PRIORITY INCOME FUND, INC.

10 East 40th Street, 42nd Floor

New York, New York 10016

August 17, 2023

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

RE: Priority Income Fund, Inc. Fidelity Bond

Ladies and Gentlemen:

Enclosed for filing, on behalf of Priority Income Fund, Inc. (the “Company”) and pursuant to Rule 17g-1 of the Investment Company Act of 1940 (the “1940 Act’), are the following documents:

•A copy of the 2023-24 Joint Fidelity Bond of the Company, Prospect Capital Corporation, Prospect Capital Funding, LLC, and ProspectProspect Floating Rate and Alternative Income Fund, Inc.;

•A copy of the resolutions of the Board of Directors (the “Board”) of the Company approving the Joint Fidelity Bond, adopted by a majority of the members of the Board who are not “interested persons” as defined by section 2(a)(19) of the 1940 Act, effective July 30, 2023;

•A copy of the Agreement Regarding the Allocation of Fidelity Bond Recoveries, effective as of July 30, 2023, by and among the Company, Prospect Capital Corporation, Prospect Capital Funding, LLC, and Prospect Floating Rate and Alternative Income Fund, Inc., meeting the requirements of Rule 17g-1(f); and

•A statement showing the amount of the single insured bond which each insured party would have provided and maintained had it not been named as an insured under the Joint Fidelity Bond.

The period for which premiums have been paid on behalf of the Company is July 30, 2023 to July 30, 2024.

Very truly yours,

PRIORITY INCOME FUND, INC.

/s/ Kristin Van Dask

Kristin Van Dask

Chief Financial Officer

Resolutions of the Board of Directors of Priority Income Fund, Inc.

July 30, 2023

THE UNDERSIGNED, being all of the members of the Board of Directors (the “Board of Directors”) of Priority Income Fund, Inc., a Maryland corporation (the “Corporation”), do hereby adopt the following resolutions pursuant to Section 2-408(c) of the Corporations and Associations Articles of the Annotated Code of Maryland and Section 10 of the Corporation’s bylaws by written consent without a meeting, with the same force and effect as a vote of the Board of Directors taken at a meeting duly called and constituted:

WHEREAS, Section 17(g) of the Investment Company Act of 1940, as amended (the “1940 Act”), and Rule 17g-1(a) thereunder (“Rule 17g-1”), require that every registered investment company, and business development company through Section 59 of the 1940 Act, shall provide and maintain a bond which shall be issued by a reputable fidelity insurance company, authorized to do business in the place where the bond is issued, to protect the company against larceny and embezzlement, covering each officer and employee of the company who may singly, or jointly with others, have access to the securities or funds of the company, either directly or through authority to draw upon such funds of, or to direct generally, the disposition of such securities, unless the officer or employee has such access solely through his position as an officer or employee of a bank (each, a “covered person”);

WHEREAS, Rule 17g-1 specifies that the bond may be in the form of (i) an individual bond for each covered person, or a schedule or blanket bond covering such persons,

(ii) a blanket bond which names the Corporation, as the only insured (a “single insured bond”), or (iii) a bond which names the Corporation and one or more other parties as insureds (a “joint insured bond”), as permitted by Rule 17g-1;

WHEREAS, Rule 17g-1 requires that a majority of directors who are not “interested persons” of the Corporation, as such term is defined under the 1940 Act (the “Disinterested Directors”) approve periodically (but not less than once every 12 months) the reasonableness of the form and amount of the bond, with due consideration to the value of the aggregate assets of the Corporation to which any covered person may have access, the type and terms of the arrangements made for the custody and safekeeping of such assets, and the nature of securities and other investments to be held by the Corporation, and pursuant to factors contained in Rule 17g-1;

WHEREAS, under Rule 17g-1, the Corporation is required to make certain filings with the U.S. Securities and Exchange Commission and give certain notices to each member of the

Board of Directors in connection with the bond, and designate an officer who shall make such filings and give such notices; and

