Maui Land & Pineapple Company, Inc. (NYSE: MLP) today reported

financial results covering the three month period ended March 31,

2024. The company’s annual meeting and shareholder presentation

will be held virtually on May 15, 2024 at 10:00 a.m. Hawaii

Standard Time, via meeting link posted on mauiland.com/investors.

“Maui Land & Pineapple Company’s renewed mission to maximize

the productive use of our diverse portfolio of land and commercial

properties is starting to yield tangible results,” said CEO Race

Randle. “Despite the challenges following the 2023 Maui wildfires,

concerted efforts to reposition and increase occupancy at the

Kapalua Village and Hali‘imaile Town Centers contributed to an 8%

year-over-year growth in revenue. Our strategic investments to

enhance the Company’s commercial properties and prepare unimproved

landholdings for new projects will help position us to meet the

needs of current and prospective tenants, improve Maui’s housing

supply, and create added value for shareholders.”

First Quarter 2024

Highlights

“During the first quarter of the year, we have focused on new

strategic investments in market research, planning, and engineering

while also evaluating future land sale strategies,”

said Randle. “We believe these investments will enhance the

value and productivity of unimproved land through planning and

building necessary infrastructure for improved lots. Concurrently,

we plan on establishing new partnerships to accelerate the

utilization of entitled parcels and have begun listing

non-strategic assets for sale.”

- Operating Revenues – Operating revenues totaled

$2,483,000 for the three months ended March 31, 2024, an increase

of $185,000 compared to the three months ended March 31, 2023.

Leasing revenues of $2,216,000 for the three months ended March 31,

2024, as compared to $2,077,000 for the three months ended March

31, 2023, increased $139,000 due to a $110,000 increase in

percentage rents and a $29,000 increase in base rents. The increase

in percentage rents is an indication that economic activity is

steadily improving post-wildfires and the rise in base rents is a

result of Maui Land & Pineapple Company’s initial work to fill

vacancies and renew leases at market rates.

- Costs and expenses – Operating costs and expenses totaled

$3,882,000 for the three months ended March 31, 2024, an increase

of $214,000 compared to the three months ended March 31, 2023. The

increase in operating costs were driven by $183,000 in land

planning and improvement costs as the Company activates

landholdings for projects and $198,000 increase in leasing costs

for tenant-related improvements on commercial properties. Cost

increases were offset by a $113,000 cost reduction in the

management and operations of the Kapalua Club, a non-equity

membership club providing amenities to resort residents.

- Net loss – Net loss was $1,375,000, or $0.07 per common

share, in the three months ended March 31, 2024, compared to net

loss of $1,364,000 or $0.07 per common share, in the three months

ended March 31, 2023. The net loss in the three months ended March

31, 2024 was primarily driven by non-cash, GAAP expenses related to

depreciation, share-based compensation and post-retirement expenses

amounting to $1,209,000. In addition, severance payments in the

amount of $108,000 to the former CEO was incurred and will extend

through March 31, 2025.

- Adjusted EBITDA (Non-GAAP) – For the three months ended

March 31, 2024, after adjusting for non-cash income and expenses of

$1,178,000, Adjusted EBITDA was ($197,000). Of the negative

Adjusted EBITDA, ($108,000) was attributed to the former CEO

severance.

- Cash and Investments Convertible to Cash (Non-GAAP) – Cash

and investments convertible to cash totaled $8,553,000 on March 31,

2024, a decrease of ($282,000) compared to December 31, 2023. The

decrease reflects the additional cash spent towards reinvestment

into the commercial assets and preparing for new projects but was

offset by collection of leasing receivables.

Appointment of Vice President of Real

Estate

Maui Land & Pineapple Company appointed Jonathan Grobe as

Vice President of Real Estate effective April 1, 2024, marking the

latest addition to the Company’s executive leadership team. Born

and raised in Hawai‘i, Grobe most recently served as a Vice

President at Lendlease, leading efforts in Google’s large scale

master-planned community in Mountain View, CA. Prior roles included

management of retail, hospitality, multifamily, residential, and

mixed-use projects in Hawaii and California.

“Jonathan brings valuable experience paired with local values

that will significantly contribute to our efforts to activate our

real estate assets,” said Randle. “As we make strategic investments

to advance our long-range vision and execution of projects at Maui

Land & Pineapple Company, a strong leadership team with a deep

understanding of the local landscape is critical to our

success.”

