0001618563--12-312023Q2false00016185632023-01-012023-06-300001618563us-gaap:CommonClassAMember2023-01-012023-06-300001618563us-gaap:RedeemablePreferredStockMember2023-01-012023-06-3000016185632023-08-07xbrli:shares00016185632023-06-30iso4217:USD00016185632022-12-310001618563us-gaap:SeriesAPreferredStockMember2023-06-30iso4217:USDxbrli:shares0001618563us-gaap:SeriesAPreferredStockMember2022-12-310001618563us-gaap:SeriesBPreferredStockMember2023-06-3000016185632023-04-012023-06-3000016185632022-04-012022-06-3000016185632022-01-012022-06-300001618563nsa:PropertyRelatedOtherMember2023-04-012023-06-300001618563nsa:PropertyRelatedOtherMember2022-04-012022-06-300001618563nsa:PropertyRelatedOtherMember2023-01-012023-06-300001618563nsa:PropertyRelatedOtherMember2022-01-012022-06-300001618563nsa:ManagementFeesAndOtherMember2023-04-012023-06-300001618563nsa:ManagementFeesAndOtherMember2022-04-012022-06-300001618563nsa:ManagementFeesAndOtherMember2023-01-012023-06-300001618563nsa:ManagementFeesAndOtherMember2022-01-012022-06-300001618563us-gaap:PreferredStockMember2021-12-310001618563us-gaap:CommonStockMember2021-12-310001618563us-gaap:AdditionalPaidInCapitalMember2021-12-310001618563us-gaap:RetainedEarningsMember2021-12-310001618563us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001618563us-gaap:NoncontrollingInterestMember2021-12-3100016185632021-12-310001618563us-gaap:NoncontrollingInterestMember2022-01-012022-03-3100016185632022-01-012022-03-310001618563nsa:OPUnitsSubordinatedPerformanceUnitsAndSeriesA1PreferredUnitsMemberus-gaap:NoncontrollingInterestMember2022-01-012022-03-310001618563us-gaap:PreferredStockMember2022-01-012022-03-310001618563us-gaap:CommonStockMember2022-01-012022-03-310001618563us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310001618563us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001618563us-gaap:RetainedEarningsMember2022-01-012022-03-310001618563us-gaap:PreferredStockMember2022-03-310001618563us-gaap:CommonStockMember2022-03-310001618563us-gaap:AdditionalPaidInCapitalMember2022-03-310001618563us-gaap:RetainedEarningsMember2022-03-310001618563us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001618563us-gaap:NoncontrollingInterestMember2022-03-3100016185632022-03-310001618563nsa:OPUnitsAndSubordinatedPerformanceUnitsNetOfOfferingCostsMemberus-gaap:NoncontrollingInterestMember2022-04-012022-06-300001618563nsa:OPUnitsAndSubordinatedPerformanceUnitsNetOfOfferingCostsMember2022-04-012022-06-300001618563us-gaap:PreferredStockMember2022-04-012022-06-300001618563us-gaap:NoncontrollingInterestMember2022-04-012022-06-300001618563us-gaap:CommonStockMember2022-04-012022-06-300001618563us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001618563us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001618563us-gaap:RetainedEarningsMember2022-04-012022-06-300001618563us-gaap:PreferredStockMember2022-06-300001618563us-gaap:CommonStockMember2022-06-300001618563us-gaap:AdditionalPaidInCapitalMember2022-06-300001618563us-gaap:RetainedEarningsMember2022-06-300001618563us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001618563us-gaap:NoncontrollingInterestMember2022-06-3000016185632022-06-300001618563us-gaap:PreferredStockMember2022-12-310001618563us-gaap:CommonStockMember2022-12-310001618563us-gaap:AdditionalPaidInCapitalMember2022-12-310001618563us-gaap:RetainedEarningsMember2022-12-310001618563us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001618563us-gaap:NoncontrollingInterestMember2022-12-310001618563us-gaap:PreferredStockMember2023-01-012023-03-310001618563us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-3100016185632023-01-012023-03-310001618563us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001618563nsa:SeriesA1PreferredUnitsMemberus-gaap:NoncontrollingInterestMember2023-01-012023-03-310001618563us-gaap:CommonStockMember2023-01-012023-03-310001618563us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001618563us-gaap:RetainedEarningsMember2023-01-012023-03-310001618563us-gaap:PreferredStockMember2023-03-310001618563us-gaap:CommonStockMember2023-03-310001618563us-gaap:AdditionalPaidInCapitalMember2023-03-310001618563us-gaap:RetainedEarningsMember2023-03-310001618563us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001618563us-gaap:NoncontrollingInterestMember2023-03-3100016185632023-03-310001618563us-gaap:NoncontrollingInterestMember2023-04-012023-06-300001618563us-gaap:CommonStockMember2023-04-012023-06-300001618563us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001618563us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001618563us-gaap:RetainedEarningsMember2023-04-012023-06-300001618563us-gaap:PreferredStockMember2023-06-300001618563us-gaap:CommonStockMember2023-06-300001618563us-gaap:AdditionalPaidInCapitalMember2023-06-300001618563us-gaap:RetainedEarningsMember2023-06-300001618563us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001618563us-gaap:NoncontrollingInterestMember2023-06-30nsa:metropolitan_statistical_area0001618563us-gaap:ConsolidatedPropertiesMember2023-06-30nsa:propertynsa:stateutr:sqftnsa:storage_unit0001618563us-gaap:CorporateJointVentureMember2023-01-010001618563us-gaap:UnconsolidatedPropertiesMemberus-gaap:CorporateJointVentureMember2023-06-300001618563nsa:A2018JointVentureMember2023-06-30xbrli:pure0001618563nsa:A2016JointVentureMember2023-06-300001618563us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-06-30nsa:partnership0001618563us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001618563nsa:FixedRateMortgagesMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:MortgagesMember2023-06-300001618563nsa:FixedRateMortgagesMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:MortgagesMember2022-12-310001618563nsa:TenantInsuranceAndProtectionPlanFeesAndCommissionsMember2023-04-012023-06-300001618563nsa:TenantInsuranceAndProtectionPlanFeesAndCommissionsMember2022-04-012022-06-300001618563nsa:TenantInsuranceAndProtectionPlanFeesAndCommissionsMember2023-01-012023-06-300001618563nsa:TenantInsuranceAndProtectionPlanFeesAndCommissionsMember2022-01-012022-06-300001618563nsa:RetailProductsAndSuppliesMember2023-04-012023-06-300001618563nsa:RetailProductsAndSuppliesMember2022-04-012022-06-300001618563nsa:RetailProductsAndSuppliesMember2023-01-012023-06-300001618563nsa:RetailProductsAndSuppliesMember2022-01-012022-06-300001618563nsa:PropertyManagementCallCenterAndPlatformFeesMember2023-01-012023-06-300001618563nsa:PropertyManagementCallCenterAndPlatformFeesMember2023-04-012023-06-300001618563nsa:PropertyManagementCallCenterAndPlatformFeesMember2022-04-012022-06-300001618563nsa:PropertyManagementCallCenterAndPlatformFeesMember2022-01-012022-06-300001618563nsa:AcquisitionFeesMember2023-04-012023-06-300001618563nsa:AcquisitionFeesMember2022-04-012022-06-300001618563nsa:AcquisitionFeesMember2023-01-012023-06-300001618563nsa:AcquisitionFeesMember2022-01-012022-06-300001618563nsa:TenantWarrantyProtectionMember2023-04-012023-06-300001618563nsa:TenantWarrantyProtectionMember2022-04-012022-06-300001618563nsa:TenantWarrantyProtectionMember2023-01-012023-06-300001618563nsa:TenantWarrantyProtectionMember2022-01-012022-06-300001618563nsa:PriorAtTheMarketSalesAgreementMember2019-02-2700016185632019-02-270001618563nsa:PriorAtTheMarketSalesAgreementMember2019-02-272019-02-270001618563nsa:AtTheMarketProgramMember2021-05-190001618563nsa:AtTheMarketProgramMember2023-06-3000016185632022-07-110001