12.7% of sales reported for the third quarter

of 2006. Operating expenses included a pre-tax charge of $1.8

million resulting from settlement of the Enron legal matter. The

acquired businesses contributed $0.9 million to income from

operations. Net income in the third quarter of 2007 was $31.2

million, a 5.0% increase from $29.7 million reported in the third

quarter of 2006. Diluted earnings per share increased 3.4% to $0.92

as compared to $0.89 for the third quarter of 2006. "We are very

pleased to be reporting yet another record quarter for the Company,

despite the challenging residential end market and significant raw

material inflation," commented Henry W. Knueppel, Chairman and CEO,

"Our performance reflects the solid execution of our strategic

initiatives. Although the sales environment is not as strong as

what we have experienced for the last two years, we are confident

about our ability to translate our strategy into outstanding

results." "We continue to believe that our Lean Six Sigma,

Digitization, Globalization, Innovation and Customer Centricity

initiatives will provide the foundation for continued profitable

growth and our ability to continue to provide high levels of

returns to shareholders" Knueppel added. "As we look at the fourth

quarter, we expect solid industrial and power generation end

markets and a seasonal decline on top of an already soft

residential end market. While we will continue to experience

commodity cost pressures we believe that continued productivity

improvements will help us offset a substantial portion of these

negative factors and as a result, we are providing fourth quarter

EPS guidance of $.67 to .74." Regal Beloit will be holding a

conference call to discuss second quarter financial results at 1:30

PM CT (2:30 PM EDT) today. Interested parties should call

888-428-4478. A replay of the call will be available through

November 14, 2007 at 800-475-6701, access code 862076. Regal Beloit

Corporation is a leading manufacturer of mechanical and electrical

motion control and power generation products serving markets

throughout the world. Regal Beloit is headquartered in Beloit,

Wisconsin, and has manufacturing, sales, and service facilities

throughout the United States, Canada, Mexico, Europe and Asia.

CAUTIONARY STATEMENT This news release contains "forward-looking

statements" as defined in the Private Securities Litigation Reform

Act of 1995. Forward-looking statements represent our management's

judgment regarding future events. In many cases, you can identify

forward-looking statements by terminology such as "may," "will,"

"plan," "expect," "anticipate," "estimate," "believe," or

"continue" or the negative of these terms or other similar words.

Actual results and events could differ materially and adversely

from those contained in the forward-looking statements due to a

number of factors, including: -- unanticipated fluctuations in

commodity prices and raw material costs; -- cyclical downturns

affecting the global market for capital goods; -- economic changes

in global markets where we do business, such as currency exchange

rates, inflation rates, interest rates, recession, foreign

government policies and other external factors that we cannot

control; -- unexpected issues and costs arising from the

integration of acquired companies and businesses; -- actions taken

by our competitors; -- unanticipated costs associated with

litigation matters; -- marketplace acceptance of new and existing

products including the loss of, or a decline in business from, any

significant customers; -- the impact of capital market transactions

that we may effect; -- difficulties in staffing and managing

foreign operations; -- the availability and effectiveness of our

information technology systems; -- other risks and uncertainties

including but not limited to those described in Item 1A-Risk

Factors of the Company's Annual Report on Form 10-K filed on

February 28, 2007 and from time to time in our reports filed with

U.S. Securities and Exchange Commission. All subsequent written and

oral forward-looking statements attributable to us or to persons

acting on our behalf are expressly qualified in their entirety by

the applicable cautionary statements. The forward-looking

statements included in this news release are made only as of their

respective dates, and we undertake no obligation to update these

statements to reflect subsequent events or circumstances. See also

Item 1A - Risk Factors in the Company's Annual Report on Form 10-K

filed on February 28, 2007. STATEMENTS OF INCOME In Thousands of

Dollars (Unaudited) Three Months Ended Nine Months Ended Sept. 29,

Sept. 30, Sept. 29, Sept. 30, 2007 2006 2007 2006 Net Sales

$449,374 $419,301 $1,327,815 $1,252,896 Cost of Sales 342,660

316,231 1,019,998 952,521 Gross Profit 106,714 103,070 307,817

300,375 Operating Expenses 53,339 50,021 147,056 145,842 Income

From Operations 53,375 53,049 160,761 154,533 Interest Expense

5,116 5,038 14,607 15,287 Interest Income 365 170 695 430 Income

Before Taxes & Minority Interest 48,624 48,181 146,849 139,676

Provision For Income Taxes 16,638 17,623 50,301 50,812 Income

Before Minority Interest 31,986 30,558 96,548 88,864 Minority

Interest in Income, Net of Tax 747 818 2,243 2,027 Net Income

$31,239 $29,740 $94,305 $86,837 Earnings per Share of Common Stock:

