Putnam Investments to Seek Expanded Opportunities to Serve College Savings Market

13 Mai 2010 - 11:45PM

Business Wire

Putnam Investments today announced that it will begin to

actively seek opportunities to serve the broader college savings

market nationwide through offering its advisor-sold investment

product lineup, program administration experience, sales

infrastructure and industry-recognized customer service standards.

Previously Putnam had addressed the 529 college savings needs

through financial advisors in an exclusive relationship with the

state of Ohio since 2000.

Putnam will be transitioning away from its exclusive work in 529

college savings for the Ohio Tuition Trust Authority (Tuition

Trust), managing the Putnam CollegeAdvantage Plan, based on Tuition

Trust’s intention to narrow the number of advisor-sold 529 plan

options offered. Beginning in October, Putnam will make its

bolstered investment organization and 529 experience set available

for a host of potential marketplace assignments in the future.

“We appreciate the experience of working in partnership with the

Ohio Tuition Trust Authority and financial advisors to help

families save for higher education over the last decade, but we see

enormous opportunity to bring the full weight and breadth of

Putnam’s strengthened investment capabilities, innovative product

solutions, and heralded service and distribution teams to bear for

the broader college savings marketplace,” commented Robert L.

Reynolds, president and chief executive officer, Putnam

Investments.

"Putnam's commitment to helping working Americans and others

save for their own retirement and for college education for their

children and grandchildren is unwavering,” Reynolds continued.

“While the challenge for families to gather resources for the

important task of funding higher education has never been greater,

we believe that our firm has a uniquely strong solution set to

offer the college savings marketplace and we plan to develop and

improve on it for years to come."

The Putnam announcement comes at a time when Reynolds’

rebuilding efforts, leading to a dramatic turnaround in Putnam’s

investment performance, have been broadly acknowledged. Recently,

Institutional Investor named Putnam Investments “Mutual Fund

Manager of the Year,” and Reynolds, “Fund Leader of the Year.” In

February, Putnam earned the #1 ranking in the 2010 Lipper/Barron’s

Best Mutual-Fund Families Survey based on dramatic gains by

individual funds and advancements across the entire fund complex in

2009.

Putnam Under

Reynolds

Since joining Putnam on July 1, 2008, Reynolds has moved

aggressively to improve fund performance and strengthen Putnam’s

investment unit. He restructured Putnam’s equity investment

division to increase individual fund manager accountability and

responsibility, and he realigned manager and analyst incentives to

reward those who deliver top-quartile results for investors.

Putnam has also recruited a number of distinguished industry

veterans in portfolio management, research, and trading during the

past 18 months, including Chief Investment Officer Walter Donovan

and Portfolio Managers Robert Ewing, David Glancy, and Nick

Thakore. The company has also sought to build a first-class,

high-talent research team to drive its fundamental investment

approach.

Besides turning around the performance of existing funds, Putnam

renewed its claim to leadership in mutual fund innovation, having

launched 15 new funds since early 2009. The products introduced or

enhanced during this period include:

- Putnam Absolute Return Funds,*

which are designed to pursue positive, targeted returns above

inflation over three years or more, and with less volatility than

more traditional funds. The absolute return strategies were also

combined among the underlying investments in the Putnam

RetirementReady® Funds, Putnam's unique suite of 10 target-date

lifecycle retirement funds, the only suite of lifecycle funds in

the industry to integrate these strategies;

- The Putnam Spectrum Funds, which

invest in the securities of leveraged companies, looking to

generate returns through investments across their entire capital

structure;

- The actively managed Putnam

Global Sector Funds, which target stocks in dynamic sectors across

global markets, cover nine sectors across the entire MSCI World

Index, and can be combined to create a highly customized

portfolio.

About Putnam Investments

Founded in 1937, Putnam Investments is a leading global money

management firm with over 70 years of investment experience. As of

April 2010, Putnam had nearly $120 billion in assets under

management. Putnam has offices in Boston, London, Frankfurt,

Amsterdam, Tokyo, Singapore, and Sydney. For more information, go

to putnam.com.

Putnam mutual funds are distributed by Putnam Retail

Management.

* Putnam's target Absolute Return Funds are not intended to

outperform stocks and bonds during strong market rallies.

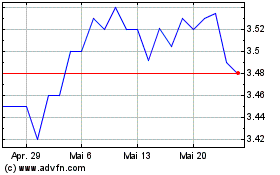

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024