618563nsa:NSAOPLPMemberus-gaap:SeriesBPreferredStockMember2023-03-150001618563nsa:NSAOPLPMemberus-gaap:SeriesBPreferredStockMember2023-03-152023-03-150001618563nsa:NSAOPLPMemberus-gaap:SeriesAPreferredStockMember2023-03-152023-03-150001618563nsa:NSAOPLPMemberus-gaap:SeriesBPreferredStockMember2023-06-300001618563nsa:NSAOPLPMembernsa:SeriesA1PreferredUnitsMember2023-01-012023-06-300001618563nsa:PersonalMiniMemberus-gaap:SeriesBPreferredStockMember2023-03-162023-03-160001618563nsa:PersonalMiniMemberus-gaap:SeriesBPreferredStockMember2023-03-160001618563nsa:ClassBUnitMembernsa:PersonalMiniAffiliateMembernsa:PersonalMiniMember2023-03-162023-03-160001618563us-gaap:SeriesBPreferredStockMember2023-03-160001618563nsa:NSAOPLPMembernsa:SeriesA1PreferredUnitsMember2023-06-300001618563nsa:NSAOPLPMembernsa:SeriesA1PreferredUnitsMember2022-12-310001618563nsa:NSAOPLPMembernsa:ClassAUnitsMember2023-06-300001618563nsa:NSAOPLPMembernsa:ClassAUnitsMember2022-12-310001618563nsa:NSAOPLPMembernsa:ClassBUnitMember2023-06-300001618563nsa:NSAOPLPMembernsa:ClassBUnitMember2022-12-310001618563nsa:NSAOPLPMembernsa:LongTermIncentivePlanUnitMember2023-06-300001618563nsa:NSAOPLPMembernsa:LongTermIncentivePlanUnitMember2022-12-310001618563nsa:ClassAUnitsMembernsa:DownREITPartnershipMember2023-06-300001618563nsa:ClassAUnitsMembernsa:DownREITPartnershipMember2022-12-310001618563nsa:ClassBUnitMembernsa:DownREITPartnershipMember2023-06-300001618563nsa:ClassBUnitMembernsa:DownREITPartnershipMember2022-12-310001618563nsa:PartnershipSubsidiariesMember2023-06-300001618563nsa:PartnershipSubsidiariesMember2022-12-310001618563us-gaap:RedeemablePreferredStockMembernsa:NSAOPLPMember2023-06-300001618563nsa:NSAOPLPMembernsa:ClassAUnitsMember2023-01-012023-06-300001618563nsa:NSAOPLPMembernsa:ClassBUnitMember2023-01-012023-06-300001618563nsa:NorthwestRetirementMembernsa:NSAOPLPMembernsa:ClassAUnitsMember2023-01-012023-06-300001618563nsa:NorthwestRetirementMembernsa:NSAOPLPMembernsa:ClassBUnitMember2023-01-012023-06-300001618563nsa:NSAOPLPMembernsa:LongTermIncentivePlanUnitMember2023-01-012023-06-300001618563nsa:NSAOPLPMemberus-gaap:CommonStockMembernsa:ClassAUnitsMember2023-01-012023-06-300001618563nsa:ClassAUnitsMembernsa:DownREITPartnershipMember2023-01-012023-06-300001618563nsa:NSAOPLPMembernsa:DownREITSubordinatedPerformancePerformanceUnitsMember2023-01-012023-06-300001618563nsa:ClassBUnitMember2023-01-012023-06-300001618563nsa:NSAOPLPMembernsa:ClassAUnitsMembernsa:RetirementOfNorthwestMember2023-01-012023-06-300001618563nsa:NSAOPLPMembernsa:ClassBUnitMembernsa:RetirementOfNorthwestMember2023-01-012023-06-300001618563us-gaap:UnconsolidatedPropertiesMemberus-gaap:CorporateJointVentureMembernsa:A2018JointVentureMember2023-06-300001618563nsa:A2016JointVentureMemberus-gaap:UnconsolidatedPropertiesMemberus-gaap:CorporateJointVentureMember2023-06-300001618563us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMemberus-gaap:CorporateJointVentureMember2023-06-300001618563us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMemberus-gaap:CorporateJointVentureMember2022-12-310001618563us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMemberus-gaap:CorporateJointVentureMember2023-04-012023-06-300001618563us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMemberus-gaap:CorporateJointVentureMember2022-04-012022-06-300001618563us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMemberus-gaap:CorporateJointVentureMember2023-01-012023-06-300001618563us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMemberus-gaap:CorporateJointVentureMember2022-01-012022-06-300001618563nsa:AssetAcquiredFromPROsMember2023-01-012023-06-300001618563us-gaap:LeasesAcquiredInPlaceMember2023-01-012023-06-300001618563us-gaap:LandAndBuildingMember2023-01-012023-06-300001618563nsa:NorthwestsRightToPropertyManagementContractsBrandIntellectualPropertyCertainTangibleAssetsMember2023-01-012023-06-300001618563us-gaap:LeasesAcquiredInPlaceMember2023-06-300001618563us-gaap:LeasesAcquiredInPlaceMember2022-12-310001618563us-gaap:RelatedPartyMember2023-06-300001618563us-gaap:RelatedPartyMember2022-12-310001618563us-gaap:TradeNamesMember2023-06-300001618563us-gaap:TradeNamesMember2022-12-310001618563us-gaap:ServiceAgreementsMember2023-06-300001618563us-gaap:ServiceAgreementsMember2022-12-310001618563nsa:TenantReinsuranceIntangibleMember2023-06-300001618563nsa:TenantReinsuranceIntangibleMember2022-12-310001618563us-gaap:LeasesAcquiredInPlaceMember2023-04-012023-06-300001618563us-gaap:LeasesAcquiredInPlaceMember2022-04-012022-06-300001618563us-gaap:LeasesAcquiredInPlaceMember2022-01-012022-06-300001618563us-gaap:ServiceAgreementsMember2023-04-012023-06-300001618563us-gaap:ServiceAgreementsMember2022-04-012022-06-300001618563us-gaap:ServiceAgreementsMember2023-01-012023-06-300001618563us-gaap:ServiceAgreementsMember2022-01-012022-06-300001618563nsa:TenantReinsuranceIntangibleMember2023-04-012023-06-300001618563nsa:TenantReinsuranceIntangibleMember2022-04-012022-06-300001618563nsa:TenantReinsuranceIntangibleMember2023-01-012023-06-300001618563nsa:TenantReinsuranceIntangibleMember2022-01-012022-06-300001618563us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMembernsa:CreditFacilityMember2023-06-300001618563us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMembernsa:CreditFacilityMember2022-12-310001618563nsa:TrancheATermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2023-06-300001618563nsa:TrancheATermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2022-12-310001618563nsa:TrancheBTermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2023-06-300001618563nsa:TrancheBTermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2022-12-310001618563nsa:TrancheCTermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2023-06-300001618563nsa:TrancheCTermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2022-12-310001618563nsa:TrancheDTermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2023-06-300001618563nsa:TrancheDTermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2022-12-310001618563nsa:TrancheETermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2023-06-300001618563nsa:TrancheETermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2022-12-310001618563us-gaap:UnsecuredDebtMembernsa:A2023TermLoanFacilityMember2023-06-300001618563us-gaap:UnsecuredDebtMembernsa:A2023TermLoanFacilityMember2022-12-310001618563us-gaap:UnsecuredDebtMembernsa:A2028TermLoanFacilityMember2023-06-300001618563us-gaap:UnsecuredDebtMembernsa:A2028TermLoanFacilityMember2022-12-310001618563nsa:A2029TermLoanFacilityMemberus-gaap:UnsecuredDebtMember2023-06-300001618563nsa:A2029TermLoanFacilityMemberus-gaap:UnsecuredDebtMember2022-12-310001618563nsa:June2029TermLoanFacilityMemberus-gaap:UnsecuredDebtMember2023-06-300001618563nsa:June2029TermLoanFacilityMemberus-gaap:UnsecuredDebtMember2022-12-310001618563us-gaap:UnsecuredDebtMembernsa:A2026SeniorNotesMember2023-06-300001618563us-gaap:UnsecuredDebtMembernsa:A2026SeniorNotesMember2022-12-310001618563us-gaap:UnsecuredDebtMembernsa:A2028SeniorNotesMember2023-06-300001618563us-gaap:UnsecuredDebtMembernsa:A2028SeniorNotesMember2022-12-310001618563nsa:A2029SeniorNotesMemberus-gaap:UnsecuredDebtMember2023-06-300001618563nsa:A2029SeniorNotesMemberus-gaap:UnsecuredDebtMember2022-12-310001618563nsa:August2030SeniorNotesMemberus-gaap:UnsecuredDebtMember2023-06-300001618563nsa:August2030SeniorNotesMemberus-gaap:UnsecuredDebtMember