Putnam Investments Hires Dr. Van Harlow to Spearhead Development of Innovative Investment Solutions

28 Juli 2010 - 7:05PM

Business Wire

Putnam Investments today announced that Dr. W. Van Harlow has

been named Director, Investment Retirement Solutions, responsible

for creating a new generation of products and services that seek to

address key investment goals while simultaneously reducing the

impact of cost and risk — such as volatility, inflation and

longevity — on eventual outcomes. Harlow, who has been serving in a

consulting role with Putnam, will report directly to Jeffrey L.

Knight, Head of Global Asset Allocation, and also work closely with

the firm’s Head of Marketing, Products and Retirement, Jeffrey R.

Carney.

In his new position, Dr. Harlow, 54, will also be focused on the

development of asset allocation tools and planning methodologies

used by financial advisors, consultants and plan sponsors in the

retirement and institutional markets. Harlow, who holds an MBA, a

Ph.D. in financial economics and a Chartered Financial Analyst

(CFA) designation, has been a thought leader in the asset

management industry for over two decades.

His statistical analysis and research played a key role in the

firm’s creation of its ground-breaking Lifetime IncomeSM Analysis

Tool and in the methodology that led to the incorporation of

absolute return investment strategies into the company’s

RetirementReady® lifecycle funds.

“Dr. Harlow has already made substantial contributions as we

have introduced innovative thinking and product solutions for the

retirement market,” said Knight. “His uniquely insightful, yet

practical analysis and application of quantitative analysis to

create understandable, user-friendly products and tools will be

enormously valuable to Putnam clients and investors.”

In discussing the need for a new generation of more risk-aware

solutions designed for an era of greater market uncertainty, Carney

noted, “Investors need help in meeting the market challenges that

have changed significantly over the past generation. They won’t

succeed in meeting their objectives by relying on outdated

strategies and ways of thinking.

“The hiring of Dr. Harlow builds upon the intellectual firepower

and thought leadership that has driven innovation at Putnam over

the past two years, and brought new product offerings, services and

strategies to better serve our clients,” Carney continued.

Harlow received a B.A. degree in physics and mathematical

science from Rice University and an MBA and a Ph.D. in financial

economics from the University of Texas (Austin). He has received

such prestigious honors as the Financial Analysts Federation’s

Graham and Dodd Award and the Journal of Finance’s Smith Breeden

Distinguished Paper Award.

Harlow has long been active in professional circles, serving as

Editor-in-Chief of the Financial Analysts Journal from 1993 to

1998, and also on the Council on Education and Research and the

Research Foundation for the CFA Institute. His research

publications have appeared in numerous academic and practitioner

journals.

Prior to serving as a financial consultant, Harlow held a number

of senior positions with Fidelity Investments from 1991 to 2008,

including serving as Managing Director of the Fidelity Research

Institute, Managing Director of Strategic New Business Development

and President and Chief Investment Officer of Fidelity Asset

Management Services. Before joining Fidelity, Harlow was a vice

president at Salomon Brothers Inc., where he was responsible for

quantitative investment and trading strategies. Previously, he

taught at the University of Texas and the University of Arizona

from 1984 to 1989.

Putnam’s Commitment to Financial Innovation

Since Putnam President and Chief Executive Officer Robert L.

Reynolds took the helm in July 2008, the 70-year-old Boston-based

company has undergone a dramatic turnaround. The company’s revival

has been driven by innovative new products and platforms, improved

performance and a renewed focus on the retirement

market. Among the steps that have been taken are:

- Launching a suite of three U.S.

multi-cap equity funds, available in its entirety by late September

2010, to provide investors and their advisors with an approach to

investing by style — value, core/blend, growth — regardless of the

market capitalization of the underlying securities;

- Developing Putnam Absolute

Return Funds*, the mutual fund industry’s first suite of absolute

return mutual funds, designed to provide positive returns over

time, with less volatility than more traditional mutual funds,

whether markets are rising or falling;

- Introducing Putnam Spectrum

Funds, which invest in the securities of leveraged companies while

looking to generate returns through investments;

- Expanding the scope of the

actively managed Putnam Global Sector Funds to target stocks in

dynamic sectors across global markets, covering nine sectors across

the entire MSCI World Index, and which can be combined to create a

highly customized portfolio. In addition, Putnam recently launched

the first fund-of-sector-funds in the global equity space,

providing exposure to all sectors contained in the MSCI World Index

— in weighted proportions — by investing in eight Putnam global

sector funds;

- Becoming the first investment

manager to add target absolute return strategies to the mix of

underlying investments in target-date/lifecycle funds via Putnam

RetirementReady® Funds, the firm’s suite of retirement funds.

Employed in retirement portfolios, absolute return strategies are

intended to pursue positive returns in up and down markets, to

protect against the harmful effects of adverse investment returns

and to reduce volatility, particularly for investors in or near

retirement.

About Putnam Investments

Founded in 1937, Putnam Investments is a leading global money

management firm with over 70 years of investment experience. The

firm was recently ranked #1 out of 61 fund families based on its

funds’ performance during 2009 in a Lipper/Barron’s Fund Families

Survey and named “Mutual Fund Manager of the Year” by Institutional

Investor. At the end of May 2010, Putnam had $112 billion in assets

under management. Putnam has offices in Boston, London, Frankfurt,

Amsterdam, Tokyo, Singapore, and Sydney. For more information,

visit putnam.com.

Putnam mutual funds are distributed by Putnam Retail

Management.

* Putnam’s target Absolute Return Funds are not intended to

outperform stocks and bonds during strong market rallies.

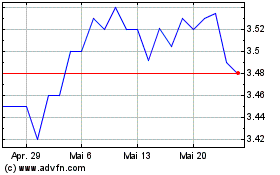

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024