UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25/A

(Amendment No. 1)

NOTIFICATION OF LATE FILING

SEC File Number: 001-41100

CUSIP Number: 29978K102

| (Check one): |

|

o Form 10-K |

o Form 20-F |

o Form 11-K |

x Form

10-Q |

o Form 10-D |

| |

|

o Form N-SAR |

o Form N-CSR |

|

|

|

| |

|

|

|

|

|

|

| |

|

For Period Ended: |

September

30, 2023 |

| |

|

o Transition Report on Form 10-K |

|

|

| |

|

o Transition Report on Form 20-F |

|

|

| |

|

o Transition Report on Form 11-K |

|

|

| |

|

o Transition Report on Form 10-Q |

|

|

| |

|

o Transition Report on Form N-SAR |

|

|

| |

|

For the Transition Period Ended: |

|

| |

|

|

|

|

|

|

|

Read Instructions (on back page) Before Preparing Form. Please Print or Type.

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein. |

If the notification relates to a portion of the filing checked above,

identify the Item(s) to which the notification relates: Not Applicable

Explanatory Note

Everest Consolidator Acquisition Corporation (the “Company”)

is filing this Amendment No. 1 to the Company’s Form 12b-25, originally filed with the Securities and Exchange Commission (the

“SEC”) on November 15, 2023 (the “Original Filing”) reporting the inability to timely file the Company’s

Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023 (the “Third Quarter 10-Q”), to amend the

Company’s response to Part III below to include additional disclosure regarding disbursements of funds withdrawn from the Company’s

Trust Account restricted for payment of tax liabilities under the Company’s Charter and the terms of the Trust Agreement (each

as defined below). The Company omitted certain information from the Original Filing relating to disbursements made by the Company between

October 1, 2023 and November 6, 2023 for general corporate purposes.

Management has concluded that, as of September 30, 2023, the Company’s

disclosure controls and procedures were not effective at the reasonable assurance level as a result of the Company’s failure to

disclose the disbursements of the balance of the funds withdrawn from the Trust Account in the the Original Filing or in the Third Quarter

10-Q and as a result of the existence of material weaknesses in the Company’s internal control over financial reporting related

to the identification of material contractual arrangements impacting the Company’s financial statements, the review and approval

of cash disbursements, and the reporting of material subsequent event information in the notes to the Company’s unaudited condensed

financial statements. The remediation process relating to the Company’s identified material weaknesses is ongoing as of the date

of this Amendment No. 1.

Except as described above, no other changes have been made to the Original

Filing, which speaks as of the date of the Original Filing, and has not been updated to reflect any events which occurred subsequent to

the date of the Original Filing.

PART I — REGISTRANT INFORMATION

| EVEREST CONSOLIDATOR ACQUISITION CORPORATION |

| Full Name of Registrant |

| |

| N/A |

| Former Name if Applicable |

| |

| 4041 MacArthur Blvd |

| Address of Principal Executive Office (Street and Number) |

| |

| Newport Beach, CA 92660 |

| City, State and Zip Code |

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort

or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

| |

(a) |

The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense |

| ¨ |

(b) |

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

| |

(c) |

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III — NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q,

10-D, N-SAR, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

Everest Consolidator Acquisition Corporation (the “Company”)

is unable, without unreasonable effort or expense, to file its Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2023 (the “Form 10-Q”) by the prescribed due date because the Company requires additional time to address the implications

of the matters described below and to complete its procedures for finalizing the Form 10-Q.

The Company is facing internal resource constraints

and a significant amount of time and personnel resources have been devoted to completing the Company’s previously announced business

combination transaction. During the third quarter of 2023, the Company withdrew $1,075,252 of interest and dividend income earned on the

balance of the Company’s Trust Account for payment of estimated tax liabilities. The amount withdrawn was restricted for payment

of such tax liabilities under the Company’s Amended and Restated Certificate of Incorporation (“Charter”) and the terms

of the Investment Management Trust Agreement between the Company and Equiniti Trust Company, LLC (f/k/a American Stock Transfer &

Trust Company, LLC), as trustee (the “Trust Agreement”). As a result of internal personnel resource constraints, the Company

mistakenly used $752,885 of the withdrawn funds in the third quarter of 2023 to pay general operating expenses counter to the terms of

the Trust Agreement. Subsequent to the end of the quarter ended September 30, 2023, Everest disbursed an aggregate of $322,267, the balance

of the funds withdrawn from the Trust Account, for payment of general operating expenses between October 1, 2023 and November 6, 2023.

As of the date hereof, the Company is working

to source additional funding to fund its future operating expenses and pay its estimated tax liability. However, there can be no assurance

that the Company will be able to obtain such funding.

The

Company is assessing the impact of the foregoing on its internal controls over financial reporting and disclosure controls and procedures.