2022-12-310001618563us-gaap:UnsecuredDebtMembernsa:November2030SeniorNotesMember2023-06-300001618563us-gaap:UnsecuredDebtMembernsa:November2030SeniorNotesMember2022-12-310001618563nsa:May2031SeniorNotesMemberus-gaap:UnsecuredDebtMember2023-06-300001618563nsa:May2031SeniorNotesMemberus-gaap:UnsecuredDebtMember2022-12-310001618563nsa:August2031SeniorNotesMemberus-gaap:UnsecuredDebtMember2023-06-300001618563nsa:August2031SeniorNotesMemberus-gaap:UnsecuredDebtMember2022-12-310001618563nsa:November2031SeniorNotesMemberus-gaap:UnsecuredDebtMember2023-06-300001618563nsa:November2031SeniorNotesMemberus-gaap:UnsecuredDebtMember2022-12-310001618563nsa:August2032SeniorNotesMemberus-gaap:UnsecuredDebtMember2023-06-300001618563nsa:August2032SeniorNotesMemberus-gaap:UnsecuredDebtMember2022-12-310001618563nsa:November2032SeniorNotesMemberus-gaap:UnsecuredDebtMember2023-06-300001618563nsa:November2032SeniorNotesMemberus-gaap:UnsecuredDebtMember2022-12-310001618563us-gaap:UnsecuredDebtMembernsa:A2033SeniorNotesMember2023-06-300001618563us-gaap:UnsecuredDebtMembernsa:A2033SeniorNotesMember2022-12-310001618563nsa:November2033SeniorNotesMemberus-gaap:UnsecuredDebtMember2023-06-300001618563nsa:November2033SeniorNotesMemberus-gaap:UnsecuredDebtMember2022-12-310001618563us-gaap:UnsecuredDebtMembernsa:A2036SeniorNotesMember2023-06-300001618563us-gaap:UnsecuredDebtMembernsa:A2036SeniorNotesMember2022-12-310001618563nsa:FixedRateMortgagesMemberus-gaap:MortgagesMember2023-06-300001618563nsa:FixedRateMortgagesMemberus-gaap:MortgagesMember2022-12-310001618563us-gaap:LineOfCreditMembernsa:CreditFacilityMember2023-01-020001618563us-gaap:LineOfCreditMembernsa:CreditFacilityMember2023-01-030001618563us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMembernsa:CreditFacilityMember2023-01-030001618563nsa:TrancheATermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2023-01-030001618563nsa:TrancheBTermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2023-01-020001618563nsa:TrancheBTermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2023-01-030001618563nsa:TrancheCTermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2023-01-030001618563nsa:TrancheDTermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2023-01-030001618563nsa:TrancheETermLoanMembernsa:CreditFacilityMemberus-gaap:UnsecuredDebtMember2023-01-030001618563nsa:TermLoanFacilityMemberus-gaap:UnsecuredDebtMember2022-12-310001618563us-gaap:LineOfCreditMembernsa:CreditFacilityMemberus-gaap:LetterOfCreditMember2023-06-300001618563nsa:NSAOPLPMembernsa:ClassAUnitsMember2023-04-012023-06-300001618563nsa:ClassAUnitsMembernsa:DownREITPartnershipMember2023-04-012023-06-300001618563nsa:NSAOPLPMembernsa:LongTermIncentivePlanUnitMember2023-04-012023-06-300001618563nsa:LongTermIncentivePlanUnitBasedOnServiceMember2023-04-012023-06-300001618563nsa:LongTermIncentivePlanUnitBasedOnFutureAcquisitionsMember2023-04-012023-06-300001618563nsa:ClassBUnitMembernsa:NSAOPLPAndDownREITPartnershipMember2023-04-012023-06-300001618563nsa:OPunitsDownREITOPunitsSubordinatedperformanceunitsDownREITsubordinatedperformanceunitsMember2023-04-012023-06-300001618563nsa:OPunitsDownREITOPunitsSubordinatedperformanceunitsDownREITsubordinatedperformanceunitsMember2022-04-012022-06-300001618563nsa:OPunitsDownREITOPunitsSubordinatedperformanceunitsDownREITsubordinatedperformanceunitsMember2023-01-012023-06-300001618563nsa:OPunitsDownREITOPunitsSubordinatedperformanceunitsDownREITsubordinatedperformanceunitsMember2022-01-012022-06-300001618563nsa:ParticipatingRegionalOperatorMembersrt:ManagementMembersrt:MinimumMembernsa:SupervisoryAndAdministrativeFeeAgreementMember2023-01-012023-06-300001618563nsa:ParticipatingRegionalOperatorMembersrt:ManagementMembersrt:MaximumMembernsa:SupervisoryAndAdministrativeFeeAgreementMember2023-01-012023-06-300001618563nsa:ParticipatingRegionalOperatorMembernsa:AffiliateMembernsa:SupervisoryAndAdministrativeFeeAgreementMember2023-04-012023-06-300001618563nsa:ParticipatingRegionalOperatorMembernsa:AffiliateMembernsa:SupervisoryAndAdministrativeFeeAgreementMember2022-04-012022-06-300001618563nsa:ParticipatingRegionalOperatorMembernsa:AffiliateMembernsa:SupervisoryAndAdministrativeFeeAgreementMember2023-01-012023-06-300001618563nsa:ParticipatingRegionalOperatorMembernsa:AffiliateMembernsa:SupervisoryAndAdministrativeFeeAgreementMember2022-01-012022-06-300001618563nsa:ParticipatingRegionalOperatorMembersrt:ManagementMembernsa:PayrollServicesMember2023-04-012023-06-300001618563nsa:ParticipatingRegionalOperatorMembersrt:ManagementMembernsa:PayrollServicesMember2022-04-012022-06-300001618563nsa:ParticipatingRegionalOperatorMembersrt:ManagementMembernsa:PayrollServicesMember2023-01-012023-06-300001618563nsa:ParticipatingRegionalOperatorMembersrt:ManagementMembernsa:PayrollServicesMember2022-01-012022-06-300001618563nsa:ParticipatingRegionalOperatorMembersrt:AffiliatedEntityMembernsa:DueDiligenceCostsMember2023-04-012023-06-300001618563nsa:ParticipatingRegionalOperatorMembersrt:AffiliatedEntityMembernsa:DueDiligenceCostsMember2022-04-012022-06-300001618563nsa:ParticipatingRegionalOperatorMembersrt:ManagementMembernsa:DueDiligenceCostsMember2023-01-012023-06-300001618563nsa:ParticipatingRegionalOperatorMembersrt:ManagementMembernsa:DueDiligenceCostsMember2022-01-012022-06-300001618563nsa:SeriesMIMember2023-01-012023-01-010001618563nsa:OPUnitsMember2023-01-012023-01-010001618563nsa:OPUnitsMembernsa:MrNordhagenMembersrt:AffiliatedEntityMember2023-01-012023-01-010001618563nsa:MrNordhagenMembersrt:AffiliatedEntityMembernsa:SeriesMIMember2023-01-012023-01-010001618563nsa:OPUnitsMembernsa:MrCramerMembersrt:AffiliatedEntityMember2023-01-012023-01-010001618563nsa:MrCramerMembersrt:AffiliatedEntityMembernsa:SeriesMIMember2023-01-012023-01-010001618563us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-06-300001618563us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001618563us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Member2021-12-310001618563us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Member2022-01-012022-06-300001618563us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Member2022-06-300001618563us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Member2022-12-310001618563us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Member2023-01-012023-06-300001618563us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Member2023-06-300001618563us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-06-300001618563us-gaap:DesignatedAsHedgingInstrumentMembernsa:ForwardStartingSwapsMember2023-03-160001618563us-gaap:DesignatedAsHedgingInstrumentMembernsa:ForwardStartingSwapsMember2023-03-240001618563us-gaap:DesignatedAsHedgingInstrumentMembernsa:ForwardStartingSwapsMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-03-160001618563us-gaap:DesignatedAsHedgingInstrumentMembernsa:ForwardStartingSwapsMember2023-04-012023-06-300001618563us-gaap:DesignatedAsHedgingInstrumentMembernsa:ForwardStartingSwapsMember2023-03-242023-03-240001618563us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-06-300001618563us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001618563us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-06-300001618563us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001618563nsa:SelfStoragePropertyAcquisitionMemberus-gaap:SubsequentEventMember2023-07-012023-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-37351

