0001554625falsePOS EX00015546252023-10-022023-10-02

As filed with the Securities and Exchange Commission on October 2, 2023

Securities Act File No. 333-268702

Investment Company Act File No. 811-22725

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

Form N-2

ý REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

o PRE-EFFECTIVE AMENDMENT NO.

ý POST-EFFECTIVE AMENDMENT NO. 1

and/or

ý REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

ý AMENDMENT NO. 72

_________________________________

Priority Income Fund, Inc.

(Exact Name of Registrant as Specified in the Charter)

_________________________________

10 East 40th Street, 42nd Floor

New York, NY 10016

(Address of Principal Executive Offices)

(212) 448-0702

(Registrant’s Telephone Number, Including Area Code)

M. Grier Eliasek

Priority Income Fund, Inc.

10 East 40th Street, 42nd Floor

New York, NY 10016

(Name and address of agent for service)

COPIES TO:

Steven B. Boehm, Esq.

Cynthia R. Beyea, Esq.

Eversheds Sutherland (US) LLP

700 Sixth Street, NW Suite 700

Washington, DC 20001-3980

Tel: (202) 383-0100

Fax: (202) 637-3593

_________________________________

Approximate date of commencement of proposed public offering: As soon as possible after the effective date of this Registration Statement.

| | | | | | | | |

| | ☐ | Check box if the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans. |

| | | | | | | | |

| | ý | Check box if any securities being registered on this Form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend reinvestment plan. |

| | | | | | | | |

| | ☐ | Check box if this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto. |

| | | | | | | | |

| | ☐ | Check box if this Form is a registration statement pursuant to General Instruction B or a post-effective amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act. |

| | | | | | | | |

| | ☐ | Check box if this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction B to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act. |

It is proposed that this filing will become effective (check appropriate box):

| | | | | | | | |

| | ☐ | when declared effective pursuant to Section 8(c) of the Securities Act. |

If appropriate, check the following box:

| | | | | | | | |

| | ☐ | This [post-effective] amendment designates a new effective date for a previously filed [post-effective amendment] [registration statement]. |

| | | | | | | | |

| | ☐ | This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: . |

| | | | | | | | |

| | ☐ | This Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: . |

| | | | | | | | |

| | ý | This Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: 333-268702 |

Check each box that appropriately characterizes the Registrant:

| | | | | | | | |

| | ý | Registered Closed-End Fund (closed-end company that is registered under the Investment Company Act of 1940 (“Investment Company Act”)). |

| | | | | | | | |

| | ☐ | Business Development Company (closed-end company that intends or has elected to be regulated as a business development company under the Investment Company Act). |

| | | | | | | | |

| | ☐ | Interval Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act). |

| | | | | | | | |

| | ☐ | A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form). |

| | | | | | | | |

| | ☐ | Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act). |

| | | | | | | | |

| | ☐ | Emerging Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange Act”). |

| | | | | | | | |

| | ☐ | If an Emerging Growth Company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. |

| | | | | | | | |

| | ☐ | New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months preceding this filing). |

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 and Amendment No. 72 (the “Post-Effective Amendment”) to the Registration Statement on Form N-2 (File Nos. 333-268702 and 811-22725) of Priority Income Fund, Inc. (the “Registration Statement”) is being filed pursuant to Rule 462(d) under the Securities Act of 1933, as amended (the “Securities Act”), solely for the purpose of filing an exhibit to the Registration Statement. Accordingly, this Post-Effective Amendment consists only of a facing page, this explanatory note and Part C of the Registration Statement on Form N-2 setting forth the exhibits to the Registration Statement. This Post-Effective Amendment does not modify any other part of the Registration Statement. Pursuant to Rule 462(d) under the Securities Act, this Post-Effective Amendment shall become effective immediately upon filing with the Securities and Exchange Commission. The contents of the Registration Statement are hereby incorporated by reference.

