UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of November 2023

Commission File Number: 001-39147

ONECONNECT FINANCIAL TECHNOLOGY CO., LTD.

(Registrant’s Name)

10-14F,

Block A, Platinum Towers

No.1 Tairan 7th Road, Futian District

Shenzhen, Guangdong, 518000

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

OneConnect Financial Technology Co., Ltd. |

| |

|

| |

By: |

/s/

Chongfeng Shen |

| |

Name: |

Chongfeng Shen |

| |

Title: |

Chairman of the Board and Chief Executive Officer |

|

Date:

November 14, 2023 |

|

|

Exhibit 99.1

Hong Kong Exchanges and Clearing

Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation

as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance

upon the whole or any part of the contents of this announcement.

OneConnect

Financial Technology Co., Ltd.

壹賬通金融科技有限公司

(Incorporated

in the Cayman Islands with limited liability)

(Stock

Code: 6638)

(NYSE

Stock Ticker: OCFT)

VERY

SUBSTANTIAL DISPOSAL AND CONNECTED TRANSACTION IN RELATION TO

DISPOSAL

OF ENTIRE ISSUED SHARES IN A WHOLLY-OWNED SUBSIDIARY

Independent Financial Adviser

to the Independent Board Committee and Independent Shareholders

INTRODUCTION

On November 13,

2023 (after Hong Kong trading hours), the Company entered into the Share Purchase Agreement with the Purchaser and PAOB, pursuant to which

the Company conditionally agreed to sell, and the Purchaser conditionally agreed to acquire PAOB through transferring the entire issued

share capital of the Disposal Company at a consideration of HK$933,000,000 in cash, subject to the terms and conditions of the Share Purchase

Agreement. Upon Closing, the Company will cease to hold any interest in the Disposal Company. Accordingly, the Disposal Group will cease

to be subsidiaries of the Company and will no longer be consolidated into the financial statements of the Group.

LISTING RULES IMPLICATIONS

As one or more of the

applicable percentage ratios in respect of the Disposal exceeds 75%, the Disposal constitutes a very substantial disposal of the Company

under Chapter 14 of the Listing Rules. As at the date of this announcement, the issued share capital of the Company is held as to approximately

32.12% by Ping An Insurance. The Purchaser is an associate of Ping An Insurance and thus a connected person of the Company. The Disposal

is therefore subject to the reporting, announcement, circular and Independent Shareholders’ approval requirements under Chapters

14 and 14A of the Listing Rules.

The Independent Board Committee comprising all the independent non-executive

Directors has been formed to advise the Independent Shareholders on the Disposal, the Share Purchase Agreement and the transactions contemplated

thereunder. The Independent Financial Adviser of the Company has been appointed to advise the Independent Board Committee and the Independent

Shareholders in the same regard.

GENERAL

The Company will convene

an EGM to approve the Disposal, the Share Purchase Agreement and the transactions contemplated thereunder. A circular containing, among

other things, (i) further particulars of the Disposal, the Share Purchase Agreement and the transactions contemplated thereunder;

(ii) recommendation from the Independent Board Committee in respect of the Disposal, the Share Purchase Agreement and the transactions

contemplated thereunder; (iii) the letter of advice of the Independent Financial Adviser to the Independent Board Committee and the

Independent Shareholders in respect of the Disposal, the Share Purchase Agreement and the transactions contemplated thereunder; and (iv) other

information as required under the Listing Rules together with a notice convening the EGM is expected to be dispatched to the Shareholders

on or before December 5, 2023.

Completion of the

Disposal is subject to the satisfaction of the conditions precedent under the Share Purchase Agreement, and therefore, may or may not

proceed to completion. Shareholders and potential investors are advised to exercise caution when dealing in the Shares.

INTRODUCTION

On November 13, 2023 (after

Hong Kong trading hours), the Company entered into the Share Purchase Agreement with the Purchaser and PAOB, pursuant to which the Company

conditionally agreed to sell and the Purchaser conditionally agreed to acquire PAOB through transferring the entire issued share capital

of the Disposal Company at a consideration of HK$933,000,000 in cash, subject to the terms and conditions of the Share Purchase Agreement.

Upon Closing, the Company will cease to hold any interest in the Disposal Company. Accordingly, the Disposal Group will cease to be subsidiaries

of the Company and will no longer be consolidated into the financial statements of the Group.

