Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

18 März 2021 - 3:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the

month of March 2021

PEARSON plc

(Exact

name of registrant as specified in its charter)

N/A

(Translation

of registrant's name into English)

80 Strand

London, England WC2R 0RL

44-20-7010-2000

(Address

of principal executive office)

Indicate

by check mark whether the Registrant files or will file annual

reports

under

cover of Form 20-F or Form 40-F:

Form

20-F

X

Form 40-F

Indicate

by check mark whether the Registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934

Yes

No X

PEARSON PLC

(the "Company")

Result of General Meeting on 18 September 2020 - Update

Statement

In accordance with the UK Corporate Governance Code, Pearson plc

("Pearson" or the "Company") is providing this update following the

outcome of the General Meeting on 18 September 2020, where the

Company sought shareholder approval for a resolution to amend its

Directors' Remuneration Policy to permit the grant of a

co-investment share award to Andy Bird, the new Chief Executive.

The Board very much appreciated the support of the majority of

shareholders (67.2%), although it noted that a significant minority

(32.8%) voted against the proposals.

In advance of the General Meeting, and in developing the

remuneration package for Mr Bird, the Remuneration Committee ("the

Committee") engaged extensively with shareholders. However, in

light of the outcome and given the Committee's commitment to an

ongoing and transparent dialogue with shareholders, an engagement

exercise was undertaken in early 2021 in order to listen and

further understand the views and perspectives of

shareholders.

In designing the remuneration package, the Committee sought to

maintain the Company's Directors' Remuneration Policy for future

years, while finding a means to bridge the considerable gap to

compensation practice in the US, Mr Bird's home market, where pay

rates are substantially higher than in the UK and the way pay is

structured is often very different. The Committee developed this

one-off co-investment arrangement to help bridge this gap. This

solution was enabled by Mr Bird's decision to invest personally and

substantially in the Company's shares. The Committee recognises

that such a one-off arrangement is not typical in the UK market,

but believes it was the optimal structure to secure Mr Bird's

recruitment whilst incentivising the creation of long-term

shareholder value.

On further discussion with shareholders, they have expressed strong

support of Mr Bird's appointment, recognised the one-off nature of

the co-investment award, appreciated our determination to keep our

approved Directors' Remuneration Policy otherwise unchanged and

noted that there was no additional buy-out of remuneration foregone

at a previous employer. The two key areas of concern raised by

investors have related to the time horizon over which the

co-investment award is held and the performance underpins. Further

details on these areas and the co-investment award in general can

be found in our 2020 Directors' Remuneration Report.

The conversations that we have had over the past 6 months have been

invaluable and the support of our shareholders has enabled the

Company to appoint a new Chief Executive who we believe will unlock

new growth potential for Pearson and ultimately return value to all

our stakeholders. The Committee will continue to engage with

investors as appropriate in the future.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

PEARSON

plc

|

|

|

|

|

Date: 18

March 2021

|

|

|

|

By: /s/

NATALIE WHITE

|

|

|

|

|

|

------------------------------------

|

|

|

Natalie

White

|

|

|

Deputy

Company Secretary

|

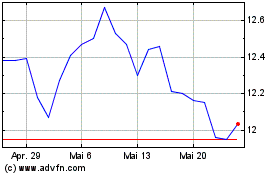

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024