false

0001595527

0001595527

2024-12-18

2024-12-18

0001595527

us-gaap:CommonStockMember

2024-12-18

2024-12-18

0001595527

us-gaap:RightsMember

2024-12-18

2024-12-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): December 18, 2024

American Strategic Investment Co.

(Exact Name of Registrant as Specified in Charter)

Maryland |

|

001-39448 |

|

46-4380248 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

|

|

222

Bellevue Ave,

Newport, Rhode Island 02840 |

(Address, including zip code, of Principal

Executive Offices) |

| |

| Registrant’s telephone number, including area code: (212)

415-6500 |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

Title

of each class: |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Class

A common stock, $0.01 par value per share |

|

NYC |

|

New

York Stock Exchange |

| Class

A Preferred Stock Purchase Rights |

|

true |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

On

December 18, 2024, ARCNYC570SEVENTH, LLC, a Delaware limited liability company (the “Seller”) and a wholly-owned subsidiary

of American Strategic Investment Co. (the “Company”), consummated the

sale of its 9 Times Square Midtown Manhattan property (the “Property”) to 9 Times Square Acquisitions, LLC, a Delaware

limited liability company (the “Buyer”), pursuant to that certain Purchase and Sale Agreement, dated August 1, 2024,

as amended on November 19, 2024, by and between the Seller and the Buyer. The Property was sold for a gross purchase price of $63.5 million.

There were no material relationships, other than in respect of the sale of the Property, among the Seller and the Company, and their respective

affiliates, on the one hand, and the Buyer and its affiliates on the other hand.

Item

9.01 Financial Statements and Exhibits.

| (b) | Pro forma financial information. |

The pro forma financial information

of the Company as adjusted to give effect to the sale of the Property is presented in the unaudited pro forma consolidated financial statements

filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference in this Item 9.01.

(d)

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

American Strategic Investment Co. |

| |

|

|

| Date: December 26, 2024 |

By: |

/s/ Michael Anderson |

| |

|

Michael Anderson |

| |

|

Chief Executive Officer |

Exhibit 99.1

UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL

INFORMATION

On December 18, 2024 (the “Closing Date”),

ARCNYC570SEVENTH, LLC a Delaware limited liability company (“Seller”) a wholly-owned subsidiary of American Strategic Investment

Co., a Maryland corporation (the “Company”), consummated the sale (the “Disposition”)

of its property located at 9 Times Square (a/k/a 200 W. 41st Street) (“9 Times Square Property”) to 9 TIMES SQUARE

ACQUISITIONS, LLC., a Delaware limited liability company (the “Buyer”), pursuant to that certain Purchase and Sale Agreement,

dated August 1, 2024, as amended on November 19, 2024, by and between the Buyer and the Seller. The gross purchase price for the 9 Times

Square Property was $63.5 million.

Prior to the consummation of the sale of the 9

Times Square Property, during the quarter ended June 30, 2024, the Company recorded an impairment charge of $84.7 million based on the

estimated fair value of the 9 Times Square Property, which the Company had determined to market for sale. During the quarter ended September

30, 2024, the Company classified the 9 Times Square Property as held for sale and recorded an additional impairment of $1.9 million for

estimated selling costs. As such, the pro forma statement of operations for the nine months ended September 30, 2024 includes an adjustment

of $86.7 million to remove such impairment charges. On the Closing Date, the Company repaid the $49.5 million mortgage held by Capital

One N.A. with respect to the 9 Times Square Property and incurred certain minimal additional closing costs of $0.3 million, which is recorded

in “Gain or (Loss) on sale of real estate investments” on the pro forma statement of operations for the nine months ended

September 30, 2024.

The following unaudited pro forma

consolidated financial information of the Company, as of and for the nine months ended September 30, 2024 and for the year ended

December 31, 2023, has been prepared for informational purposes only in accordance with Article 11 of Regulation S-X and does not

purport to be indicative of what would have resulted had the Disposition occurred on the dates indicated or the Company’s

future results. The unaudited pro forma consolidated balance sheet as of September 30, 2024 assumes the Disposition closed on

September 30, 2024. The unaudited pro forma consolidated statements of operations for the year ended December 31, 2023, and the nine

months ended September 30, 2024, assumes the Disposition was consummated on January 1, 2023. The unaudited pro forma consolidated

financial information of the Company reflects the removal of the assets and liabilities of the 9 Times Square Property and its

results of operations and reflects a loss associated with the anticipated disposition of that property, which is preliminary.