THE SHARE PURCHASE AGREEMENT

Principal terms of the Share Purchase Agreement are

summarized below:

| Date |

: |

November 13, 2023 |

| |

|

|

|

| Parties |

: |

(1) |

the Company; |

| |

|

|

|

| |

|

(2) |

the Purchaser; and |

| |

|

|

|

| |

|

(3) |

PAOB |

| |

|

|

|

| Subject matter |

: |

The Purchaser will purchase from the Company the entire issued share capital of the Disposal Company, which indirectly holds 100% of the issued share capital in PAOB. |

| Consideration and payment |

: |

Pursuant to the Share Purchase Agreement, the consideration for the Disposal is HK$933,000,000 in cash, which will be paid in full on the Closing Date. The consideration for the Disposal shall be settled by wire transfer of immediately available funds in Hong Kong dollars. |

| |

|

|

|

| Basis of the consideration |

: |

The consideration was determined after arm’ s length negotiations between the Company and the Purchaser on normal commercial terms with reference to, among other things, (i) the fair market value range of PAOB’s 100% equity interest as of June 30, 2023 implied under the market approach (i.e. the guideline companies method), which is from HK$853 million to HK$943 million; (ii) the potential development of PAOB with reference to its latest operational and financial performance; and (iii) the reasons for and benefits of the Disposal as set out in the section headed “Reasons for and benefits of the Disposal” in this announcement below. In particular, the price-to-book ratio was selected as basis of analysis and the value estimates were derived by taking into account the financial performance of both PAOB and comparable companies which carry out similar businesses, together with the prices paid for the trading shares of comparable companies. The Board is of the view that the abovementioned valuation basis reflects the fair market value of PAOB, and the consideration is fair and reasonable and is in the interests of the Company and the Shareholders as a whole. |

| |

|

|

|

| Conditions Precedent |

: |

Closing of the Disposal is subject to the fulfillment of the following conditions or waiver (if applicable) of the following conditions: |

| |

|

|

|

| |

|

(1) |

the receipt of all necessary corporate approvals (including but not limited to the approval by the Independent Shareholders of the Disposal), governmental approvals (including but not limited to the approvals from the Hong Kong Monetary Authority) and authorizations and consents of third parties (if required), and remaining to be effective; |

| |

|

|

|

| |

|

(2) |

no law or order by a government authority of competent jurisdiction restraining, enjoining or otherwise prohibiting the consummation of the transactions contemplated under the Share Purchase Agreement; |

| |

|

|

|

| |

|

(3) |

each of the parties to the Share Purchase Agreement has executed and delivered the transaction documents contemplated under the Share Purchase Agreement; |

| |

|

|

|

| |

|

(4) |

no member of the Disposal Group has suffered any material adverse effect (as defined in the Share Purchase Agreement) in the business, results of operations or condition (financial or otherwise) of the Disposal Group, taken as a whole; |

| |

|

(5) |

all fundamental representations and warranties and non- fundamental representations and warranties with any materiality qualifier with respect to the Company, the Purchaser and the Disposal Group are true and correct in all respects, and all non-fundamental representations and warranties without any materiality qualifier with respect to the Company, the Purchaser and the Disposal Group are true and correct in all material respects subject to standard materiality read-out, as of the date of the Share Purchase Agreement when made and as of the Closing with the same force and effect as if made as of the Closing, except to the extent such representations and warranties relate to another date; |

| |

|

|

|

| |

|

(6) |

the parties to the Share Purchase Agreement have performed and complied with, in all material respects, each of the obligations and agreements required by the Share Purchase Agreement to be performed or complied with by them on or prior to the Closing Date; |

| |

|

|

|

| |

|

(7) |

there being no action or proceeding against the Company or any member of the Disposal Group or the Purchaser prohibiting or restricting the transaction contemplated under the Share Purchase Agreement or have any material adverse effect (as defined in the Share Purchase Agreement) on the business of any member of the Disposal Group or on any member of the Disposal Group (if applicable); |

| |

|

|

|

| |

|

(8) |

none of the members of the Disposal Group has been an obligor under any indebtedness (as defined in the Share Purchase Agreement) other than any indebtedness incurred or arising in the ordinary course of business; |