Non-GAAP Financial Measures

Certain non-GAAP financial measures are presented in this press

release, including Adjusted EBITDA and Cash and Investments

Convertible to Cash, to provide information that may assist

investors in understanding the Company's financial results and

financial condition and assessing its prospects for future

performance. We believe that Adjusted EBITDA is an important

indicator of our operating performance because it excludes items

that are unrelated to, and may not be indicative of, our core

operating results. We believe cash and investments convertible to

cash are important indicators of liquidity because it includes

items that are convertible into cash in the short term. These

non-GAAP financial measures are not intended to represent and

should not be considered more meaningful measures than, or

alternatives to, measures of operating performance or liquidity as

determined in accordance with GAAP. To the extent we utilize such

non-GAAP financial measures in the future, we expect to calculate

them using a consistent method from period to period.

EBITDA is a non-GAAP financial measure defined as net income

(loss) excluding interest, taxes, depreciation, and amortization.

Adjusted EBITDA is further adjusted for non-cash stock-based

compensation expense and pension and post-retirement expenses.

Adjusted EBITDA is a key measure used by the Company to evaluate

operating performance, generate future operating plans, and make

strategic decisions for the allocation of capital. The Company

presents Adjusted EBITDA to provide information that may assist

investors in understanding its financial results. However, Adjusted

EBITDA is not intended to be a substitute for net income (loss). A

reconciliation of Adjusted EBITDA to the most directly comparable

GAAP financial measure is provided further below.

Cash and investments convertible to cash is a non-GAAP financial

measure defined as cash and cash equivalents plus restricted cash

and investments. Cash and cash investments convertible to cash is a

key measure used by the Company to evaluate internal liquidity. The

inclusion of the convertible investments to cash better describes

the overall liquidity of the company as convertible investments

convert to cash within forty eight hours of authorization to

liquidate the investment portfolio.

Additional Information

More information about Maui Land & Pineapple Company’s

fiscal year 2023 operating results are available in the Form 10-K

filed with the Securities and Exchange Commission on March 28, 2024

and posted at mauiland.com.

About Maui Land & Pineapple

Company

Maui Land & Pineapple Company, Inc. (NYSE: MLP) is dedicated

to the thoughtful stewardship of their portfolio including over

22,400 acres of land and 266,000 square feet of commercial real

estate. The Company envisions a future where Maui residents thrive

in more resilient communities with sufficient housing supply,

economic stability, food and water security, and renewed

connections between people and place. For over a century, the

Company has built a legacy of authentic innovation through

conservation, agriculture, community building and land management.

The Company continues this legacy today with a mission to

carefully maximize the use of its assets in a way that honors

the past, meets current critical needs, and provides security for

future generations.

The Company’s assets include land for future residential

communities within the world-renowned Kapalua Resort, home to

luxury hotels, such as The Ritz-Carlton Maui and Montage Kapalua

Bay, two championship golf courses, pristine beaches, a network of

walking and hiking trails, and the Pu‘u Kukui Watershed, the

largest private nature preserve in Hawai‘i.

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements include but are not limited to

statements regarding the Company’s ability to repurpose its land

for productive use, increase Maui’s housing supply and improve

tenanting of the village centers, and fill the vacancies in our

commercial properties. These forward-looking statements are based

on the current beliefs and expectations of management and are

inherently subject to significant business, economic and

competitive uncertainties, and contingencies, many of which are

beyond the control of the Company. In addition, these

forward-looking statements are subject to assumptions with respect

to future business strategies and decisions that are subject to

change. Actual results may differ materially from the anticipated

results discussed in these forward-looking statements because of

possible uncertainties. Factors that could cause actual results to

differ materially from those expressed in the forward-looking

statements are discussed in the Company's reports (such as Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K) filed with the SEC and available on the SEC's

Internet site (http://www.sec.gov). We undertake no obligation to

publicly update any forward-looking statement, whether written or

oral, that may be made from time to time, whether because of new

information, future developments or otherwise.

|

CONTACT |

| Investors: |

Wade Kodama | Chief Financial

Officer | Maui Land & Pineapple Companye:

wade@mauiland.com |

| |

|

| Media: |

Ashley Takitani Leahey | Vice

President | Maui Land & Pineapple Companye:

ashley@mauiland.comDylan Beesley | Senior Vice President | Bennet

Group Strategic Communicationse: dylan@bennetgroup.com |

|

MAUI LAND & PINEAPPLE COMPANY, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME

(LOSS)(UNAUDITED) |

| |

| |

|

Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

(in thousands except per share amounts) |

|

|

OPERATING REVENUES |

|

|

|

|

|

|

|

|

| Land development and

sales |

|

$ |

- |

|

|

$ |

- |

|

| Leasing |

|

|

2,216 |

|

|

|

2,077 |

|

| Resort amenities and

other |

|

|

267 |

|

|

|

221 |

|

| Total operating revenues |

|

|

2,483 |

|

|

|

2,298 |

|

| |

|

|

|

|

|

|

|

|

| OPERATING COSTS AND

EXPENSES |

|

|

|

|

|

|

|

|

| Land development and

sales |

|

|

266 |

|

|

|

83 |

|

| Leasing |

|

|

992 |

|

|

|

794 |

|

| Resort amenities and

other |

|

|

436 |

|

|

|

549 |

|

| General and

administrative |

|

|

1,057 |

|

|

|

1,025 |

|

| Share-based compensation |

|

|

959 |

|

|

|

964 |

|

| Depreciation |

|

|

172 |

|

|

|

253 |

|

| Total operating costs and

expenses |

|

|

3,882 |

|

|

|

3,668 |

|

| |

|

|

|

|

|

|

|

|

| OPERATING LOSS |

|

|

(1,399 |

) |

|

|

(1,370 |

) |

| |

|

|

|

|

|

|

|

|

| Other income |

|

|

104 |

|

|

|

129 |

|

| Pension and other

post-retirement expenses |

|

|

(78 |

) |

|

|

(121 |

) |

| Interest expense |

|

|

(2 |

) |

|

|

(2 |

) |

| |

|

|

|

|

|

|

|

|

| NET LOSS |

|

$ |

(1,375 |

) |

|

$ |

(1,364 |

) |

| Other comprehensive income -

pension, net |

|

|

68 |

|

|

|

82 |

|

| TOTAL COMPREHENSIVE LOSS |

|

$ |

(1,307 |

) |

|

$ |

(1,282 |

) |

| |

|

|

|

|

|

|

|

|

| NET LOSS PER COMMON

SHARE-BASIC AND DILUTED |

|

$ |

(0.07 |

) |

|

$ |

(0.07 |

) |

| |

|

MAUI LAND & PINEAPPLE COMPANY, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS |

| |

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| |

|

(unaudited) |

|

|

(audited) |

|

| |

|

(in thousands except share data) |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

