OneConnect Financial Technology Co., Ltd. (“OneConnect” or the

“Company”) (NYSE: OCFT), a leading technology-as-a-service provider

for financial institutions in China, today announced that it

intends to make arrangements to facilitate conversion of its

American depositary shares (the “ADSs”) to ordinary shares

(“Shares”) in connection with the Proposed Listing (as

defined below). The Company filed an application on February 28,

2022 with The Stock Exchange of Hong Kong Limited (“SEHK”)

in connection with a proposed dual primary listing of Shares on the

Main Board of the SEHK by way of introduction (“Proposed

Listing”).

The Company wishes to highlight to the investors that the

Proposed Listing is still subject to the Company obtaining the

approval in-principle of the SEHK for the Proposed Listing

(“AIP”), and thereafter, the fulfilment of certain

conditions under the AIP, including the granting of the final

approval for the listing of, and permission to deal in, the Shares

on the Main Board of the SEHK by the listing committee of the SEHK.

There is no assurance that the AIP will be obtained, or that the

final approval for the Proposed Listing will be granted. The

Proposed Listing may or may not occur.

For the purpose of trading on the SEHK, the Shares must be

registered on the branch share register of members of the Company

in Hong Kong (the “Hong Kong Share Register”). In order to

facilitate the investors with a more timely and cost-effective

conversion process from ADSs to Shares trading in Hong Kong, the

Company intends to remove a portion of the underlying Shares

represented by our ADSs, other than the underlying Shares of the

ADSs issued but yet to be vested pursuant to the stock incentive

plan of the Company adopted in November 2017, and amended from time

to time, from the Company’s Cayman share register and entered into

the Hong Kong Share Register.

Subject to the approval of the SEHK and any other approval

required by the Company in connection with the Proposed Listing,

the depositary of the Company (the “Depositary”) will

provide up to four (4) batch-conversions (subject to the Conversion

Cap (as defined below)) for holders of ADSs seeking to cancel their

ADSs and transfer the underlying Shares to their designated CCASS

participant stock accounts prior to the Listing and during the

three-month period thereafter (excluding those Shares converted

under the first batch of the Batch-Conversions, which will be

issued in the names of the relevant shareholders of the Company

(the “Shareholders”) in physical share certificates and the

relevant Shareholders may forthwith arrange for deposit of the

Shares into their respective CCASS participant stock accounts).

The key dates in relation to such batch-conversion exercises

(the “Batch-Conversions”) are set out below:

Events

First Batch-Conversion (Notes 1

& 2)

Second Batch-Conversion (Note

2)

Third Batch-Conversion (Note 2)

Fourth Batch-Conversion (Note

2)

The date/period to notify the Company

June 24, 2022 (before 12 noon, U.S.

time)

July 11, 2022 to July 14, 2022 (U.S.

time)

August 1, 2022 to August 4, 2022 (U.S.

time)

August 22, 2022 to August 25, 2022 (U.S.

time)

The date to instruct the relevant brokers

to arrange for cancellation of the ADSs with the Depositary

July 19, 2022 –July 22, 2022 (U.S.

time)

August 9, 2022 –August 12, 2022 (U.S.

time)

August 30, 2022 –September 2, 2022 (U.S.

time)

Estimated time for Shares being

transferred to the designated CCASS participant stock accounts

July 4, 2022 (Hong Kong time)

July 21, 2022 –July 26, 2022 (Hong Kong

time)

August 11, 2022 –August 16, 2022 (Hong

Kong time)

September 1, 2022 –September 6, 2022 (Hong

Kong time)

Notes:

(1) For holders of ADSs who are interested to participate in the

first batch of the Batch-Conversions, the relevant holders of ADSs

shall notify the Company and submit the request for cancellation of

ADSs and arrange for brokers to deliver the relevant ADRs

evidencing such ADSs to the Depositary. The Shares so converted

will be issued in the names of the relevant Shareholders in

physical share certificates and the relevant Shareholders may

forthwith arrange for deposit of the Shares into their respective

CCASS participant stock accounts. The estimated time for Shares

being transferred to the designated CCASS participant stock

accounts referred herein is based on the assumption that relevant

Shareholders shall deposit the Shares into their respective

designated CCASS participant stock accounts forthwith upon

receiving the physical share certificates issued in their own

names.

(2) In the event that the Conversion Cap is reached before the

occurrence of any batch of the Batch-Conversions, the remaining

batch(es) of the Batch-Conversions will not take place, but holders

of ADSs may still instruct their respective brokers to arrange for

the conversion of ADSs to Shares trading in Hong Kong at their own

cost. The Company shall announce the completion of the

Batch-Conversions on its website as soon as the Conversion Cap is

reached and an announcement will be published on the websites of

the SEHK and the Company.

