0001816708FALSE00018167082023-07-112023-07-110001816708us-gaap:CommonStockMember2023-07-112023-07-110001816708us-gaap:WarrantMember2023-07-112023-07-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 11, 2023

____________________________

OWLET, INC.

(Exact name of registrant as specified in its charter)

____________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-39516 | | 85-1615012 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | |

3300 North Ashton Boulevard, Suite 300 Lehi, Utah | 84043 |

| (Address of principal executive offices) | (Zip Code) |

(844) 334-5330

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered | |

Class A Common Stock, $0.0001 par value per share | | OWLT | | New York Stock Exchange | |

Warrants to purchase Class A Common Stock | | OWLT WS | | New York Stock Exchange | * |

*On June 15, 2023, Owlet, Inc. (the "Company") was notified by the New York Stock Exchange ("NYSE") that the NYSE had halted trading in the Company’s warrants due to the low trading price of the warrants. On July 5, 2023, the NYSE filed a Form 25 with the Securities and Exchange Commission to delist the warrants.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.o

Item 7.01. Regulation FD Disclosure.

On July 11, 2023, Owlet, Inc. (the “Company”) issued a press release announcing that the New York Stock Exchange (“NYSE”) has accepted the Company’s business plan to regain compliance with the NYSE continued listing standards set forth in Section 802.01B of the NYSE Listed Company Manual. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information contained in, or incorporated into, this Item 7.01 of this Report, including Exhibit 99.1 attached hereto, is furnished under Item 7.01 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act or the Exchange Act regardless of any general incorporation language in such filings.

This Report shall not be deemed an admission as to the materiality of any information in this Report that is being disclosed pursuant to Regulation FD.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Exhibit No. | | | Description |

| | |

99.1 | | |

| |

104 | | Cover Page Interactive Data file (the cover page XBRL tags are embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Owlet, Inc. |

| | |

| Date: July 11, 2023 | By: | /s/ Kathryn R. Scolnick |

| Name: | Kathryn R. Scolnick |

| Title: | Chief Financial Officer |

Owlet, Inc. Announces NYSE Acceptance of

Continued Listing Compliance Plan

LEHI, Utah--(BUSINESS WIRE)--Owlet, Inc. (NYSE: OWLT) (“Owlet” or the “Company”) today announced that the New York Stock Exchange (“NYSE”) has accepted the Company’s business plan to regain compliance with the continued listing standards set forth in Section 802.01B of the NYSE Listed Company Manual.

"We’re proud of our team’s great progress towards our goals of profitability, sustainable growth and long-term category leadership,” said Kurt Workman, Chief Executive Officer and cofounder of Owlet. “With the recent receipt of clearance from the U.S. Food and Drug Administration (“FDA”) of BabySatTM, Owlet’s first medical pulse-oximetry device featuring its advanced, wire-free sock design, we believe Owlet is paving the way for digital health technology to have an impact in pediatrics. We believe home monitoring will become ubiquitous and that Owlet's platform will play a key role in this large and growing category."

As previously disclosed, on April 4, 2023, the Company received written notice (the “Notice”) from the NYSE that the Company was not in compliance with listing standards set forth in Section 802.01B of the NYSE Listed Company Manual because the Company’s average global market capitalization over a consecutive 30 trading-day period was less than $50 million and, at the same time, its stockholders’ equity was less than $50 million.

Based upon a review of the compliance plan and information submitted by the Company, the NYSE has accepted the submission. In accordance with NYSE rules, the Company will now be given an 18-month cure period from the date of the Notice to regain conformity with continued listing standards by having stockholders’ equity of at least $50 million or by having an average global market capitalization over a consecutive 30 trading-day period of at least $50 million. The Company’s Class A common stock (“Common Stock”) will continue to be listed on the NYSE during such time, subject to the Company’s compliance with other continued listing standards. The Company will also be subject to quarterly monitoring by the NYSE for compliance with the plan. If the Company fails to comply with the plan or does not meet continued listing standards at the end of the cure period, it will be subject to the prompt initiation of NYSE suspension and delisting procedures.

