Mayville Engineering Company (NYSE: MEC) (the “Company” or

“MEC”), a leading value-added provider of design, prototyping and

manufacturing solutions serving diverse end-markets, today

announced results for the three months ended September 30,

2023.

THIRD QUARTER 2023 RESULTS

(All comparisons versus the prior-year period)

- Net sales of $158.2 million, or +16.1% y/y including organic

growth of 6.2% y/y

- Net income of $1.4 million, or $0.07 per diluted share

- Non-GAAP Adjusted Diluted EPS of $0.21

- Adjusted EBITDA of $19.2 million, including the $1.7 million

impact from the ramp-up of production at Hazel Park

- Adjusted EBITDA margin of 12.1% of net sales, including a 110

basis point impact from the ramp-up of production at Hazel

Park

- Record quarterly Free Cash Flow of $16.1 million, an increase

of $10.9 million y/y

- Net debt leverage ratio finished slightly below 2.5x

MANAGEMENT COMMENTARY

“We delivered significant year-over-year growth in revenue,

Adjusted EBITDA and free cash flow in the third quarter, while

continuing to demonstrate focused execution under our MBX value

creation framework,” stated Jag Reddy, President and Chief

Executive Officer. “We generated organic sales growth across our

commercial vehicle, powersports and military markets during the

third quarter. Our collective focus on driving improved cost

absorption and price discipline resulted in strong Adjusted EBITDA

margins and record free cash flow generation during the quarter,

even as our Hazel Park facility continued to ramp up

utilization.”

“At our inaugural Investor Day event in September, we introduced

three-year performance targets that highlight the significant value

creation potential of our business,” continued Reddy. "Our value

creation roadmap seeks to drive margin expansion and improved free

cash flow conversion through sustained volume growth, value-based

pricing, improved asset optimization and process improvements, all

of which were evident in our strong third quarter performance. In

combination, these initiatives are expected to deliver between $105

to $135 million of annual Adjusted EBITDA, 14% to 16% Adjusted

EBITDA margins and $65 to $75 million of annual free cash flow

generation by year-end 2026.”

“Customer indications of interest and order activity remained

healthy entering the fourth quarter,” continued Reddy. “Even so, we

remain mindful of the potential for a macroeconomic slowing

entering 2024, including expectations for a general slowing in

commercial vehicle demand, all of which were contemplated in our

2026 financial forecast shared at the Investor Day.”

“From a capital allocation perspective, debt reduction remains

our top near-term priority, followed by the opportunistic

open-market purchase of our common stock under our share repurchase

authorization,” continued Reddy. “We generated a record $16.1

million in free cash flow in the third quarter, allowing us to

repay $17.1 million of debt from the MSA acquisition, while also

repurchasing $1.0 million of stock. As previously communicated, we

intend to reduce our net leverage to between 1.5x to 2.0x by

year-end 2024. At the same time, we continue to build a longer-term

pipeline of acquisition targets that provide us entry into

high-value market adjacencies, including those equipped to

capitalize on energy transition, reshoring and outsourcing

themes.”

PERFORMANCE SUMMARY

Net sales increased by 16.1% on a year-over-year basis in the

third quarter 2023, driven in part by the recent acquisition of

Mid-States Aluminum (“MSA”) and increased organic volumes in our

commercial vehicle, military and powersports end markets, partially

offset by softening demand in our construction and agriculture end

markets. Excluding the impact of the MSA acquisition, net sales

increased organically by 6.2% year-over-year.

Manufacturing margin was $19.0 million in the third quarter

2023, or 12.0% of net sales, versus $15.5 million, or 11.3% of net

sales, in the prior year period. The year-over-year increase in

manufacturing margin was driven by the increased organic volumes,

MBX initiatives and the MSA acquisition, partially offset by

unabsorbed fixed costs associated with new project launches and

non-recurring inventory step-up expense associated with the MSA

acquisition.

Profit sharing, bonus and deferred compensation expense

increased $2.2 million to $2.3 million in the third quarter of

2023. Other selling, general and administrative expenses were $8.6

million in the third quarter of 2023 as compared to $6.5 million

for the same prior year period. The increase in these expenses

during the third quarter primarily reflects the lower stock-based

compensation expense in the prior year due to forfeitures of

unvested awards, transaction costs associated with the acquisition

of MSA, an increase in legal costs associated with litigation

against a former customer and increased salaries, wages and

benefits.

