Murphy USA Inc. (NYSE: MUSA), a leading marketer of retail motor

fuel products and convenience merchandise, today announced

financial results for the three and six months ended June 30,

2024.

Key Highlights:

- Net income was $144.8 million, or $6.92 per diluted share, in

Q2 2024 compared to net income of $132.8 million, or $6.02 per

diluted share, in Q2 2023.

- Total fuel contribution for Q2 2024 was 31.7 cpg, compared to

29.5 cpg in Q2 2023.

- Total retail gallons decreased 0.6% in Q2 2024 compared to Q2

2023, while volumes on a same store sales ("SSS") basis declined

1.3% in Q2 2024 compared to Q2 2023.

- Merchandise contribution dollars for Q2 2024 increased 4.7% to

$216.5 million on average unit margins of 20.0%, compared to Q2

2023 contribution dollars of $206.8 million on unit margins of

19.7%.

- During Q2 2024, the Company repurchased approximately 238.4

thousand common shares for $107.1 million at an average price of

$449.30 per share.

- The Company paid a quarterly cash dividend of $0.44 per share,

or $1.76 per share on an annualized basis, on June 3, 2024, a 4.8%

increase from March of 2024, for a total cash payment of $9.1

million.

“Murphy USA’s advantaged business model delivered strong second

quarter results led by continued outperformance in the core

non-discretionary fuel and tobacco categories,” said President and

CEO Andrew Clyde. “Record second quarter retail fuel contribution

dollars helped make up for a slow start in the first quarter and

clearly demonstrated that structural margin dynamics remain intact,

despite limited volatility versus prior years. Nicotine continues

to gain share, while center-of-store results remain mixed,

particularly in the Northeast where inflation and other drivers are

impacting traffic at QuickChek, more than offsetting the benefits

of our initiatives to drive further value in the business. Given

these trends remain below our high expectations into the third

quarter, we are revising our full-year merchandise margin guidance.

Despite these headwinds, customer spend on non-discretionary

categories remains robust in our core footprint, creating

sustainable value as our NTI activity accelerates in the second

half of 2024 and into 2025.”

Consolidated Results

Three Months Ended June

30,

Six Months Ended June

30,

Key Operating Metrics

2024

2023

2024

2023

Net income (loss) ($ Millions)

$

144.8

$

132.8

$

210.8

$

239.1

Earnings per share (diluted)

$

6.92

$

6.02

$

10.02

$

10.82

Adjusted EBITDA ($ Millions)

$

278.6

$

257.1

$

442.9

$

477.3

Net income and Adjusted EBITDA for Q2 2024 were higher versus

the prior-year quarter, due primarily to higher total fuel

contribution and higher overall merchandise contribution, which

were partially offset by higher store operating expenses.

Fuel

Three Months Ended June

30,

Six Months Ended June

30,

Key Operating Metrics

2024

2023

2024

2023

Total retail fuel contribution ($

Millions)

$

365.2

$

334.7

$

615.2

$

599.4

Total PS&W contribution ($

Millions)

(3.8

)

(53.0

)

2.9

(103.1

)

RINs (included in Other operating revenues

on Consolidated Income Statement) ($ Millions)

28.9

84.1

58.3

199.4

Total fuel contribution ($ Millions)

$

390.3

$

365.8

$

676.4

$

695.7

Retail fuel volume - chain (Million

gal)

1,231.6

1,238.8

2,384.7

2,380.5

Retail fuel volume - per store (K gal

APSM)1

247.2

249.3

238.6

239.8

Retail fuel volume - per store (K gal

SSS)2

244.3

245.2

235.7

236.2

Total fuel contribution (cpg)

31.7

29.5

28.4

29.2

Retail fuel margin (cpg)

29.7

27.0

25.8

25.2

PS&W including RINs contribution

(cpg)

2.0

2.5

2.6

4.0

1Average Per Store Month ("APSM") metric

includes all stores open through the date of calculation

22023 amounts not revised for 2024

raze-and-rebuild activity

Total fuel contribution dollars of $390.3 million increased

$24.5 million, or 6.7%, in Q2 2024 compared to Q2 2023 due to

higher margins partially offset by lower retail volumes sold during

the period. Retail fuel contribution dollars increased $30.5

million, or 9.1%, to $365.2 million compared to Q2 2023 due to

higher retail fuel margins partially offset by lower volumes sold.