PART C

Other Information

Item 25. Financial Statements and Exhibits

(1) Financial Statements

Part A: Financial Highlights and Senior Securities.

Part B: Incorporated by reference to the Company’s annual report for the period ended June 30, 2022 filed electronically pursuant to Section 30(b)(2) of the Investment Company Act of 1940, as amended.

(2) Exhibits

| | | | | |

| (a)(1) | |

| (a)(2) | |

| (a)(3) | |

| (a)(4) | |

| (a)(5) | |

| (a)(6) | |

| (a)(7) | |

| (a)(8) | |

| (a)(9) | |

| (a)(10) | |

| (a)(11) | |

| (a)(12) | |

| (a)(13) | |

| (a)(14) | |

| (a)(15) | |

| (a)(16) | |

| (a)(17) | |

| (b) | |

| (d)(1) | Form of Subscription Agreement (included in the Prospectus as Appendix A and incorporated herein by reference) |

| (d)(2) | |

| (d)(3) | |

| | | | | |

| (d)(4) | |

| (d)(5) | |

| (d)(6) | |

| (d)(7) | |

| (d)(8) | |

| (d)(9) | |

| (d)(10) | |

| (d)(11) | |

| (d)(12) | |

| (d)(13) | |

| (e) | Amended and Restated Distribution Investment Plan of the Registrant* |

| (g) | |

| (h)(1) | |

| (h)(2) | |

| (j) | |

| (k)(1) | |

| (k)(2) | |

| (k)(3) | |

| (k)(4) | |

| (k)(5) | |

| (l) | |

| (n)(1) | |

| (n)(2) | |

| (n)(3) | |

| (r) | |

| (s) | |

| | | | | |

| (1) | Incorporated by reference to Exhibits (e), (j), and (k)(1) to Registrant’s Form N-2 Pre-Effective Amendment No. 2 (File Nos. 333-182941 and 811-22725) filed on November 13, 2012. |

| (2) | Incorporated by reference to Exhibit (a) to Registrant’s Form N-2 Pre-Effective Amendment No. 3 (File Nos. 333-182941 and 811-22725) filed on February 15, 2013. |

| (3) | Incorporated by reference to Exhibit (a) to Registrant’s Form N-2 Post-Effective Amendment No. 5 (File Nos. 333-182941 and 811-22725) filed on October 27, 2014. |

| (4) | Incorporated by reference to Exhibit (k)(4) to Registrant’s Form N-2 Post-Effective Amendment No. 6 (File Nos. 333-182941 and 811-22725) filed on December 18, 2014. |

| (5) | Incorporated by reference to Exhibit (r) to Registrant’s Form N-2 Post-Effective Amendment No. 7 (File Nos. 333-182941 and 811-22725) filed on September 2, 2015. |

| (6) | Incorporated by reference to Exhibit (k)(7) to Registrant’s Form N-2 Post-Effective Amendment No. 9 (File Nos. 333-182941 and 811-22725) filed on October 21, 2015. |

| (7) | Incorporated by reference to Exhibit (k)(7) to Registrant’s Form N-2 Post-Effective Amendment No. 11 (File Nos. 333-182941 and 811-22725) filed on March 31, 2016. |

| (8) | Incorporated by reference to Exhibit (b) to Registrant’s Form N-2 Post-Effective Amendment No. 4 (File Nos. 333-213498 and 811-22825) Filed on April 26, 2018. |

| (9) | Incorporated by reference to Exhibit (d)(2) to Registrant’s Form N-2 Pre-Effective Amendment No. 2 (File Nos. 333-221434 and 811-22725) filed on June 22, 2018. |

| | | | | |

| (10) | Incorporated by reference to Exhibit (d)(3) to Registrant’s Form N-2 Pre-Effective Amendment No. 2 (File Nos. 333-226876 and 811-22725) filed on October 16, 2018. |

| (11) | Incorporated by reference to Exhibit (d)(4) to Registrant’s Form N-2 Pre-Effective Amendment No. 1 (File Nos. 333-228334 and 811-22725) filed on February 13, 2019. |

