Nuveen Municipal Income Fund, Inc. Announces Update to Investment Policies

29 September 2023 - 10:15PM

Business Wire

The Board of Trustees of Nuveen Municipal Income Fund, Inc.

(NYSE: NMI) has approved certain investment policy changes for the

fund. The fund’s investment objective to provide a high level of

current income exempt from federal income tax remains

unchanged.

The policy changes grant the fund more flexibility to invest in

lower rated municipal securities. The table below summarizes the

changes, which are effective immediately.

Description of Investment Policy Changes

Current Policy

New Policy

The Fund will invest at least 80% of its

Managed Assets in investment grade quality municipal securities

that, at the time of investment, are rated within the four highest

grades (Baa or BBB or better) by at least one NRSRO that rate such

securities, or if it is unrated but judged to be of comparable

quality by the Fund’s sub-adviser. A security is considered

investment grade if it is rated within the four highest letter

grades by at least one NRSRO that rate such securities (even if

rated lower by another), or if it is unrated but judged to be of

comparable quality by the Fund’s sub-adviser (such securities are

commonly referred to as split-rated securities).

The Fund may invest up to 75% of its

Managed Assets in municipal securities that are rated BBB/Baa or

lower by at least one NRSRO or are unrated but judged to be of

comparable quality by the fund’s sub-adviser.

The Fund may invest up to 20% of its

Managed Assets in municipal securities that at the time of

investment are rated below investment grade (Ba or BB or lower) by

all NRSRO or are unrated but judged to be of comparable quality by

the Fund’s sub-adviser; however, the Fund may not invest more than

10% of its Managed Assets in municipal securities rated below B3/B-

by all NRSROs that rate the security or that are unrated but judged

to be of comparable quality by the Fund’s sub-adviser.

The Fund may not invest more than 10% of

its Managed Assets in municipal securities rated below B3/B- by any

NRSROs that rate the security or that are unrated but judged to be

of comparable quality by the fund’s sub-adviser.

The Fund may invest in distressed

securities but may not invest in the securities of an issuer which,

at the time of investment, is in default on its obligations to pay

principal or interest thereon when due or that is involved in a

bankruptcy proceeding (i.e., rated below C-, at the time of

investment); provided, however, that the Fund’s sub-adviser may

determine that it is in the best interest of shareholders in

pursuing a workout arrangement with issuers of defaulted securities

to make loans to the defaulted issuer or another party, or purchase

a debt, equity or other interest from the defaulted issuer or

another party, or take other related or similar steps involving the

investment of additional monies, but only if that issuer’s

securities are already held by the Fund.

The Fund may invest in the securities of

an issuer which, at the time of investment, is in default on its

obligations to pay principal or interest thereon when due or that

is involved in a bankruptcy proceeding (i.e., rated below C- at the

time of investment) (“defaulted securities”), and may invest in

municipal securities that are experiencing other financial

difficulties at the time of acquisition (such securities are

commonly referred to as distressed securities). The Fund’s

sub-adviser may determine that it is in the best interest of

shareholders in pursuing a workout arrangement with issuers of

defaulted securities to make loans to the defaulted issuer or

another party, or purchase a debt, equity or other interest from

the defaulted issuer or another party, or take other related or

similar steps involving the investment of additional monies.

Exposure to lower rated securities involves special risks,

including an increased risk with respect to the issuer’s capacity

to pay interest or dividends and repay principal.

Nuveen is a leading sponsor of closed-end funds (CEFs) with $53

billion of assets under management across 51 CEFs as of 30 Jun

2023. The funds offer exposure to a broad range of asset classes

and are designed for income-focused investors seeking regular

distributions. Nuveen has more than 35 years of experience managing

CEFs.

About Nuveen

Nuveen, the investment manager of TIAA, offers a comprehensive

range of outcome-focused investment solutions designed to secure

the long-term financial goals of institutional and individual

investors. Nuveen has $1.1 trillion in assets under management as

of 30 Jun 2023 and operations in 27 countries. Its investment

specialists offer deep expertise across a comprehensive range of

traditional and alternative investments through a wide array of

vehicles and customized strategies. For more information, please

visit www.nuveen.com.

Nuveen Securities, LLC, member FINRA and SIPC.

The information contained on the Nuveen website is not a part of

this press release.

FORWARD LOOKING STATEMENTS

Certain statements made in this release are forward-looking

statements. Actual future results or occurrences may differ

significantly from those anticipated in any forward-looking

statements due to numerous factors. These include, but are not

limited to:

• market developments; including the timing of distributions and

other events identified in this press release;

• legal and regulatory developments; and

• other additional risks and uncertainties.

EPS-3140917CR-E0923W

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230929671843/en/

For more information, please visit Nuveen’s CEF homepage

www.nuveen.com/closed-end-funds or contact:

Financial Professionals: 800-752-8700

Investors: 800-257-8787

Media: media-inquiries@nuveen.com

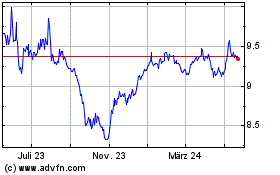

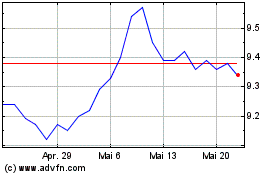

Nuveen Muni Income (NYSE:NMI)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Nuveen Muni Income (NYSE:NMI)

Historical Stock Chart

Von Feb 2024 bis Feb 2025