For Q2 2024, retail fuel margins were 29.7 cpg, a 10.0% increase

versus the prior-year quarter, and overall retail volumes were 0.6%

lower in Q2 2024 compared to the prior-year quarter. PS&W

contribution including RINs decreased $6.0 million when compared to

Q2 2023, primarily due to a regional supply imbalance that offset

improved spot-to-rack spreads seen in other regions.

Merchandise

Three Months Ended June

30,

Six Months Ended June

30,

Key Operating Metrics

2024

2023

2024

2023

Total merchandise contribution ($

Millions)

$

216.5

$

206.8

$

408.1

$

393.9

Total merchandise sales ($ Millions)

$

1,080.4

$

1,049.0

$

2,081.1

$

2,015.2

Total merchandise sales ($K SSS)1,2

$

211.3

$

204.7

$

203.2

$

197.0

Merchandise unit margin (%)

20.0

%

19.7

%

19.6

%

19.6

%

Tobacco contribution ($K SSS)1,2

$

20.0

$

18.2

$

19.2

$

17.8

Non-tobacco contribution ($K SSS)1,2

$

22.8

$

22.5

$

21.1

$

21.1

Total merchandise contribution ($K

SSS)1,2

$

42.8

$

40.7

$

40.3

$

38.9

12023 amounts not revised for 2024

raze-and-rebuild activity

2Includes store-level discounts for Murphy

Drive Reward ("MDR") redemptions and excludes change in value of

unredeemed MDR points

Total merchandise contribution increased $9.7 million, or 4.7%,

to $216.5 million in Q2 2024 compared to the prior-year quarter,

due primarily to higher merchandise sales. Total tobacco

contribution dollars in Q2 2024 increased 10.3% and non-tobacco

contribution dollars increased 0.3% compared to Q2 2023. Total

merchandise contribution increased 5.0% on a SSS basis in the

current quarter compared to the prior-year quarter.

Other Areas

Three Months Ended June

30,

Six Months Ended June

30,

Key Operating Metrics

2024

2023

2024

2023

Total store and other operating expenses

($ Millions)

$

269.9

$

256.7

$

522.0

$

495.0

Store OPEX excluding payment fees and

rent

($K APSM)

$

35.5

$

33.5

$

34.4

$

32.3

Total SG&A cost ($ Millions)

$

59.1

$

59.4

$

121.2

$

118.4

Total store and other operating expenses were $13.2 million

higher in Q2 2024 versus Q2 2023, mainly due to employee related

expenses and store maintenance costs combined with new store

growth. Store OPEX excluding payment fees and rent on an APSM basis

were 6.0% higher versus Q2 2023, primarily attributable to

increased employee related expenses and maintenance costs.

Store Openings

The tables below reflect changes in our store portfolio in Q2

2024:

Net Change in Q2 2024

Murphy USA /

Express

QuickChek

Total

New-to-industry ("NTI")

3

—

3

Closed

—

—

—

Net change

3

—

3

Raze-and-rebuilds reopened in Q2*

9

—

9

Under Construction at End of Q2

NTI

15

3

18

Raze-and-rebuilds*

26

—

26

Total under construction at end of Q2

41

3

44

Net Change YTD in 2024

NTI

5

1

6

Closed

—

(3

)

(3

)

Net change

5

(2

)

3

Raze-and-rebuilds reopened YTD*

11

—

11

Store count at June 30, 2024*

1,582

154

1,736

*Store counts include raze-and-rebuild

stores

Financial Resources

As of June 30,

Key Financial Metrics

2024

2023

Cash and cash equivalents ($ Millions)

$

79.8

$

92.9

Marketable securities, current ($

Millions)

$

4.5

$

13.0

Marketable securities, non-current ($

Millions)

$

3.0

$

7.4

Long-term debt, including finance lease

obligations ($ Millions)

$

1,781.4

$

1,787.3

Cash balances as of June 30, 2024 totaled $79.8 million, and the

Company also had total marketable securities of $7.5 million.