| (12) | Incorporated by reference to Exhibit (d)(5) to Registrant’s Form N-2 Pre-Effective Amendment No. 1 (File Nos. 333-229007 and 811-22725) filed on April 26, 2019. |

| (13) | Incorporated by reference to Exhibits (d)(6) and (g) to Registrant’s Form N-2 Pre-Effective Amendment No. 2 (File Nos. 333-229007 and 811-22725) filed on September 27, 2019. |

| (14) | Incorporated by reference to Exhibit (d)(7) to Registrant’s Form N-2 Pre-Effective Amendment No. 1 (File Nos. 333-234289 and 811-22725) filed on February 14, 2020). |

| (15) | Incorporated by reference to Exhibit (d)(8) to Registrant’s Form N-2 Pre-Effective Amendment No. 2 (File Nos. 333-237329 and 811-22725) filed on March 11, 2021. |

| (16) | Incorporated by reference to Exhibit (d)(9) to Registrant’s Form N-2 Pre-Effective Amendment No. 1 (File Nos. 333-254804 and 811-22725) filed on April 29, 2021. |

| (17) | Incorporated by reference to Exhibit (d)(10) to Registrant’s Form N-2 Pre-Effective Amendment No. 1 (File Nos. 333-256184 and 811-22725) filed on June 9, 2021. |

| (18) | Incorporated by reference to Exhibit (d)(11) to Registrant’s Form N-2 Pre-Effective Amendment No. 1 (File Nos. 333-257702 and 811-22725) filed on July 28, 2021. |

| (19) | Incorporated by reference to Registrant’s Form N-2 (File Nos. 333-254804 and 811-22725) filed on March 26, 2021. |

| (20) | Incorporated by reference to Registrant’s Form N-14 Registration Statement (File No. 333-229041) filed on December 27, 2018. |

| (21) | Incorporated by reference to Exhibit (d)(12) to Registrant’s Form N-2 Pre-Effective Amendment No. 1 (File Nos. 333-259310 and 811-22725) filed on October 4, 2021. |

| (22) | Incorporated by reference to Exhibit (d)(13) to Registrant’s Form N-2 Pre-Effective Amendment No. 3 (File Nos. 333-259310 and 811-22725) filed on February 14, 2022. |

| (23) | Incorporated by reference to Exhibit (r) to Registrant’s Form N-2 Post-Effective Amendment No. 5 (File Nos. 333-235356 and 811-22725) filed on October 28, 2022. |

| (24) | Incorporated by reference to Exhibit (n)(3) to Registrant’s Form N-2 (File Nos. 333-268702 and 811-22725) filed on December 7, 2022. |

| (25) | Incorporated by reference to Exhibit (s) to Registrant’s Form N-2 (File Nos. 333-268702 and 811-22725) filed on December 7, 2022. |

| (26) | Incorporated by reference to Exhibits (h)(1) and (h)(2) to Registrant’s Form N-2 (File Nos. 333-268702 and 811-22725) filed on February 14, 2023. |

| (27) | Incorporated by reference to Exhibit (l) to Registrant’s Form N-2 (File Nos. 333-268702 and 811-22725) filed on February 14, 2023. |

| (28) | Incorporated by reference to Exhibit (n)(1) to Registrant’s Form N-2 (File Nos. 333-268702 and 811-22725) filed on February 14, 2023. |

| (29) | Incorporated by reference to Exhibit (n)(2) to Registrant’s Form N-2 (File Nos. 333-268702 and 811-22725) filed on February 14, 2023. |

| * | Filed herewith. |

Item 26. Marketing Arrangements

The information contained under the heading “Plan of Distribution” in this Registration Statement is incorporated herein by reference.

