REGAL-BELOIT Second Quarter Earnings Per Share Doubles Net Income

Increases 142% BELOIT, Wis., July 26 /PRNewswire-FirstCall/ --

REGAL-BELOIT CORPORATION (NYSE:RBC) today announced its second

quarter 2005 financial results. Net income in the second quarter of

2005 was $18.4 million, a 141.8% increase from $7.6 million

reported in the second quarter of 2004. For the first six months of

2005, net income increased 112.1% to $30.7 million from $14.5 for

the same period of 2004. Earnings per share were $.62 and $1.03 for

the second quarter and first half of 2005, respectively, increases

of 100% and 77.6% from $.31 and $.58 in the comparable periods in

2004. Second quarter net sales increased 107.5% to $368.8 million

from $177.7 million reported in the second quarter of 2004. Sales

attributable to the Commercial AC motor and HVAC motor and

capacitor acquisitions of 2004 were $177.5 million in the quarter.

Second quarter sales in the Electrical segment increased 150.7%

including the sales attributable to the acquired businesses.

Approximately 93% of the sales increase is attributable to sales

from the acquired businesses. Sales in the Mechanical segment,

which reflect the impact of the sale of the Illinois Gear business

in May 2005, increased .8%. Six months sales of the Company of

$706.6 million reflect an increase of 107.4% as compared to the

$340.7 million reported for the same period in 2004. Sales

attributable to the acquisitions for this period were $332.6

million. Income from operations increased 152.7% to $35.8 million

from $14.2 million reported for the second quarter of 2004. For the

first six months of 2005, income from operations was $61.7 million

as compared to $26.7 million for the same period of 2004. The gross

profit for the second quarter of 2005 was 21.6%, as compared to the

23.0% reported in the second quarter last year and the 20.3%

reported in the first quarter of 2005. Our price increases and

productivity improvements were offset by the impact of continued

raw material inflation. However, our efforts to obtain additional

pricing and productivity improvements continue to gain traction.

The Company's long-term debt decreased to $536.9 million at the end

of the second quarter of 2005 from $563.6 million at the end of the

first quarter of 2005. "We continue to be extremely pleased with

our financial performance and the progress on our strategic

initiatives," said Henry W. Knueppel, President and CEO. "Despite

continued cost pressures from raw materials and the cooler weather

that impacted sales into the HVAC channel, we delivered strong

sales and income results. Our legacy Electrical businesses reported

strong revenue growth and we continue to see strong results from

the acquisitions." "Earnings for the third quarter, which reflect

the seasonal pattern of our business, are projected to be in a

range of $.52- $.56 per share using the second quarter's average

diluted shares," Knueppel added. "Reflected in this guidance is our

belief that we will continue to see strong performances from our

legacy businesses and results from the acquisitions that are in

line with the previously announced guidance." REGAL-BELOIT will be

holding a telephone conference call pertaining to this news release

at 9:00 AM CDT (10:00 AM EDT) on Tuesday, July 26, 2005. Interested

parties should call 866-297-6315, referencing the REGAL-BELOIT

conference call, access code 12302867. A replay of the call will be

available through August 5, 2005 at 877-213-9653, access code

12302867. REGAL-BELOIT CORPORATION is a leading manufacturer of

mechanical and electrical motion control and power generation

products serving markets throughout the world. REGAL-BELOIT is

headquartered in Beloit, Wisconsin, and has manufacturing, sales,

and service facilities throughout North America, and in Mexico,

Europe and Asia. CAUTIONARY STATEMENT The following is a cautionary

statement made under the Private Securities Litigation Reform Act

of 1995: With the exception of historical facts, the statements

contained in this press release may be forward looking statements.

Forward-looking statements represent our management's judgment

regarding future events. We cannot guarantee the accuracy of the

forward-looking statements, and you should be aware that results

and events could differ materially and adversely from those

contained in the forward-looking statements due to a number of

factors, including: unexpected issues and costs arising from the

integration of acquired companies and businesses, such as our

recent acquisitions of the HVAC motors and capacitors businesses

and the Commercial AC motors business from General Electric

Company; marketplace acceptance of our recent acquisitions,

including the loss of, or a decline in business from, any

significant customers; unanticipated fluctuations in commodity

prices and raw material costs and issues affecting our ability to

pass increased costs on to our customers; cyclical downturns

affecting the markets for capital goods; substantial increases in

interest rates that impact the cost of our outstanding debt; the

impact of capital market transactions that the Company may effect;

unanticipated costs associated with litigation matters; the success

of our management in increasing sales and maintaining or improving

the operating margins of our businesses; actions taken by our

competitors; difficulties in staffing and managing foreign

operations; our ability to satisfy various covenant requirements

under our credit facility; and other risks and uncertainties

described from time to time in our reports filed with U.S.

