0001579877FALSE00015798772024-06-102024-06-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM 8-K

__________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 10, 2024 (June 7, 2024)

_________________________

OUTFRONT Media Inc.

(Exact name of registrant as specified in its charter)

__________________________

| | | | | | | | | | | | | | |

Maryland | | 001-36367 | | 46-4494703 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

| | | | | | | | | | | |

90 Park Avenue, 9th Floor | | |

New York, | New York | | 10016 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 297-6400

__________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01, par value | OUT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 7.01 | Regulation FD Disclosure. |

On June 10, 2024, OUTFRONT Media Inc. (the “Company”) issued a press release announcing the completion of the previously announced sale of all of its (and its affiliates’) equity interests in Outdoor Systems Americas ULC and its subsidiaries (the “Transaction”), which hold all of the assets of the Company’s outdoor advertising business in Canada (the “Canadian Business”), to Bell Media Inc. A copy of the press release is attached hereto as Exhibit 99.1, and is incorporated herein by reference.

The information contained in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished pursuant to this Item 7.01. This information shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, or incorporated by reference into any filing under the Securities Act, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

On June 7, 2024, the Company completed the previously announced sale of the Canadian Business in the Transaction. In connection with the Transaction, the Company received C$410.0 million in cash, which is subject to certain purchase price adjustments.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are filed or furnished, as applicable, herewith:

| | | | | | | | |

| | |

Exhibit

Number | | Description |

| |

| 99.1 | | Press Release dated June 10, 2024. |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

EXHIBIT INDEX

| | | | | | | | |

| | |

Exhibit

Number | | Description |

| |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

OUTFRONT MEDIA INC. |

| | |

By: | | /s/ Matthew Siegel |

| | Name: | | Matthew Siegel |

| | Title: | | Executive Vice President and |

| | | | Chief Financial Officer |

| | | | |

Date: June 10, 2024

OUTFRONT Media and Bell Media Announce Closing of the Sale of OUTFRONT Media’s Canadian Business

New York, June 10, 2024 — OUTFRONT Media Inc. (NYSE: OUT) and Bell Media Inc., a wholly-owned subsidiary of BCE Inc. (TSX, NYSE: BCE), announced today that they have closed the sale of OUTFRONT Media’s Canadian business to Bell Media for a purchase price of C$410 million in cash, subject to certain purchase price adjustments.

Jeremy Male, Chairman and Chief Executive Officer of OUTFRONT Media, said: “The sale of our Canadian business illustrates the inherent value of our out-of-home assets, and will enable us to proactively reduce our financial leverage and also focus entirely on operating what is now a fully domestic business here in the United States.”

Sean Cohan, President of Bell Media, said: “This acquisition marks a significant milestone for Bell Media and solidifies our leadership position in the out-of-home space. Our now expanded national inventory of both digital and out-of-home assets will drive even better, industry-leading results for our advertising partners.”

About OUTFRONT Media Inc.

OUTFRONT leverages the power of technology, location, and creativity to connect brands with consumers outside of their homes through one of the largest and most diverse sets of billboard, transit, and mobile assets in North America. Through its technology platform, OUTFRONT will fundamentally change the ways advertisers engage audiences on-the-go.

About Bell Media

Bell Media is Canada’s leading media and entertainment company with a portfolio of assets in premium video, audio, out-of-home advertising, and digital. This includes Canada’s most-watched television network, CTV; the largest Canadian-owned video streamer, Crave, with a premium add-on to include STARZ; a powerful suite of specialty channels; the most-trusted news brand, CTV News; Canada’s cross-platform sports leaders, TSN and RDS; leading out-of-home advertising network, Astral; Québec’s fast-growing conventional French-language network, Noovo; the country’s leading radio and podcast app, iHeartRadio Canada; and a range of award-winning original productions, brands, and services. As a content leader and partner in Sphere Media, Montréal’s Grande Studios, and Dome Productions, one of North America’s leading production facilities providers, Bell Media is committed to keeping Canadians entertained and informed.

