Putnam Investments has announced the introduction of a

ground-breaking new approach that will change the lens through

which investors view their current retirement savings activities,

placing much greater focus on future income needs and shortfall

planning. Putnam’s Lifetime Income SM Analysis Tool is designed to

help 401(k) plan participants project how much income their current

retirement savings may generate in retirement compared to what they

may need, and then offer actionable next steps.

The delivery method for helping investors to translate their

current and future retirement savings efforts into income needs and

ramifications is the Putnam Lifetime IncomeSM Analysis Tool, which will enable plan

participants to model how much income their savings might generate

in retirement, and determine if they are on track to have

sufficient income to maintain their current lifestyle once they

stop working.

The Putnam Lifetime Income Analysis Tool and a new participant

Web site were unveiled yesterday at a Retirement Income Summit

sponsored by Putnam Investments in New York. The event, attended by

financial advisors, retirement plan sponsors and consultants,

focused on the importance for investors to have greater awareness

of how much income they are likely to generate – and need — in

retirement.

Speaking at yesterday’s event, Putnam President and Chief

Executive Officer Robert L. Reynolds said, “Many investors focus

only on accumulating assets in their retirement savings plan, when

the important thing is how much income their plan will produce in

retirement. One of the best measures of success for any retirement

system is its ability to reliably replace — for life — the income

people made while working.”

Reynolds continued, “We are seeking to reframe the conventional

mindset from inputs to outcomes – from accumulating assets to

measuring the income-generating potential of a retirement plan. We

are not only offering a new lens through which to view retirement

savings, but also providing real solutions that every investor can

consider in working towards a secure retirement.”

Initially available only to Putnam’s plan sponsor clients and

their employee plan participants, the Lifetime Income Analysis Tool

also will help individuals and their advisors plan for retirement

by factoring in the impact of remaining life expectancy as well as

potential income from outside sources, such as Social Security and

IRA account balances. The tool can help provide suggestions on how

investors may generate any additional income needed in

retirement.

One of the primary ways Putnam will assist plan sponsors and

their 401(k) participants to focus on their income potential in

retirement is through Putnam’s new Web site that has turned the

traditional 401(k) participant site inside out. On other sites,

planning tools that lead to income analyses are usually hidden

behind the home page and require accessing multiple pages to get to

a result. Consequently, many participants never find the tools,

never use them, never finish completing them or never go back to

them. On Putnam’s site, the income planning view always remains in

front of participants.

“It has become increasingly clear that Americans need to save

more for retirement and that providers and plan sponsors need to

help their participants specifically understand their future income

requirements — and try to make it easier for them to save. The

focus on real, everyday future income needs and solutions will help

to change investors’ mindsets and bring greater awareness and

participation by investors in 401(k) plans,” said Edmund F. Murphy,

III, Managing Director, Head of Defined Contribution, Putnam

Investments.

Putnam’s Retirement Income summit included remarks by Reynolds

and Murphy and a panel chaired by Jeffrey R. Carney, Putnam

Investments Head of Global Marketing, Products, and Retirement. The

panel featured practitioners and academics, including Shlomo

Benartzi, Professor and Co-Chair of the Behavioral Decision Making

Group at UCLA’s Anderson School of Management; Charles A. Ruffel,

Founder and Director of Asset International/ PLANSPONSOR; Dallas L.

Salisbury, President and CEO of the Employee Benefits Research

Institute; and Jeffrey Knight, Managing Director, Head of Global

Asset Allocation, Putnam Investments.

Putnam Investments and Retirement

Americans Cite Need for a Clearer Picture

At yesterday’s event, Putnam discussed recent research findings

based on a survey of nearly 1,500 Americans. The research revealed

that investors claim to know little about what they will need in

retirement or how much income they can expect to have. Key research

highlights included:

- More than half of all Americans

(52 percent), and even more of those who identified themselves as

participating in defined-contribution plans (61 percent), said they

needed a clearer picture of how much income they needed in

retirement.

- Only 23 percent of the 1,496

respondents consider themselves to be “knowledgeable” when it comes

to determining how much income their retirement savings will

generate in retirement.

The Lifetime Income Analysis Tool is part of a deepened

commitment by Putnam Investments to the retirement market and

complements calls by Reynolds for sweeping policy reforms to help

meet the nation's emergent retirement savings challenge. Reynolds’

proposals are helping to shape a growing debate in Washington over

how to help Americans save more for retirement.

In recent months, Putnam has launched a series of retirement

initiatives, including its new online Roth IRA Resource Center with

a full range of information about individual retirement account

(IRA) conversions, how to evaluate whether they make sense and how

to perform them. The Roth IRA Conversion Center is aimed at

financial advisors, who are dealing with a flood of demand from

their clients for advice on conversions since a tax law change took

effect on January 1, 2010, eliminating income caps that restricted

higher-income investors from converting traditional IRA assets to

Roth IRAs.

Putnam also has expanded the services it offers to 401(k)

retirement plans and developed products to meet the needs of those

planning for or already in retirement. The firm has created a

platform that provides flexible and scalable services and solutions

for advisors, consultants, and their plan sponsor clients in every

segment of the retirement market.

Putnam RetirementReady® Funds, the firm's suite of 10

target-date/lifecycle retirement funds, recently added target

Absolute Return Funds* to its mix of underlying investments.

RetirementReady Funds became the only suite of lifecycle funds to

integrate absolute return strategies, which seek positive returns

over time with less volatility than more traditional mutual funds.

Employed in retirement portfolios, Putnam Absolute Return Funds are

intended to pursue positive returns in up and down markets, to

protect against the harmful effects of adverse investment returns

and to reduce volatility, particularly for investors in or near

retirement.

About Putnam Investments

Founded in 1937, Putnam Investments is a leading global money

management firm with over 70 years of investment experience. As of

December 31, 2009, Putnam had $115 billion in assets under

management. Putnam has offices in Boston, London, Frankfurt,

Amsterdam, Tokyo, Singapore, and Sydney. For more information,

visit http://www.putnam.com.

Putnam mutual funds are distributed by Putnam Retail

Management.

* Putnam's target Absolute Return Funds are not intended to

outperform stocks and bonds during strong market rallies.

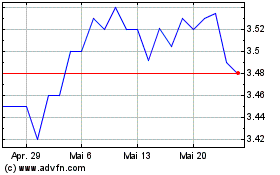

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024