| |

|

|

|

| |

|

(9) |

delivery of duly executed resignation and release letters dated the Closing Date from the director(s) on the boards of PAOB, Jin Yi Rong and Disposal Company as the Purchaser may designate; and |

| |

|

|

|

| |

|

(10) |

receipt of certificates by the Company and the Purchaser certifying the aforementioned conditions have been satisfied. |

| |

|

|

|

| Closing |

: |

Closing of the Disposal shall take place on a date that is no later than the fifth (5th) business day after the satisfaction or valid waiver of each of the closing conditions (other than the conditions that by their nature are to be satisfied at the Closing), unless another time, date or place is agreed to in writing by the Purchaser and the Company. Upon Closing, the Company will cease to hold any interest in the Disposal Company. Accordingly, the Disposal Group will cease to be subsidiaries of the Company and will no longer be consolidated into the financial statements of the Group. |

INFORMATION OF THE COMPANY

The Group is a technology-as-a-service

provider for the financial services industry in China with an expanding international presence. The Company provides integrated technology

solutions to financial institutional customers, including digital banking solutions and digital insurance solutions. The Company also

provides digital infrastructure for financial institutions through the Gamma Platform. The Company’s solutions and platform help

financial institutions expedite their digital transformation and ensure their sustainability.

The Company has established long-term

cooperation relationships with financial institutions to address their needs of digital transformation. The Company has also expanded

its services to other participants in the value chain to support the digital transformation of financial services ecosystem. In addition,

the Company has successfully served overseas financial institutions with its technology solutions.

INFORMATION OF THE PURCHASER

The Purchaser is a leading financial

services enabler for small business owners (“SBOs”) in China and it offers financing products designed principally

to address the needs of SBOs. The Purchaser’s group is currently primarily engaged in the business of enablement of loans in China.

The Purchaser’s group has established relationships with financial institutions in China as funding and credit enhancement partners

to enable general unsecured loans and secured loans under its core retail credit and enablement business model. The Purchaser’s

group also enables consumer finance loans through its consumer finance subsidiary.

INFORMATION ON THE DISPOSAL GROUP

The Disposal Company is a wholly-owned

subsidiary of the Company. It is a company incorporated in the British Virgin Islands and is a holding company. It indirectly holds the

entire interest of PAOB through Jin Yi Rong, a company incorporated in Hong Kong. PAOB was the first virtual bank to provide flexible

and efficient banking services with a focus on the small and medium- sized enterprises (“SME”) in Hong Kong and was

the first virtual bank to participate in the SME Financing Guarantee Scheme launched by The Hong Kong Mortgage Corporation Limited. In

terms of credit assessment, PAOB adopted alternative data to support its credit decisions, allowing it to better understand SMEs’

financing needs and perform more complete and accurate credit risk assessment.

Set out below is a summary of

the audited consolidated financial information of the Disposal Group for the two financial years ended December 31, 2022 and 2021

as extracted from the consolidated financial statements of the Disposal Company for the years ended December 31, 2022 and 2021 which

are prepared in accordance with International Financial Reporting Standards:

| | |

For the year ended December 31,

| |

| | |

2022 | | |

2021 | |

| | |

| HK$’000 | | |

| HK$’000 | |

| Revenue | |

| 124,143 | | |

| 41,516 | |

| Loss before taxation | |

| 157,159 | | |

| 214,190 | |

| Loss after taxation | |

| 157,159 | | |

| 214,190 | |

Based on the unaudited consolidated

management accounts of the Disposal Company, the unaudited consolidated net asset value of the Disposal Group as at June 30, 2023

was approximately HK$761 million.

FINANCIAL EFFECTS OF THE DISPOSAL

Upon Closing, the Company will

cease to hold any interest in the Disposal Company and the Disposal Group will cease to be subsidiaries of the Company.

Subject to audit to be performed

by the Company’s auditors and without taking into account currency translation differences, it is expected that the Company will

record a gain from the Disposal of approximately HK$164 million, after taking into account of (i) the consideration for the Disposal

of HK$933 million; (ii) the unaudited consolidated net asset value of the Disposal Group as of June 30, 2023 in the amount of

approximately HK$761 million; and (iii) the estimated relevant fees and expenses in relation to the Disposal.