Item 27. Other Expenses of Issuance and Distribution

| | | | | |

| SEC registration fee | $ | 67,892 | |

| FINRA filing fee | $ | 200,000 | |

| Advertising and sales literature | $ | 4,800,000 | |

| Accounting fees and expenses | $ | 1,500,000 | |

| Legal fees and expenses | $ | 1,500,000 | |

| Due Diligence expenses | $ | 1,560,000 | |

| Printing and engraving | $ | 260,000 | |

| Seminars | $ | 265,000 | |

| Transfer Agent fees | $ | 2,000,000 | |

| Miscellaneous fees and expenses | $ | 3,500,000 | |

| Total | $ | 15,652,892 | |

The amounts set forth above, except for the SEC and FINRA fees, are in each case estimated. All of the expenses set forth above shall be borne by the Registrant.

Item 28. Persons Controlled by or Under Common Control

See “Management” in the Prospectus and “Certain Relationships and Related Party Transactions” in the Statement of Additional Information contained herein.

Item 29. Number of Holders of Securities

The following table sets forth the number of record holders of the Registrant’s capital shares at February 13, 2023.

| | | | | |

| Title of Class | Number of

Record Holders |

| Shares of common stock | 12,655 | |

Item 30. Indemnification

Directors and Officers

Reference is made to Section 2-418 of the Maryland General Corporation Law and the Registrant’s charter and bylaws.

Maryland law permits a Maryland corporation to include in its charter a provision limiting the liability of its directors and officers to the corporation and its stockholders for money damages except for liability resulting from (a) actual receipt of an improper benefit or profit in money, property or services or (b) active and deliberate dishonesty established by a final judgment as being material to the cause of action. The Registrant’s charter contains such a provision which eliminates directors’ and officers’ liability to the maximum extent permitted by Maryland law, subject to the requirements of the Investment Company Act of 1940, as amended, or the “1940 Act.”

The Registrant’s charter authorizes the Registrant, to the maximum extent permitted by Maryland law and subject to the requirements of the 1940 Act, to indemnify any present or former director or officer or any individual who, while serving as the Registrant’s director or officer and at the Registrant’s request, serves or has served another corporation, real estate investment trust, partnership, joint venture, limited liability company, trust, employee benefit plan or other enterprise as a director, officer, partner, manager, managing member or trustee, from and against any claim or liability to which that person may become subject or which that person may incur by reason of his or her service in any such capacity and to pay or reimburse their reasonable expenses in advance of final disposition of a proceeding. The Registrant’s bylaws obligate the Registrant, to the maximum extent permitted by Maryland law and subject to the requirements of the 1940 Act, to indemnify any present or former director or officer or any individual who, while serving as the Registrant’s director or officer and at the Registrant’s request, serves or has served another corporation, real estate investment trust, partnership, joint venture, limited liability company, trust, employee benefit plan or other enterprise as a director, officer, partner, manager, managing member or trustee and who is made, or threatened to be made, a party to the proceeding by reason of his or her service in that capacity from and against any claim or liability to which that person may become subject or which that person may incur by reason of his or her

service in any such capacity and to pay or reimburse his or her reasonable expenses in advance of final disposition of a proceeding. The charter and bylaws also permit the Registrant to indemnify and advance expenses to any person who served a predecessor of the Registrant in any of the capacities described above and any of the Registrant’s employees or agents or any employees or agents of the Registrant’s predecessor. In accordance with the 1940 Act, the Registrant will not indemnify any person for any liability to which such person would be subject by reason of such person’s willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his or her office.