National Storage Affiliates Trust

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Maryland | | 46-5053858 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

8400 East Prentice Avenue, 9th Floor

Greenwood Village, Colorado 80111

(Address of principal executive offices) (Zip code)

(720) 630-2600

(Registrant's telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading symbols | Name of each exchange on which registered |

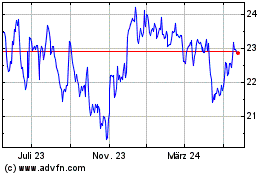

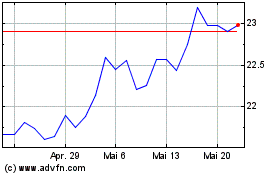

| Common Shares of Beneficial Interest, $0.01 par value per share | NSA | New York Stock Exchange |

| Series A Cumulative Redeemable Preferred Shares of Beneficial Interest, par value $0.01 per share | NSA Pr A | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange

Act. | | | | | | | | | | | | | | |

| Large Accelerated Filer | ☒ | | Accelerated Filer | ☐ |

| Non-accelerated Filer | ☐ | | Smaller Reporting Company | ☐ |

| | | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of August 7, 2023, 89,237,894 common shares of beneficial interest, $0.01 par value per share, were outstanding.

| | | | | | | | |

| NATIONAL STORAGE AFFILIATES TRUST |

| | |

| TABLE OF CONTENTS |

| FORM 10-Q |

| | Page |

| PART I. FINANCIAL INFORMATION |

| ITEM 1. | Financial Statements | |

| Condensed Consolidated Balance Sheets as of June 30, 2023 and December 31, 2022 (Unaudited) | |

| Condensed Consolidated Statements of Operations for the Three and Six Months Ended June 30, 2023 and 2022 (Unaudited) | |

| Condensed Consolidated Statements of Comprehensive Income (Loss) for the Three and Six Months Ended June 30, 2023 and 2022 (Unaudited) | |

| Condensed Consolidated Statements of Changes in Equity for the Three and Six Months Ended June 30, 2023 and 2022 (Unaudited) | |

| Condensed Consolidated Statements of Cash Flows for the Six Months Ended June 30, 2023 and 2022 (Unaudited) | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

| ITEM 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| ITEM 3. | Quantitative and Qualitative Disclosures About Market Risk | |

| ITEM 4. | Controls and Procedures | |

| PART II. OTHER INFORMATION |

| ITEM 1. | Legal Proceedings | |

| ITEM 1A. | Risk Factors | |

| ITEM 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

| ITEM 3. | Defaults Upon Senior Securities | |

| ITEM 4. | Mine Safety Disclosures | |

| ITEM 5. | Other Information | |

| ITEM 6. | Exhibits | |

| Signatures | | |

PART I. FINANCIAL INFORMATION

ITEM 1. Financial Statements

NATIONAL STORAGE AFFILIATES TRUST

CONDENSED CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | |

| June 30, | | December 31, |

| 2023 | | 2022 |

| ASSETS | | | |

| Real estate | | | |

| Self storage properties | $ | 6,579,167 | | | $ | 6,391,572 | |

| Less accumulated depreciation | (877,707) | | | (772,661) | |

Self storage properties, net | 5,701,460 | | | 5,618,911 | |

| Cash and cash equivalents | 44,022 | | | 35,312 | |

| Restricted cash | 3,299 | | | 6,887 | |

| Debt issuance costs, net | 9,607 | | | 1,393 | |

| Investment in unconsolidated real estate ventures | 219,060 | | | 227,441 | |

| Other assets, net | 160,618 | | | 156,228 | |

| Operating lease right-of-use assets | 23,325 | | | 23,835 | |

| Total assets | $ | 6,161,391 | | | $ | 6,070,007 | |

| LIABILITIES AND EQUITY | | | |

| Liabilities | | | |

| Debt financing | $ | 3,639,547 | | | $ | 3,551,179 | |

| Accounts payable and accrued liabilities | 87,007 | | | 80,377 | |

| Interest rate swap liabilities | — | | | 483 | |

| Operating lease liabilities | 25,314 | | | 25,741 | |

| Deferred revenue | 25,122 | | | 23,213 | |

| Total liabilities | 3,776,990 | | | 3,680,993 | |

| Commitments and contingencies (Note 11) | | | |

| Equity | | | |

Series A Preferred shares of beneficial interest, par value $0.01 per share. 50,000,000 authorized, 9,017,588 and 9,017,588 issued and outstanding at June 30, 2023 and December 31, 2022, respectively, at liquidation preference | 225,439 | | | 225,439 | |

Series B Preferred shares of beneficial interest, par value $0.01 per share. 7,000,000 authorized, 5,668,128 issued and outstanding at June 30, 2023 (Note 3) | 115,212 | | | — | |

Common shares of beneficial interest, par value $0.01 per share. 250,000,000 authorized, 88,649,794 and 89,842,145 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively | 886 | | | 898 | |

| Additional paid-in capital | 1,692,741 | | | 1,777,984 | |

| Distributions in excess of earnings | (445,813) | | | (396,650) | |

| Accumulated other comprehensive income | 36,906 | | | 40,530 | |

| Total shareholders' equity | 1,625,371 | | | 1,648,201 | |

| Noncontrolling interests | 759,030 | | | 740,813 | |

| Total equity | 2,384,401 | | | 2,389,014 | |

| Total liabilities and equity | $ | 6,161,391 | | | $ | 6,070,007 | |

See notes to condensed consolidated financial statements.

3

NATIONAL STORAGE AFFILIATES TRUST

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| REVENUE | | | | | | | |

| Rental revenue | $ | 199,311 | | | $ | 184,636 | | | $ | 393,440 | | | $ | 359,105 | |

| Other property-related revenue | 7,613 | | | 6,341 | | | 14,420 | | | 12,507 | |

| Management fees and other revenue | 8,587 | | | 7,913 | | | 15,644 | | | 14,462 | |

| Total revenue | 215,511 | | | 198,890 | | | 423,504 | | | 386,074 | |

| OPERATING EXPENSES | | | | | | | |

| Property operating expenses | 57,094 | | | 53,188 | | | 113,577 | | | 102,546 | |

| General and administrative expenses | 14,404 | | | 14,702 | | | 29,225 | | | 28,668 | |

| Depreciation and amortization | 56,705 | | | 57,891 | | | 112,163 | | | 115,963 | |

| Other | 3,220 | | | 525 | | | 4,393 | | | 995 | |

| Total operating expenses | 131,423 | | | 126,306 | | | 259,358 | | | 248,172 | |

| | | | | | | |

| OTHER (EXPENSE) INCOME | | | | | | | |

| Interest expense | (39,693) | | | (24,448) | | | (77,641) | | | (47,095) | |

| Loss on early extinguishment of debt | — | | | — | | | (758) | | | — | |

Equity in earnings of unconsolidated real estate ventures | 1,861 | | | 1,962 | | | 3,539 | | | 3,456 | |

| Acquisition costs | (239) | | | (682) | | | (1,083) | | | (1,235) | |

| Non-operating income (expense) | 196 | | | (261) | | | (402) | | | (373) | |

| Gain on sale of self storage properties | — | | | — | | | — | | | 2,134 | |

| Other expense | (37,875) | | | (23,429) | | | (76,345) | | | (43,113) | |

| Income before income taxes | 46,213 | | | 49,155 | | | 87,801 | | | 94,789 | |

| Income tax expense | (737) | | | (730) | | | (1,933) | | | (1,578) | |

| Net income | 45,476 | | | 48,425 | | | 85,868 | | | 93,211 | |

Net income attributable to noncontrolling interests | (16,028) | | | (23,387) | | | (27,461) | | | (42,945) | |

Net income attributable to National Storage Affiliates Trust | 29,448 | | | 25,038 | | | 58,407 | | | 50,266 | |

Distributions to preferred shareholders | (5,119) | | | (3,382) | | | (8,799) | | | (6,661) | |

Net income attributable to common shareholders | $ | 24,329 | | | $ | 21,656 | | | $ | 49,608 | | | $ | 43,605 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Earnings per share - basic and diluted | $ | 0.28 | | | $ | 0.24 | | | $ | 0.56 | | | $ | 0.48 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Weighted average shares outstanding - basic and diluted | 88,312 | | | 91,541 | | | 88,902 | | | 91,433 | |

| | | | | | | |

| Dividends declared per common share | $ | 0.56 | | | $ | 0.55 | | | $ | 1.11 | | | $ | 1.05 | |

See notes to condensed consolidated financial statements.

4

NATIONAL STORAGE AFFILIATES TRUST

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(dollars in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 45,476 | | | $ | 48,425 | | | $ | 85,868 | | | $ | 93,211 | |

| Other comprehensive income (loss) | | | | | | | |

| Unrealized gain on derivative contracts | 28,226 | | | 14,556 | | | 15,273 | | | 53,164 | |

| Realized loss on derivative contracts | (1,643) | | | — | | | (1,643) | | | — | |

Reclassification of other comprehensive (income) loss to interest expense | (9,460) | | | 3,286 | | | (17,221) | | | 8,260 | |

Other comprehensive income (loss) | 17,123 | | | 17,842 | | | (3,591) | | | 61,424 | |

| Comprehensive income | 62,599 | | | 66,267 | | | 82,277 | | | 154,635 | |

Comprehensive income attributable to noncontrolling interests | (21,493) | | | (28,608) | | | (26,374) | | | (60,949) | |

Comprehensive income attributable to National Storage Affiliates Trust | $ | 41,106 | | | $ | 37,659 | | | $ | 55,903 | | | $ | 93,686 | |

See notes to condensed consolidated financial statements.