WHEREAS, the Board of Directors, including all of the Disinterested Directors, have considered the expected aggregate value of the securities and funds of the Corporation to which the Corporation’s officers and employees may have access (either directly or through authority to draw upon such funds or to direct generally the disposition of such securities), the type and terms of the arrangements made for the custody of such securities and funds, the nature of securities and other investments to be held by the Corporation, the accounting procedures and controls of the Corporation, the nature and method of conducting the operations of the Corporation, the requirements of Section 17(g) of the 1940 Act and Rule 17g-1 thereunder, and all other factors deemed relevant by the Board of Directors, including the Disinterested Directors.

NOW THEREFORE BE IT RESOLVED, that having considered the expected aggregate value of the securities and funds of the Corporation to which the Corporation’s officers and employees may have access (either directly or through authority to draw upon such funds or to direct generally the disposition of such securities), the type and terms of the arrangements made for the custody of such securities and funds, the nature of securities and other investments to be held by the Corporation, the accounting procedures and controls of the Corporation, the nature and method of conducting the operations of the Corporation, the requirements of Section 17(g) of the 1940 Act and Rule 17g-1 thereunder, and all other factors deemed relevant by the Board of Directors, including such Disinterested Directors, the Board of Directors, including all of the Disinterested Directors, determine that the amount of coverage, type, form, and premium, covering the officers and employees of the Corporation and insuring the Corporation against loss from fraudulent or dishonest acts, including larceny and embezzlement, issued by AIG Specialty Insurance Company in the amount of $1,000,000.00 (the “Joint Fidelity Bond”) be, and hereby are approved effective July 30, 2023; and it is

FURTHER RESOLVED, by the Board of Directors, including all of the Disinterested Directors, that $1,093.77 as the portion of the premium to be paid by the Corporation be, and it hereby is, approved effective July 30, 2023, taking all relevant factors into consideration including, but not limited to, the number of the other insured parties named as insureds, the nature of business activities of the other insured parties, the amount of the Joint Fidelity Bond and the amount of the premium for such Joint Fidelity Bond, the ratable allocation of the premium among the insureds, and the extent to which the share of the premium allocated to the Corporation is less than the premium the Corporation would have had to pay had such Joint Insured Bond not been obtained; and it is

FURTHER RESOLVED, that the appropriate officers be, and each of them hereby is, authorized and directed to cause the Corporation to pay its ratable allocation of the annual premium payable with respect to the Joint Fidelity Bond and to enter into and execute, on behalf of the Corporation, an agreement reflecting the provisions of the Joint Fidelity Bond and relating to the division of proceeds in the event of a joint fidelity loss, as required by Rule 17g-1

(f) (the “Joint Insured Bond Allocation Agreement”); and it is

FURTHER RESOLVED, that the terms and conditions of the Joint Insured Bond Allocation Agreement, in substantially the form presented attached hereto as Exhibit A, be, and hereby are, approved and adopted in all respects effective July 30, 2023, with such amendments thereto as an appropriate officer may approve, and with approval of such further amendments evidenced by their inclusion in the Joint Insured Bond Allocation Agreement; and it is

FURTHER RESOLVED, that the appropriate officers be, and hereby are, authorized to make filings with the U.S. Securities and Exchange Commission, in consultation with counsel to the Corporation, and to give notices as may be required, from time to time, pursuant to Rule 17g-1(g) and Rule 17g-1(h) under the 1940 Act; and it is

FURTHER RESOLVED, that the appropriate officers be, and each of them hereby is, authorized and directed to amend the Joint Fidelity Bond, in consultation with counsel to the Corporation, and to execute such other documents as he or she may deem necessary or appropriate to effect the intent of this resolution; and it is

FURTHER RESOLVED, that each of the appropriate officers is hereby authorized in the name and on behalf of the Corporation, to make or cause to be made, and to execute and deliver, all such additional agreements, documents, instruments and certifications and to take all such steps, and to make all such payments, fees and remittances, as any one or more of such officers may at any time or times deem necessary or desirable in order to effectuate the purpose and intent of the foregoing resolutions; and it is

FURTHER RESOLVED, that any and all actions previously taken by the Corporation or any of its directors, officers or other employees in connection with the documents, and actions contemplated by the foregoing resolutions be, and they hereby are, ratified, confirmed, approved and adopted in all respects as and for the acts and deeds of the Corporation.

