Putnam Investments Absolute Return Funds Reach $1 Billion in Assets

16 Dezember 2009 - 6:10PM

Business Wire

Putnam Investments announced today that its unique suite of

target Absolute Return Funds*, has passed $1 billion in assets as

of December 14, 2009 — less than a year after they were launched in

January 2009 — making the funds one of the best selling in its

category. The funds pursue positive real returns with less

volatility than traditional mutual funds.

“This marks the emergence of a major new category in mutual fund

investing in America,” said Putnam Investments President and Chief

Executive Officer Robert L. Reynolds. “Reaching this milestone so

quickly reflects the very strong appetite in the marketplace for

products that are designed to produce more steady investment

returns over time to address volatility, longevity, inflation and

income concerns.

“This is just the beginning,” Reynolds continued. “We think

absolute return strategies — our own and others — will become a

major part of the entire investment landscape in coming years — as

core elements of portfolios, and through inclusion in retirement

and other savings vehicles, including lifecycle date funds, 529

plans, and 401(k) plans.”

The versatility and broad application of the Absolute Return

Fund suite has been well received by the advisor community, which

has made use of each of the four funds in varying combinations to

address portfolio needs around longevity and volatility risks, the

specter of inflation, and the increasing desire for a more

dependable stream of income. As evidence of its wide-ranging use,

the suite has assets spread across each of its four funds.

In addition to being sold individually to investors, the

Absolute Return Funds are combined among the underlying investments

in the Putnam RetirementReady Funds, Putnam’s suite of 10

target-date lifecycle retirement funds. Putnam RetirementReady

Funds are the only suite of lifecycle funds to integrate these

strategies alongside more conventional relative return — or

benchmark-focused — mutual fund strategies to control volatility.

When used in retirement portfolios, Putnam Absolute Return Funds

strive to pursue positive returns in up and down markets, and,

importantly, to protect against the harmful effects of adverse

investment returns, by relying on a greater percentage of absolute

return fund exposure the closer the target date fund is to its

maturity using a changing mix of absolute return funds, as

investors near retirement.

Putnam offers four Absolute Return Funds, which collectively

make up the industry’s first suite of target absolute return mutual

funds:

- Putnam Absolute Return 100

Fund (Class A, PARTX) seeks to outperform inflation by 1% over

periods of three years or more net of all fund expenses as measured

by T-bills, and can be an alternative to short-term

securities.

- Putnam Absolute Return 300

Fund (Class A, PTRNX) seeks to outperform inflation by 3% over

periods of three years or more net of all fund expenses as measured

by T-bills, and can be an alternative to bond funds.

- Putnam Absolute Return 500

Fund (Class A, PJMDX) seeks to outperform inflation by 5% over

periods of three years or more net of all fund expenses as measured

by T-bills, and can be an alternative to balanced funds.

- Putnam Absolute Return 700

Fund (Class A, PDMAX) seeks to outperform inflation by 7% over

periods of three years or more net of all fund expenses as measured

by T-bills, and can be an alternative to stock funds.

“The growth of Putnam’s Absolute Return Funds has exceeded all

expectations,” said Reynolds. “The appeal for financial advisors

and brokers is clear. Less than a year after the funds were

launched, over 350 brokerage and wirehouse firms and 4,800

financial advisors are already using the Putnam Absolute Return

Funds with their clients. With a reawakened awareness of risk

across all asset classes, as well as approximately $11 trillion in

cash still sitting on the sidelines of the markets, we think there

is enormous potential for the continued growth of these strategies

among mainstream investors.”

The introduction of the Putnam Absolute Return Funds exemplifies

Putnam’s renewed leadership in product innovation during 2009. In

addition to the four target Absolute Return Funds, Putnam has

launched 10 new mutual funds in 2009, including Putnam Spectrum

Funds, which invest in the securities of leveraged companies. The

actively managed Putnam Global Sector Funds, which target stocks in

dynamic sectors across global markets, cover nine sectors across

the entire MSCI World Index and can be combined to create a highly

customized portfolio.

About Putnam Investments

Founded in 1937, Putnam Investments is a leading global money

management firm with over 70 years of investment experience. As of

November 30, 2009, Putnam had $114 billion in assets under

management. Putnam has offices in Boston, London, Frankfurt,

Amsterdam, Tokyo, Singapore, and Sydney. For more information,

visit putnam.com.

* Putnam’s target Absolute Return Funds are not intended to

outperform stocks and bonds during strong market rallies.

Putnam mutual funds are distributed by Putnam Retail

Management.

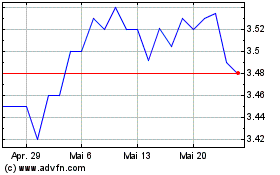

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024