Maryland law requires a corporation (unless its charter provides otherwise, which the Registrant’s charter does not) to indemnify a director or officer who has been successful in the defense of any proceeding to which he or she is made, or threatened to be made, a party by reason of his or her service in that capacity. Maryland law permits a corporation to indemnify its present and former directors and officers, among others, against judgments, penalties, fines, settlements and reasonable expenses actually incurred by them in connection with any proceeding to which they may be made, or threatened to be made, a party by reason of their service in those or other capacities unless it is established that (a) the act or omission of the director or officer was material to the matter giving rise to the proceeding and (1) was committed in bad faith or (2) was the result of active and deliberate dishonesty, (b) the director or officer actually received an improper personal benefit in money, property or services or (c) in the case of any criminal proceeding, the director or officer had reasonable cause to believe that the act or omission was unlawful. However, under Maryland law, a Maryland corporation may not indemnify for an adverse judgment in a suit by or in the right of the corporation or for a judgment of liability on the basis that a personal benefit was improperly received unless, in either case, a court orders indemnification, and then only for expenses. In addition, Maryland law permits a corporation to advance reasonable expenses to a director or officer in advance of final disposition of a proceeding upon the corporation’s receipt of (a) a written affirmation by the director or officer of his or her good faith belief that he or she has met the standard of conduct necessary for indemnification by the corporation and (b) a written undertaking by him or her or on his or her behalf to repay the amount paid or reimbursed by the corporation if it is ultimately determined that the standard of conduct was not met.

Adviser and Administrator

The Investment Advisory Agreement provides that, absent willful misfeasance, bad faith or gross negligence in the performance of its duties or by reason of the reckless disregard of its duties and obligations, Priority Senior Secured Income Management, LLC (the “Adviser”) and its officers, managers, agents, employees, controlling persons, members and any other person or entity affiliated with it are entitled to indemnification from the Registrant for any damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) arising from the rendering of the Adviser’s services under the Investment Advisory Agreement or otherwise as an investment adviser of the Registrant.

The Administration Agreement provides that, absent willful misfeasance, bad faith or gross negligence in the performance of its duties or by reason of the reckless disregard of its duties and obligations, Prospect Administration LLC and its officers, managers, agents, employees, controlling persons, members and any other person or entity affiliated with it are entitled to indemnification from the Registrant for any damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) arising from the rendering of Prospect Administration LLC’s services under the Administration Agreement or otherwise as administrator for the Registrant.

The law also provides for comparable indemnification for corporate officers and agents. Insofar as indemnification for liability arising under the Securities Act of 1933, as amended, or the “Securities Act,” may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

The Registrant has entered into indemnification agreements with its directors. The indemnification agreements are intended to provide the Registrant’s directors the maximum indemnification permitted under Maryland law and the 1940 Act. Each indemnification agreement provides that the Registrant shall indemnify the director who is a party to the agreement (an “Indemnitee”), including the advancement of legal expenses, if, by reason of his or her corporate status, the Indemnitee is, or is threatened to be, made a party to or a witness in any threatened, pending, or completed proceeding, other than a proceeding by or in the right of the Registrant.

Item 31. Business and Other Connections of Investment Adviser

A description of any other business, profession, vocation, or employment of a substantial nature in which the Adviser, and each director or executive officer of the Adviser, is or has been during the past two fiscal years, engaged in for his or her own account or in the capacity of director, officer, employee, partner or trustee, is set forth in Part A of this Registration Statement in the sections entitled “Management—Board of Directors,” and “Executive Officers” and “Investment Advisory Agreement.” Additional information regarding the Adviser and its officers and directors is set forth in its Form ADV, as filed with the Securities and Exchange Commission (SEC File No. 801-77270), and is incorporated herein by reference.

Item 32. Location of Accounts and Records

All accounts, books and other documents required to be maintained by Section 31(a) of the Investment Company Act of 1940, and the rules thereunder are maintained at the offices of:

(1) the Registrant, Priority Income Fund, Inc., 10 East 40th Street, 42nd Floor, New York, New York 10016;

(2) the Transfer Agent, DST Systems, Inc., 430 W. 7th Street, Kansas City, MO 64105;

(3) the Custodian, U.S. Bank National Association, 1719 Range Way, Florence, South Carolina 29501;

(4) the Adviser, Priority Senior Secured Income Management, LLC, 10 East 40th Street, 42nd Floor, New York, New York 10016; and

(5) the Administrator, Prospect Administration LLC, 10 East 40th Street, 42nd Floor, New York, New York 10016.