5,377 |

|

|

$ |

5,700 |

|

| Accounts receivable, net |

|

|

1.253 |

|

|

|

1,166 |

|

| Investment in debt

securities , current portion |

|

|

2,589 |

|

|

|

2,671 |

|

| Prepaid expenses and other

assets |

|

|

347 |

|

|

|

467 |

|

|

Total current assets |

|

|

9,566 |

|

|

|

10,004 |

|

| |

|

|

|

|

|

|

|

|

| PROPERTY & EQUIPMENT,

NET |

|

|

16,027 |

|

|

|

16,059 |

|

| |

|

|

|

|

|

|

|

|

| OTHER ASSETS |

|

|

|

|

|

|

|

|

| Investment in debt securities,

net of current portion |

|

|

587 |

|

|

|

464 |

|

| Investment in joint

venture |

|

|

1,627 |

|

|

|

1,608 |

|

| Deferred development

costs |

|

|

12,860 |

|

|

|

12,815 |

|

| Other noncurrent assets |

|

|

1,388 |

|

|

|

1,273 |

|

|

Total other assets |

|

|

16,462 |

|

|

|

16,160 |

|

| TOTAL ASSETS |

|

$ |

42,055 |

|

|

$ |

42,223 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES &

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

1,408 |

|

|

$ |

1,154 |

|

| Payroll and employee

benefits |

|

|

217 |

|

|

|

502 |

|

| Accrued retirement benefits,

current portion |

|

|

142 |

|

|

|

142 |

|

| Deferred revenue, current

portion |

|

|

308 |

|

|

|

217 |

|

| Other current liabilities |

|

|

475 |

|

|

|

465 |

|

|

Total current liabilities |

|

|

2,550 |

|

|

|

2,480 |

|

| |

|

|

|

|

|

|

|

|

| LONG-TERM LIABILITIES |

|

|

|

|

|

|

|

|

| Accrued retirement benefits,

net of current portion |

|

|

1,528 |

|

|

|

1,550 |

|

| Deferred revenue, net of

current portion |

|

|

1,333 |

|

|

|

1,367 |

|

| Deposits |

|

|

2,078 |

|

|

|

2,108 |

|

| Other noncurrent

liabilities |

|

|

12 |

|

|

|

14 |

|

|

Total long-term liabilities |

|

|

4,951 |

|

|

|

5,039 |

|

| TOTAL LIABILITIES |

|

|

7,501 |

|

|

|

7,519 |

|

| |

|

|

|

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

Preferred stock--$0.0001 par value; 5,000,000 shares authorized; no

shares issued and outstanding |

|

|

- |

|

|

|

- |

|

|

Common stock--$0.0001 par value; 43,000,000 shares authorized;

19,641,045 and 19,615,350 shares issued and outstanding

at March 31, 2024 and December 31, 2023, respectively |

|

|

85,201 |

|

|

|

84,680 |

|

| Additional

paid-in-capital |

|

|

11,174 |

|

|

|

10,538 |

|

| Accumulated deficit |

|

|

(54,992 |

) |

|

|

(53,617 |

) |

| Accumulated other

comprehensive loss |

|

|

(6,829 |

) |

|

|

(6,897 |

) |

|

Total stockholders' equity |

|

|

34,554 |

|

|

|

34,704 |

|

| TOTAL LIABILITIES &

STOCKHOLDERS' EQUITY |

|

$ |

42,055 |

|

|

$ |

42,223 |

|

| |

|

MAUI LAND & PINEAPPLE COMPANY, INC. AND

SUBSIDIARIES |

|

SUPPLEMENTAL FINANCIAL INFORMATION |

|

(NON-GAAP) UNAUDITED |

| |

|

|

|

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| |

(in thousands) |

|

(in thousands) |

| |

|

|

|

| NET INCOME (LOSS) |

$ |

(1,375 |

) |

|

$ |

(1,364 |

) |

| |

|

|

|

| Add: Non-cash expenses |

|

|

|

| Interest expense |

|

2 |

|

|

|

2 |

|

| Depreciation |

|

172 |

|

|

|

253 |

|

| Amortization of licensing fee

revenue |

|

(33 |

) |

|

|

(33 |

) |

| Share-based compensation |

|

|

|

| Vesting of former CEO upon

separation from the Company |

|

- |

|

|

|

675 |

|

| Vesting of Stock Options

granted to Board Chair and Directors |

|

439 |

|

|

|

- |

|

| Vesting of Stock Compensation

granted to Board Chair and Directors |

|

144 |

|

|

|

174 |

|

| Vesting of Stock Options

granted to CEO |

|

197 |

|

|

|

- |

|

| Vesting of employee Incentive

Stock |

|

179 |

|

|

|

116 |

|

| Pension and other

post-retirement expenses |

|

78 |

|

|

|

121 |

|

| |

|

|

|

| ADJUSTED EBITDA (LOSS) |

$ |

(197 |

) |

|

$ |

(56 |

) |

| |

March 31, 2024 |

|

December 31, 2023 |

| |

(unaudited) |

|

(audited) |

| |

(in thousands) |

|

(in thousands) |

| CASH AND INVESTMENTS |

|

|

|

| |

|

|

|

|

Cash and cash equivalents |

$ |

5,377 |

|

$ |

5,700 |

| Investments, current

portion |

|

2,589 |

|

|

2,671 |

| Investments, net of current

portion |

|

587 |

|

|

464 |

| |

|

|

|

| TOTAL CASH AND INVESTMENTS

CONVERTIBLE TO CASH |

$ |

8,553 |

|

$ |

8,835 |

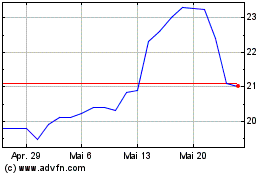

Maui Land and Pineapple (NYSE:MLP)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Maui Land and Pineapple (NYSE:MLP)

Historical Stock Chart

Von Jan 2024 bis Jan 2025