Interest expense was $3.9 million in the third quarter of 2023,

as compared to $0.8 million in the prior year period, due to higher

interest rates and an increase in borrowings. The increase in

borrowings relative to the prior year is due to the acquisition of

MSA, which closed on July 1, 2023.

Net income for the third quarter of 2023 was $1.4 million, or

$0.07 per diluted share, versus $6.6 million, or $0.32 per diluted

share, in the prior-year period.

MEC reported Adjusted EBITDA of $19.2 million in the third

quarter 2023, or 12.1% of net sales, versus $16.1 million, or 11.8%

of net sales, in the prior-year period. Third quarter 2023 Adjusted

EBITDA reflects $1.7 million of losses associated with the ramp-up

of production at our Hazel Park facility as compared to $1.3

million of losses in the prior year period. Excluding the impact of

the ramp-up of the Hazel Park facility, Adjusted EBITDA margin for

the third quarter of 2023 would have been 13.2%.

Adjusted net income for the third quarter of 2023 was $4.2

million, or $0.21 per diluted share, versus $6.7 million, or $0.33

per diluted share, in the prior year period. The decrease in

adjusted net income reflects an increase in selling, general and

administrative costs, the impact of unabsorbed fixed costs from new

project launches and higher interest expense, which offset an

increase in manufacturing margins.

Free cash flow during the third quarter 2023 was $16.1 million

as compared to $5.2 million in the prior year period. The increase

in free cash flow was primarily attributable to an $8.9 million

decrease in capital expenditures associated with the completion of

the Hazel Park facility and an increase in net cash provided by

operating activities.

END-MARKET UPDATE

Three Months Ended

September 30,

2023

2022

Commercial Vehicle

$

57,264

$

53,714

Construction & Access

26,296

26,918

Powersports

25,143

23,344

Agriculture

15,029

14,373

Military

10,960

6,436

Other

23,525

11,490

Net Sales

$

158,217

$

136,276

Commercial Vehicles

MEC is a Tier 1 supplier to many of the country’s top original

equipment manufacturers (OEM) of commercial vehicles providing

exhaust & aftertreatment, engine components, cooling, fuel and

structural systems for both heavy- and medium-duty commercial

vehicles.

Net sales to the commercial vehicle market were $57.3 million in

the third quarter of 2023, an increase of 6.6% versus the

prior-year period. The increase in sales was primarily the result

of volume increases and strengthened end market demand due to a

3.5% year-over-year increase in class 8 commercial vehicle

production.

Construction & Access

MEC manufactures thousands of parts for the construction &

access market including fenders, hoods, supports, frames,

platforms, frame structures, doors and tubular products such as

exhaust & aftertreatment, engine components, cooling system

components, handrails and full electro-mechanical assemblies.

Net sales to the construction & access market were $26.3

million in the third quarter 2023, a decrease of 2.3% versus the

prior-year period. The decrease in sales was primarily driven by

lower residential construction demand.

Powersports

MEC manufactures stampings and complex metal assemblies and

coatings for the marine propulsion, all-terrain vehicles (ATV),

multi-utility vehicles (MUV) and motorcycle markets. MEC’s

powersports expertise includes axle housings, steering columns,

swing arms, fenders, suspension components, ATV/MUV racks, cowl

assemblies and vehicle frames.

Net sales to the powersports market were $25.1 million in the

third quarter of 2023, an increase of 7.7% versus the prior-year

period. The increase in sales was the result of higher volumes from

new project wins and share gains from both new and existing

customers.

Agriculture

MEC is an integral partner in the supply chain of the world’s

leading agriculture OEMs manufacturing thousands of parts including

fenders, hoods, supports, frames, platforms, frame structures,

doors, and tubular products such as exhaust, engine components,

cooling system components, handrails and full electro-mechanical

assemblies.

Net sales to the agriculture market were $15.0 million during

the third quarter of 2023, an increase of 4.6% versus the

prior-year period. The increase in sales was driven mostly by the

acquisition of MSA and was slightly offset by continued demand

softness in our legacy business.

Military

MEC holds the International Traffic in Arms Regulations (ITAR)

certification and produces components for the United States

military. Products include exhaust, engine components, cooling,

fuel, suspension, structural systems, and chemical agent resistant

coating (CARC) painting capabilities.