Long-term debt consisted of approximately $298.6 million in

carrying value of 5.625% senior notes due in 2027, $496.1 million

in carrying value of 4.75% senior notes due in 2029, $494.9 million

in carrying value of 3.75% senior notes due in 2031, and $379.2

million of term debt, combined with approximately $112.6 million in

long-term finance leases. The $350 million revolving cash flow

facility was undrawn as of June 30, 2024.

Three Months Ended June

30,

Six Months Ended June

30,

Key Financial Metric

2024

2023

2024

2023

Average shares outstanding (diluted) (in

thousands)

20,922

22,051

21,043

22,092

At June 30, 2024, the Company had common shares outstanding of

20,492,205. Common shares repurchased during the quarter were

approximately 238.4 thousand shares for $107.1 million. Common

shares purchased during the six months ended June 30, 2024, were

approximately 454.5 thousand shares for a total of $194.0 million.

As of June 30, 2024, approximately $1.2 billion remained available

under the existing $1.5 billion 2023 authorization.

The effective income tax rate for Q2 2024 was 25.1% compared to

24.4% in Q2 2023.

The Company paid a quarterly cash dividend on June 3, 2024 of

$0.44 per share, or $1.76 per share on an annualized basis, a 4.8%

increase from the previous quarter, for a total cash payment of

$9.1 million. The total amount paid in dividends year-to-date is

$17.9 million, or $0.86 per share.

2024 Guidance Update

Concurrent with the earnings release, the Company is also

updating our full-year merchandise contribution results to a range

of $830 million to $840 million, down from the original guided

range of $860 million to $880 million. While nicotine results have

been stronger than planned in 2024, we have experienced weaker than

expected consumer demand, particularly in the Northeast, that has

impacted both core food and beverage traffic drivers and related

discretionary center-of-store sales. We expect the lower demand to

persist through the remainder of 2024 and mostly offset the

benefits from some of our back-half weighted initiatives

In addition, we are revising our guidance for raze-and-rebuild

sites to more than 40, up from the originally guided range of 35 to

40, due primarily to the successful efforts of our team to pull

forward some future projects into the current year.

All other previously issued guidance metrics remain unchanged.

More details on the guidance updates will be shared in the earnings

conference call noted below.

Earnings Call Information

The Company will host a conference call on August 1, 2024 at

10:00 a.m. Central Time to discuss second quarter 2024 results. The

conference call number is 1 (888) 330-2384 and the conference ID

number is 6680883. The earnings and investor related materials,

including reconciliations of any non-GAAP financial measures to

GAAP financial measures and any other applicable disclosures, will

be available on that same day on the investor section of the Murphy

USA website (http://ir.corporate.murphyusa.com). Approximately one

hour after the conclusion of the conference, the webcast will be

available for replay. Shortly thereafter, a transcript will be

available.

Source: Murphy USA Inc. (NYSE: MUSA)

Forward-Looking Statements

Certain statements in this news release contains certain

statements or may suggest “forward-looking” information (as defined

in the Private Securities Litigation Reform Act of 1995) that

involve risk and uncertainties, including, but not limited to our

M&A activity, anticipated store openings and associated capital

expenditures, fuel margins, merchandise margins, sales of RINs,

trends in our operations, dividends, and share repurchases. Such

statements are based upon the current beliefs and expectations of

the Company’s management and are subject to significant risks and

uncertainties. Actual future results may differ materially from

historical results or current expectations depending upon factors

including, but not limited to: our ability to successfully expand

our food and beverage offerings; our ability to continue to

maintain a good business relationship with Walmart; successful

execution of our growth strategy, including our ability to realize

the anticipated benefits from such growth initiatives, and the

timely completion of construction associated with our newly planned

stores which may be impacted by the financial health of third

parties; our ability to effectively manage our inventory, manage

disruptions in our supply chain and our ability to control costs;

