Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

29 April 2022 - 12:56PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April

2022

PEARSON plc

(Exact

name of registrant as specified in its charter)

N/A

(Translation

of registrant's name into English)

80 Strand

London, England WC2R 0RL

44-20-7010-2000

(Address

of principal executive office)

Indicate

by check mark whether the Registrant files or will file annual

reports

under

cover of Form 20-F or Form 40-F:

Form

20-F

X

Form 40-F

Indicate

by check mark whether the Registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934

Yes

No X

Pearson 2022 Q1 Trading Update (Unaudited)

|

29th April

2022

|

Continued momentum with underlying sales growth of 7% in the first

quarter

|

|

Highlights

●

Ongoing

strategic and operational progress, with underlying sales growth of

7%. 2022 adjusted operating profit guidance

reaffirmed.

●

Direct to consumer

strategy strengthened with acquisition of Mondly further enhancing

our position in English Language Learning.

●

First tranche of

£350m share buyback commenced.

Andy Bird, Pearson's Chief Executive,

said:

"Pearson has continued to make strong strategic, operational and

financial progress through the first quarter. Underlying sales grew

by 7%, and we remain on track to deliver on our 2022 financial

expectations and medium term guidance.

"Our acquisition of Mondly, one of the world's leading online

language learning platforms, is another exciting strategic

development. It strengthens Pearson's direct to consumer strategy

and supports our ambition to become the global leader in English

language learning for committed learners.

"We remain sharply focused on the successful execution of our

strategy and we are encouraged by the momentum we are seeing across

the business."

|

Underlying sales growth of 7%

●

Assessment &

Qualifications sales grew 22% with growth across all areas. US

Student Assessment delivered a strong performance partially

reflecting the normalisation of exam timetables. Clinical

Assessment also delivered a strong performance due in part to the

phasing of orders.

●

Virtual Learning sales

increased 3% underpinned by strong retention rates in Virtual

Schools and growth in OPM. As announced on 19th April,

our OPM contract with ASU will end as of June

2023.

●

English Language

Learning sales increased 18%, with growth in Pearson Test of

English volumes weighted to Q1 from borders re-opening and

improving global mobility.

●

Workforce Skills sales

grew 9% (excluding acquisitions) driven by ongoing growth in BTEC,

GED and TalentLens. We made good strategic progress with

Pearson's GED Testing Service selected as an education partner for

Amazon's Career Choice programme.

●

Higher Education sales

were down 5% due to expected declines in US Higher Education

reflecting the continued decline in enrolments and courses per

enrolment combined for the 2021/22 academic

year.

●

Sales in businesses

under strategic review decreased 11% as

expected.

Strategically important acquisition of Mondly in English Language

Learning announced today

●

The acquisition marks

another step in our digital strategy, giving us access to the fast

growing direct to consumer English language learning

market.

●

Strategic growth area

for Pearson with synergies and cross-selling opportunities,

particularly in Institutional, Pearson Test of English and

Workforce Skills.

●

Full details are available in the

press release on our website, https://plc.pearson.com/en-GB/news/pearson-acquires-leading-online-language-learning-platform.

Share buyback programme to return £350m to

shareholders

●

First tranche commenced

in April, of which over £75m already

completed.

Financial summary

|

|

Underlying growth

|

|

Sales

|

|

|

Assessment & Qualifications

|

22%

|

|

Virtual Learning

|

3%

|

|

English Language Learning

|

18%

|

|

Workforce Skills

|

9%

|

|

Higher Education

|

(5)%

|

|

Strategic review

|

(11)%

|

|

Total

|

7%

|

Throughout this announcement growth rates are stated on an

underlying basis unless otherwise stated. Underlying growth rates

exclude currency movements and portfolio changes.

Financial update

The statute of limitations on a number of tax provisions lapsed in

April 2022. This will lead to a one-off impact in 2022, reducing

our effective tax rate from current market expectations of c.21% to

15-17%, and our interest charge from c.£57m to

£10m-£15m. For 2023, we currently expect our tax rate to

be in the range of 23-25%, reflecting our geographical footprint,

and our interest charge to be £40m-£45m. We anticipate

that a decision regarding the ongoing EU Commission investigation

into whether certain aspects of the UK tax system constituted State

Aid could be announced over the summer.

Contacts

|

Investor Relations

|

Jo Russell

James Caddy

|

+44 (0) 7785 451 266

+44 (0) 7825 948 218

|

|

Media

|

Tom Steiner

Gemma Terry

|

+44 (0) 7787 415 891

+44 (0) 7841 363 216

|

|

Teneo

|

Charles Armitstead

|

+44 (0) 7703 330 269

|

Notes

Forward looking statements: Except for the historical information

contained herein, the matters discussed in this statement include

forward-looking statements. In particular, all statements that

express forecasts, expectations and projections with respect to

future matters, including trends in results of operations, margins,

growth rates, overall market trends, the impact of interest or

exchange rates, the availability of financing, anticipated cost

savings and synergies and the execution of Pearson's strategy, are

forward-looking statements. By their nature, forward-looking

statements involve risks and uncertainties because they relate to

events and depend on circumstances that will occur in future. They

are based on numerous assumptions regarding Pearson's present and

future business strategies and the environment in which it will

operate in the future. There are a number of factors which could

cause actual results and developments to differ materially from

those expressed or implied by these forward-looking statements,

including a number of factors outside Pearson's control. These

include international, national and local conditions, as well as

competition. They also include other risks detailed from time to

time in Pearson's publicly-filed documents and you are advised to

read, in particular, the risk factors set out in Pearson's latest

annual report and accounts, which can be found on its website

(www.pearsonplc.com). Any forward-looking statements speak only as

of the date they are made, and Pearson gives no undertaking to

update forward-looking statements to reflect any changes in its

expectations with regard thereto or any changes to events,

conditions or circumstances on which any such statement is based.

Readers are cautioned not to place undue reliance on such

forward-looking statements.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

PEARSON

plc

|

|

|

|

|

Date: 29

April 2022

|

|

|

|

By: /s/

NATALIE WHITE

|

|

|

|

|

|

------------------------------------

|

|

|

Natalie

White

|

|

|

Deputy

Company Secretary

|

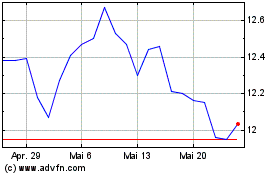

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024