Securities and Exchange Commission. All subsequent written and oral

forward-looking statements attributable to us or to persons acting

on our behalf are expressly qualified in their entirety by the

applicable cautionary statements. The forward-looking statements

included in this press release are made only as of the date of this

release, and we undertake no obligation to update these statements

to reflect subsequent events or circumstances. STATEMENT OF INCOME

In Thousands of Dollars (Unaudited) Three Months Ended Six Months

Ended June 29, June 29, June 29, June 29, 2005 2004 2005 2004 Net

Sales $368,768 $177,652 $706,591 $340,736 Cost of Sales 288,950

136,811 558,329 261,708 Gross Profit 79,818 40,841 148,262 79,028

Operating Expenses 44,007 26,667 86,586 52,322 Income From

Operations 35,811 14,174 61,676 26,706 Interest Expense 5,894 1,509

11,348 2,836 Interest Income 28 29 76 32 Income Before Income Taxes

and Minority Interest 29,945 12,694 50,404 23,902 Provision For

Income Taxes 10,996 4,558 18,638 8,594 Income Before Minority

Interest 18,949 8,136 31,766 15,308 Minority Interest in Income,

Net of Tax 504 507 1,035 819 Net Income $18,445 $7,629 $30,731

$14,489 Per Share of Common Stock: Earnings Per Share- Basic $.63

$.31 $1.06 $.59 Earnings Per Share- Assuming Dilution $.62 $.31

$1.03 $.58 Cash Dividends Declared $.13 $.12 $ .25 $.24 Average

Number of Share Outstanding- Basic 29,064,518 24,450,391 29,049,209

24,744,342 Average Number of Shares-Assuming Dilution 29,720,400

24,677,155 29,982,397 24,977,674 Condensed Balance Sheet In

Thousands of Dollars (Unaudited) (Audited) Assets June 29, 2005

December 31, 2004 Current Assets Cash and Cash Equivalents $29,066

$31,275 Receivables, less reserves of $2,742 in 2005 and $2,376 in

2004 200,178 176,941 Inventories 234,642 246,816 Other Current

Assets 34,697 19,887 Total Current Assets 498,583 474,919 Net

Property, Plant and Equipment 249,872 253,673 Goodwill 554,038

544,440 Purchased Intangible Assets, Net 48,866 52,058 Other

Noncurrent Assets 23,924 26,962 Total Assets $1,375,283 $1,352,052

Liabilities and Shareholders' Investment Current Liabilities

$199,447 $195,209 Long Term Debt 536,895 547,350 Other Noncurrent

Liabilities 73,669 71,314 Shareholders' Investment 565,272 538,179

Total Liabilities and Shareholders' Investment $ 1,375,283 $

1,352,052 NOTES TO FINANCIAL STATEMENTS 1. Certain footnotes and

other information normally included in financial statements

prepared in accordance with accounting principles generally

accepted in the United States have been condensed or omitted from

these statements, and therefore these statements should be read in

conjunction with the Company's 2004 Annual Report and Securities

and Exchange Commission filings. 2. The results of operations for

the interim periods are not necessarily indicative of the results

to be expected for the year. Certain items, such as income taxes,

LIFO charges and various other accruals, are included in these

statements base on estimates for the entire year. SEGMENT

INFORMATION In Thousands of Dollars (Unaudited) Mechanical Segment

Three Months Ended Six Months Ended June 29, June 29, June 29, June

29, 2005 2004 2005 2004 Net Sales $51,546 $51,142 $100,147 $98,040

Income From Operations $3,139 $3,889 $5,876 $6,634 (Unaudited)

Electrical Segment Three Months Ended Six Months Ended June 29,

June 29, June 29, June 29, 2005 2004 2005 2004 Net Sales $317,222

$126,510 $606,444 $242,696 Income From Operations $32,672 $10,285

$55,800 $20,072 DATASOURCE: REGAL-BELOIT CORPORATION CONTACT: Dave

Barta, Chief Financial Officer, ext 106, or Ken Kaplan, Treasurer

& Secretary, ext. 104, both of REGAL-BELOIT Corporation,

+1-608-364-8808 Web site: http://www.regal-beloit.com/

Copyright

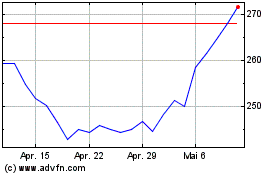

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

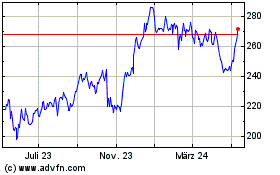

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024