Net sales to the military market were $11.0 million in the third

quarter of 2023, an increase of 70.3% versus the prior-year period.

Contributions from new programs, new vehicle introductions and

demand associated with the conflict in Ukraine, contributed to the

year-over-year sales growth.

Other

MEC also produces a wide variety of components and assemblies

for customers in the power generation, industrial equipment,

mining, forestry, communications, and medical markets.

Net sales to other end markets for the third quarter of 2023

were $23.5 million, an increase of 104.7% year-over-year. The

increase is primarily attributable to sales from MSA, which was

acquired on July 1, 2023. Sales in this market primarily relate to

MEC Outdoors, tooling, and additional miscellaneous markets.

STRATEGIC UPDATE

During the third quarter, MEC continued the rigorous

implementation of its MEC Business Excellence (MBX) initiative, a

value-creation framework designed to drive sustained operational

and commercial excellence execution across all aspects of the

organization. Upon full implementation, MEC expects MBX to drive

Adjusted EBITDA margin expansion to between 14% to 16% of net sales

and total net sales of between $750 to $850 million by year-end

2026.

- Drive a High-Performance Culture. The Company is focused

on effectuating cultural change across the organization by

implementing performance-based metrics, daily lean management and

other process-oriented strategies. Through these efforts, the

Company is building a high-performance culture capable of driving

improved performance, asset utilization and cost optimization.

During the third quarter, the Company continued the implementation

and alignment of processes and best-practices across the enterprise

to drive strategic execution. As part of the implementation, the

Company has updated its organizational mission statement to align

with a culture of standardization and consistency; One MEC. One

Mission.

- Drive Operational Excellence. The Company is focused on

leveraging technologies and capabilities to increase productivity

and reduce costs across the value chain. The Company intends to

achieve this objective through the implementation of lean

initiatives such as value stream mapping, sales, inventory, and

operations planning (SIOP), and further optimization of its supply

chain and procurement strategies. The Company’s operational

excellence initiatives also focus on improving fixed cost

absorption, labor productivity and inventory efficiency by

leveraging its recent investments in advanced manufacturing

capabilities and automation. As of the end of the third quarter,

the Company had held 100 MBX lean events and continues to estimate

that its operational excellence initiatives will generate 200 to

300 bps of Adjusted EBITDA margin improvement by 2026.

- Drive Commercial Expansion. The Company is focused on

driving commercial growth through an integrated, solutions-oriented

approach that leverages its full suite of design, prototyping, and

aftermarket services; an expansion of its fabrication capabilities

beyond steel, with an emphasis on lightweight aluminum, plastics

and composites; diversification within high-growth energy

transition markets; further market penetration within existing

end-markets; and the implementation of value-based pricing. During

the third quarter, the Company closed the acquisition of MSA, which

positions MEC to capitalize on revenue synergies within its

existing legacy customer base and is now positioned to grow

organically by pursuing demand for light-weight aluminum products

in high-growth EV and energy transition markets. During the third

quarter, MEC secured an agreement with an existing customer to

leverage MSA’s aluminum extrusion capabilities, which will begin

during 2024.

- Drive Human Resource Optimization. The Company remains

focused on the recruitment and retention of skilled, experienced

employees to support the growth of its business. This component of

the MBX value creation framework is designed to provide

competitive, performance-based incentives; develop high-potential

candidates for internal development and advancement; ensure

business continuity through multi-tiered succession planning; and

to ensure a stable recruiting pipeline. As part of this effort, the

Company announced during the third quarter that it intends to

relocate its corporate headquarters to Milwaukee beginning in early

2024.

BALANCE SHEET UPDATE

As of September 30, 2023, MEC had net debt outstanding of $169.6

million and total cash and availability on its senior secured

revolving credit facility of $250.01 million. During the third

quarter 2023, the Company utilized free cash flow to repay $17.1

million of debt that it incurred in conjunction with the MSA

acquisition. At the end of the third quarter, the ratio of net debt

to trailing twelve-month Adjusted EBITDA was 2.46x.

_________________

1 This amount is reduced to approximately

$81.6 million after taking into account the $168.4 million of

outstanding borrowings under the credit facility as of September

30, 2023.

FINANCIAL GUIDANCE

Today, the Company reaffirmed its financial guidance for the

full year 2023. All guidance is current as of the time provided and

is subject to change.