5

NATIONAL STORAGE AFFILIATES TRUST

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(dollars in thousands, except number of shares)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Accumulated | | | | |

| | | | | | | | | Additional | | Distributions | | Other | | | | |

| Preferred Shares | | Common Shares | | Paid-in | | In Excess Of | | Comprehensive | | Noncontrolling | | Total |

| Number | | Amount | | Number | | Amount | | Capital | | Earnings | | (Loss) Income | | Interests | | Equity |

| Balances, December 31, 2021 | 8,736,719 | | | $ | 218,418 | | | 91,198,929 | | | $ | 912 | | | $ | 1,866,773 | | | $ | (291,263) | | | $ | (19,611) | | | $ | 707,226 | | | $ | 2,482,455 | |

OP equity issued for property acquisitions: | | | | | | | | | | | | | | | | | |

Internalization of PRO, net of offering costs | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 3,217 | | | 3,217 | |

OP units, subordinated performance units and Series A-1 preferred units, net of offering costs | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 16,576 | | | 16,576 | |

| Redemptions of Series A-1 preferred units | 8,216 | | | 205 | | | — | | | — | | | — | | | — | | | — | | | (205) | | | — | |

| Redemptions of OP units | — | | | — | | | 258,477 | | | 3 | | | 4,601 | | | — | | | (44) | | | (4,560) | | | — | |

| | | | | | | | | | | | | | | | | |

Effect of changes in ownership for consolidated entities | — | | | — | | | — | | | — | | | (40,627) | | | — | | | 590 | | | 40,037 | | | — | |

Equity-based compensation expense | — | | | — | | | — | | | — | | | 103 | | | — | | | — | | | 1,441 | | | 1,544 | |

Issuance of restricted common shares | — | | | — | | | 7,913 | | | — | | | — | | | — | | | — | | | — | | | — | |

Vesting and forfeitures of restricted common shares, net | — | | | — | | | (3,599) | | | — | | | (118) | | | — | | | — | | | — | | | (118) | |

| Preferred share dividends | — | | | — | | | — | | | — | | | — | | | (3,279) | | | — | | | — | | | (3,279) | |

| Common share dividends | — | | | — | | | — | | | — | | | — | | | (45,710) | | | — | | | — | | | (45,710) | |

Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (33,009) | | | (33,009) | |

| Other comprehensive income | — | | | — | | | — | | | — | | | — | | | — | | | 30,799 | | | 12,783 | | | 43,582 | |

| Net income | — | | | — | | | — | | | — | | | — | | | 25,228 | | | — | | | 19,558 | | | 44,786 | |

| Balances, March 31, 2022 | 8,744,935 | | | $ | 218,623 | | | 91,461,720 | | | $ | 915 | | | $ | 1,830,732 | | | $ | (315,024) | | | $ | 11,734 | | | $ | 763,064 | | | $ | 2,510,044 | |

OP equity issued for property acquisitions: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

OP units and subordinated performance units, net of offering costs | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 13,938 | | | 13,938 | |

| Redemptions of Series A-1 preferred units | 272,653 | | | 6,816 | | | — | | | — | | | — | | | — | | | — | | | (6,816) | | | — | |

See notes to condensed consolidated financial statements.

6

NATIONAL STORAGE AFFILIATES TRUST

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(dollars in thousands, except number of shares)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Accumulated | | | | |

| | | | | | | | | Additional | | Distributions | | Other | | | | |

| Preferred Shares | | Common Shares | | Paid-in | | In Excess Of | | Comprehensive | | Noncontrolling | | Total |

| Number | | Amount | | Number | | Amount | | Capital | | Earnings | | (Loss) Income | | Interests | | Equity |

| Redemptions of OP units | — | | | — | | | 294,573 | | | 3 | | | 5,140 | | | — | | | 59 | | | (5,202) | | | — | |

| | | | | | | | | | | | | | | | | |

Effect of changes in ownership for consolidated entities | — | | | — | | | — | | | — | | | 5,924 | | | — | | | (47) | | | (5,877) | | | — | |

Equity-based compensation expense | — | | | — | | | — | | | — | | | 127 | | | — | | | — | | | 1,453 | | | 1,580 | |

Issuance of restricted common shares | — | | | — | | | 630 | | | — | | | — | | | — | | | — | | | — | | | — | |

Vesting and forfeitures of restricted common shares, net | — | | | — | | | (1,251) | | | — | | | (43) | | | — | | | — | | | — | | | (43) | |

| Preferred share dividends | — | | | — | | | — | | | — | | | — | | | (3,382) | | | — | | | — | | | (3,382) | |

| Common share dividends | — | | | — | | | — | | | — | | | — | | | (50,466) | | | — | | | — | | | (50,466) | |

Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (36,625) | | | (36,625) | |

| Other comprehensive income | — | | | — | | | — | | | — | | | — | | | — | | | 12,626 | | | 5,216 | | | 17,842 | |

| Net income | — | | | — | | | — | | | — | | | — | | | 25,038 | | | — | | | 23,387 | | | 48,425 | |

| Balances, June 30, 2022 | 9,017,588 | | | $ | 225,439 | | | 91,755,672 | | | $ | 918 | | | $ | 1,841,880 | | | $ | (343,834) | | | $ | 24,372 | | | $ | 752,538 | | | $ | 2,501,313 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

See notes to condensed consolidated financial statements.

7

NATIONAL STORAGE AFFILIATES TRUST

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(dollars in thousands, except number of shares)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Accumulated | | | | |

| | | | | | | | | Additional | | Distributions | | Other | | | | |

| Preferred Shares | | Common Shares | | Paid-in | | In Excess Of | | Comprehensive | | Noncontrolling | | Total |

| Number | | Amount | | Number | | Amount | | Capital | | Earnings | | (Loss) Income | | Interests | | Equity |

| Balances, December 31, 2022 | 9,017,588 | | | $ | 225,439 | | | 89,842,145 | | | $ | 898 | | | $ | 1,777,984 | | | $ | (396,650) | | | $ | 40,530 | | | $ | 740,813 | | | $ | 2,389,014 | |

| Issuance of preferred shares | 5,668,128 | | | 115,212 | | | — | | | — | | | (1,938) | | | — | | | — | | | — | | | 113,274 | |

| OP equity issued: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Acquisition of properties | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 37,257 | | | 37,257 | |

| | | | | | | | | | | | | | | | | |

| Issuance of Series A-1 preferred units | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 750 | | | 750 | |

| Redemptions of OP Units | — | | | — | | | 67,431 | | | 1 | | | 1,093 | | | — | | | 30 | | | (1,124) | | | — | |

| Repurchase of common shares | — | | | — | | | (1,622,874) | | | (16) | | | (69,295) | | | — | | | — | | | — | | | (69,311) | |

| Effect of changes in ownership for consolidated entities | — | | | — | | | — | | | — | | | (18,720) | | | — | | | (1,245) | | | 19,965 | | | — | |

| Equity-based compensation expense | — | | | — | | | — | | | — | | | 101 | | | — | | | — | | | 1,548 | | | 1,649 | |

| Issuance of restricted common shares | — | | | — | | | 12,417 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Vesting and forfeitures of restricted common shares, net | — | | | — | | | (2,977) | | | — | | | (89) | | | — | | | — | | | — | | | (89) | |

| Preferred share dividends | — | | | — | | | — | | | — | | | — | | | (3,962) | | | — | | | — | | | (3,962) | |

| Common share dividends | — | | | — | | | — | | | — | | | — | | | (48,755) | | | — | | | — | | | (48,755) | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (34,431) | | | (34,431) | |

| Other comprehensive (loss) | — | | | — | | | — | | | — | | | — | | | — | | | (14,162) | | | (6,552) | | | (20,714) | |

| Net income | — | | | — | | | — | | | — | | | — | | | 28,959 | | | — | | | 11,433 | | | 40,392 | |

| Balances, March 31, 2023 | 14,685,716 | | | $ | 340,651 | | | 88,296,142 | | | $ | 883 | | | $ | 1,689,136 | | | $ | (420,408) | | | $ | 25,153 | | | $ | 769,659 | | | $ | 2,405,074 | |

| | | | | | | | | | | | | | | | | |

| OP equity issued: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Acquisition of properties | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 5,577 | | | 5,577 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Redemptions of OP Units | — | | | — | | | 354,936 | | | 3 | | | 5,530 | | | — | | | 113 | | | (5,646) | | | — | |

| | | | | | | | | | | | | | | | | |

| Effect of changes in ownership for consolidated entities | — | | | — | | | — | | | — | | | (1,833) | | | — | | | (18) | | | 1,851 | | | — | |

| Equity-based compensation expense | — | | | — | | | — | | | — | | | 125 | | | — | | | — | | | 1,552 | | | 1,677 | |

See notes to condensed consolidated financial statements.

