TV advertising revenue: €458.5 m, up

7.2%

Consolidated revenue: €656.9 m, up 7.1%

excluding scope effects1

Consolidated EBITA: €120.1 m

Regulatory News:

M6 Group is rolling out its transformation strategy focused

on the development of its streaming activities and the power of its

brands and linear content. The second quarter was characterised by

the successful launch of its new streaming platform, M6+, and by

the broadcast of Euro 2024 matches.

- For the first half of the 2024 financial year, M6 Group

recorded consolidated revenue of €656.9 million, up

7.1% on a like-for-like basis.

- Group advertising revenue grew 4.9% compared with the first

half of 2023, driven by the recovery in the TV advertising

market and the broadcast of popular sporting events, primarily

football’s Euro 2024. TV advertising revenue thus increased

by 7.2% to €458.5 million.

- M6+ launched successfully in May 2024. It already has a

brand recognition rate of 88% and the number of hours viewed

since its launch is 60% higher than in 2023. Streaming

revenue for the half-year stood at €44.3 million, an

increase of 39% in relation to 2023, and accounting for

8.4% of total TV revenue, up 2 percentage points

year-on-year.

- Non-advertising advertising grew 8.9%, primarily driven

by the momentum of the film business over the first half-year.

The Group recorded €120.1 million in consolidated profit from

recurring operations (EBITA) (down 11.1%), representing an

operating margin of 18.3%, impacted by the increased cost of

programmes (Euro 2024) and investments in streaming, notably costs

related to the launch of M6+.

Equity-accounted entities posted a loss of €6.1 million, due to

continued investments in streaming technology in Bedrock, and an

increase in the cost of GSG’s debt which absorbed its operating

margin improvement (12% compared with 8.8% in 2023).

Net profit attributable to the Group stood at €85.1

million.

H1 (€ millions)

2024

2023

% change

Consolidated revenue2

656.9

621.9

+5.6%

Group advertising revenue

528.8

504.3

+4.9% - of which TV advertising revenue

458.5

427.8

+7.2% - of which other advertising revenue

70.3

76.5

-8.2%

Group non-advertising revenue

128.1

117.6

+8.9%

Consolidated profit from

recurring operations (EBITA)3

120.1

135.0

-11.1%

Margin from recurring operations

18.3%

21.7%

-3.4pp Operating income and expenses

related to business combinations

(4.9)

(4.9)

+0.2%

Capital gains on

disposals of equity investments

0.0

4.7

n.a

Operating profit (EBIT)

115.1

134.7

-14.6%

Net financial income

9.8

4.5

n.a Share of profit/(loss) of

equity-accounted entities

(6.1)

4.3

n.a Current and deferred tax

(33.5)

(37.0)

-9.5%

Net profit for the period

85.3

106.5

-19.9%

Net profit for the period

- Group share

85.1

104.6

-18.7%

In accordance with IFRS 8, the contribution of the Group’s 4

operating segments to consolidated revenue and EBITA was as

follows:

Q1

Q2 H1

(€ millions)

2024

2023

%

2024

2023

%

2024

2023

%

TV

254.5

249.8

+1.9%

270.8

246.3

9.9%

525.3

496.1

+5.9% Radio

33.9

34.4

-1.4%

40.7

43.9

-7.2%

74.7

78.3

-4.6%

Production & Audiovisual Rights

27.0

18.7

+44.3%

13.3

8.6

54.8%

40.3

27.3

+47.6% Diversification

6.6

9.8

-31.9%

9.6

10.0

-4.0%

16.2

19.7

-17.8%

Other revenue

0.2

0.2

n.a

0.2

0.2

n.a

0.4

0.5

n.a

Consolidated revenue

322.3

312.9

+3.0%

334.6

309.0

8.3%

656.9

621.9

+5.6%

TV

86.5

99.0

-12.7%

Radio

15.0

18.5

-18.9%

Production & Audiovisual Rights

16.8

10.3

+62.8% Diversification

3.2

9.9

-67.4%

Unallocated items

(1.5)

(2.8)

n.a

EBITA

57.9

59.5

-2.6%

62.2

75.5

-17.7%

120.1

135.0

-11.1%

Operating margin

18.0%

19.0%

18.6%

24.4%

18.3%

21.7%

Television

Linear broadcasting

During the first half of 2024, the Group’s free to air channels

(M6, W9, 6ter and Gulli) achieved an audience share of 20.5%4 on

the commercial target of 25-49 year olds (against 20.6% during the

first half of 2023), within an ever more competitive

environment.

