Putnam Investments Holiday Survey Finds Americans More Hopeful about the Economy in 2010

17 Dezember 2009 - 6:40PM

Business Wire

As America heads into the holiday season, consumers are

displaying optimism tempered by realism after two years of

recession and volatile financial markets, according to a survey of

1,000 adults released today by Putnam Investments. Most surveyed

expect improvements in the economy and their personal finances, but

are planning to rein in holiday spending this year and step up

saving next year.

In fact, Americans are focused more on their financial health

than on their physical health, with “saving more” the number-one

New Year’s resolution for 2010, cited by 36 percent. Old standbys

such as “exercise more” (34%) and “lose weight” (34%) trail

behind.

“People are starting to sense the light at the end of the

tunnel, and think that both the economy and their personal finances

will start to rebound in 2010,” said Mark McKenna, Director of

Communications, Putnam Investments. “Americans have a long history

of picking themselves up and getting back in the race, and we’re

seeing a genuine – yet realistic – optimism take hold across the

country as people work hard to save and invest for the future.”

Looking Ahead to 2010: A Cautious Optimism Takes Hold

Nearly two-thirds of Americans (63%) think that stock prices

will go up in 2010 and just over half are expecting improvements in

the housing market, consumer confidence, consumer spending and

unemployment. However, caution prevails, with 57 percent expecting

that consumers will still spend less next year than they did this

year and only 40 percent expecting that the U.S. economy will be

“much healthier” in 2010.

Survey respondents were optimistic about their personal

situations, with more than half (52%) saying they were more hopeful

about their own financial health going into 2010 than they were a

year ago.

Consumers Plan to Control Holiday Spending

Although guardedly optimistic about next year, Americans

surveyed reported that they are frugal-minded as the holiday season

gets underway, hoping to avoid a financial hangover. Four in 10

(42%) say they have established an overall spending limit, 36

percent said they will pay for gifts only with cash and 33 percent

say they will limit the number of people for whom they will buy

gifts. Thirty percent say they will limit spending on holiday

entertainment and 18 percent say they will enter into a “no gift

exchange” agreement with people with whom they have exchanged gifts

in the past.

Men expect to be less restrained in their holiday spending than

women: Just 26 percent of men, but 40 percent of women, say they

will limit the number of people for whom they will buy gifts. Males

are also less likely to say they will avoid the use of credit

cards, limit spending on holiday entertainment or enter into “no

gift exchange” agreements.

Americans who hope to rein in holiday spending expect to find

support from friends and family. More than half of those surveyed

(51%) say that their family and friends would respect their need to

save more for retirement if they were to spend one-quarter less

this holiday season and instead put the money into retirement

savings. A further one in seven (15%) say that doing so might even

start a new tradition in their circle.

Americans Hope to Increase Saving

Saving is on the minds of many Americans, with a fifth (18%)

definitely planning to save more in 2010; another 30 percent hope

to do so, and a further 30 percent “hope to, but are not sure it

will be possible.” With awareness of the nation’s emergent

retirement savings challenge growing, 28 percent of those polled

specifically said they will try to save more for their retirement

in 2010. Smaller numbers intend to make additional payments to

reduce their mortgages (14%) and regularly review their 401(k)

plans and other investments (13%).

Underscoring concern about debt, one-third of respondents (33%)

said they would pay down personal debt if they received cash for a

holiday gift this year. Seventeen percent said they would use the

cash to pay for daily living expenses and 13 percent said they

would save it in an “emergency” fund.

Jobs Top Healthcare Reform as Americans’ Priority

As the year ends, pocketbook issues dominate Americans’

thoughts. When asked what would they would most like to see happen

in 2010, nearly a third (32%) said “job growth,” while 18 percent

said “U.S. economic growth.” Just one in seven (14%) said passage

of a healthcare reform bill, the issue which has consumed

Washington for much of this year.

Showing some skepticism about the effects of government action,

fewer than two in five Americans (38%) expect that consumers will

finally see the benefits of the economic stimulus package in

2010.

The online survey of 1,000 American adults was conducted by

Insight Express for Putnam Investments in November 2009.

About Putnam Investments

Founded in 1937, Putnam Investments is a leading global money

management firm with over 70 years of investment experience. As of

November 30, 2009, Putnam had $114 billion in assets under

management. Putnam has offices in Boston, London, Frankfurt,

Amsterdam, Tokyo, Singapore, and Sydney. For more information, go

to putnam.com.

Putnam mutual funds are distributed by Putnam Retail

Management.

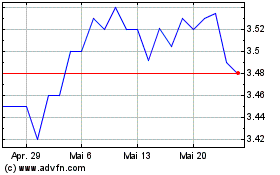

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024