geopolitical events, such as Russia's invasion of Ukraine and the

conflicts in the Middle East, that impact the supply and demand and

price of crude oil; the impact of severe weather events, such as

hurricanes, floods and earthquakes; the impact of a global health

pandemic and any governmental response thereto; the impact of any

systems failures, cybersecurity and/or security breaches of the

company or its vendor partners, including any security breach that

results in theft, transfer or unauthorized disclosure of customer,

employee or company information or our compliance with information

security and privacy laws and regulations in the event of such an

incident; successful execution of our information technology

strategy; reduced demand for our products due to the implementation

of more stringent fuel economy and greenhouse gas reduction

requirements, or increasingly widespread adoption of electric

vehicle technology; future tobacco or e-cigarette legislation and

any other efforts that make purchasing tobacco products more costly

or difficult could hurt our revenues and impact gross margins;

efficient and proper allocation of our capital resources, including

the timing, declaration, amount and payment of any future dividends

or levels of the Company's share repurchases, or management of

operating cash; the market price of the Company's stock prevailing

from time to time, the nature of other investment opportunities

presented to the Company from time to time, the Company's cash

flows from operations, and general economic conditions; compliance

with debt covenants; availability and cost of credit; and changes

in interest rates. Our SEC reports, including our most recent

annual Report on Form 10-K and quarterly report on Form 10-Q,

contain other information on these and other factors that could

affect our financial results and cause actual results to differ

materially from any forward-looking information we may provide. The

Company undertakes no obligation to update or revise any

forward-looking statements to reflect subsequent events, new

information or future circumstances.

Murphy USA Inc.

Consolidated Statements of

Income

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

(Millions of dollars, except share and per

share amounts)

2024

2023

2024

2023

Operating Revenues

Petroleum product sales1

$

4,340.5

$

4,450.6

$

8,152.2

$

8,444.8

Merchandise sales

1,080.4

1,049.0

2,081.1

2,015.2

Other operating revenues

30.8

85.8

62.1

202.6

Total operating revenues

5,451.7

5,585.4

10,295.4

10,662.6

Operating Expenses

Petroleum product cost of goods sold1

3,980.2

4,170.0

7,536.3

7,950.6

Merchandise cost of goods sold

863.9

842.2

1,673.0

1,621.3

Store and other operating expenses

269.9

256.7

522.0

495.0

Depreciation and amortization

59.3

57.8

118.0

114.2

Selling, general and administrative

59.1

59.4

121.2

118.4

Accretion of asset retirement

obligations

0.8

0.7

1.6

1.5

Total operating expenses

5,233.2

5,386.8

9,972.1

10,301.0

Gain (loss) on sale of assets

(1.4

)

0.1

(1.0

)

(0.1

)

Income (loss) from operations

217.1

198.7

322.3

361.5

Other income (expense)

Investment income

0.9

1.8

2.1

2.6

Interest expense

(24.9

)

(25.0

)

(49.8

)

(49.9

)

Other nonoperating income (expense)

0.1

0.2

0.5

0.5

Total other income (expense)

(23.9

)

(23.0

)

(47.2

)

(46.8

)

Income before income taxes

193.2

175.7

275.1

314.7

Income tax expense (benefit)

48.4

42.9

64.3

75.6

Net Income

$

144.8

$

132.8

$

210.8

$

239.1

Basic and Diluted Earnings Per Common

Share

Basic

$

7.02

$

6.12

$

10.17

$

11.01

Diluted

$

6.92

$

6.02

$

10.02

$

10.82

Weighted-average Common shares outstanding

(in thousands):

Basic

20,643

21,686

20,728

21,712

Diluted

20,922

22,051

21,043

22,092

Supplemental information:

1Includes excise taxes of:

$

597.5

$

594.2

$

1,156.3

$

1,139.0

Murphy USA Inc.