8

NATIONAL STORAGE AFFILIATES TRUST

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(dollars in thousands, except number of shares)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Accumulated | | | | |

| | | | | | | | | Additional | | Distributions | | Other | | | | |

| Preferred Shares | | Common Shares | | Paid-in | | In Excess Of | | Comprehensive | | Noncontrolling | | Total |

| Number | | Amount | | Number | | Amount | | Capital | | Earnings | | (Loss) Income | | Interests | | Equity |

| Issuance of restricted common shares | — | | | — | | | 439 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Vesting and forfeitures of restricted common shares, net | — | | | — | | | (1,723) | | | — | | | (217) | | | — | | | — | | | — | | | (217) | |

| Preferred share dividends | — | | | — | | | — | | | — | | | — | | | (5,402) | | | — | | | — | | | (5,402) | |

| Common share dividends | — | | | — | | | — | | | — | | | — | | | (49,451) | | | — | | | — | | | (49,451) | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (35,456) | | | (35,456) | |

| Other comprehensive income | — | | | — | | | — | | | — | | | — | | | — | | | 11,658 | | | 5,465 | | | 17,123 | |

| Net income | — | | | — | | | — | | | — | | | — | | | 29,448 | | | — | | | 16,028 | | | 45,476 | |

| Balances, June 30, 2023 | 14,685,716 | | | $ | 340,651 | | | 88,649,794 | | | $ | 886 | | | $ | 1,692,741 | | | $ | (445,813) | | | $ | 36,906 | | | $ | 759,030 | | | $ | 2,384,401 | |

See notes to condensed consolidated financial statements.

9

NATIONAL STORAGE AFFILIATES TRUST

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollars in thousands)

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2023 | | 2022 |

| OPERATING ACTIVITIES | | | |

| Net income | $ | 85,868 | | | $ | 93,211 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 112,163 | | | 115,963 | |

| Amortization of debt issuance costs | 3,235 | | | 2,116 | |

| Amortization of debt discount and premium, net | (292) | | | (346) | |

| | | |

| Other | 969 | | | — | |

| Gain on sale of self storage properties | — | | | (2,134) | |

| | | |

| | | |

| | | |

| Equity-based compensation expense | 3,326 | | | 3,124 | |

Equity in earnings of unconsolidated real estate ventures | (3,539) | | | (3,456) | |

Distributions from unconsolidated real estate ventures | 11,921 | | | 10,905 | |

Change in assets and liabilities, net of effects of self storage property acquisitions: | | | |

| Other assets | (2,729) | | | (282) | |

| Accounts payable and accrued liabilities | 5,979 | | | 7,133 | |

| Deferred revenue | 1,284 | | | 809 | |

| Net Cash Provided by Operating Activities | 218,185 | | | 227,043 | |

| INVESTING ACTIVITIES | | | |

| Acquisition of self-storage properties | (18,087) | | | (174,951) | |

| | | |

| Capital expenditures | (17,933) | | | (20,333) | |

| Investment in unconsolidated real estate venture | — | | | (53,335) | |

| Deposits and advances for self storage properties and other acquisitions | — | | | (1,925) | |

| Expenditures for corporate furniture, equipment and other | (678) | | | (548) | |

| | | |

| | | |

| | | |

| | | |

| Acquisition of management company assets and interest in reinsurance company from PRO retirement | (16,924) | | | — | |

| Proceeds from sale of self storage properties | — | | | 6,166 | |

| Net Cash Used In Investing Activities | (53,622) | | | (244,926) | |

| FINANCING ACTIVITIES | | | |

| | | |

| | | |

| | | |

| Borrowings under debt financings | 449,000 | | | 864,000 | |

| | | |

| | | |

| | | |

| Repurchase of common shares | (69,311) | | | — | |

| Principal payments under debt financings | (359,496) | | | (661,163) | |

| | | |

| Payment of dividends to common shareholders | (98,206) | | | (96,176) | |

| Payment of dividends to preferred shareholders | (9,364) | | | (6,661) | |

| Distributions to noncontrolling interests | (69,969) | | | (69,841) | |

| | | |

| | | |

| | | |

| Debt issuance costs | (2,095) | | | (3,763) | |

| Equity offering costs | — | | | (772) | |

| Net Cash (Used In) Provided By Financing Activities | (159,441) | | | 25,624 | |

| Increase in Cash, Cash Equivalents and Restricted Cash | 5,122 | | | 7,741 | |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH | | | |

| Beginning of period | 42,199 | | | 27,875 | |

| End of period | $ | 47,321 | | | $ | 35,616 | |

See notes to condensed consolidated financial statements.

10

NATIONAL STORAGE AFFILIATES TRUST

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollars in thousands)

(Unaudited)

| | | | | | | | | | | |

| Supplemental Cash Flow and Noncash Information | | | |

Cash paid for interest | $ | 64,536 | | | $ | 44,102 | |

| Consideration exchanged in investment activity | | | |

| Issuance of OP Units and subordinated performance units | 42,834 | | | 33,731 | |

| Issuance of Series B preferred shares | 113,274 | | | — | |

| Deposits on acquisitions applied to purchase price | — | | | 800 | |

| Other net liabilities assumed | 119 | | | 973 | |

| | | |

See notes to condensed consolidated financial statements.

11

NATIONAL STORAGE AFFILIATES TRUST

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2023

(Unaudited)

1. ORGANIZATION AND NATURE OF OPERATIONS

National Storage Affiliates Trust was organized in the state of Maryland on May 16, 2013 and is a fully integrated, self-administered and self-managed real estate investment trust focused on the self storage sector. As used herein, "NSA," the "Company," "we," "our," and "us" refers to National Storage Affiliates Trust and its consolidated subsidiaries, except where the context indicates otherwise. The Company has elected and believes that it has qualified to be taxed as a real estate investment trust for U.S. federal income tax purposes ("REIT") commencing with its taxable year ended December 31, 2015.

Through its controlling interest as the sole general partner of NSA OP, LP (its "operating partnership"), a Delaware limited partnership formed on February 13, 2013, the Company is focused on the ownership, operation, and acquisition of self storage properties predominantly located within the top 100 metropolitan statistical areas throughout the United States. Pursuant to the Agreement of Limited Partnership (as amended, the "LP Agreement") of its operating partnership, the Company's operating partnership is authorized to issue preferred units, Class A Units ("OP units"), different series of Class B Units ("subordinated performance units"), and Long-Term Incentive Plan Units ("LTIP units"). The Company also owns certain of its self storage properties through other consolidated limited partnership subsidiaries of its operating partnership, which the Company refers to as "DownREIT partnerships." The DownREIT partnerships issue equity ownership interests that are intended to be economically equivalent to the Company's OP units ("DownREIT OP units") and subordinated performance units ("DownREIT subordinated performance units").

The Company owned 932 consolidated self storage properties in 39 states and Puerto Rico with approximately 59.4 million rentable square feet in approximately 462,000 storage units as of June 30, 2023. These properties are managed with local operational focus and expertise by the Company and its participating regional operators ("PROs"). As of June 30, 2023, the Company directly managed 603 of these self storage properties through its corporate brands of iStorage, SecurCare, Northwest and Move It, and the PROs managed the remaining 329 self storage properties. These PROs are Optivest Properties LLC and its controlled affiliates ("Optivest"), Guardian Storage Centers LLC and its controlled affiliates ("Guardian"), Arizona Mini Storage Management Company d/b/a Storage Solutions and its controlled affiliates ("Storage Solutions"), Hide-Away Storage Services, Inc. and its controlled affiliates ("Hide-Away"), an affiliate of Shader Brothers Corporation d/b/a Personal Mini Storage ("Personal Mini"), Southern Storage Management Systems, Inc. d/b/a Southern Self Storage ("Southern"), affiliates of Investment Real Estate Management, LLC d/b/a Moove In Self Storage of York, Pennsylvania ("Moove In") and Blue Sky Self Storage, LLC, a strategic partnership between Argus Professional Storage Management and GYS Development LLC ("Blue Sky").

Effective January 1, 2023, one of our PROs, Move It Self Storage and its controlled affiliates ("Move It"), retired as one of the Company's PROs. As a result of the retirement, on January 1, 2023, management of our 72 properties in the Move It managed portfolio was transferred to us and the Move It brand name and related intellectual property was internalized by us, and we discontinued payment of any supervisory and administrative fees or reimbursements to Move It. In addition, on January 1, 2023, we issued a notice of non-voluntary conversion to convert all of the subordinated performance units related to Move It's managed portfolio into OP units. As part of the internalization, a majority of Move It's employees were offered and provided employment by us and will continue managing Move It's portfolio of properties as members of our existing property management platform. See Note 3 and Note 6 for additional information related to the Move It retirement and internalization.

As of June 30, 2023, the Company also managed through its property management platform an additional portfolio of 185 properties owned by the Company's unconsolidated real estate ventures. These properties contain approximately 13.5 million rentable square feet, configured in approximately 111,000 storage units and located across 21 states. The Company owns a 25% equity interest in each of its unconsolidated real estate ventures.