The aforesaid estimation is for

illustrative purpose only and does not purport to represent the financial position of the Company after Closing. The actual amount of

gain or loss as a result of the Disposal to be recorded by the Company will be subject to the review and final audit by the auditors of

the Company. The actual financial effects of the Disposal will be determined with reference to the financial position of the Disposal

Group as at the Closing Date and therefore may be different from the amounts mentioned above.

REASONS FOR AND BENEFITS OF

THE DISPOSAL

The Group is a technology-as-a-service

provider for the financial services industry in China with an expanding international presence. The Board undertakes strategic review

of its businesses from time to time with a view to maximizing returns to the Shareholders. Taking into account the current business strategy

of the Group, the Directors believe that the Disposal represents a good opportunity for the Group to focus more on technology-driven products

and services that require less capital and allow the Group to deploy appropriate resources towards such technology-driven products and

services. Upon completion of the Disposal, the Group will continue to focus on its existing technology solutions business. As at the date

of this announcement, save for the Disposal, the Company has not entered into any negotiation, arrangement or agreement, nor does it have

any intention, to downsize, cease or dispose the existing business of the Group.

In view of the capital commitment

required by the virtual banking business, the Directors are of the view that the Disposal will significantly improve the financial position

of the Group. The Directors currently intend to apply the proceeds from the Disposal as general working capital, as well as to improve

the main business operations of the Company and to focus on the Company’s technology capabilities and business to facilitate the

long-term business development of the Group. The intended use of proceeds is subject to actual circumstances and decision of the Board

when concrete details of proposed uses are put forward for consideration.

The Directors (excluding the independent

non-executive Directors whose opinions will be contained in the circular of the Company to be dispatched to the Shareholders after having

taken into consideration the advice of the Independent Financial Adviser) are of the view that the terms of the Disposal, the Share Purchase

Agreement and the transactions contemplated thereunder as a whole are entered into on normal commercial terms, and are fair and reasonable

and in the interests of the Company and its Shareholders as a whole.

CONTINUING CONNECTED TRANSACTIONS

AFTER CLOSING OF THE DISPOSAL

Upon Closing, the Disposal Group

will become wholly-owned subsidiaries of the Purchaser, each member of the Disposal Group will in turn be an associate of Ping An Insurance

and thus a connected person of the Company. Accordingly, certain existing continuing transactions between the Group and the Disposal Group

will become continuing connected transactions of the Company under Chapter 14A of the Listing Rules upon Closing. Further announcement(s) will

be made by the Company as and when appropriate in accordance with the Listing Rules.

LISTING RULES IMPLICATIONS

As one or more of the applicable

percentage ratios in respect of the Disposal exceeds 75%, the Disposal constitutes a very substantial disposal of the Company under Chapter

14 of the Listing Rules. As at the date of this announcement, the issued share capital of the Company is held as to approximately 32.12%

by Ping An Insurance. The Purchaser is held as to approximately 24.86% by An Ke Technology Company Limited and approximately 16.57% by

Ping An Insurance Overseas as at the date of this announcement. Both An Ke Technology Company Limited and Ping An Insurance Overseas are

wholly-owned by Ping An Insurance. As such, the Purchaser is an associate of Ping An Insurance and thus a connected person of the Company.

The Disposal is therefore subject to the reporting, announcement, circular and Independent Shareholders’ approval requirements under

Chapters 14 and 14A of the Listing Rules.

The Independent Board Committee

comprising all the independent non-executive Directors has been formed to advise the Independent Shareholders on the Disposal, the Share

Purchase Agreement and the transactions contemplated thereunder. The Independent Financial Adviser of the Company has been appointed to

advise the Independent Board Committee and the Independent Shareholders in the same regard.