Segment Operating

Results

(Unaudited)

(Millions of dollars, except revenue per

same store sales (in thousands) and store counts)

Three Months Ended June

30,

Six Months Ended June

30,

Marketing Segment

2024

2023

2024

2023

Operating Revenues

Petroleum product sales

$

4,340.5

$

4,450.6

$

8,152.2

$

8,444.8

Merchandise sales

1,080.4

1,049.0

2,081.1

2,015.2

Other operating revenues

30.8

85.8

62.0

202.5

Total operating revenues

5,451.7

5,585.4

10,295.3

10,662.5

Operating expenses

Petroleum products cost of goods sold

3,980.2

4,170.0

7,536.3

7,950.6

Merchandise cost of goods sold

863.9

842.2

1,673.0

1,621.3

Store and other operating expenses

269.8

256.8

521.9

495.0

Depreciation and amortization

55.7

53.2

110.6

105.6

Selling, general and administrative

59.1

59.4

121.2

118.4

Accretion of asset retirement

obligations

0.8

0.7

1.6

1.5

Total operating expenses

5,229.5

5,382.3

9,964.6

10,292.4

Gain (loss) on sale of assets

(1.0

)

0.1

(1.1

)

(0.1

)

Income (loss) from operations

221.2

203.2

329.6

370.0

Other income (expense)

Interest expense

(2.1

)

(2.2

)

(4.2

)

(4.5

)

Total other income (expense)

(2.1

)

(2.2

)

(4.2

)

(4.5

)

Income (loss) before income taxes

219.1

201.0

325.4

365.5

Income tax expense (benefit)

55.3

49.3

76.1

87.9

Net income (loss) from operations

$

163.8

$

151.7

$

249.3

$

277.6

Total tobacco sales revenue same store

sales1,2

$

135.0

$

128.5

$

130.5

$

124.0

Total non-tobacco sales revenue same store

sales1,2

76.3

76.2

72.7

73.0

Total merchandise sales revenue same store

sales1,2

$

211.3

$

204.7

$

203.2

$

197.0

12023 amounts not revised for 2024

raze-and-rebuild activity

2Includes store-level discounts for Murphy

Drive Reward ("MDR") redemptions and excludes change in value of

unredeemed MDR points

Store count at end of period

1,736

1,725

1,736

1,725

Total store months during the period

5,133

5,149

10,297

10,290

Same store sales information compared to APSM metrics

Variance from prior year

period

Three months ended

Six months ended

June 30, 2024

June 30, 2024

SSS1

APSM2

SSS1

APSM2

Retail fuel volume per month

(1.3

)%

(0.8

)%

(1.1

%)

(0.5

%)

Merchandise sales

3.1

%

3.3

%

3.2

%

3.2

%

Tobacco sales

5.9

%

5.5

%

6.3

%

5.5

%

Non tobacco sales

(1.5

)%

(0.2

)%

(1.9

%)

(0.5

%)

Merchandise margin

5.0

%

5.0

%

3.7

%

3.5

%

Tobacco margin

12.1

%

10.7

%

9.2

%

7.4

%

Non tobacco margin

(0.5

)%

0.6

%

(0.9

%)

0.4

%

1Includes store-level discounts for MDR

redemptions and excludes change in value of unredeemed MDR

points

2Includes all MDR activity

Notes

Average Per Store Month (APSM) metric includes all stores open

through the date of the calculation, including stores acquired

during the period.

Same store sales (SSS) metric includes aggregated individual

store results for all stores open throughout both periods

presented. For all periods presented, the store must have been open

for the entire calendar year to be included in the comparison.

Remodeled stores that remained open or were closed for just a very

brief time (less than a month) during the period being compared

remain in the same store sales calculation. If a store is replaced

either at the same location (raze-and-rebuild) or relocated to a

new location, it will be excluded from the calculation during the

period it is out of service. Newly constructed stores do not enter

the calculation until they are open for each full calendar year for

the periods being compared (open by January 1, 2023 for the stores

being compared in the 2024 versus 2023 comparison). Acquired stores

are not included in the calculation of same store sales for the

first 12 months after the acquisition. When prior period same store

sales volumes or sales are presented, they have not been revised

for current year activity for raze-and-rebuilds and asset

dispositions.

