Putnam Announces Distribution Rates for Closed-End Funds

09 August 2013 - 9:07PM

Marketwired

The Trustees of The Putnam Funds have declared the following fund

distributions.

EX RECORD PAYMENT

FUND NAME AND DISTRIBUTIONS DATE DATE DATE

---------------------------------------------- -------- -------- --------

Putnam High Income Securities Fund (NYSE: PCF)

(CUSIP: 746779-10-7)

$0.0390 per share investment income 8/21/13 8/23/13 9/03/13

9/20/13 9/24/13 10/01/13

Putnam Master Intermediate Income Trust

(NYSE: PIM) (CUSIP: 746909-10-0)

$0.0260 per share investment income 8/21/13 8/23/13 9/03/13

9/20/13 9/24/13 10/01/13

Putnam Managed Municipal Income Trust

(NYSE: PMM) (CUSIP: 746823-10-3)

$0.0389 per share investment income 8/21/13 8/23/13 9/03/13

9/20/13 9/24/13 10/01/13

Putnam Municipal Opportunities Trust

(NYSE: PMO) (CUSIP: 746922-10-3)

$0.0559 per share investment income 8/21/13 8/23/13 9/03/13

9/20/13 9/24/13 10/01/13

Putnam Premier Income Trust (NYSE: PPT)

(CUSIP: 746853-10-0)

$0.0260 per share investment income 8/21/13 8/23/13 9/03/13

9/20/13 9/24/13 10/01/13

SECTION 19 DISCLOSURE

High Income Securities Fund Putnam

estimates that $0.0371 per share of High Income Securities Fund's

dividend is paid from accumulated net investment income, and

$0.0019 per share represents a return of capital. These estimates

and the sources of the fund's dividends and distributions are

determined in accordance with accounting principles applicable to

the fund. These principles may vary from those applicable to the

characterization of distributions under federal tax law and,

accordingly, federal tax law treatment will likely vary from the

estimated characterization above. In addition, the sources of

dividends are estimated at the time of declaration. Actual results

will vary from these estimates. A non-taxable return of capital, if

any, cannot be determined until after the end of the fund's fiscal

year. In January 2014, you will receive final information as to the

federal tax status of this and other distributions from the fund in

the preceding calendar year.

Managed Municipal Income Trust Putnam

estimates that $0.0386 per share of Managed Municipal Income

Trust's dividend is paid from accumulated net investment income,

and $0.0003 per share represents a non-taxable return of capital.

These estimates and the sources of the fund's dividends and

distributions are determined in accordance with accounting

principles applicable to the fund. These principles may vary from

those applicable to the characterization of distributions under

federal tax law and, accordingly, federal tax law treatment will

likely vary from the estimated characterization above. In addition,

the sources of dividends are estimated at the time of declaration.

Actual results will vary from these estimates. A non-taxable return

of capital, if any, cannot be determined until after the end of the

fund's fiscal year. In January 2014, you will receive final

information as to the federal tax status of this and other

distributions from the fund in the preceding calendar year.

Master Intermediate Income Trust Putnam

estimates that $0.0238 per share of Master Intermediate Income

Trust's dividend is paid from accumulated net investment income,

and $0.0022 per share represents a return of capital. These

estimates and the sources of the fund's dividends and distributions

are determined in accordance with accounting principles applicable

to the fund. These principles may vary from those applicable to the

characterization of distributions under federal tax law and,

accordingly, federal tax law treatment will likely vary from the

estimated characterization above. In addition, the sources of

dividends are estimated at the time of declaration. Actual results

will vary from these estimates. A non-taxable return of capital, if

any, cannot be determined until after the end of the fund's fiscal

year. In January 2014, you will receive final information as to the

federal tax status of this and other distributions from the fund in

the preceding calendar year.

Putnam Shareholders Contact: 1-800-225-1581

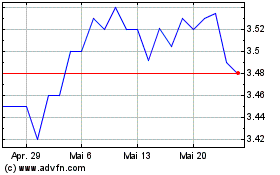

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024