Form SD - Specialized disclosure report

30 Mai 2024 - 10:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM SD

Specialized Disclosure Report

_____________________________________________

METHODE ELECTRONICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

|

001-33731 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

|

|

8750 West Bryn Mawr Avenue, Chicago, IL |

|

60631-3518 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Ronald L.G. Tsoumas (708) 867-6777 (Name and telephone number, including area code, of the person to contact in connection with this report) |

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

|

|

☒ |

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023. |

☐ |

Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the reporting period from January 1 to December 31, 2023. |

Section 1 – Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

In accordance with the disclosure requirements of Rule 13p-1 (the “Rule”) promulgated by the U.S. Securities and Exchange Commission (the “SEC”) under Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and related provisions of the Securities and Exchange Act of 1934, as amended, Methode Electronics, Inc. (the “Company”) has undertaken efforts to determine its conflict minerals reporting requirements for the period from January 1 to December 31, 2023. Methode is a leading global supplier of custom engineered solutions with sales, engineering and manufacturing locations in North America, Europe, Middle East and Asia. The Company designs, engineers, and produces mechatronic products for Original Equipment Manufacturers (“OEMs”) utilizing our broad range of technologies for user interface, light-emitting diode (“LED”) lighting system, power distribution and sensor applications.

The term “conflict mineral” is defined in Section 1502(e)(4) of the Dodd-Frank Act as (A) columbite-tantalite, also known as coltan (the metal ore from which tantalum is extracted); cassiterite (the metal ore from which tin is extracted); gold; wolframite (the metal ore from which tungsten is extracted); or their derivatives; or (B) any other mineral or its derivatives determined by the Secretary of State to be financing conflict in the Democratic Republic of the Congo (“DRC”) or an adjoining country.

The Company is subject to the Rule as we have determined that, during 2023, conflict minerals were likely necessary to the functionality or production of products we manufactured or contracted to manufacture. The Company, as a purchaser of component parts, is many steps removed from the mining of conflict minerals. The Company does not purchase raw ore or unrefined conflict minerals and conducts no purchasing activities directly in the DRC or adjoining countries.

The Company has developed a policy statement to support the goals expressed by Congress in enacting Section 1502 of the Dodd-Frank Act. The policy highlights the Company’s commitment to complying with the reporting and due diligence obligations required by the Rule and the Company’s expectations from its suppliers. In addition, the policy includes language encouraging suppliers to source responsibly by conducting the necessary inquiry and, where appropriate, additional due diligence to provide the Company with confirmation of the source of the materials used in their processes and ultimately contained in the Company’s products. The policy resides under the investor relations section of our website, which is located at www.methode.com. Information on Methode’s corporate website is not incorporated by reference into, and is not considered to be a part of, this Form SD.

Reasonable Country of Origin Inquiry

Methode has conducted in good faith a Reasonable Country of Origin Inquiry (“RCOI”) that was reasonably designed to determine whether the necessary conflict minerals originated in the DRC or an adjoining country or came from recycled or scrap sources.

The Company’s RCOI process included reviewing the products manufactured or contracted to be manufactured during the Reporting Period to identify products that should be deemed within the scope of the Rule and conducting an inquiry of our direct suppliers of the in-scope products using the Conflict Minerals Reporting Template (“CMRT”) developed by the Responsible Minerals Initiative (the “RMI”).

Due Diligence Program

Based on the results of our RCOI which indicated potential sourcing from the DRC or adjoining countries, the Company exercised due diligence on the source and chain of custody of the conflict minerals in accordance with the Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas published by the Organisation for Economic Co-operation and Development (the “OECD Due Diligence Guidance”).

The Company designed its conflict minerals due diligence program to conform, in all material respects, with the framework outlined by the OECD Due Diligence Guidance, including its Supplement on Tin, Tantalum, and Tungsten, and its Supplement on Gold, specifically as they relate to the Company’s position in the minerals supply chain as a “downstream” company.

The Company’s program has several elements including:

•Establishing a conflict minerals team with the involvement from those in upper management roles, including legal, procurement, and sustainability.

•An anonymous reporting hotline that can be used by interested parties to report conflict minerals issues.

•Supplier engagement, such as requesting information from the Tier 1 suppliers who provide materials and components for the products deemed in-scope by our conflict minerals team, and using such information to compile a list of smelters or refiners in our supply chain.

•Reconciling the list of smelters or refiners collected from suppliers to the list of smelter facilities validated by the RMI.

Some of the Company’s suppliers were unable to identify the smelters or countries of origin in their supply chain, some suppliers responded by providing information related to all of the items the supplier produces without identifying smelters specific to the items purchased by the Company, and some suppliers included names of smelters that the Company believes may have been misidentified as smelters or that are not operational. Additionally, due to the lack of product-level detail provided by some of the suppliers, in many cases supplier responses did not provide the Company with the information needed to determine whether the necessary conflict minerals in its products were processed by any particular smelter or smelters.

The Company has elected not to file disclosure under Item 1.01(c) of Form SD in accordance with the “Updated Statement on the Effect of the Court of Appeals Decision on the Conflict Minerals Rule” issued by the Division of Corporation Finance of the SEC on April 7, 2017.

Section 2 – Resource Extraction Issuer Disclosure

Item 2.01 Resource Extraction Issuer Disclosure and Report.

Not applicable.

Section 3 – Exhibits

Item 3.01 Exhibits

Not applicable.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

|

|

|

|

|

|

METHODE ELECTRONICS, INC. |

|

|

|

|

Date: May 30, 2024 |

|

By: |

/s/ Ronald L.G. Tsoumas |

|

|

|

Ronald L.G. Tsoumas |

|

|

|

Chief Financial Officer |

.

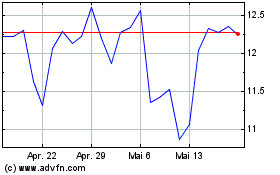

Methode Electronics (NYSE:MEI)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

Methode Electronics (NYSE:MEI)

Historical Stock Chart

Von Jun 2023 bis Jun 2024