FY 2022

FY 2023

(in Millions)

Actual

Forecast

Net Sales

$539.4

$580 - $610

Adjusted EBITDA

$60.8

$66 - $71

Capital Expenditures

$58.6

$15 - $20

The Company’s 2023 guidance includes the pro-rata contribution

of the MSA acquisition, including $30 to $35 million of incremental

net sales and $4 to $6 million of incremental Adjusted EBITDA. The

Company continues to expect that Net Sales and Adjusted EBITDA

margin in the second half of the year will be favorably impacted by

improved capacity utilization, relative to the first half of the

year. Full-year 2023 guidance excludes the potential impact from

the United Auto Workers strikes within the CV and Auto industries,

which is currently estimated to negatively impact net sales by

approximately $6 to $7 million and Adjusted EBITDA by approximately

$1 to $2 million per month beginning in November.

As before, the Company continues to expect net sales for 2023 to

reflect raw material pass-through costs of between negative 4% to

negative 5% of total net sales for the year, as compared to

positive 5% of net sales for the full year 2022. The Company’s

Adjusted EBITDA guidance reflects scrap income of between $13

million and $15 million, as compared to $13 million in the full

year 2022. The guidance for full year 2023 Adjusted EBITDA also

reflects $5 million to $7 million of under-absorbed overhead costs

associated with the ramp-up of production at the Company’s Hazel

Park, Michigan manufacturing facility. The Company expects the

unfavorable impact from the ramp-up of production at Hazel Park to

be partially offset by a 40 to 70 basis point improvement in

manufacturing margins resulting from the MBX initiatives, which

will directly benefit Adjusted EBITDA.

THIRD QUARTER 2023 RESULTS CONFERENCE CALL

The Company will host a conference call on Wednesday, November

1, 2023 at 10:00 a.m. Eastern Time (9:00 a.m. Central Time).

For a live webcast of the conference call and to access the

accompanying investor presentation, please visit www.mecinc.com and

click on the link to the live webcast on the Investors page.

For telephone access to the conference, call (833) 470-1428

within the United States, or call (833) 950-0062 within Canada and

please use the Access Code: 116929.

FORWARD-LOOKING STATEMENTS

This press-release includes forward-looking statements that

reflect plans, estimates and beliefs. Such statements involve risk

and uncertainties. Actual results may differ materially from those

contemplated by these forward-looking statements as a result of

various factors. Important factors that could cause actual results

or events to differ materially from those expressed in

forward-looking statements include, but are not limited to:

macroeconomic conditions, including inflation, rising interest

rates and recessionary concerns, as well as ongoing supply chain

challenges, labor availability and cost pressures, and the COVID-19

pandemic, have had, and may continue to have, a negative impact on

our business, financial condition, cash flows and results of

operations (including future uncertain impacts); risks relating to

developments in the industries in which our customers operate;

risks related to scheduling production accurately and maximizing

efficiency; our ability to realize net sales represented by our

awarded business; failure to compete successfully in our markets;

our ability to maintain our manufacturing, engineering and

technological expertise; the loss of any of our large customers or

the loss of their respective market shares; risks related to

entering new markets; our ability to recruit and retain our key

executive officers, managers and trade-skilled personnel;

volatility in the prices or availability of raw materials critical

to our business; manufacturing risks, including delays and

technical problems, issues with third-party suppliers,

environmental risks and applicable statutory and regulatory

requirements; our ability to successfully identify or integrate

acquisitions; our ability to develop new and innovative processes

and gain customer acceptance of such processes; risks related to

our information technology systems and infrastructure; geopolitical

and economic developments, including foreign trade relations and

associated tariffs; results of legal disputes, including product

liability, intellectual property infringement and other claims;

risks associated with our capital-intensive industry; risks related

to our treatment as an S Corporation prior to the consummation of

our initial public offering; risks related to our employee stock

ownership plan’s treatment as a tax-qualified retirement plan; and

other factors described in “Risk Factors” in Part I, Item 1A of our

Annual Report on Form 10-K for the year ended December 31, 2022, as

such may be amended or supplemented in our subsequently filed

Quarterly Reports on Form 10-Q. This discussion should be read in

conjunction with our audited consolidated financial statements

included in the Company’s previously filed Annual Report on Form

10-K for the year ended December 31, 2022. We undertake no

obligation to update or revise any forward-looking statements after

the date on which any such statement is made, whether as a result

of new information, future events or otherwise, except as required

by federal securities laws.