Item 33. Management Services

Not Applicable.

Item 34. Undertakings

| | | | | | | | | | | | | | |

| 1. | The Registrant undertakes to suspend the offering of shares until the prospectus is amended if (i) subsequent to the effective date of this registration statement, our net asset value declines more than ten percent from our net asset value as of the effective date of this registration statement, or (ii) our net asset value increases to an amount greater than our net proceeds as stated in the prospectus |

| 2. | Not Applicable. |

| 3. | The Registrant undertakes: |

(a) to file, during any period in which offers or sales are being made, a post-effective amendment to the registration statement:

(1) To include any prospectus required by Section 10(a)(3) of the 1933 Act.

(2) To reflect in the prospectus any facts or events after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement.

(3) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

(b) That, for the purpose of determining any liability under the 1933 Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of those securities at that time shall be deemed to be the initial bona fide offering thereof; and

(c) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(d) that, for the purpose of determining liability under the Securities Act to any purchaser:

(1) If the Registrant is relying on Rule 430B [17 CFR 230.430B]: (A) Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and (B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (x), or (xi) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or

(2) if the Registrant is subject to Rule 430C [17 CFR 230.430C]: each prospectus filed pursuant to Rule 424(b) under the Securities Act as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

(e) That for the purpose of determining liability of the Registrant under the 1933 Act to any purchaser in the initial distribution of securities:

The undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to the purchaser:

(1) any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424 under the 1933 Act;

(2) free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrants;

(3) the portion of any other free writing prospectus or advertisement pursuant to Rule 482 under the 1933 Act relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(4) any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

| | | | | | | | | | | | | | |

4. The Registrant undertakes that: |

| (a) | for the purpose of determining any liability under the 1933 Act, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the Registrant under Rule 424(b)(1) under the 1933 Act shall be deemed to be part of this registration statement as of the time it was declared effective; and |

| (b) | for the purpose of determining any liability under the 1933 Act, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of the securities at that time shall be deemed to be the initial bona fide offering thereof. |

| | | | | | | | | | | | | | |

| 5. | Not Applicable. |

| 6. | Insofar as indemnification for liabilities arising under the 1933 Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue. |

| 7. | The Registrant undertakes to send by first class mail or other means designed to ensure equally prompt delivery, within two business days of receipt of a written or oral request, any prospectus or statement of additional information. |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933 and the Investment Company Act of 1940, as amended, the Registrant has duly caused this Registration Statement on Form N-2 to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New York, State of New York, on October 2, 2023.

| | | | | | | | | | | | | | |

| | | Priority Income Fund, Inc. |

| | | |

| | | |

| | | By | /s/ M. GRIER ELIASEK |

| | | | Name: | M. Grier Eliasek |

| | | | Title: | Chief Executive Officer and President |

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement on Form N-2 has been signed below by the following persons in the capacities and on the dates indicated:

| | | | | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | | | | |

| /s/ M. GRIER ELIASEK | | Chairman of the Board of Directors, Chief Executive Officer and President (Principal Executive Officer) | | October 2, 2023 |

| M. Grier Eliasek | | | |

| | | | | |

| | | | | |

| /s/ KRISTIN VAN DASK | | Chief Financial Officer, Chief Compliance Officer, Treasurer and Secretary (Principal Financial Officer and Principal Accounting Officer) | | October 2, 2023 |

| Kristin Van Dask | | | |

| | | | |

| | | | | |

| /s/ ANDREW C. COOPER* | | Director | | October 2, 2023 |

| Andrew C. Cooper | | | | |

| | | | | |

| | | | | |

| /s/ WILLIAM J. GREMP* | | Director | | October 2, 2023 |

| William J. Gremp | | | | |

| | | | | |

| | | | | |

| /s/ EUGENE S. STARK* | | Director | | October 2, 2023 |

| Eugene S. Stark | | | | |

| | | | | |

| | | | | |

| *By: | /s/ M. GRIER ELIASEK | | | | |

| | as Attorney-in-Fact | | | | |

INDEX TO EXHIBITS

AMENDED AND RESTATED

DISTRIBUTION REINVESTMENT PLAN

OF

PRIORITY INCOME FUND, INC.

