0001108426false00011084262024-06-032024-06-03

| | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM | 8-K |

| |

| CURRENT REPORT |

| Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 |

| |

| | | | | | | | |

| Date of Report (Date of earliest event reported) | June 3, 2024 | |

| (June 3, 2024) | |

| | | | | | | | | | | | | | |

Name of Registrant, State of Incorporation, Address Of Principal Executive Offices, Telephone Number, Commission File No., IRS Employer Identification No. |

PNM Resources, Inc.

(A New Mexico Corporation)

414 Silver Ave. SW

Albuquerque, New Mexico 87102-3289

Telephone Number - (505) 241-2700

Commission File No. - 001-32462

IRS Employer Identification No. - 85-0468296

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | | | | |

| | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 40.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 40.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

Registrant | Title of each class | Trading Symbol(s) | Name of exchange on which registered |

PNM Resources, Inc. | Common Stock, no par value | PNM | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On June 3, 2024, PNM Resources, Inc. (the “Company”) issued a press release announcing a proposed offering of $500,000,000 aggregate principal amount of its junior subordinated convertible notes due 2054 (the “Notes”) in a private offering to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended. In addition, the Company expects to grant the initial purchasers of the Notes an option to purchase, for settlement within a period of 13 days from, and including, the date the Notes are first issued, up to an additional $50,000,000 aggregate principal amount of the Notes, solely for the purpose of covering over-allotments, if any.

A copy of the press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | |

| PNM RESOURCES, INC. |

| |

| (Registrant) |

| |

| |

| Date: June 3, 2024 | /s/ Gerald R. Bischoff |

| Gerald R. Bischoff |

| Vice President and Corporate Controller |

| (Officer duly authorized to sign this report) |

Exhibit 99.1

For Immediate Release

June 3, 2024

PNM Resources Announces Offering of Junior Subordinated Convertible Notes due 2054

(ALBUQUERQUE, N.M.), June 3, 2024 – PNM Resources (NYSE: PNM) today announced that it intends to offer, subject to market and other conditions, $500,000,000 in aggregate principal amount of its junior subordinated convertible notes due 2054 (the “convertible notes”) in a private offering to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”). In addition, PNM Resources expects to grant the initial purchasers of the convertible notes an option to purchase, within a 13-day period beginning on, and including, the date the convertible notes are first issued, up to an additional $50,000,000 in aggregate principal amount of the convertible notes, solely for the purpose of covering over-allotments, if any.

Final terms of the convertible notes, including the initial conversion rate, interest rate and certain other terms of the convertible notes, will be determined at the time of pricing. The convertible notes will be unsecured obligations of PNM Resources and will rank junior and subordinate in right of payment to the prior payment in full of PNM Resources’ existing and future senior indebtedness. Interest on the convertible notes will be paid semiannually, subject to PNM Resources’ right to defer payments of interest as described below. The convertible notes will mature on June 1, 2054, unless earlier converted, redeemed or repurchased in accordance with their terms.

So long as no event of default with respect to the convertible notes has occurred and is continuing, PNM Resources may, at its option, defer interest payments on the convertible notes on one or more occasions for up to 20 consecutive semi-annual interest payment periods. During any deferral period, interest on the convertible notes will continue to accrue at the then-applicable interest rate on the convertible notes. In addition, during any deferral period, interest on deferred interest will accrue at the then-applicable interest rate on the notes, compounded semi-annually, to the extent permitted by applicable law.

PNM Resources may not redeem the convertible notes prior to June 6, 2029 except upon the occurrence of certain tax events, rating agency events or treasury stock events (each, a “special event”). PNM Resources may redeem for cash all, but not less than all, of the convertibles notes upon the occurrence of a special event, at a redemption price equal to 100% of the principal amount of the convertible notes to be redeemed, plus accrued and unpaid interest to, but excluding, the redemption date. In addition, PNM Resources may redeem for cash all or part (subject to certain limitations on partial redemptions) of the convertible notes, at its option, on or after June 6, 2029, at a redemption price equal to 100% of the principal amount of the convertible notes to be redeemed, plus accrued and unpaid interest to, but excluding, the redemption date, if the last reported sale price of PNM Resources’ common stock has been at least 130% of the conversion price of the convertible notes then in effect for at least 20 trading days (whether or not consecutive) during any 30 consecutive trading day period (including the last trading day of such period) ending on, and including, the trading day immediately preceding the date on which PNM Resources provides notice of redemption. In each case, PNM Resources will not, and will not be permitted to, issue a notice of redemption, or specify a redemption date, during any interest deferral period.