On M6, entertainment shows remain popular, attracting large

audiences (best ever season for Pékin Express, the brands Top Chef,

Mariés au premier regard and Qui veut être mon associé were leaders

on the commercial target), the range of films and new French dramas

enhanced the evening line-up, as did the shake-up of magazine

shows.

In June, Euro 2024 attracted wide audiences with 47 million

French viewers enjoying these high points on M6, with 12.7 million

tuning into the France vs Portugal quarter final, the channel’s

best audience in 3 years.

W9 achieved its best six months in four years on the commercial

target, as a result of the successful refresh of its access

primetime schedule (The Power, Les apprentis champions), along with

its popular evening line-ups both with Europa League matches and a

wide range of films and magazine shows.

6ter remains the top DTT HD channel with a 2.3% audience share

on the 25-49 year old target, and Gulli maintained its position as

the gold standard for kids’ TV whilst simultaneously recording

strong growth in the evening schedule with adult audiences (+0.4

point compared with first-half 2023 on the commercial target).

Lastly, Paris Première attracted 12.7 million viewers per month

and posted growth of 0.1 percentage points, achieving an audience

share of 0.8% amongst viewers over 4, a new record. Téva, the

Group’s women’s channel, achieved 0.6% on the WRP<50 target.

Non-linear broadcasting

M6 Group has gone on to record a record six months for its

streaming activity, driven by the highly successful launch of

M6+, a strategic shift which underlines the relevance of

amplifying the non-linear broadcasting of its content. More than a

third of consumption of leading recurring linear programmes is

digital, demonstrating the growing interest in watching on-demand.

In this regard, and to improve its appeal, M6+ has enhanced its

range with new and exclusive content. The platform remains the

platform with the youngest audience on the market, nine

years younger than the average of its competitors.

H1

2024

2023

% change

Monthly users(millions)

21.3

16.1

+33%

MHV streaming5(millions

of hours viewed)

322

262

+23% % total MHV

6.5%

5.5%

+1pp

Streaming revenue6(€

millions)

44.3

31.8

+39% % TV revenue

8.4%

6.4%

+2pp

Overall performance

The strong growth in non-linear consumption is thus reflected in

a 39% increase in streaming revenue over the first six months of

2024.

Overall and driven by the strong performance of the advertising

market and the broadcast of football’s Euros in June, the TV

division’s advertising revenues grew 7.2% in comparison with the

first half of 2023.

The cost of content for the TV division increased by

€22.2 million and stood at €264.2 million for the six months ended

30 June 2024 against €242.0 million for the half-year ended 30 June

2023, due to the broadcast of Euro 2024 and the growth in streaming

investments.

The TV activity contributed €86.5 million to consolidated

EBITA and the segment’s margin from recurring operations was

16.5%, down 3.5 percentage points due to the €19.2 million increase

in streaming OPEX.

Radio

Over the first half of 2024, RTL radio division recorded an

audience share of 16.5%7 with listeners aged 13 and over and

thereby maintained its position as the leading commercial radio

group, attracting more than 8.8 million listeners each day.

Over the first six months of the year, Radio revenue stood at

€74.7 million, a decline of 4.6% compared with H1 2023 including a

3.4% decrease in advertising revenue.

EBITA stood at €15.0 million, compared with €18.5 million over

the first half of 2023, thereby recording an operating margin of

20.1%, compared with 23.7% for H1 2023, which was impacted by an

increase in programme investments and broadcasting costs.

Production & Audiovisual Rights

Revenue from the Production and Audiovisual Rights division was

€40.3 million for the first half-year, an increase of 47.6% driven

by the momentum of film revenues over the period and great box

office successes.

The number of cinema admissions for films distributed by SND was

5.4 million in the first half of 2024 (compared with 1.5 million

over the first half of 2023), primarily driven by the success of

the films Cocorico (2 million admissions) and One Life (1.6

million), with no equivalent in 2023.