The Company will bear all of the costs, fees and duties payable

associated with cancelling the ADSs and receiving Shares to be

traded on the SEHK for all conversion requests under the

Batch-Conversions, subject to a maximum number of ADSs representing

5.5% of the total issued share capital of the Company (the

“Conversion Cap”) so converted (on a first-come, first

served basis). For investors who wish to participate in the first

batch of the Batch-Conversions or require clarification with

respect to any of the procedures in relation to the

Batch-Conversions , please contact below as soon as possible to

ensure submission of all relevant documents necessary for the

conversion under the Batch-Conversions before the stipulated time

set out in the timetable above:

Investor Relations: OCFT IR Team OCFT_IR@ocft.com

ADSs holders who wish to participate in the Batch-Conversions

first need to have a broker/CCASS account open through which they

can trade Hong Kong listed securities on the SEHK. Such ADS holders

also need to notify the Company and instruct the broker to arrange,

or arrange personally, for surrender of the ADSs to the Depositary

for cancellation of the ADSs within the stipulated period set out

above. The Shares withdrawn from the Depositary’s account with the

custodian within the CCASS system will then be transferred to such

ADS holders’ respective designated broker/CCASS accounts.

The Company wishes to highlight to the ADS holders who are

considering participating in the Batch-Conversions that the above

timetable for the Batch-Conversions are still subject to changes

depending on the date of the Proposed Listing and the Company shall

announce the relevant details to inform the ADS holders as soon as

possible. Further, there is no assurance that the AIP will be

obtained, or that the final approval for the Proposed Listing will

be granted. the Proposed Listing may or may not occur. In the event

that the Proposed Listing does not occur, Shareholders who have

withdrawn their ADSs will not be able to trade on the New York

Stock Exchange unless their Shares are re-deposited to the

Depositary. There is no assurance that Shareholders can trade their

Shares being transferred via the first batch of the

Batch-Conversions by the first day of trading of the Shares on the

SEHK.

The Shares have not been registered under the U.S. Securities

Act of 1933, as amended (the “Securities Act”), or the

securities laws of any other jurisdiction. Unless they are

registered, the Shares may be offered only in transactions that are

exempt from registration under the Securities Act, or the

securities laws of any other jurisdiction. This press release shall

not constitute an offer to sell or the solicitation of an offer or

an invitation to buy any securities of the Company, nor shall there

be any offer or sale of the securities in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or other jurisdiction.

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements constitute “forward-looking” statements within the

meaning of Section 21E of the Securities Exchange Act of 1934, as

amended, and as defined in the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements can be

identified by terminology such as “will”, “expects”, “anticipates”,

“future”, “intends”, “plans”, “believes”, “estimates”, “confident”

and similar statements. Such statements are based upon management’s

current expectations and current market and operating conditions

and relate to events that involve known or unknown risks,

uncertainties and other factors, all of which are difficult to

predict and many of which are beyond the Company’s control.

Forward-looking statements involve inherent risks and

uncertainties. A number of factors could cause actual results to

differ materially from those contained in any forward-looking

statement, including but not limited to the following: the

Company’s limited operating history in the technology-as-a-service

for financial institutions industry; its ability to achieve or

sustain profitability; the tightening of laws, regulations or

standards in the financial services industry; the Company’s ability

to comply with the evolving regulatory requirements in the PRC and

other jurisdictions where it operates; its ability to comply with

existing or future laws and regulations related to data protection

or data security; its ability to maintain and enlarge the customer

base or strengthen customer engagement; its ability to maintain its

relationship with Ping An Group, which is its strategic partner,

most important customer and largest supplier; its ability to

compete effectively to serve China’s financial institutions; the

effectiveness of its technologies, its ability to maintain and

improve technology infrastructure and security measures; its

ability to protect its intellectual property and proprietary

rights; risks of defaults by borrowers under the loans for which

the Company provided credit enhancement under its legacy credit

management business; its ability to maintain or expand relationship

with its business partners and the failure of its partners to

perform in accordance with expectations; its ability to protect or

promote its brand and reputation; its ability to timely implement

and deploy its solutions; its ability to obtain additional capital

when desired; litigation and negative publicity surrounding

China-based companies listed in the U.S.; disruptions in the

financial markets and business and economic conditions; the

Company’s ability to pursue and achieve optimal results from

acquisition or expansion opportunities; the duration of the

COVID-19 outbreak, including the emergence of COVID variants, and

its potential impact on the Company’s business and financial

performance; and assumptions underlying or related to any of the

foregoing. Further information regarding these and other risks is

included in the Company’s filings with the SEC. All information

provided in this press release and in the attachments is as of the

date of this press release, and the Company undertakes no

obligation to update any forward-looking statement, except as

required under applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220621005601/en/

Investor Relations: OCFT IR Team OCFT_IR@ocft.com

Media Relations: Amy Ding PUB_JRYZTPR@ocft.com

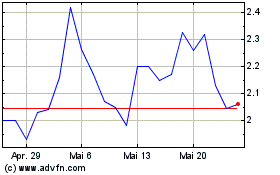

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

Von Jan 2024 bis Jan 2025