The unaudited

combined pro forma adjustments reflecting the consummation of the Disposition are based on the foregoing and certain other estimates

and assumptions described below, which are based on information available as of the date of these unaudited pro forma combined financial

statements and may be revised as additional information becomes available. Therefore, it is likely that the actual adjustments will differ

from the pro forma adjustments and it is possible the difference may be material.

American Strategic Investment Co.

Unaudited Pro Forma Consolidated Balance Sheet

September 30, 2024

(In thousands, except per share amounts)

| | |

Historical

Company (a) | | |

9 Times Square

Disposition Adjustments (b) | | |

Pro Forma

Company | |

| ASSETS | |

| | | |

| | | |

| | |

| Real estate investments, at cost: | |

| | | |

| | | |

| | |

| Land | |

$ | 129,517 | | |

$ | - | | |

$ | 129,517 | |

| Buildings, fixtures and improvements | |

| 341,159 | | |

| - | | |

| 341,159 | |

| Acquired intangible lease assets | |

| 19,177 | | |

| - | | |

| 19,177 | |

| Total real estate investments, at cost | |

| 489,853 | | |

| - | | |

| 489,853 | |

| Less: accumulated depreciation and amortization | |

| (87,889 | ) | |

| - | | |

| (87,889 | ) |

| Total real estate investments, net | |

| 401,964 | | |

| - | | |

| 401,964 | |

| Cash and cash equivalents | |

| 5,234 | | |

| 10,442 | (c) | |

| 15,676 | |

| Restricted cash | |

| 10,528 | | |

| (328 | ) | |

| 10,200 | |

| Operating lease right-of-use asset | |

| 54,570 | | |

| - | | |

| 54,570 | |

| Prepaid expenses and other assets | |

| 4,353 | | |

| (683 | ) | |

| 3,670 | |

| Derivative asset, at fair value | |

| - | | |

| - | | |

| - | |

| Straight-line rent receivable | |

| 30,001 | | |

| (6,822 | ) | |

| 23,179 | |

| Deferred Costs, net | |

| 8,338 | | |

| (1,589 | ) | |

| 6,749 | |

| Assets held for sale | |

| 52,924 | | |

| (52,924 | ) | |

| - | |

| Total assets | |

$ | 567,912 | | |

$ | (51,903 | ) | |

$ | 516,009 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | | |

| | |

| Mortgage Notes Payable, net | |

$ | 396,838 | | |

$ | (49,501 | ) | |

$ | 347,337 | |

| Accounts payable, accrued expenses and other liabilities (including amounts due to related parties of $226 and $20 at September 30, 2024 and December 31, 2023, respectively) | |

| 18,137 | | |

| (1,706 | ) | |

| 16,431 | |

| Note payable to related parties | |

| 575 | | |

| - | | |

| 575 | |

| Operating lease liability | |

| 54,609 | | |

| - | | |

| 54,609 | |

| Below-market lease liabilities, net | |

| 1,361 | | |

| - | | |

| 1,361 | |

| Deferred revenue | |

| 4,019 | | |

| (360 | ) | |

| 3,659 | |

| Total liabilities | |

| 475,539 | | |

| (51,566 | ) | |

| 423,973 | |

| | |

| | | |

| | | |

| | |

| Preferred stock, $0.01 par value, 50,000,000 shares authorized, none issued and outstanding at September 30, 2024 and December 31, 2023 | |

| - | | |

| - | | |

| - | |

| Common stock, $0.01 par value, 300,000,000 shares authorized, 2,663,980 and 2,334,340 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively | |

| 26 | | |

| - | | |

| 26 | |

| Additional paid-in capital | |

| 731,567 | | |

| - | | |

| 731,567 | |

| Accumulated other comprehensive income | |

| - | | |

| - | | |

| - | |

| Distributions in excess of accumulated earnings | |

| (639,220 | ) | |

| (337 | )(d) | |

| (639,557 | ) |

| Total equity | |

| 92,373 | | |

| (337 | ) | |

| 92,036 | |

| Total liabilities and equity | |

$ | 567,912 | | |

$ | (51,903 | ) | |

$ | 516,009 | |

American Strategic Investment Co.

