Putnam Announces Distribution Rates for Closed-End Funds

11 Mai 2012 - 2:30PM

Marketwired

The Trustees of The Putnam Funds have declared the following

distributions.

EX RECORD PAYMENT

FUND NAME AND DISTRIBUTIONS DATE DATE DATE

------------------------------------------------- -------- -------- --------

Putnam High Income Securities Fund (NYSE: PCF)

(CUSIP: 746779-10-7)

$0.0439 per share investment income 05/22/12 5/24/12 6/1/12

06/20/12 6/22/12 7/2/12

Putnam Master Intermediate Income Trust

(NYSE: PIM) (CUSIP: 746909-10-0)

$0.0290 per share investment income 05/22/12 5/24/12 6/1/12

06/20/12 6/22/12 7/2/12

Putnam Premier Income Trust (NYSE: PPT) (CUSIP:

746853-10-0)

$0.0300 per share investment income 05/22/12 5/24/12 6/1/12

06/20/12 6/22/12 7/2/12

Putnam Managed Municipal Income Trust (NYSE: PMM)

(CUSIP: 746-823-10-3)

$0.0389 per share investment income 05/22/12 5/24/12 6/1/12

06/20/12 6/22/12 7/2/12

Putnam Municipal Opportunities Trust (NYSE: PMO)

(CUSIP: 746922-10-3)

$0.0663 per share investment income 05/22/12 5/24/12 6/1/12

06/20/12 6/22/12 7/2/12

Section 19 Disclosure

Master Intermediate Income Trust Putnam

estimates that $0.0189 per share of Master Intermediate Income

Trust's dividend is paid from accumulated net investment income and

$0.0101 per share represents a return of capital. These estimates

and the sources of the fund's dividends and distributions are

determined in accordance with accounting principles applicable to

the fund. These principles may vary from those applicable to the

characterization of distributions under federal tax law and,

accordingly, federal tax law treatment will likely vary from the

estimated characterization above. In addition, the sources of

dividends are estimated at the time of declaration. Actual results

will vary from these estimates. A non-taxable return of capital, if

any, cannot be determined until after the end of the fund fiscal

year. In January 2013, you will receive final information as to the

federal tax status of this and other distributions from the fund in

the preceding calendar year.

Municipal Opportunities Trust Putnam

estimates that $0.0661 per share of Municipal Opportunities Trust

dividend is paid from accumulated net investment income and $0.0002

per share represents a taxable distribution in excess of

accumulated net investment income. These estimates and the sources

of the fund's dividends and distributions are determined in

accordance with accounting principles applicable to the fund. These

principles may vary from those applicable to the characterization

of distributions under federal tax law and, accordingly, federal

tax law treatment will likely vary from the estimated

characterization above. In addition, the sources of dividends are

estimated at the time of declaration. Actual results will vary from

these estimates. A non-taxable return of capital, if any, cannot be

determined until after the end of the fund fiscal year. In January

2013, you will receive final information as to the federal tax

status of this and other distributions from the fund in the

preceding calendar year.

Putnam Shareholders Contact: 1-800-225-1581

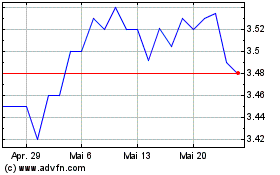

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024