Putnam CEO Reynolds Calls for 2010 to Be the Year of Retirement Reform, with a “New Generation” of Workplace Savings Plans

03 November 2009 - 7:46PM

Business Wire

While 2009 has been the year of healthcare reform in Washington,

Putnam Investments President and Chief Executive Officer Robert L.

Reynolds today called for 2010 to be the year when major retirement

reform is finally enacted to make possible a new generation of

workplace savings plans that generate more dependable sources of

lifetime income.

Reynolds said that, with reforms he is proposing, annuities and

other non-annuity assured income products could play a greater role

in generating retirement income, with the market for such products

perhaps growing to more than $5.5 trillion by 2020, compared to

today’s fixed and variable annuity market, which is estimated to

total about $1.7 trillion according to the Insured Retirement

Institute.

“America faces a retirement challenge that encompasses federal

entitlement reform, extending workplace savings coverage to the

half of all Americans who have no such access today and taking our

defined contribution system to the next level,” Reynolds said at an

industry conference in San Francisco. “Meeting this challenge, and

revitalizing America’s retirement savings system for the 21st

century, is too big a job for any single firm or industry. We will

need to forge new alliances among mutual fund companies, insurance

companies, retirement plan sponsors and advisors and government

itself.”

A crucial part of the reform effort is helping to protect

workers’ savings as they reach retirement in order to allow for a

dependable source of lifetime income. In addition to stock and bond

mutual funds, asset allocation funds and absolute return

strategies, Reynolds said that assured income options should become

part of a “lifetime financial product allocation” glide path that

adjusts throughout life to protect assets and ensure a dependable

“retirement paycheck.”

Reynolds added that reforms are needed to enable assured income

products, including both annuities and non-annuity products such as

guaranteed minimum withdrawal benefits and stand-alone lifetime

benefits, to play a greater role in providing income throughout

life. In order to build confidence in assured income options among

workers and sponsors of 401(k) plans and other defined-contribution

retirement plans, Reynolds called for reforms in Washington

including:

- The creation of a national

insurance charter, for nationwide consistency of regulation for

assured income products;

- A new regulatory body empowered

to approve assured income offerings, which he provisionally named

the Lifetime Income Security Agency (“LISA”);

- A national industry-funded,

FDIC-like insurance pool to ensure that approved assured income

solutions deliver on their promises to retirement plan

participants;

- Requiring that all workplace

savings plans offer plan participants the option of choosing

annuity or non-annuity income solutions for a portion of their

savings;

- Offering plan participants

compelling tax incentives if they choose assured income

streams.

“Assured income products could add a significant layer of

security to future generations’ lifelong income prospects,” said

Reynolds. “Admittedly, that vision is dependent on major reform in

Washington – and that’s precisely why I am calling for

cross-industry collaboration and bipartisan action from Congress

next year as we work to meet the nation’s retirement savings

challenge.”

Leadership in Retirement Product Innovation

Putnam recently announced that its RetirementReady® Funds are

the industry’s first suite of target date funds that integrate

target absolute return strategies with traditional relative return

mutual funds. The enhancement is designed to lower volatility

during accumulation and to pursue a higher level of income for

investors in retirement. The suite of 10 dynamically managed funds,

each of which has a target date based on when investors expect to

begin withdrawing assets, will seek to better shield investors

close to or in retirement from market extremes, thereby creating a

more stable sequencing of investment returns. The funds strive to

do this without sacrificing the potential for gains in more

positive markets.

The first use of absolute return strategies in target date funds

is just the most recent step in Putnam’s commitment to the

retirement market. Earlier this year, Putnam launched a new

401(k)/defined-contribution platform for advisors and their plan

sponsor clients that provides them with highly flexible and

scalable services and solutions.

The application of absolute return strategies to lifecycle

investing exemplifies Putnam’s renewed leadership in product

innovation. During the past year, Putnam launched the industry’s

first suite of target Absolute Return Funds, which already have

attracted nearly $800 million in investments;* Spectrum Funds,

which invest in the securities of undervalued, leveraged companies;

and Global Sector Funds, which target stocks in dynamic sectors

across global markets.

NOTE: For more information on Putnam CEO Robert Reynolds’

address to the Pensions and Investments 12th Annual Defined

Contribution Conference, please visit

www.theretirementsavingschallenge.com.

About Putnam Investments

Founded in 1937, Putnam Investments is a leading global money

management firm with over 70 years of investment experience. As of

September 30, 2009, Putnam had $114 billion in assets under

management. Putnam has offices in Boston, London, Frankfurt,

Amsterdam, Tokyo, Singapore, and Sydney. For more information, go

to putnam.com.

Putnam’s target Absolute Return Funds are not intended to

outperform stocks and bonds during strong market rallies.

Putnam mutual funds are distributed by Putnam Retail

Management.

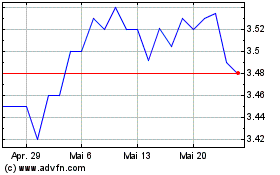

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024