Unaudited Pro Forma Consolidated Statement of Operations

For the Nine Months Ended September 30, 2024

(In thousands, except share and per share data)

| |

|

Historical

Company (a) |

|

|

9 Times Square

Disposition Adjustments (b) |

|

|

Pro Forma

Company |

|

| Revenue from tenants |

|

$ |

46,681 |

|

|

$ |

(6,759 |

) |

|

$ |

39,922 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Asset and property management fees to related parties |

|

|

5,824 |

|

|

|

(171 |

) |

|

|

5,653 |

|

| Property operating |

|

|

25,439 |

|

|

|

(3,362 |

) |

|

|

22,077 |

|

| Impairment of real estate investments |

|

|

112,541 |

|

|

|

(86,698 |

) |

|

|

25,843 |

|

| Equity-based compensation |

|

|

316 |

|

|

|

- |

|

|

|

316 |

|

| General and administrative |

|

|

6,526 |

|

|

|

(99 |

) |

|

|

6,427 |

|

| Depreciation and amortization |

|

|

14,826 |

|

|

|

(2,662 |

) |

|

|

12,164 |

|

| Total operating expenses |

|

|

165,472 |

|

|

|

(92,992 |

) |

|

|

72,480 |

|

| Operating income (loss) before gain on sale of real estate investments |

|

|

(118,791 |

) |

|

|

86,233 |

|

|

|

(32,558 |

) |

| Gain or (Loss) on sale/exchange of real estate investments |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Operating income |

|

|

(118,791 |

) |

|

|

86,233 |

|

|

|

(32,558 |

) |

| Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(15,177 |

) |

|

|

2,573 |

|

|

|

(12,604 |

) |

| Other income |

|

|

27 |

|

|

|

(4 |

) |

|

|

23 |

|

| Loss on non-designated derivatives |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Total other expense, net |

|

|

(15,150 |

) |

|

|

2,569 |

|

|

|

(12,581 |

) |

| Net loss and Net loss attributable to common stockholders |

|

|

(133,941 |

) |

|

|

88,802 |

|

|

|

(45,139 |

) |

| Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

| Change in unrealized (loss) gain on derivative |

|

|

(406 |

) |

|

|

406 |

|

|

|

- |

|

| Comprehensive loss |

|

|

(134,347 |

) |

|

|

89,208 |

|

|

|

(45,139 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares outstanding - Basic and Diluted |

|

|

2,464,574 |

|

|

|

|

|

|

|

2,464,574 |

|

| Net (loss) income attributable to common stockholders - Basic and Diluted |

|

$ |

(54.35 |

) |

|

|

|

|

|

$ |

(18.32 |

) |

American Strategic Investment Co.

Unaudited Pro Forma Consolidated Statement of Operations

For the Year Ended December 31, 2023

(In thousands, except

share and per share data)

