Putnam Renews Share Repurchase Program for Closed-End Funds

17 September 2009 - 10:41PM

Business Wire

Putnam Investments announced today that the Board of Trustees of

The Putnam Funds (the “Trustees”) has voted to renew the current

repurchase program for Putnam’s closed-end funds. As renewed, the

program will allow each of the five Putnam closed-end funds to

repurchase, during the one-year period beginning October 8, 2009,

up to 10% of its common shares outstanding as of October 7,

2009.

The share repurchase program is intended to enhance shareholder

value, as repurchases made at a discount have the effect of

increasing the net asset value per share of the applicable fund’s

remaining shares. The Trustees believe that the record of the

repurchase program to date shows that share repurchases represent

attractive investment opportunities for the funds. Since the

commencement of the program in 2005, repurchases by these five

funds have contributed in the aggregate approximately $50.4 million

in per-share net asset value to remaining common shareholders of

the funds. As indicated in the table on the following page, the

repurchase program has been an important contributor to fund

returns at net asset value.

Contribution of

Share Repurchases to Total Returns at Net

Asset Value (10/25/05-8/31/09)

Cumulative Total

Returns (Including Share Repurchases) at Net

Asset Value (10/25/05-8/31/09)

Putnam High Income SecuritiesFund

(NYSE: PCF)

2.00% 12.51%

Putnam Managed MunicipalIncome

Trust (NYSE: PMM)

0.89% 3.77%

Putnam Master IntermediateIncome

Trust (NYSE: PIM)

2.03% 9.62%

Putnam Municipal

OpportunitiesTrust (NYSE: PMO)

1.27% 8.18%

Putnam Premier IncomeTrust (NYSE:

PPT)

2.68% 11.11%

Performance information does not reflect returns at market

price, which will vary from, and may be lower than, returns at net

asset value. Past performance does not guarantee future results.

More recent returns may be less or more than those shown.

Investment return, net asset value and market price will fluctuate

and you may have a gain or a loss when you sell your shares.

Performance assumes reinvestment of distributions and does not

account for taxes. For more recent performance information, call

1-800-225-1581 or visit www.putnam.com.

Performance attribution is approximate and reflects the daily

impact, gross of fees, of per-share net asset value increases

caused by share repurchases made at a discount to net asset value

during the period. In addition to reflecting repurchases under the

share repurchase program, cumulative total returns at net asset

value reflect the impact of issuer tender offers completed both by

each fund in July 2007 for 10% of its outstanding shares at 98% of

net asset value and by PIM in April 2008 for 15% of its outstanding

shares at 99% of net asset value. For PMO and PMM, contributions to

returns at net asset value reflect that the number of shares deemed

to have been repurchased by these funds was revised using the pro

forma combinations, as of October 5, 2007, of Putnam High Yield

Municipal Trust and PMM and of Putnam Investment Grade Municipal

Trust and Putnam Municipal Bond Fund and PMO. (In February 2008,

Putnam High Yield Municipal Trust merged into PMM, and Putnam

Investment Grade Municipal Trust and Putnam Municipal Bond Fund

merged into PMO.)

In October 2005, the Trustees initiated the program, which, as

subsequently amended, authorized the repurchase of up to 10% of

each fund’s outstanding common shares over the two-years ending

October 5, 2007. The Trustees subsequently renewed the program

twice, to permit the repurchase of an additional 10% of each fund’s

outstanding common shares over the twelve-month period beginning on

October 8, 2007 and of an additional 10% over the twelve-month

period beginning on October 8, 2008 (in each case based on common

shares outstanding as of the last business day prior to such

period).

The funds will repurchase shares at a discount, subject to

procedures approved by the Trustees. There is no assurance that the

funds will purchase shares at any particular discount levels or in

any particular amounts. Under certain conditions, regulatory

requirements and other legal considerations may limit the fund’s

ability to repurchase shares. Each fund’s repurchase activity will

be disclosed in its shareholder reports for the relevant fiscal

periods. See the funds’ most recent shareholder reports for

details. There is no assurance that the market price of a fund’s

shares, either absolutely or relative to net asset value, will

increase as a result of any share repurchases. Some of Putnam’s

closed-end funds use leverage, which involves risk and may increase

the volatility of such funds’ net asset value.

About Putnam Investments

Founded in 1937, Putnam Investments is a leading global money

management firm with over 70 years of investment experience. As of

August 31, 2009, Putnam had $110 billion in assets under

management. Putnam has offices in Boston, London, Frankfurt,

Amsterdam, Tokyo, Singapore, and Sydney. For more information, go

to www.putnam.com.

Putnam mutual funds are distributed by Putnam Retail

Management.

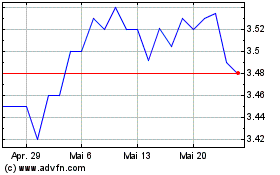

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Putnam Premier Income (NYSE:PPT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024