QuickChek uses a weekly retail calendar where each quarter has

13 weeks. The QuickChek results for Q2 2024 covers the period March

30, 2024 to June 28, 2024 and for the 2024 year-to-date period

December 30, 2023 to June 28, 2024. The QuickChek results for Q2

2023 covers the period April 1, 2023 to June 30, 2023 and the 2023

year-to-date period December 31, 2022 to June 30, 2023. The

difference in the timing of the period ends is immaterial to the

overall consolidated results.

Murphy USA Inc.

Consolidated Balance

Sheets

(Millions of dollars, except share

amounts)

June 30, 2024

December 31, 2023

(unaudited)

Assets

Current assets

Cash and cash equivalents

$

79.8

$

117.8

Marketable securities, current

4.5

7.1

Accounts receivable—trade, less allowance

for doubtful accounts of $0.6 and $1.3 at 2024 and 2023,

respectively

386.5

336.7

Inventories, at lower of cost or

market

315.9

341.2

Prepaid expenses and other current

assets

33.4

23.7

Total current assets

820.1

826.5

Marketable securities, non-current

3.0

4.4

Property, plant and equipment, at cost

less accumulated depreciation and amortization of $1,824.9 and

$1,739.2 at 2024 and 2023, respectively

2,655.4

2,571.8

Operating lease right of use assets,

net

463.5

452.1

Intangible assets, net of amortization

139.6

139.8

Goodwill

328.0

328.0

Other assets

20.3

17.5

Total assets

$

4,429.9

$

4,340.1

Liabilities and Stockholders'

Equity

Current liabilities

Current maturities of long-term debt

$

15.6

$

15.0

Trade accounts payable and accrued

liabilities

924.0

834.7

Income taxes payable

31.1

23.1

Total current liabilities

970.7

872.8

Long-term debt, including capitalized

lease obligations

1,781.4

1,784.7

Deferred income taxes

323.0

329.5

Asset retirement obligations

46.3

46.1

Non-current operating lease

liabilities

464.6

450.3

Deferred credits and other liabilities

32.6

27.8

Total liabilities

3,618.6

3,511.2

Stockholders' Equity

Preferred Stock, par $0.01 (authorized

20,000,000 shares, none outstanding)

—

—

Common Stock, par $0.01 (authorized

200,000,000 shares, 46,767,164 shares issued at 2024 and 2023,

respectively)

0.5

0.5

Treasury stock (26,274,959 and 25,929,836

shares held at 2024 and 2023, respectively)

(3,139.4

)

(2,957.8

)

Additional paid in capital (APIC)

479.3

508.1

Retained earnings

3,470.9

3,278.1

Total stockholders' equity

811.3

828.9

Total liabilities and stockholders'

equity

$

4,429.9

$

4,340.1

Murphy USA Inc.

Consolidated Statements of

Cash Flows

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

(Millions of dollars)

2024

2023

2024

2023

Operating Activities

Net income

$

144.8

$

132.8

$

210.8

$

239.1

Adjustments to reconcile net income (loss)

to net cash provided by operating activities

Depreciation and amortization

59.3

57.8

118.0

114.2

Deferred and noncurrent income tax charges

(benefits)

(6.0

)

2.8

(6.5

)

9.4

Accretion of asset retirement

obligations

0.8

0.7

1.6

1.5

Amortization of discount on marketable

securities

—

—

(0.1

)

—

(Gains) losses from sale of assets

1.4

(0.1

)

1.0

0.1

Net (increase) decrease in noncash

operating working capital

51.6

(31.2

)

55.8

(61.6

)

Other operating activities - net

8.9

8.4

16.2

18.2

Net cash provided (required) by operating

activities

260.8

171.2

396.8

320.9

Investing Activities

Property additions

(118.0

)

(72.5

)

(194.2

)

(145.2

)

Proceeds from sale of assets

0.6

1.8

1.6

1.8

Investment in marketable securities

—

(8.4

)

—

(8.4

)

Redemptions of marketable securities

3.0

6.0

4.0

10.5

Other investing activities - net

(0.1

)