As of June 30, 2023, in total, the Company operated and held ownership interests in 1,117 self storage properties located across 42 states and Puerto Rico with approximately 72.8 million rentable square feet in approximately 573,000 storage units.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying condensed consolidated financial statements are presented on the accrual basis of accounting in accordance with U.S. generally accepted accounting principles ("GAAP") and have been prepared by the Company pursuant to the rules and regulations of the Securities and Exchange Commission (the "SEC") regarding interim financial reporting. Accordingly, certain information and footnote disclosures required by GAAP for complete financial statements have been condensed or omitted in accordance with such rules and regulations. In the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation of the condensed consolidated financial statements have been included. The Company's results of operations for the quarterly and year to date periods are not necessarily indicative of the results to be expected for the full year or any other future period.

Principles of Consolidation

The Company's financial statements include the accounts of its operating partnership and its controlled subsidiaries. All significant intercompany balances and transactions have been eliminated in the consolidation of entities.

When the Company obtains an economic interest in an entity, the Company evaluates the entity to determine if the entity is deemed a variable interest entity ("VIE"), and if the Company is deemed to be the primary beneficiary, in accordance with authoritative guidance issued on the consolidation of VIEs. When an entity is not deemed to be a VIE, the Company considers the provisions of additional guidance to determine whether the general partner controls a limited partnership or similar entity when the limited partners have certain rights. The Company consolidates all entities that are VIEs and of which the Company is deemed to be the primary beneficiary. The Company has determined that its operating partnership is a VIE. The sole significant asset of National Storage Affiliates Trust is its investment in its operating partnership, and consequently, substantially all of the Company’s assets and liabilities represent those assets and liabilities of its operating partnership.

As of June 30, 2023, the Company's operating partnership was the primary beneficiary of, and therefore consolidated, 22 partnerships that are considered VIEs, which owned 48 self storage properties. The net book value of the real estate owned by these VIEs was $409.0 million and $412.9 million as of June 30, 2023 and December 31, 2022, respectively. For certain DownREIT partnerships which are subject to fixed rate mortgages payable, the carrying value of such fixed rate mortgages payable held by these VIEs was $188.7 million and $188.7 million as of June 30, 2023 and December 31, 2022, respectively. The creditors of the consolidated VIEs do not have recourse to the Company's general credit.

Revenue Recognition

Rental revenue

Rental revenue consists of space rentals and related fees. Management has determined that all of the Company's leases are operating leases. Substantially all leases may be terminated on a month-to-month basis and rental income is recognized ratably over the lease term using the straight-line method. Rents received in advance are deferred and recognized on a straight-line basis over the related lease term associated with the prepayment. Promotional discounts and other incentives are recognized as a reduction to rental income over the applicable lease term.

Other property-related revenue

Other property-related revenue primarily consists of ancillary revenues such as tenant insurance and/or tenant warranty protection-related access fees, sales of storage supplies and truck rentals which are recognized in the period earned.

The Company and certain of the Company’s PROs have tenant insurance and/or tenant warranty protection plan-related arrangements with insurance companies and the Company’s tenants. During the three months ended June 30, 2023 and 2022, the Company recognized $6.1 million and $4.9 million, respectively, of tenant insurance and tenant warranty protection plan revenues and during the six months ended June 30, 2023 and 2022, the Company recognized $11.6 million and $9.8 million, respectively, of tenant insurance and tenant warranty protection plan revenues.

The Company sells boxes, packing supplies, locks, other retail merchandise and rents moving trucks at its properties. During the three months ended June 30, 2023 and 2022, the Company recognized retail sales of $0.7 million and $0.7 million, respectively and during the six months ended June 30, 2023 and 2022, the Company recognized retail sales of $1.3 million and $1.3 million, respectively.

Management fees and other revenue

Management fees and other revenue consist of property management fees, platform fees, call center fees, acquisition fees, amounts related to the facilitation of tenant warranty protection or tenant insurance programs for certain stores in the Company's consolidated portfolio and unconsolidated real estate ventures, access fees associated with tenant insurance-related arrangements, and profit distributions from the Company's interest in a reinsurance company.

With respect to both the 2018 Joint Venture and the 2016 Joint Venture (as each is defined in Note 5), the Company provides supervisory and administrative property management services, centralized call center services, and technology platform and revenue management services to the properties in the unconsolidated real estate ventures. The property management fees are equal to 6% of monthly gross revenues and net sales revenues from the assets of the unconsolidated real estate ventures, and the platform fees are equal to $1,250 per month per unconsolidated real estate venture property. With respect to the 2016 Joint Venture only, the call center fee is equal to 1% of each of monthly gross revenues and net sales revenues from the 2016 Joint Venture properties. During the three months ended June 30, 2023 and 2022, the Company recognized property management fees, call center fees and platform fees of $4.2 million and $4.1 million, respectively and during the six months ended June 30, 2023 and 2022, the Company recognized property management fees, call center fees and platform fees of $8.4 million and $7.9 million, respectively.

The Company also earns acquisition fees for properties acquired by the unconsolidated real estate ventures subsequent to the Initial 2016 JV Portfolio and the Initial 2018 JV Portfolio. These fees are based on a percentage of the gross capitalization of the acquired assets determined by the members of the 2016 Joint Venture and the 2018 Joint Venture, and are generally earned when the unconsolidated real estate ventures obtain title and control of an acquired property. During the three months ended June 30, 2023 and 2022, the Company recognized acquisition fees of $0 and $0.9 million, respectively and during the six months ended June 30, 2023 and 2022, the Company recognized acquisition fees of $0 and $1.1 million, respectively.

The Company provides or makes available tenant insurance or tenant warranty protection programs for tenants at its properties. For certain of the properties in the Company’s consolidated portfolio and unconsolidated real estate ventures, the Company provides such tenant insurance through the Company’s wholly-owned captive insurance company and a separate reinsurance company in which the Company has a partial ownership interest. With respect to properties in both of the Company’s unconsolidated real estate ventures, the Company receives 50% of all proceeds from tenant insurance and tenant warranty protection programs at each unconsolidated real estate venture property in exchange for facilitating the programs at those properties. During the three months ended June 30, 2023 and 2022, the Company recognized $4.3 million and $2.8 million, respectively, of revenue related to these activities and during the six months ended June 30, 2023 and 2022, the Company recognized $7.1 million and $5.2 million, respectively, of revenue related to these activities.

Gain on sale of self storage properties

The Company recognizes gains from disposition of facilities only upon closing in accordance with the guidance on sales of nonfinancial assets. Profit on real estate sold is recognized upon closing when all, or substantially all, of the promised consideration has been received and is nonrefundable and the Company has transferred control of the facilities to the purchaser.

Investments in Unconsolidated Real Estate Ventures

The Company’s investments in its unconsolidated real estate ventures are recorded under the equity method of accounting in the accompanying condensed consolidated financial statements. Under the equity method, the Company’s investments in unconsolidated real estate ventures are stated at cost and adjusted for the Company’s share of net earnings or losses and reduced by distributions. Equity in earnings (losses) is recognized based on the Company’s ownership interest in the earnings (losses) of the unconsolidated real estate ventures. The Company follows the "nature of the distribution approach" for classification of distributions from its unconsolidated real estate ventures in its condensed consolidated statements of cash flows. Under this approach, distributions are reported on the basis of the nature of the activity or activities that generated the distributions as either a return on investment, which are classified as operating cash flows, or a return of investment (e.g., proceeds from the unconsolidated real estate ventures' sale of assets) which are reported as investing cash flows.

Noncontrolling Interests

All of the limited partner equity interests ("OP equity") in the operating partnership not held by the Company are reflected as noncontrolling interests. Noncontrolling interests also include ownership interests in DownREIT partnerships held by entities other than the operating partnership or its subsidiaries. In the condensed consolidated statements of operations, the Company allocates net income (loss) attributable to noncontrolling interests to arrive at net income (loss) attributable to National Storage Affiliates Trust.

For transactions that result in changes to the Company's ownership interest in its operating partnership, the carrying amount of noncontrolling interests is adjusted to reflect such changes. The difference between the fair value of the consideration received or paid and the amount by which the noncontrolling interest is adjusted is reflected as an adjustment to additional paid-in capital on the condensed consolidated balance sheets.

Allocation of Net Income (Loss)

The distribution rights and priorities set forth in the operating partnership's LP Agreement differ from what is reflected by the underlying percentage ownership interests of the unitholders. Accordingly, the Company allocates GAAP income (loss) utilizing the hypothetical liquidation at book value ("HLBV") method, in which the Company allocates income or loss based on the change in each unitholders’ claim on the net assets of its operating partnership at period end after adjusting for any distributions or contributions made during such period. The HLBV method is commonly applied to equity investments where cash distribution percentages vary at different points in time and are not directly linked to an equity holder’s ownership percentage.