The

Company also expects to disclose the ongoing remediation activities relating to its existing material weakness in internal control over

financial reporting related to the identification of material contractual arrangements impacting the Company’s financial statements,

as previously disclosed in the Company’s Form 10-Q for the quarterly period ended June 30, 2023.

PART IV — OTHER INFORMATION

| (1) |

Name and telephone number of person to contact in regard to this notification |

| |

Adam

Dooley |

|

949 |

|

610-0835 |

| |

(Name) |

|

(Area Code) |

|

(Telephone Number) |

| |

|

| (2) |

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). |

| |

|

| |

|

|

|

|

xYes o No |

| |

|

|

|

|

|

| (3) |

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? |

| |

|

| |

|

|

|

|

xYes ¨ No |

| |

|

|

|

|

|

| |

If so, attach an explanation of the anticipated change, both narratively

and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made. |

The

Company expects to report that for the three months ended September 30, 2023, it had a net loss of $1,594,960 which consists of investment

income held in the trust account of $2,225,997, general and administrative expenses of $3,187,663, conditional guarantee expense of $139,134,

interest expense of $37,200, and the provision for income taxes of $456,960. Of the $3,187,663 of general and administrative expenses,

approximately $2.4 million relate to business combination costs.

The

Company expects to report that for the nine months ended September 30, 2023, it had a net loss of $9,215,480, which consists of investment

income held in the trust account of $6,294,454, general and administrative expenses of $10,400,770, conditional guarantee expense of

$3,706,339, interest expense of $112,200 and the provision for income taxes of $1,290,625. Of the $10,400,770 of general and administrative

expenses, approximately $8.4 million relate to business combination costs.

For

the three months ended September 30, 2022, we had net income of $222,640, which consists of general and administrative expenses of $379,100,

which was offset by investment income of $601,740.

For

the nine months ended September 30, 2022, we had a net loss of $559,203, which consists of general and administrative expenses of $1,301,314

and income tax expense of $109,576 which were offset by investment income of $851,687.

The

Company expects to report that, as of September 30, 2023, the Company held $322,367 outside of the Trust Account (reserved for tax payments)

and had a working capital deficit of $13,863,333.

The

amounts reported above are still under review by the Registrant’s independent registered public accounting firm and accounting

staff and may differ once reported in the Form 10-Q to be filed by the Registrant.

Disclosure Regarding Forward-Looking Statements

This Form 12b-25 contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions

for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange

Act of 1934, as amended. Words such as “expect,” “will,” “anticipates,” “estimates” and

variations of such words and similar future or conditional expressions are intended to identify forward-looking statements. These forward-looking

statements include, but are not limited to, statements regarding our expected financial results for the quarterly period ended September

30, 2023 to be reported in the Form 10-Q and expectations as to the Company’s ability to obtain funding to pay tax liabilities,

which reflect the Company’s expectations based upon currently available information and data. Because such statements are based

on the Company’s current expectations and are not statements of fact, actual results may differ materially from those projected

or estimated and you are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements are

not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions

and other important factors, many of which are outside the Company's control, that could cause actual results or outcomes to differ materially

from those discussed in the forward-looking statements, including our ability to complete the filing of the Form 10-Q within the 5-day

extension permitted by SEC rules, risks related to the material weaknesses identified in our internal control over financial reporting

and the ineffectiveness of our disclosure controls and procedures; risks arising from our use of funds restricted for payment of the Company’s

tax liabilities counter to the terms of the Trust Agreement and the other risks discussed in the Company’s filings with the SEC.

Forward-looking statements speak only as of the date they are made. The Company disclaims and does not undertake any obligation to update

or revise any forward-looking statement in this report, except as required by applicable law or regulation.

EVEREST CONSOLIDATOR ACQUISITION CORPORATION

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its

behalf by the undersigned hereunto duly authorized.

| Date |

February 14, 2024 |

|

By |

/s/ Adam Dooley |

| |

|

|

|

Name: |

Adam Dooley |

| |

|

|

|

Title: |

Chief Executive Officer |

INSTRUCTION: The form may be signed by an executive officer of the

registrant or by any other duly authorized representative. The name and title of the person signing the form shall be typed or printed

beneath the signature. If the statement is signed on behalf of the registrant by an authorized representative (other than an executive

officer), evidence of the representative’s authority to sign on behalf of the registrant shall be filed with the form.

| |

ATTENTION |

|

| Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001). |

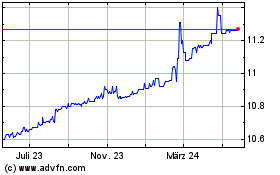

Everest Consolidator Acq... (NYSE:MNTN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

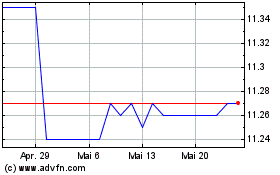

Everest Consolidator Acq... (NYSE:MNTN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025