Owens Corning (NYSE: OC) today announced that, in connection

with the previously announced exchange offer (the “Exchange Offer”)

by Owens Corning and consent solicitation (the “Consent

Solicitation”) by Masonite International Corporation (“Masonite”),

it has elected to have an Early Settlement Date of May 22, 2024

(the “Early Settlement Date”).

Owens Corning and Masonite are making the Exchange Offer and

Consent Solicitation pursuant to the terms of and subject to the

conditions set forth in the offering memorandum and consent

solicitation statement dated May 1, 2024 (as amended, the

“Statement”).

On the Early Participation Deadline (as defined below), Masonite

and Computershare Trust Company, N.A. entered into the supplemental

indenture that gave effect to the Proposed Amendments (as defined

in the Statement) to the 3.50% Senior Notes due 2030 issued by

Masonite (the “Existing Masonite Notes”). On the Early Settlement

Date, Owens Corning will accept for exchange all of the Existing

Masonite Notes that were validly tendered and not validly withdrawn

at or prior to 5:00 p.m., New York City time, on May 14, 2024 (the

“Early Participation Deadline”) and the Proposed Amendments will

become operative.

Notwithstanding the Early Settlement Date, Eligible Holders (as

defined below) who did not tender at or prior to the Early

Participation Deadline may still tender Existing Masonite Notes in

the Exchange Offer until 5:00 p.m., New York City time, on May 30,

2024, unless such date is extended or the Exchange Offer and

Consent Solicitation are earlier terminated (such date and time, as

the same may be extended, the “Expiration Time”).

Owens Corning has engaged Morgan Stanley & Co. LLC as Lead

Dealer Manager and Solicitation Agent and Wells Fargo Securities,

LLC as Co-Dealer Manager and Solicitation Agent for the Exchange

Offer. Copies of the Statement may be obtained from Global

Bondholder Services Corporation, the Exchange Agent and Information

Agent, by phone at (855) 654-2015 (toll-free) or (212) 430-3774

(collect for banks and brokers) or by email at

contact@gbsc-usa.com. Please direct questions regarding the

Exchange Offer to Morgan Stanley & Co. LLC at (800) 624-1808

(toll-free) or (212) 761-1057 (collect for banks and brokers).

The Statement and other documents relating to the Exchange Offer

and Consent Solicitation will only be distributed to Eligible

Holders of Existing Masonite Notes who complete and return an

eligibility form confirming that they are either (a) a “Qualified

Institutional Buyer” as that term is defined in Rule 144A under the

Securities Act of 1933, as amended (“Securities Act”), or (b) a

person that is outside the “United States” and is (i) not a “U.S.

person,” as those terms are defined in Rule 902 under the

Securities Act and (ii) a “non-U.S. qualified offeree” (as defined

in the Statement) (such holders, the “Eligible Holders”). Eligible

Holders of Existing Masonite Notes who desire to obtain and

complete an eligibility form should either visit the website for

this purpose at https://gbsc-usa.com/eligibility/owenscorning or

call Global Bondholder Services Corporation, the Exchange Agent and

Information Agent for the Exchange Offer and Consent Solicitation

at (855) 654-2015 (toll-free) or (212) 430-3774 (collect for banks

and brokers).

The New Owens Corning Notes (as defined in the Statement) have

not been registered under the Securities Act or any state

securities laws. Therefore, the New Owens Corning Notes may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements of the

Securities Act and any applicable state securities laws.

About Owens Corning

Owens Corning is a global building and construction materials

leader committed to building a sustainable future through material

innovation. Our four integrated businesses – Roofing, Insulation,

Doors, and Composites – provide durable, sustainable,

energy-efficient solutions that leverage our unique material

science, manufacturing, and market knowledge to help our customers

win and grow. We are global in scope, human in scale with more than

25,000 employees in 31 countries dedicated to generating value for

our customers and shareholders, and making a difference in the

communities where we work and live. Founded in 1938 and based in

Toledo, Ohio, USA, Owens Corning posted 2023 sales of $9.7

billion.

Forward-Looking Statements

This communication contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements present our current forecasts and estimates of future

events. These statements do not strictly relate to historical or

current results and can be identified by words such as

“anticipate,” “appear,” “assume,” “believe,” “estimate,” “expect,”

“forecast,” “intend,” “likely,” “may,” “plan,” “project,” “seek,”

“should,” “strategy,” “will,” “can,” “could,” “predict,” “future,”

“potential,” “intend,” “forecast,” “look,” “build,” “focus,”

“create,” “work,” “continue,” “target,” “poised,” “advance,”

“drive,” “aim,” “approach,” “seek,” “schedule,” “position,”

“pursue,” “progress,” “budget,” “outlook,” “trend,” “guidance,”

“commit,” “on track,” “objective,” “goal,” “opportunity,”

“ambitions,” “aspire” and variations of negatives of such terms or

variations thereof. Other words and terms of similar meaning or

import in connection with any discussion of future plans, actions,

events or operating, financial or other performance identify

forward-looking statements.