ABSTENTION FROM VOTING ON BOARD RESOLUTIONS AND

AT THE EGM

Mr. Michael Guo (a non-executive

Director of the Company and the co-chief executive officer of Ping An Insurance), Ms. Xin Fu (a non-executive Director of the Company,

a non-executive director of the Purchaser, and the senior vice president and director of the strategic development center of Ping An Insurance),

Mr. Wenwei Dou (a non-executive Director of the Company) and Ms. Wenjun Wang (a non-executive Director of the Company, who,

together with Mr. Wenwei Dou and based on public information available to the Company, are each a 50% nominee shareholder of a company

which is indirectly interested in approximately 26.99% of the issued share capital of the Purchaser) have abstained from voting on the

Board resolutions to approve the Disposal, the Share Purchase Agreement and the transactions contemplated thereunder. Save for the aforesaid,

none of the Directors has any material interest in the Disposal, the Share Purchase Agreement and the transactions contemplated thereunder

and was required to abstain from voting on the Board resolutions in relation to the Disposal, the Share Purchase Agreement and the transactions

contemplated thereunder.

Furthermore, pursuant to the Listing

Rules, any Shareholder with a material interest in the Disposal (and its close associates), will abstain from voting in the EGM. (i) Bo

Yu and Ping An Insurance Overseas (both of which are subsidiaries of Ping An Insurance), which together hold approximately 32.12% of the

issued share capital of the Company as at the date of this announcement based on public information available to the Company; and (ii) Rong

Chang Limited (which is held as to 50% each as nominee shareholders by Mr. Wenwei Dou and Ms. Wenjun Wang), which directly holds

approximately 16.84% of the issued share capital of the Company at the date of this announcement, will abstain from voting at the EGM

on the resolution(s) in relation to the Disposal, the Share Purchase Agreement and the transactions contemplated thereunder.

GENERAL

The Company will convene an EGM

to approve the Disposal, the Share Purchase Agreement and the transactions contemplated thereunder. A circular containing, among other

things, (i) further particulars of the Disposal, the Share Purchase Agreement and the transactions contemplated thereunder; (ii) recommendation

from the Independent Board Committee in respect of the Disposal, the Share Purchase Agreement and the transactions contemplated thereunder;

(iii) the letter of advice of the Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders

in respect of the Disposal, the Share Purchase Agreement and the transactions contemplated thereunder; and (iv) other information

as required under the Listing Rules together with a notice convening the EGM is expected to be dispatched to the Shareholders on

or before December 5, 2023.

Completion of the Disposal

is subject to the satisfaction of the conditions precedent under the Share Purchase Agreement, and therefore, may or may not proceed to

completion. Shareholders and potential investors are advised to exercise caution when dealing in the Shares.

DEFINITIONS

In this announcement, unless the context otherwise requires, the following

terms shall have the following meanings.

| “associate(s)” |

has the meaning ascribed to it under the Listing Rules |

| |

|

| “Board” |

the board of Directors of the Company |

| |

|

| “Bo Yu” |

Bo Yu Limited, a limited liability company incorporated in the British Virgin Islands ultimately wholly-owned by Ping An Insurance |

| |

|

| “Closing” |

closing of the Disposal in accordance with the terms and conditions of the Share Purchase Agreement |

| |

|

| “Closing Date” |

the date on which the Closing is to take place |

| |

|

| “Company” |

OneConnect Financial Technology Co., Ltd. (壹賬通金融科技有限公司), a limited liability company incorporated in the Cayman Islands listed on the NYSE (stock ticker: OCFT) and the HKSE (stock code: 6638) |

| |

|

| “connected person(s)” |

has the meaning ascribed to it under the Listing Rules |

| |

|

| “Director(s)” |

the director(s) of the Company |

| |

|

| “Disposal” |

the disposal by the Company of the entire share capital of the Disposal Company, which indirectly holds 100% of the issued share capital in PAOB, pursuant to the Share Purchase Agreement |

| |

|

| “Disposal Company” |

Jin Yi Tong Limited, a company with l imited l iability incorporated in the British Virgin Islands, which indirectly holds 100% of the issued share capital of PAOB through Jin Yi Rong |

| |

|

| “Disposal Group” |

the Disposal Company, Jin Yi Rong and PAOB and any company that is directly or indirectly controlled by PAOB |

| |

|

| “EGM” |

an extraordinary general meeting of the Company to be convened and held to consider, among others and, if thought fit, approve, the Disposal, the Share Purchase Agreement and the transactions contemplated thereunder |

| |

|

| “Gamma Platform” |

a platform provided by the Company which consolidates an array of solutions that can be applied across a wide range of financial services industries including core banking, artificial intelligence customer service, regtech, digitalized management and technology infrastructure |