Lastly, M6 Films was pleased with its investment in co-producing

the film Un petit truc en plus, which has just passed 9 million

admissions.

Divisional EBITA was €16.8 million, compared with €10.3 million

for the first half of 2023.

Diversification

Diversification revenue stood at €16.2 million, down €3.5

million due to the deconsolidation of M6 Digital Services’ media

and services division, sold on 30 September 2023. Excluding the

scope effect, revenue increased by €1.9 million, helped by the tour

of the musical comedy Molière.

Conversely, Diversification EBITA stood at €3.2 million, against

€9.9 million for the first half of 2023, recording a decline of

€5.6 million excluding the scope effect, primarily due to the

property market crisis in France which had a direct impact on the

performance of Stéphane Plaza France.

Financial position

The Group had shareholders’ equity of €1,236.0 million at 30

June 2024, compared with €1,305.1 million at 31 December 2023.

The net cash position was positive, standing at €173.4 million8,

compared with €180.2 million at 30 June 2023, due to the increase

in the dividend amount and investments in streaming and sporting

rights.

CSR commitments

On 3 July 2024, the M6 Group Foundation received the Trophée Or

at the “Talents!” Awards in the Diversity and Inclusion category

for its company discovery day, a social innovation tool aimed at

bringing together the representative bodies of both the prison

system and the company.

In addition, in December 2023 the Group launched the training

module “Understanding and covering climate and environmental

issues” which had been completed by 46 journalists as of 30 June

2024.

Outlook

In an uncertain macro-economic environment, the second half of

2024 will be marked by the continuation of operational investments

in M6+ and the return of the Group’s major content brands on our

channels and on M6+ from the end of August. In addition, M6 Group

is delighted that RTL Germany has announced its intention to use

the Bedrock platform to operate its streaming service, project

which will give Bedrock even more resources and ensure its

profitability from 2026.

Next release: Third quarter 2024 financial

information on 23 October 2024 after close of trading M6

Métropole Télévision is listed on Euronext Paris, Compartment A.

Ticker: MMT, ISIN Code: FR0000053

1 Excluding the deconsolidation of Ctzar, sold on 1 July 2023

and M6 Digital Services’ special interest media and services

division, sold on 30 September 2023.

2 The information provided is intended to highlight the

breakdown of consolidated revenue between advertising and

non-advertising revenue. Group advertising revenue includes TV

advertising revenue (advertising revenue of free-to-air channels

M6, W9, 6ter and Gulli, and the platforms 6play and Gulli Replay,

as well as the share of advertising revenue from pay channels), the

advertising revenue of radio stations RTL, RTL2 and Fun, and the

share of advertising revenue generated by diversification

activities.

3 Profit from recurring operations (EBITA) is defined as

operating profit (EBIT) before amortisation and impairment of

intangible assets (excluding audiovisual rights) related to

acquisitions and capital gains and losses on the disposal of

financial assets and subsidiaries.

4 Médiamétrie Mediamat – Whole of France, all locations (change

in measurement on 1 January 2024)

5 Médiamétrie - 4 Screens in 2023 / Médiamétrie – Médiamat in

2024 – Total hours consumed via catch-up across the scope of the

Group’s channels measured by Médiamétrie (inc. pay channels)

6 Total revenue from digital advertising revenue (AVOD) and SVOD

subscription revenue (6playMax/M6+ Max and GulliMax)

7 Médiamétrie Radio Audience Survey > National, January- June

24 Mon-Fri, 05:00 – 24:00

8 The net cash position does not take into account lease

liabilities resulting from the application of IFRS 16 - Leases and

now excludes loans to and borrowings from associates. Earlier

periods have been restated to provide a similar comparison

base.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723817828/en/

INVESTOR RELATIONS Myriam Pinot +33 (0)1 41 92 57 73

/ myriam.pinot@m6.fr

PRESS Paul Mennesson +33 (0)1 41 92 61 36

/ paul.mennesson@m6.fr

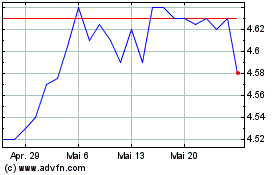

MFS Multimarket Income (NYSE:MMT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

MFS Multimarket Income (NYSE:MMT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024