(0.2

)

(0.8

)

(1.0

)

Net cash provided (required) by investing

activities

(114.5

)

(73.3

)

(189.4

)

(142.3

)

Financing Activities

Purchase of treasury stock

(106.1

)

(94.2

)

(192.5

)

(107.9

)

Dividends paid

(9.1

)

(8.2

)

(17.9

)

(16.3

)

Borrowings of debt

120.0

—

120.0

8.0

Repayments of debt

(123.9

)

(3.9

)

(127.8

)

(15.7

)

Amounts related to share-based

compensation

(4.1

)

(0.8

)

(27.2

)

(14.3

)

Net cash provided (required) by financing

activities

(123.2

)

(107.1

)

(245.4

)

(146.2

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

23.1

(9.2

)

(38.0

)

32.4

Cash, cash equivalents and restricted cash

at beginning of period

56.7

102.1

117.8

60.5

Cash, cash equivalents and restricted cash

at end of period

$

79.8

$

92.9

$

79.8

$

92.9

Supplemental Disclosure Regarding Non-GAAP Financial

Information

The following table reconciles EBITDA and Adjusted EBITDA to Net

Income for the three and six months ended June 30, 2024 and 2023.

EBITDA means net income (loss) plus net interest expense, plus

income tax expense, depreciation and amortization, and Adjusted

EBITDA adds back (i) other non-cash items (e.g., impairment of

properties and accretion of asset retirement obligations) and (ii)

other items that management does not consider to be meaningful in

assessing our operating performance (e.g., (income) from

discontinued operations, net settlement proceeds, (gain) loss on

sale of assets, loss on early debt extinguishment, transaction and

integration costs related to acquisitions, and other non-operating

(income) expense). EBITDA and Adjusted EBITDA are not measures that

are prepared in accordance with U.S. generally accepted accounting

principles (GAAP).

We use Adjusted EBITDA in our operational and financial

decision-making, believing that the measure is useful to eliminate

certain items in order to focus on what we deem to be a more

reliable indicator of ongoing operating performance and our ability

to generate cash flow from operations. Adjusted EBITDA is also used

by many of our investors, research analysts, investment bankers,

and lenders to assess our operating performance. We believe that

the presentation of Adjusted EBITDA provides useful information to

investors because it allows understanding of a key measure that we

evaluate internally when making operating and strategic decisions,

preparing our annual plan, and evaluating our overall performance.

However, non-GAAP measures are not a substitute for GAAP

disclosures, and EBITDA and Adjusted EBITDA may be prepared

differently by us than by other companies using similarly titled

non-GAAP measures.

The reconciliation of net income (loss) to EBITDA and Adjusted

EBITDA is as follows:

Three Months Ended June

30,

Six Months Ended June

30,

(Millions of dollars)

2024

2023

2024

2023

Net income

$

144.8

$

132.8

$

210.8

$

239.1

Income tax expense (benefit)

48.4

42.9

64.3

75.6

Interest expense, net of investment

income

24.0

23.2

47.7

47.3

Depreciation and amortization

59.3

57.8

118.0

114.2

EBITDA

$

276.5

$

256.7

$

440.8

$

476.2

Accretion of asset retirement

obligations

0.8

0.7

1.6

1.5

(Gain) loss on sale of assets

1.4

(0.1

)

1.0

0.1

Other nonoperating (income) expense

(0.1

)

(0.2

)

(0.5

)

(0.5

)

Adjusted EBITDA

$

278.6

$

257.1

$

442.9

$

477.3

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731046117/en/

Investor Contact: Christian Pikul Vice President,

Investor Relations and Financial Planning and Analysis

christian.pikul@murphyusa.com

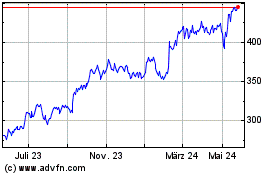

Murphy USA (NYSE:MUSA)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Murphy USA (NYSE:MUSA)

Historical Stock Chart

Von Feb 2024 bis Feb 2025