Prior to December 1, 2053, holders will have the right to convert their convertible notes only upon the occurrence of certain events and during certain periods. On or after December 1, 2053, holders will have the right to convert their convertible notes at any time until the close of business on the second business day immediately preceding the maturity date of the convertible notes. Upon conversion of the convertible notes, PNM Resources will (1) (a) deliver an equal aggregate principal amount of a newly issued series of its non-

convertible junior subordinated notes with the same terms as the convertible notes (other than the conversion features) or (b) in certain circumstances as set forth in the indenture that will govern the convertible notes, pay cash, in either case, up to the aggregate principal amount of the convertible notes being converted, and (2) deliver shares of PNM Resources’ common stock in respect of the remainder, if any, of PNM Resources’ conversion obligation in excess of the aggregate principal amount of the convertible notes being converted.

If PNM Resources undergoes a fundamental change (as defined in the indenture that will govern the convertible notes), subject to certain conditions and exceptions, holders of the convertible notes may require PNM Resources to repurchase for cash all or any portion of their notes at a fundamental change repurchase price equal to 100% of the principal amount of the notes to be repurchased, plus accrued and unpaid interest (including any accrued but unpaid deferred interest) to, but excluding, the repurchase date.

PNM Resources intends to use the net proceeds from this offering to repay a portion of its outstanding term loans.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of these securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful. The offer and sale of the convertible notes, the non-convertible junior subordinated notes issuable upon conversion of the convertible notes, if any, and shares of common stock issuable upon conversion of the convertible notes, if any, have not been, and will not be, registered under the Securities Act or the securities laws of any other jurisdiction, and the convertible notes, such non-convertible junior subordinated notes and such shares of common stock may not be offered or sold without registration or an applicable exemption from registration requirements.

Background:

PNM Resources (NYSE: PNM) is an energy holding company based in Albuquerque, N.M. Through its regulated utilities, PNM and TNMP, PNM Resources provides electricity to more than 800,000 homes and businesses in New Mexico and Texas. For more information, visit the company's website at www.PNMResources.com.

Contacts:

Analysts Media

Lisa Goodman Corporate Communications

(505) 241-2160 (505) 241-2783

Safe Harbor under the Private Securities Litigation Reform Act of 1995

Certain statements contained in this press release are “forward-looking statements” under federal securities laws. These statements are based upon management’s current expectations and are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated in the forward-looking statements. Readers are cautioned not to place undue reliance on these statements. Forward-looking statements include, among other things, statements concerning the anticipated terms of the convertible notes being offered, the completion, timing and size of the offering and the intended use of proceeds.

Factors that could cause actual results to differ materially from those contemplated in any forward-looking statements include, but are not limited to: market conditions, including market interest rates; the trading price and volatility of PNM Resources’ common stock; and risks relating to PNM Resources’ business, including those described under the headings “Disclosure Regarding Forward Looking Statements” and “Risk Factors” in the company’s Annual Report on Form 10-K for the year ended December 31, 2023, and in subsequent reports filed with the Securities and Exchange Commission. For a discussion of risk factors and other important factors affecting forward-looking statements, please see the company’s Form 10-K, Form 10-Q filings and the information included in the company’s Forms 8-K with the Securities and Exchange Commission, which factors are specifically incorporated by reference herein. There can be no assurance that the planned offering of convertible notes will be completed on the anticipated terms, or at all. Except as may be required by law, PNM Resources expressly disclaims any obligation to update any forward-looking information.

(END)

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

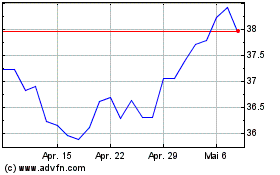

PNM Resources (NYSE:PNM)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

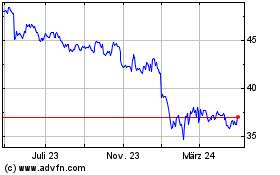

PNM Resources (NYSE:PNM)

Historical Stock Chart

Von Jun 2023 bis Jun 2024