| | |

Historical

Company (a) | | |

9 Times Square

Disposition Adjustments (b) | | |

Pro Forma

Company | |

| Revenue from tenants | |

$ | 62,710 | | |

$ | (8,903 | ) | |

$ | 53,807 | |

| | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | |

| Asset and property management fees to related parties | |

| 7,680 | | |

| (231 | ) | |

| 7,449 | |

| Property operating | |

| 33,797 | | |

| (4,800 | ) | |

| 28,997 | |

| Impairment of real estate investments | |

| 66,565 | | |

| - | | |

| 66,565 | |

| Equity-based compensation | |

| 5,863 | | |

| - | | |

| 5,863 | |

| General and administrative | |

| 9,375 | | |

| (151 | ) | |

| 9,224 | |

| Depreciation and amortization | |

| 26,532 | | |

| (6,058 | ) | |

| 20,474 | |

| Total operating expenses | |

| 149,812 | | |

| (11,241 | ) | |

| 138,571 | |

| Operating income (loss) before gain on sale of real estate investments | |

| (87,102 | ) | |

| 2,337 | | |

| (84,765 | ) |

| Gain or (Loss) on sale/exchange of real estate investments | |

| - | | |

| (249 | ) | |

| (249 | ) |

| Operating Loss | |

| (87,102 | ) | |

| 2,088 | | |

| (85,014 | ) |

| Other (expense) income: | |

| | | |

| | | |

| | |

| Interest expense | |

| (18,858 | ) | |

| 2,341 | | |

| (16,517 | ) |

| Other income | |

| 36 | | |

| (5 | ) | |

| 31 | |

| Loss on non-designated derivatives | |

| - | | |

| - | | |

| - | |

| Total other expense, net | |

| (18,822 | ) | |

| 2,337 | | |

| (16,485 | ) |

| Net loss and Net loss attributable to common stockholders | |

| (105,924 | ) | |

| 4,425 | | |

| (101,499 | ) |

| Other comprehensive income (loss): | |

| | | |

| | | |

| | |

| Change in unrealized (loss) gain on derivative | |

| (1,231 | ) | |

| 1,207 | | |

| (24 | ) |

| Comprehensive loss | |

| (107,155 | ) | |

| 5,632 | | |

| (101,523 | ) |

| | |

| | | |

| | | |

| | |

| Weighted-average shares outstanding - Basic and Diluted | |

| 2,226,721 | | |

| | | |

| 2,226,721 | |

| Net (loss) income attributable to common stockholders - Basic and Diluted | |

$ | (47.57 | ) | |

| | | |

$ | (45.59 | ) |

AMERICAN STRATEGIC INVESTMENT

CO.

NOTES TO UNAUDITED PRO FORMA

CONSOLIDATED

FINANCIAL STATEMENTS

The above unaudited pro forma consolidated financial

statement presentation has been prepared based upon certain pro forma adjustments to the historical consolidated financial statements

of the Company. Certain assumptions regarding the operations of the Company have been made in connection with the preparation of these

unaudited pro forma consolidated financial statements. These assumptions are as follows:

1. Adjustments to Pro Forma Consolidated

Balance Sheet

(a) Represents

the Company’s historical consolidated balance sheet as of September 30, 2024, which was derived from the Company’s Quarterly

Report on Form 10-Q for the quarterly period ended September 30, 2024.

(b) Represents

the necessary removal from the historical balance sheet as of September 30, 2024 of the impact of the following assets and liabilities

associated with the 9 Times Square Property: cash and cash equivalents; restricted cash; prepaid expenses and other assets; straight-line

rent receivable; deferred costs, net; the $49.5 million mortgage held by Capital One mortgage with respect to the property; certain accrued

payable, accrued expenses and other liabilities; deferred revenue; and distributions in excess of accumulated earnings.

(c) Represents

further adjustments to cash and cash equivalents as a result of the net $10.5 million of net cash proceeds the Company received from the

Disposition after the settlement of prorations, payment of the mortgage and selling costs.

(d) The

Company incurred $2.2 million of total selling costs, of which $1.9 million were recorded during the nine months ended September 30,

2024, within “Impairment on real estate investments” and an additional $0.3 million of such costs incurred at the time

of the closing of the Disposition.

2. Adjustments to Pro Forma Consolidated Statements

of Operation

(a) Represents

the Company’s historical consolidated statements of operations for the nine months ended September 30, 2024 and the year ended December

31, 2023, which were derived from the Company’s Quarterly Report on Form 10-Q for the nine months ended September 30, 2024 and the

Annual Report on Form 10-K for the year ended December 31, 2023, respectively.

(b) Represents

the necessary removal from the historical consolidated statements of operations for the year ended December 31, 2023, and the nine

months ended September 30, 2024, of the impact of the following associated with the 9 Times Square Property: impairment charges

recorded for the property as it was determined that the carrying value exceeded the Company’s expected sales price of the

asset, less the costs to sell the property; certain property expenses and general and administrative expenses associated with

maintenance of the property; depreciation and amortization with respect to the property; interest expense related to the mortgage on

the property that was repaid on the Closing Date, as well as adjustments for the $0.3 million of additional selling costs incurred

at the time of the closing of the Disposition.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_RightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

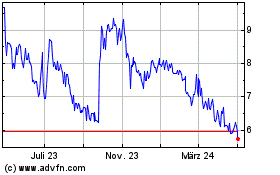

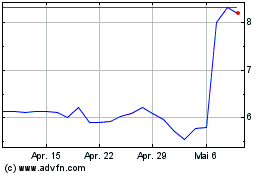

American Strategic Inves... (NYSE:NYC)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

American Strategic Inves... (NYSE:NYC)

Historical Stock Chart

Von Jan 2024 bis Jan 2025