Basic $1.00 $0.96 $3.02 $2.82 Assuming Dilution $0.92 $0.89 $2.78

$2.60 Cash Dividends Declared $0.15 $0.14 $0.44 $0.41 Weighted

Average Number of Shares Outstanding: Basic 31,320,838 30,888,136

31,227,373 30,802,048 Assuming Dilution 34,104,123 33,440,015

33,943,057 33,347,817 CONDENSED BALANCE SHEETS In Thousands of

Dollars (From Audited (Unaudited) Statements) ASSETS Sept. 29, 2007

Dec. 30, 2006 Current Assets: Cash and Cash Equivalents $55,564

$36,520 Receivables and Other Current Assets 355,256 263,470

Inventories 285,839 275,138 Total Current Assets 696,659 575,128

Net Property, Plant and Equipment 326,637 268,880 Goodwill 636,077

546,152 Intangible Assets, net of Amortization 102,989 43,257 Other

Noncurrent Assets 14,458 10,102 Total Assets $1,776,820 $1,443,519

LIABILITIES AND SHAREHOLDERS' INVESTMENT Current Liabilities

$310,954 $258,541 Long-Term Debt 497,262 323,946 Deferred Income

Taxes 75,071 65,937 Other Noncurrent Liabilities 10,967 12,302

Minority Interest in Consolidated Subsidiaries 12,171 9,634 Pension

and Other Postretirement Benefits 24,276 23,184 Total Current

Liabilities 930,701 693,544 Shareholders' Investment 846,119

749,975 Total Liabilities and Shareholders' Investment $1,776,820

$1,443,519 SEGMENT INFORMATION In Thousands of Dollars (Unaudited)

Mechanical Segment Third Quarter Ending Nine Months Ending Sept.

29, Sept. 30, Sept. 29, Sept. 30, 2007 2006 2007 2006 Net Sales

$50,620 $48,931 $156,602 $154,934 Income from Operations 7,205

5,458 22,485 16,299 % of Net Sales 14.2% 11.2% 14.4% 10.5% Goodwill

at end of period $530 $530 $530 $530 (Unaudited) Electrical Segment

Third Quarter Ending Nine Months Ending Sept. 29, Sept. 30, Sept.

29, Sept. 30, 2007 2006 2007 2006 Net Sales $398,754 $370,370

$1,171,213 $1,097,962 Income from Operations 46,170 47,591 138,276

138,234 % of Net Sales 11.6% 12.8% 11.8% 12.6% Goodwill at end of

period $635,547 $546,842 $635,547 $546,842 CONDENSED CASH FLOW

STATEMENT In Thousands of Dollars (Unaudited) Nine Months Ended

Sept. 29, 2007 Sept. 30, 2006 CASH FLOWS FROM OPERATING ACTIVITIES:

Net income $94,305 $ 86,837 Adjustments to reconcile net income to

net cash provided by operating activities; net of effect of

acquisitions Depreciation and amortization 30,345 25,835 Minority

interest 2,243 2,027 Excess tax benefit from stock-based

compensation (6,681) (1,960) Gain on sale of assets, net (34)

(1,881) Stock-based compensation expense 2,802 2,665 Change in

assets and liabilities, net 45,337 (60,713) Net cash provided by

operating activities 168,317 52,810 CASH FLOWS FROM INVESTING

ACTIVITIES: Additions to property, plant and equipment (23,818)

(37,689) Purchases of short-term investments, net - (5,853)

Business acquisitions, net of cash acquired (253,241) (10,962) Sale

of property, plant and equipment 160 15,555 Net cash used in

investing activities (276,899) (38,949) CASH FLOWS FROM FINANCING

ACTIVITIES: Net proceeds from short-term borrowing 8,200 -

Long-term debt proceeds 250,000 - Payments of long-term debt (333)

(333) Net repayments under revolving credit facility (76,200)

(23,600) Net (repayments) proceeds from commercial paper borrowings

(49,000) 22,737 Dividends paid to shareholders (13,394) (12,301)

Proceeds from the exercise of stock options 1,684 5,132 Excess tax

benefits from stock-based compensation 6,681 1,960 Distributions to

minority partners (106) - Financing fees paid (1,397) - Net cash

provided by (used in) financing activities 126,135 (6,405) EFFECT

OF EXCHANGE RATES ON CASH 1,491 (17) Net increase in cash and cash

equivalents 19,044 7,439 Cash and cash equivalents at beginning of

period 36,520 32,747 Cash and cash equivalents at end of period

$55,564 $ 40,186 DATASOURCE: Regal Beloit Corporation CONTACT:

David A. Barta, Vice President, Chief Financial Officer of Regal

Beloit Corporation, +1-608-361-7405 Web site:

http://www.regal-beloit.com/

Copyright

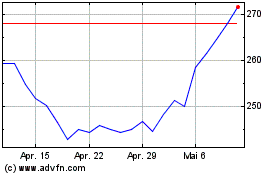

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

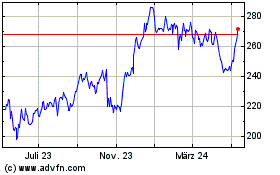

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024