AGREEMENT REGARDING THE ALLOCATION OF FIDELITY BOND RECOVERIES

THIS AGREEMENT is effective as of July 30, 2023, by and among Prospect Capital Corporation, Prospect Capital Funding LLC, Priority Income Fund, Inc. and Prospect Floating Rate and Alternative Income Fund, Inc. (each, an “Insured,” and, together, the “Insureds”), each acting on behalf of itself.

WHEREAS, the Insureds have initiated joint coverage under an investment company fidelity bond issued by AIG Specialty Insurance Company (as the same may be amended, supplemented, extended or renewed from time to time, the “Bond”); and

WHEREAS, the Insureds desire to confirm the criteria by which recoveries under the Bond shall be allocated between the Insureds.

NOW, THEREFORE, it is agreed as follows:

1.In the event that recovery is received under the Bond as a result of a loss sustained by more than one Insured, each Insured shall receive an equitable and proportionate share of the recovery, but at least equal to the amount it would have received had it provided and maintained a single insured bond with the minimum coverage required by paragraph (d)(1) of Rule 17g-1 under the Investment Company Act of 1940.

2.The obligations of an Insured under this Agreement are not binding upon any of the board members or officers of an Insured or Insured shareholders individually, but are binding only with respect to the assets of that Insured.

[The remainder of this page has been left blank]

IN WITNESS WHEREOF, the insured parties have caused this Agreement to be executed by their officers thereunto duly authorized.

PROSPECT CAPITAL CORPORATION

By: /s/ John Francis Barry III

Name: John Francis Barry III

Title: Chief Executive Officer

PROSPECT CAPITAL FUNDING LLC

By: /s/ John Francis Barry III

Name: John Francis Barry III

Title: Authorized Signatory

PRIORITY INCOME FUND, INC.

By: /s/ M. Grier Eliasek

Name: M. Grier Eliasek

Title: President and Chief Operating Officer

PROSPECT FLOATING RATE AND ALTERNATIVE INCOME FUND, INC.

By: /s/ M. Grier Eliasek

Name: M. Grier Eliasek

Title: Chief Executive Officer

Single Insured Bond Statement

| | | | | | | | |

| Co-Insured Entities | Gross Assets

as of March 31, 2023 | Minimum Bond Limit

Under Rule 17g-1 |

| Prospect Capital Corporation | $7,700,000,000 | | $2,500,000 | |

| Prospect Capital Funding LLC | 0* | 0 | |

| Priority Income Fund, Inc. | 961,400,000 | | 1,000,000 | |

| Prospect Floating Rate and Alternative Income Fund, Inc. | 36,300,000 | | 350,000 | |

| | |

| Total: | $8,697,700,000 | | $3,850,000 | |

__________________________________

* Prospect Capital Funding LLC’s assets are consolidated with Prospect Capital Corporation because Prospect Capital Funding LLC is a wholly-owned subsidiary of Prospect Capital Corporation serving as a bankruptcy remote special purpose vehicle which holds certain of Prospect Capital Corporation’s portfolio loan investments used as collateral for a credit facility.

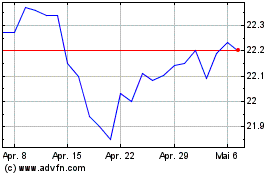

Priority Income (NYSE:PRIF-J)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

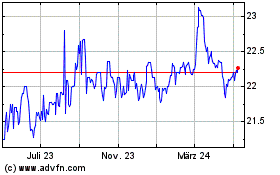

Priority Income (NYSE:PRIF-J)

Historical Stock Chart

Von Jul 2023 bis Jul 2024