Effective as of November 3, 2023 (the “Effective Date”)

Priority Income Fund, Inc., a Maryland corporation (the “Company”), hereby adopts the following amended and restated plan (the “Plan”) with respect to distributions declared by its board of directors (the “Board of Directors”) on its shares of common stock, par value $0.01 per share (the “Shares”):

1. Unless a stockholder specifically elects to receive cash pursuant to paragraph 2 below, all distributions hereafter declared by the Company’s Board of Directors shall be reinvested by the Company in the Shares on behalf of each stockholder, and no action shall be required on such stockholder’s part to receive such Shares.

2. A stockholder may elect to receive its distributions in cash. To exercise this option, such stockholder shall notify DST Systems, Inc., the Plan administrator and the Company’s transfer agent and registrar (collectively the “Plan Administrator”), in writing so that such notice is received by the Plan Administrator no later than the record date fixed by the Board of Directors for the first distribution such stockholder wishes to receive in cash. Such election shall remain in effect until the stockholder shall notify the Plan Administrator in writing of such stockholder’s desire to change its election, which notice shall be delivered to the Plan Administrator prior to the record date fixed by the Board of Directors for the first distribution for which such stockholder wishes its new election to take effect. Each stockholder of the Company prior to the Effective Date will maintain their status regarding participation in the Plan as was in place prior to the Effective Date until the time as such stockholder changes their election (i) pursuant to the process set forth above or (ii) through the completion of a Subscription Agreement for new Shares.

3. The Company shall use newly-issued Shares to implement the Plan. There will be no selling commissions, dealer manager fees or other sales charges on Shares issued to a stockholder.

a) To the extent the Shares are not listed on a national stock exchange or quoted on an over-the-counter market or a national market system (collectively, an “Exchange”):

i. during any period when the Company is making a “best-efforts” public offering of Shares, the number of Shares to be issued to a stockholder shall be determined by dividing the total dollar amount of the distribution payable to such stockholder by a price equal to 95% of the price that Class I Shares are sold in the offering at the closing immediately following the distribution payment date (provided that, during any period in which the Company does not have weekly closings, in order to better align the offering price with the issuance price, the offering price used for this clause (3)(a)(i) should be interpreted as the offering price for Class I that is based on the net asset value most recently available at the time the distribution is payable); and

ii. during any period when the Company is not making a “best-efforts” offering of Shares, the number of Shares to be issued to a stockholder shall be determined by dividing the total dollar amount of the distribution payable to such stockholder by a price equal to the net asset value as determined by the Company’s board of directors;

b) To the extent the Shares are listed on an Exchange, the number of shares to be issued to a stockholder shall be determined by dividing the total dollar amount of the distribution payable to such stockholder by the market price per share of the Shares at the close of regular trading on such Exchange on the valuation date fixed by the Board of Directors for such distribution.

4. The Plan Administrator will set up an account for Shares acquired pursuant to the Plan for each stockholder enrolled in the Plan (each a “Participant”). The Plan Administrator may hold each Participant’s Shares, together with the Shares of other Participants, in non-certificated form in the Plan Administrator’s name or that of its nominee. If a Participant’s Shares are held by a broker or other financial intermediary, the Participant may “opt out” of the Plan by notifying its broker or other financial intermediary of its election.

5. The Plan Administrator will confirm to each Participant each acquisition made pursuant to the Plan as soon as practicable but not later than 10 business days after the date thereof. Distributions on fractional shares will be credited to each Participant’s account. In the event of termination of a Participant’s account under the Plan, the Plan Administrator will adjust for any such undivided fractional interest in cash at the current offering price of the Company’s Shares in effect at the time of termination.