Bell Media also offers best-in-class technology, marketing, and analytics support through Bell Marketing Platform, an omnichannel self-serve platform which includes Bell Analytics, Strategic Audience Management (SAM), and Bell DSP, in addition to advanced advertising solutions, including Linear Addressable TV, Addressable Audio, and ads on Crave. Bell Media is part of BCE Inc. (TSX, NYSE: BCE), Canada’s largest communications company. 1 Learn more at BellMedia.ca.

1 Based on total revenue and total combined customer connections.

Contacts:

| | | | | |

OUTFRONT Media Inc. | Bell Canada |

| |

| Investors | Investors |

| Stephan Bisson | Thane Fotopoulos |

| Investor Relations | Investor Relations |

| (212) 297-6573 | (514) 870-4619 |

stephan.bisson@OUTFRONT.com | thane.fotopoulos@bell.ca |

| | | | | |

| Media | Media |

| Courtney Richards | Kaitlynn Jong |

| Communications & Event Manager | Manager, Digital and Strategic Communications |

| (646) 876-9404 | (647) 456-7487 |

courtney.richards@OUTFRONT.com | Kaitlynn.jong@bellmedia.ca |

OUTFRONT Media’s Cautionary Statement Regarding Forward-Looking Statements

We have made statements in this document that are forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by the use of forward-looking terminology such as “will,” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions related to our capital resources, portfolio performance and results of operations. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and may not be able to be realized. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: declines in advertising and general economic conditions; the severity and duration of pandemics, and the impact on our business, financial condition and results of operations; competition; government regulation; our ability to operate our digital display platform; losses and costs resulting from recalls and product liability, warranty and intellectual property claims; our ability to obtain and renew key municipal contracts on favorable terms; taxes, fees and registration requirements; decreased government compensation for the removal of lawful billboards; content-based restrictions on outdoor advertising; seasonal variations; acquisitions and other strategic transactions that we may pursue could have a negative effect on our results of operations; dependence on our management team and other key employees; diverse risks in our Canadian business, including risks related to the sale of our Canadian business; experiencing a cybersecurity incident; changes in regulations and consumer concerns regarding privacy, information security and data, or any failure or perceived failure to comply with these regulations or our internal policies; asset impairment charges for our long-lived assets and goodwill; environmental, health and safety laws and regulations; expectations relating to environmental, social and governance considerations; our substantial indebtedness; restrictions in the agreements governing our indebtedness; incurrence of additional debt;

interest rate risk exposure from our variable-rate indebtedness; our ability to generate cash to service our indebtedness; cash available for distributions; hedging transactions; the ability of our board of directors to cause us to issue additional shares of stock without common stockholder approval; certain provisions of Maryland law may limit the ability of a third party to acquire control of us; our rights and the rights of our stockholders to take action against our directors and officers are limited; our failure to remain qualified to be taxed as a real estate investment trust (“REIT”); REIT distribution requirements; availability of external sources of capital; we may face other tax liabilities even if we remain qualified to be taxed as a REIT; complying with REIT requirements may cause us to liquidate investments or forgo otherwise attractive investments or business opportunities; our ability to contribute certain contracts to a taxable REIT subsidiary (“TRS”); our planned use of TRSs may cause us to fail to remain qualified to be taxed as a REIT; REIT ownership limits; complying with REIT requirements may limit our ability to hedge effectively; failure to meet the REIT income tests as a result of receiving non-qualifying income; the Internal Revenue Service may deem the gains from sales of our outdoor advertising assets to be subject to a 100% prohibited transaction tax; establishing operating partnerships as part of our REIT structure; and other factors described in our filings with the Securities and Exchange Commission (the "SEC"), including but not limited to the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 22, 2024. All forward-looking statements in this document apply as of the date of this document or as of the date they were made and, except as required by applicable law, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes.

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

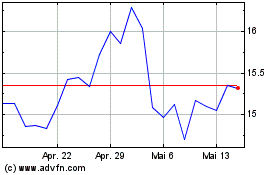

OUTFRONT Media (NYSE:OUT)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

OUTFRONT Media (NYSE:OUT)

Historical Stock Chart

Von Nov 2023 bis Nov 2024