As previously announced, a 1-for-14 reverse stock split (“Reverse Split”) of the Common Stock became effective on July 7, 2023, and the Common Stock began trading on the NYSE on a split-adjusted basis at the market open on July 10, 2023. The Company expects that the Reverse Split will allow the Company to regain compliance with the $1.00 minimum average closing price requirement of the NYSE.

About Owlet, Inc.

Owlet was founded by a team of parents in 2012. Owlet’s mission is to empower parents with the right information at the right time, to give them more peace of mind and help them find more joy in the journey of parenting. Owlet’s digital parenting platform aims to give parents real-time data and insights to help parents feel calmer and more confident. Owlet believes that every parent deserves peace of mind and the opportunity to feel their well-rested best. Owlet also believes that every child deserves to live a long, happy, and healthy life, and is working to develop products to help further that belief. To learn more, visit www.owletcare.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company’s ability to return to compliance with the NYSE continued listing standards, the Reverse Split and the timing thereof and Owlet’s progress towards profitability, sustainable growth and long-term category leadership and key role in the home monitoring category. In some cases, you can identify forward-looking statements by terms such as “estimate,” “may,” “believes,” “plans,” “expects,” “anticipates,” “intends,” “goal,” “potential,” “upcoming,” “outlook,” “guidance,” the negation thereof, or similar expressions, although not all forward-looking statements contain these identifying words. Forward-looking statements are based on the Company’s expectations at the time such statements are made, speak only as of the dates they are made and are susceptible to a number of risks, uncertainties and other factors. For all such forward-looking statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Reform Act. The Company’s actual results, performance or achievements may differ materially from any future results, performance or achievements expressed or implied by our forward-looking statements. Many important factors could affect the Company’s future results and cause those results to differ materially from those expressed in or implied by the Company’s forward-looking statements. Such factors include, but are not limited to, the Company’s ability to execute the business plan accepted by the NYSE, the Company’s ability to regain and maintain compliance with the continued listing standards of the NYSE, market conditions and their impact on the trading price of the Common Stock and other risks and uncertainties set forth in the Company’s other releases, public statements and filings with the U.S. Securities and Exchange Commission, including those identified in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as updated in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023 and as any such factors may be updated from time to time in the Company’s other filings with the SEC. All such forward-looking statements attributable to the Company or any person acting on the Company’s behalf are expressly qualified in their entirety by the cautionary statements contained or referred to above. Moreover, the Company operates in an evolving environment. New risk factors and uncertainties may emerge from time to time, and factors that the Company currently deems immaterial may become material, and it is impossible for the Company to predict such events or how they may affect Owlet. Except as required by law, the Company assumes no obligation to update any forward-looking statements after the date of this press release, whether because of new information, future events or otherwise, although Owlet may do so from time to time. The Company does not endorse any projections regarding future performance that may be made by third parties.

Contacts

Investors and Media

Mike Cavanaugh

Westwicke/ICR

Phone: +1.617.877.9641

mike.cavanaugh@westwicke.com

v3.23.2

Cover

|

Jul. 11, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 11, 2023

|

| Entity Registrant Name |

OWLET, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39516

|

| Entity Tax Identification Number |

85-1615012

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Lehi

|

| Entity Address, State or Province |

UT

|

| Entity Address, Postal Zip Code |

84043

|

| City Area Code |

844

|

| Local Phone Number |

334-5330

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001816708

|

| Amendment Flag |

false

|

| Entity Address, Address Line One |

3300 North Ashton Boulevard

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, $0.0001 par value per share

|

| Trading Symbol |

OWLT

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase Class A Common Stock

|

| Trading Symbol |

OWLT WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

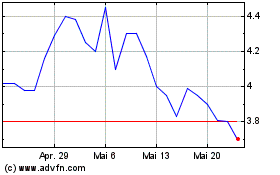

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Sandbridge Aquisition (NYSE:OWLT)

Historical Stock Chart

Von Mai 2023 bis Mai 2024