6. Shares issued pursuant to the Plan will have the same voting rights as the Shares issued pursuant to the Company’s public offering. The Plan Administrator will forward to each Participant any Company-related proxy solicitation materials and each Company report or other communication to stockholders, and will vote any Shares held by it under the Plan in accordance with the instructions set forth on proxies returned by Participants to the Company.

7. In the event that the Company makes available to its stockholders rights to purchase additional Shares or other securities, the Shares held by the Plan Administrator for each Participant under the Plan will be used in calculating the number of rights to be issued to the Participant.

8. The Plan Administrator’s service fee, if any, and expenses for administering the Plan will be paid for by the Company.

9. Each Participant may terminate his, her or its account under the Plan by filling out the transaction request form located at the bottom of the Participant’s Plan statement and sending it to the Plan Administrator at Priority Senior Secured Income Fund, Inc., P.O. Box 219768, Kansas City, Missouri 64121-9768. Such termination will be effective immediately if the Participant’s notice is received by the Plan Administrator at least 2 days prior to any distribution record date; otherwise, such termination will be effective only with respect to any subsequent distribution. The Plan may be terminated by the Company upon notice in writing mailed to each Participant at least 30 days prior to any record date for the payment of any distribution by the Company. Upon any termination, the Plan Administrator will credit the Participant’s account for the full Shares held for the Participant under the Plan and a cash adjustment for any fractional share to be delivered to the Participant without charge to the Participant. If a Participant elects by his, her or its written notice to the Plan Administrator in advance of termination to have the Plan Administrator sell part or all of his, her or its Shares and remit the proceeds to the Participant, the Plan Administrator is authorized to deduct a $15 transaction fee plus a $0.10 per share brokerage commission from the proceeds.

10. These terms and conditions may be amended or supplemented by the Company at any time but, except when necessary or appropriate to comply with applicable law or the rules or policies of the Securities and Exchange Commission or any other regulatory authority, only by mailing to each Participant appropriate written notice at least 30 days prior to the effective date thereof. The amendment or supplement shall be deemed to be accepted by each Participant unless, prior to the effective date thereof, the Plan Administrator receives written notice of the termination of such Participant’s account under the Plan. Any such amendment may include an appointment by the Plan Administrator in its place and stead of a successor agent under these terms and conditions, with full power and authority to perform all or any of the acts to be performed by the Plan Administrator under these terms and conditions. Upon any such appointment of any agent for the purpose of receiving dividends and distributions, the Company will be authorized to pay to such successor agent, for each Participant’s account, all dividends and distributions payable on Shares of the Company held in the Participant’s name or under the Plan for retention or application by such successor agent as provided in these terms and conditions.

11. The Plan Administrator will at all times act in good faith and use its best efforts within reasonable limits to ensure its full and timely performance of all services to be performed by it under the Plan and to comply with applicable law, but assumes no responsibility and shall not be liable for loss or damage due to errors, unless such error is caused by the Plan Administrator’s negligence, bad faith, or willful misconduct or that of its employees or agents.

12. These terms and conditions shall be governed by the laws of the State of New York.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 462

-Subsection d

| Name: |

dei_ExhibitsOnly462d |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 462

-Subsection c

| Name: |

dei_NoSubstantiveChanges462c |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

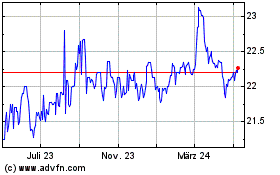

Priority Income (NYSE:PRIF-J)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

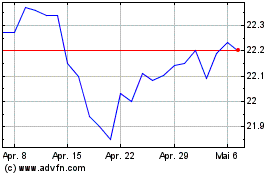

Priority Income (NYSE:PRIF-J)

Historical Stock Chart

Von Jul 2023 bis Jul 2024