The HLBV method is a balance sheet-focused approach to income (loss) allocation. A calculation is prepared at each balance sheet date to determine the amount that unitholders would receive if the operating partnership were to liquidate all of its assets (at GAAP net book value) and distribute the resulting proceeds to its creditors and unitholders based on the contractually defined liquidation priorities. The difference between the calculated liquidation distribution amounts at the beginning and the end of the reporting period, after adjusting for capital contributions and distributions, is used to derive each unitholder's share of the income (loss) for the period. Due to the stated liquidation priorities and because the HLBV method incorporates non-cash items such as depreciation expense, in any given period, income or loss may be allocated disproportionately to unitholders as compared to their respective ownership percentage in the operating partnership, and net income (loss) attributable to National Storage Affiliates Trust could be more or less net income than actual cash distributions received and more or less income or loss than what may be received in the event of an actual liquidation. Additionally, the HLBV method could result in net income (or net loss) attributable to National Storage Affiliates Trust during a period when the Company reports consolidated net loss (or net income), or net income (or net loss) attributable to National Storage Affiliates Trust in excess of the Company's consolidated net income (or net loss). The computations of basic and diluted earnings (loss) per share may be materially affected by these disproportionate income (loss) allocations, resulting in volatile fluctuations of basic and diluted earnings (loss) per share.

Other Comprehensive Income (Loss)

The Company has cash flow hedge derivative instruments that are measured at fair value with unrealized gains or losses recognized in other comprehensive income (loss) with a corresponding adjustment to accumulated other comprehensive income (loss) within equity, as discussed further in Note 12. Under the HLBV method of allocating income (loss) discussed above, a calculation is prepared at each balance sheet date by applying the HLBV method including, and excluding, the assets and liabilities resulting from the Company's cash flow hedge derivative instruments to determine comprehensive income (loss) attributable to National Storage Affiliates Trust. As a result of the distribution rights and priorities set forth in the operating partnership's LP Agreement, in any given period, other comprehensive income (loss) may be allocated disproportionately to unitholders as compared to their respective ownership percentage in the operating partnership and as compared to their respective allocation of net income (loss).

Cash and Cash Equivalents

The Company considers all highly-liquid investments purchased with original maturities of three months or less to be cash equivalents. From time to time, the Company maintains cash balances in financial institutions in excess of federally insured limits. We mitigate credit risk by placing cash and cash equivalents with major financial institutions. The Company has never experienced a loss that resulted from exceeding federally insured limits.

Restricted Cash

The Company's restricted cash consists of escrowed funds deposited with financial institutions resulting from property sales for which we elected to purchase replacement property in accordance with Section 1031 of the Code, for real estate taxes, insurance and other reserves for capital improvements in accordance with the Company's loan agreements.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

3. SHAREHOLDERS' EQUITY AND NONCONTROLLING INTERESTS

Shareholders' Equity

At the Market ("ATM") Program

On February 27, 2019, the Company entered into a sales agreement with certain sales agents, pursuant to which the Company may sell from time to time up to an aggregate of $250.0 million of common shares of beneficial interest, $0.01 par value per share of the Company ("common shares") and 6.000% Series A cumulative redeemable Preferred Shares of beneficial interest ("Series A Preferred Shares") in sales deemed to be "at the market" offerings (the "sales agreement"). On May 19, 2021, the Company entered into an amendment to the sales agreement with certain sales agents, whereby the Company increased the aggregate gross sale price under the program to $400.0 million, which included $31.0 million of the remaining available offered shares. The sales agreement contemplates that, in addition to the issuance and sale by the Company of offered shares to or through the sale agents, the Company may enter into separate forward sale agreements with any forward purchaser. Forward sale agreements, if any, will include only the Company's common shares and will not include any Series A Preferred Shares. If the Company enters into a forward sale agreement with any forward purchaser, such forward purchaser will attempt to borrow from third parties and sell, through the related agent, acting as sales agent for such forward purchaser (each, a "forward seller"), offered shares, in an amount equal to the offered shares subject to such forward sale agreement, to hedge such forward purchaser’s exposure under such forward sale agreement. The Company may offer the common shares and Series A Preferred Shares through the agents, as the Company's sales agents, or, as applicable, as forward seller, or directly to the agents or forward sellers, acting as principals, by means of, among others, ordinary brokers’ transactions on the NYSE or otherwise at market prices prevailing at the time of sale or at negotiated prices.

During the six months ended June 30, 2023, the Company did not sell any shares through the ATM program. As of June 30, 2023, the Company had $169.1 million of capacity remaining under its ATM Program.

Common Share Repurchase Program

On July 11, 2022, the Company approved a share repurchase program authorizing, but not obligating, the repurchase of up to $400.0 million of the Company's common shares of beneficial interest from time to time. The timing, manner, price and amount of any repurchase transactions will be determined by the Company in its discretion and will be subject to share price, availability, trading volume and general market conditions. During the six months ended June 30, 2023 the Company repurchased 1,622,874 common shares for approximately $69.3 million.

Series B Preferred Shares

On March 15, 2023, the Company classified 7,000,000 of the Company's authorized but unissued preferred shares of beneficial interest as 6.000% Series B Cumulative Redeemable Preferred Shares ("Series B Preferred Shares"). The Series B Preferred Shares rank senior to the Company’s common shares of beneficial interest, and on parity with the Company’s 6.000% Series A Cumulative Redeemable Preferred Shares of Beneficial Interest (“Series A Preferred Shares”) and any future equity shares that the Company may later authorize or issue and that by their terms are on parity with the Series B Preferred Shares, and junior to any other class of the Company’s shares expressly designated as ranking senior to the Series B Preferred Shares. The Series B Preferred Shares have a per share liquidation preference of $25.00 per share and receive distributions at an annual rate of 6.000%. These distributions are payable quarterly in arrears on or about the last day of March, June, September and December of each year, beginning on June 30, 2023. The first dividend was a pro rata dividend from and including March 16, 2023, to and including June 30, 2023. Generally, Series B Preferred Shares are not redeemable by the Company prior to September 15, 2043.

On March 16, 2023, the Company issued 5,668,128 Series B Preferred Shares for approximately $139.6 million, to shareholders of an affiliate of Personal Mini, in connection with the acquisition of a portfolio of 15 properties. As part of the acquisition transaction, the Company recorded a $26.1 million promissory note receivable from an affiliate of Personal Mini. Proceeds from the promissory note were used by the affiliate of Personal Mini to acquire $26.1 million of subordinated performance units. The promissory note bears interest at a rate equivalent to the dividends paid on 1,059,683 of the Series B Preferred Shares. As a result of these agreements, in accordance with GAAP, the $26.1 million promissory note receivable, interest income on the note receivable, $26.1 million of Series B Preferred Shares value, and dividends on such Series B Preferred Shares have been offset in the accompanying consolidated balance sheets, statements of operations, and statements of changes in equity, resulting in a net amount presented as proceeds from the issuance of Series B Preferred Shares of $113.3 million.

Noncontrolling Interests

All of the OP equity in the Company's operating partnership not held by the Company are reflected as noncontrolling interests. Noncontrolling interests also include ownership interests in DownREIT partnerships held by entities other than the Company's operating partnership. NSA is the general partner of its operating partnership and is authorized to cause its operating partnership to issue additional partner interests, including OP units and subordinated performance units, at such prices and on such other terms as it determines in its sole discretion.

As of June 30, 2023 and December 31, 2022, units reflecting noncontrolling interests consisted of the following:

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| Series A-1 preferred units | 745,649 | | | 712,208 | |

| OP units | 38,470,275 | | | 35,737,281 | |

| Subordinated performance units | 7,686,387 | | | 8,154,524 | |

| LTIP units | 814,826 | | | 728,890 | |

| DownREIT units | | | |

| DownREIT OP units | 2,120,491 | | | 1,924,918 | |

| DownREIT subordinated performance units | 4,133,474 | | | 4,337,111 | |

| Total | 53,971,102 | | | 51,594,932 | |

Series A-1 Preferred Units

The 6.000% Series A-1 Cumulative Redeemable Preferred Units ("Series A-1 preferred units") rank senior to OP units and subordinated performance units in the Company's operating partnership with respect to distributions and liquidation. The Series A-1 preferred units have a stated value of $25.00 per unit and receive distributions at an annual rate of 6.000%. These distributions are cumulative. The Series A-1 preferred units are redeemable at the option of the holder after the first anniversary of the date of issuance, which redemption obligations may be satisfied at the Company’s option in cash in an amount equal to the market value of an equivalent number of the Series A Preferred Shares or the issuance of Series A Preferred Shares on a one-for-one basis, subject to adjustments. The Series A Preferred Shares are redeemable by the Company for a cash redemption price of $25.00 per share, plus accrued but unpaid dividends beginning in October 2022. The increase in Series A-1 preferred units outstanding from December 31, 2022 to June 30, 2023 was due to the issuance of 33,441 Series A-1 preferred units in connection with the termination of a lease and the contribution of the development rights for vacant land owned by the Company at one of the Company’s self storage facilities.

OP Units and DownREIT OP units