Putnam Investments Empowers 401(k) Participants to Further Drive Lifetime Income Through Asset Allocation Actions

08 Juni 2010 - 9:35PM

Business Wire

Putnam Investments today announced it has significantly enhanced

the Putnam Lifetime IncomeSM Analysis Tool, its innovative

retirement planning platform, with the addition of a robust new

asset allocation application, which enables 401(k) plan

participants to model changes to the mix of assets in their

retirement savings account and implement the changes in

real-time.

Launched in January, the Lifetime Income Analysis Tool redefines

the way investors view their current retirement savings activities,

by placing greater focus on helping 401(k) plan participants

project how much income their current retirement savings may

generate in retirement to determine if they are on track to achieve

their desired lifestyle. The new asset allocation function takes

participants a step further by providing them with an analysis of

likely investment outcomes for their account based on their asset

class mix, and gives them the ability to instantly reallocate their

portfolio to better align with their retirement income goals.

“The financial crisis made it painfully clear that investors

need to change the way they view the retirement savings process by

shifting their focus away from simply amassing assets to

specifically planning how much actual income will be needed – and

can be expected – in retirement,” said Jeffrey R. Carney, Putnam

Investments Head of Global Products and Retirement. “The most

critical factors in determining a successful retirement outcome are

an individual’s level of savings and striking an appropriate asset

allocation. Putnam’s enhancement to its Lifetime Income Analysis

Tool directly addresses the crucial asset allocation element.”

The new asset allocation function of the Lifetime Income

Analysis Tool provides plan participants with the option of

building their own portfolio to achieve their target asset

allocation using the existing funds in their plan. In some cases,

participants may have the option to choose from a variety of

professionally managed, pre-diversified solutions is they are part

of the plan option. No matter what asset allocation method a

participant chooses, the reallocation of their portfolio can be

made directly from the tool in real-time.

“While asset allocation is one of the most important decisions

that plan participants make when it comes to determining whether

their retirement savings plan will meet their income needs in

retirement, it is often woefully overlooked due to its perceived

complexities,” said Edmund F. Murphy, III, Managing Director, Head

of Defined Contribution, Putnam Investments. “By providing

investors with an intuitive, simplified and easy-to-use approach to

assessing and impacting their retirement readiness, we believe they

will employ greater consideration to the driving factors behind

securing a dignified retirement.”

Commitment to the Retirement Market

The Lifetime Income Analysis Tool is part of a deepened

commitment by Putnam Investments to the retirement market. This

year, Putnam has launched a series of retirement initiatives,

including groundbreaking fee transparency disclosures in its effort

to provide the clearest, most complete overview of fees and

expenses in the workplace savings industry. (For more details on

Putnam’s approach to transparency, please visit

www.theretirementsavingschallenge.com.)

Putnam also has expanded the services it offers to 401(k)

retirement plans and developed products to meet the needs of those

planning for or already in retirement. The firm has created a

platform that provides flexible and scalable services and solutions

for advisors, consultants, and their plan sponsor clients in every

segment of the retirement market.

Putnam RetirementReady® Funds, the firm's suite of 10

target-date/lifecycle retirement funds, added target Absolute

Return Funds* to its mix of underlying investments. RetirementReady

Funds became the only suite of lifecycle funds to integrate

absolute return strategies, which seek positive returns over a

period of three years with less volatility than more traditional

mutual funds. Employed in retirement portfolios, Putnam Absolute

Return Funds are intended to pursue positive returns in up and down

markets, to protect against the harmful effects of adverse

investment returns and to reduce volatility, particularly for

investors in or near retirement.

About Putnam Investments

Founded in 1937, Putnam Investments is a leading global money

management firm with over 70 years of investment experience. The

firm was recently ranked #1 out of 61 fund families, based on its

funds’ performance during 2009, in a Lipper/Barron’s Fund Families

Survey. Putnam is a leader in product innovation, and is the first

mutual fund family to offer a full suite of Target Absolute Return

Funds and a complete suite of Global Sector Funds. At the end of

May 2010, Putnam had $112 billion in assets under management,

including mutual fund assets of $62 billion and institutional

assets of $50 billion. Putnam has offices in Boston, London,

Frankfurt, Amsterdam, Tokyo, Singapore, and Sydney. For more

information, visit putnam.com.

Putnam mutual funds are distributed by Putnam Retail

Management.

* Putnam's target Absolute Return Funds are not intended to

outperform stocks and bonds during strong market rallies.

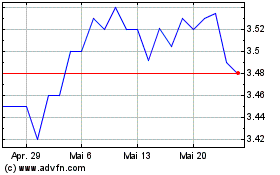

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024