Forward-looking statements by their nature address matters that

are, to different degrees, uncertain. All such forward-looking

statements are based upon current plans, estimates, expectations

and ambitions that are subject to risks, uncertainties, assumptions

and other factors, many of which are beyond our control, that could

cause actual results to differ materially from the results

projected in such forward-looking statements. These risks,

uncertainties, assumptions and other factors include, without

limitation: levels of residential and commercial or industrial

construction activity; demand for our products; industry and

economic conditions including, but not limited to, supply chain

disruptions, recessionary conditions, inflationary pressures,

interest rate and financial markets volatility, and the viability

of banks and other financial institutions; availability and cost of

energy and raw materials; levels of global industrial production;

competitive and pricing factors; relationships with key customers

and customer concentration in certain areas; issues related to

acquisitions, divestitures and joint ventures or expansions,

including the acquisition of Masonite; climate change, weather

conditions and storm activity; legislation and related regulations

or interpretations, in the United States or elsewhere; domestic and

international economic and political conditions, policies or other

governmental actions, as well as war and civil disturbance; changes

to tariff, trade or investment policies or laws; uninsured losses,

including those from natural disasters, catastrophes, pandemics,

theft or sabotage; environmental, product-related or other legal

and regulatory liabilities, proceedings or actions; research and

development activities and intellectual property protection; issues

involving implementation and protection of information technology

systems; foreign exchange and commodity price fluctuations; our

level of indebtedness, including indebtedness incurred in

connection with the acquisition of Masonite; our liquidity and the

availability and cost of credit; our ability to achieve expected

synergies, cost reductions and/or productivity improvements; the

level of fixed costs required to run our business; levels of

goodwill or other indefinite-lived intangible assets; price

volatility in certain wind energy markets in the U.S.; loss of key

employees and labor disputes or shortages; our ability to

successfully integrate the Masonite acquisition; any material

adverse changes in the business of Masonite; our ability to achieve

the strategic and other objectives relating to the Masonite

acquisition, including any expected synergies; the strategic review

of our glass reinforcements business; defined benefit plan funding

obligations; and other factors detailed from time to time in our

SEC filings.

All forward-looking statements in this communication should be

considered in the context of the risks and other factors described

above and in the specific factors discussed under the heading “Risk

Factors” in our most recent Annual Report on Form 10-K filed with

the SEC, in each case as these risk factors are amended or

supplemented by subsequent Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K. Our reports that are filed with the

SEC are available on our website at

https://investor.owenscorning.com/investors and on the SEC website

at http://www.sec.gov. Any forward-looking statements speak only as

of the date the statement is made and we undertake no obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by law. It is not possible to identify all of the risks,

uncertainties and other factors that may affect future results. In

light of these risks and uncertainties, the forward-looking events

and circumstances discussed herein may not occur and actual results

may differ materially from those anticipated or implied in the

forward-looking statements. Accordingly, readers are cautioned not

to place undue reliance on any forward-looking statements.

No Offer or Solicitation

This communication is not intended to and does not constitute an

offer to purchase, or the solicitation of an offer to sell, or the

solicitation of tenders or consents with respect to any security.

No offer, solicitation, purchase or sale will be made in any

jurisdiction in which such an offer, solicitation, or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. In the case of the

Exchange Offer and Consent Solicitation, the Exchange Offer and

Consent Solicitation are being made solely pursuant to the

Statement and only to such persons and in such jurisdictions as is

permitted under applicable law.

Owens Corning Company News / Owens Corning Investor Relations

News

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240520258310/en/

Media Relations: Megan James 419.348.0768

Investor Relations: Amber Wohlfarth 419.248.5639

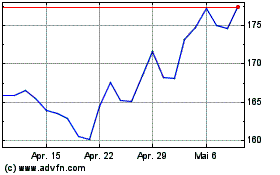

Owens Corning (NYSE:OC)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

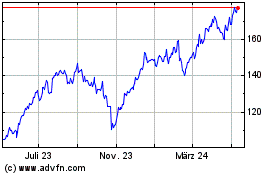

Owens Corning (NYSE:OC)

Historical Stock Chart

Von Jun 2023 bis Jun 2024