| “Group” |

the Company and its subsidiaries and consolidated affiliated entities |

| |

|

| “Hong Kong” |

the Hong Kong Special Administrative Region of the PRC |

| |

|

| “Hong Kong Monetary Authority” |

Hong Kong’s central banking institution established on April 1, 1993 |

| |

|

| “HKSE” |

The Stock Exchange of Hong Kong Limited |

| |

|

| “HK$” |

Hong Kong dollar(s), the lawful currency of Hong Kong |

| |

|

| “Independent Board Committee” |

an independent committee of the Board comprising all the independent non-executive Directors |

| |

|

| “Independent Financial Adviser” |

Elstone Capital Limited, a licensed corporation to carry out Type 6 (advising on corporate finance) regulated activities under the SFO and the independent financial adviser appointed by the Company to advise the Independent Board Committee and the Independent Shareholders on the Disposal, the Share Purchase Agreement and the transactions contemplated thereunder |

| |

|

| “Independent Shareholders” |

the Shareholder(s) other than (i) Bo Yu and Ping An Insurance Overseas (both of which are subsidiaries of Ping An Insurance) and (ii) Rong Chang Limited, and those who do not have material interests in the Disposal, the Share Purchase Agreement and the transactions contemplated thereunder (including its close associates) |

| |

|

| “Jin Yi Rong” |

Jin Yi Rong Limited, a company with limited liability incorporated in Hong Kong, which directly holds 100% of the issued share capital of PAOB |

| |

|

| “Listing Rules” |

the Rules Governing the Listing of Securities on the HKSE |

| |

|

| “NYSE” |

New York Stock Exchange |

| |

|

| “PAOB” |

Ping An Insurance OneConnect Bank (Hong Kong) Limited, a wholly-owned subsidiary of the Company incorporated in Hong Kong with limited liability |

| |

|

| “Ping An Insurance” |

Ping An Insurance (Group) Company of China, Ltd. (中國平安保險(集團)股份有限公司), a company established as a joint stock company under the laws of PRC listed on the SHSE (stock code: 601318) and the HKSE (stock code: 2318), and the issued share capital of the Company is held as to approximately 32.12% by Ping An Insurance |

| “Ping An Insurance Overseas” |

China Ping An Insurance Overseas (Holdings) Limited, a limited liability company incorporated in Hong Kong and a subsidiary of Ping An Insurance |

| |

|

| “Purchaser” |

Lufax Holding Ltd (陸金所控股有限公司), a company with limited liability incorporated in the Cayman Islands and listed on the NYSE (NYSE ticker: LU) and the HKSE (stock code: 6623) |

| |

|

| “PRC” or “China” |

the People’s Republic of China and, for the purpose of this announcement only, excludes Hong Kong, the Macau Special Administrative Region of the PRC and the Republic of China (Taiwan) |

| |

|

| “SFO” |

the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong), as amended and supplemented from time to time |

| |

|

| “Share Purchase Agreement” |

the share purchase agreement dated November 13, 2023 entered into among the Company, the Purchaser and PAOB in relation to the Disposal |

| |

|

| “SHSE” |

Shanghai Stock Exchange |

| |

|

| “Share(s)” |

ordinary share(s) in the share capital of the Company |

| |

|

| “Shareholder(s)” |

the holder(s) of the Shares |

| |

|

| “subsidiaries” |

has the meaning as ascribed to it under the Listing Rules |

| |

|

| “%” |

per cent |

| |

By Order of the Board |

| |

OneConnect Financial

Technology Co., Ltd. |

| |

Mr. Chongfeng

Shen |

| |

Chairman of

the Board and Chief Executive Officer |

Hong Kong, November 14, 2023

As

at the date of this announcement, the board of directors of the Company comprises Mr. Chongfeng Shen as the executive director, Mr. Michael

Guo, Ms. Xin Fu, Mr. Wenwei Dou and Ms. Wenjun Wang as the non-executive directors and Dr. Yaolin Zhang, Mr. Tianruo

Pu, Mr. Wing Kin Anthony Chow and Mr. Koon Wing Ernest Ip as the independent non-executive directors.

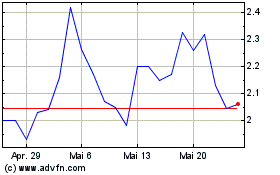

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024