ABOUT MAYVILLE ENGINEERING COMPANY

Founded in 1945, MEC is a leading U.S.-based,

vertically-integrated, value-added manufacturing partner providing

a full suite of manufacturing solutions from concept to production,

including design, prototyping and tooling, fabrication, aluminum

extrusion, coating, assembly and aftermarket components. Our

customers operate in diverse end markets, including heavy- and

medium-duty commercial vehicles, construction & access

equipment, powersports, agriculture, military and other end

markets. Along with process engineering and development services,

MEC maintains an extensive manufacturing infrastructure with 22

facilities across seven states. These facilities make it possible

to offer conventional and CNC (computer numerical control)

stamping, shearing, fiber laser cutting, forming, drilling,

tapping, grinding, tube bending, machining, welding, assembly, and

logistic services. MEC also possesses a broad range of finishing

capabilities including shot blasting, e-coating, powder coating,

wet spray and military grade chemical agent resistant coating

(CARC) painting. For more information, please visit

www.mecinc.com.

NON-GAAP FINANCIAL MEASURES

This press release contains financial information calculated in

a manner other than in accordance with U.S generally accepted

accounting principles (“GAAP”).

The non-GAAP measures used in this press release are EBITDA,

EBITDA Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted

Net Income and Diluted EPS, and Free Cash Flow.

EBITDA represents net income before interest expense, provision

for income taxes, depreciation, and amortization. EBITDA Margin

represents EBITDA as a percentage of net sales for each period.

Adjusted EBITDA represents EBITDA before CEO transition costs,

stock-based compensation expense, MSA acquisition related costs,

loss on debt extinguishment, field replacement claim, Hazel Park

transition and legal costs due to the former fitness customer,

costs recognized on step-up of MSA acquired inventory and

impairment charges on long-lived assets and gain on contracts

specifically purchased to meet obligations under the agreement with

our former fitness customer. Adjusted EBITDA Margin represents

Adjusted EBITDA as a percentage of net sales for each period.

Adjusted Net Income and Diluted EPS represent net income before the

aforementioned Adjusted EBITDA addback items which do not reflect

our core operating performance. Free Cash Flow represents net cash

provided by, or used in, operating activities, less cash flows used

in the purchase of property, plant and equipment. We present

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and

Diluted EPS, and Free Cash Flow as management uses these measures

as key performance indicators, and we believe they are measures

frequently used by securities analysts, investors and other parties

to evaluate companies in our industry. These metrics are

supplemental measures of our operating performance that are neither

required by, nor presented in accordance with, GAAP. These measures

should not be considered as an alternative to net income or cash

flow provided by, or used in, operating activities, or any other

performance measure derived in accordance with GAAP as an indicator

of our operating performance. These measures may not be comparable

to the similarly named measures reported by other companies and

have limitations as analytical tools and should not be considered

in isolation or as substitutes for analysis of our results as

reported under GAAP.

Please reference our reconciliation of net income, the most

directly comparable measure calculated in accordance with GAAP, to

EBITDA, Adjusted EBITDA, Adjusted Net Income and Diluted EPS, Free

Cash Flow and the calculation of EBITDA Margin and Adjusted EBITDA

Margin included in this press release.

Mayville Engineering Company,

Inc.

Consolidated Balance

Sheet

(in thousands, except share

amounts)

(unaudited)

September 30,

December 31,

2023

2022

ASSETS

Cash and cash equivalents

$

2,305

$

127

Receivables, net of allowances for

doubtful accounts of $672 at September 30, 2023 and $545 at

December 31, 2022

72,069

58,001

Inventories, net

73,311

71,708

Tooling in progress

5,664

7,938

Prepaid expenses and other current

assets

4,513

3,529

Total current assets

157,862

141,303

Property, plant and equipment, net

178,014

145,771

Assets held for sale

81

83

Goodwill

92,650

71,535

Intangible assets, net

60,760

43,809

Operating lease assets

32,725

36,073

Other long-term assets

2,705

2,007

Total assets

$

524,797

$

440,581

LIABILITIES AND SHAREHOLDERS’

EQUITY

Accounts payable

$

53,366

$

53,735

Current portion of operating lease

obligation

5,079

4,857

Accrued liabilities:

Salaries, wages, and payroll taxes

8,601

7,288

Profit sharing and bonus

1,627

6,860

Current portion of deferred

compensation

266

18,062

Other current liabilities

12,520

11,646

Total current liabilities

81,459

102,448

Bank revolving credit notes

168,412

72,236

Operating lease obligation, less current

maturities

28,550

31,891

Deferred compensation, less current

portion

3,495

3,132

Deferred income tax liability

12,773

11,818

Other long-term liabilities

3,066

1,189

Total liabilities

$

297,755

$

222,714

Commitments and contingencies

Common shares, no par value, 75,000,000

authorized, 21,851,249 shares issued at September 30, 2023 and

21,645,193 at December 31, 2022

—

—

Additional paid-in-capital

204,664

200,945

Retained earnings

31,891

26,274

Treasury shares at cost, 1,542,893 shares

at September 30, 2023 and 1,472,447 at December 31, 2022

(9,513

)

(9,352

)

Total shareholders’ equity

227,042

217,867

Total

$

524,797

$

440,581

Mayville Engineering Company,

Inc.

Consolidated Statement of Net

Income

(in thousands, except share

amounts and per share data)

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Net sales

$

158,217

$

136,276

$

439,843

$

410,865

Cost of sales

139,197

120,812

388,351

362,782

Amortization of intangible assets

2,173

1,738

5,649

5,214

Profit sharing, bonuses, and deferred

compensation

2,346

166

8,037

3,921

Employee stock ownership plan expense

(income)

—

(152

)

—

1,668

Other selling, general and administrative

expenses

8,608

6,533

22,969

18,653

Impairment of long-lived assets and gain

on contracts

—

(1,737

)

—

(4,346

)

Income from operations

5,893

8,916

14,837

22,973

Interest expense

(3,907

)

(830

)

(7,533

)

(2,163

)

Loss on extinguishment of debt

—

—

(216

)

—

Income before taxes

1,986

8,086

7,088

20,810

Income tax expense

554

1,490

1,471

4,464

Net income and comprehensive

income

$

1,432

$

6,596

$

5,617

$

16,346

Earnings per share:

Basic

$

0.07

$

0.32

$

0.28

$

0.80

Diluted

$

0.07

$

0.32

$

0.27

$

0.80

Weighted average shares

outstanding:

Basic

20,439,602

20,390,221

20,416,914

20,457,001

Diluted

20,622,864

20,394,386

20,644,915

20,545,983

Mayville Engineering Company,

Inc.

Consolidated Statement of Cash

Flows

(in thousands)

(unaudited)

Nine Months Ended

September 30,

2023

2022

CASH FLOWS FROM OPERATING

ACTIVITIES

Net income

$

5,617

$

16,346

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

19,849

16,342

Amortization

5,649

5,214

Allowance for doubtful accounts

127

(29

)

Inventory excess and obsolescence

reserve

277

(2

)

Stock-based compensation expense

3,755

2,854

Loss (gain) on disposal of property, plant

and equipment

(342

)

11

Impairment of long-lived assets and gain

on contracts

—

(4,346

)

Deferred compensation

(17,433

)

(5,368

)

Loss on extinguishment of debt

216

—

Non-cash lease expense

3,348

3,006

Other non-cash adjustments

202

259

Changes in operating assets and

liabilities:

Accounts receivable

(6,819

)

(11,961

)

Inventories

7,818

(4,762

)

Tooling in progress

2,348

(2,745

)

Prepaids and other current assets

(769

)

(1,093

)

Accounts payable

(4,134

)

10,241

Deferred income taxes

1,017

5,491

Operating lease obligations

(3,119

)

(2,698

)

Accrued liabilities

(3,911

)

6,555

Net cash provided by operating

activities

13,696

33,315

CASH FLOWS FROM INVESTING

ACTIVITIES

Purchase of property, plant and

equipment

(9,814

)

(38,808

)

Proceeds from sale of property, plant and

equipment

753

7,736

Payment for acquisition, net of cash

acquired

(88,593

)

—

Net cash used in investing activities

(97,654

)

(31,072

)

CASH FLOWS FROM FINANCING

ACTIVITIES

Proceeds from bank revolving credit

notes

454,587

327,170

Payments on bank revolving credit

notes

(358,411

)

(323,410

)

Repayments of other long-term debt

(5,877

)

(825

)

Payments of financing costs

(1,206

)

—

Purchase of treasury stock

(2,661

)

(4,947

)

Payments on finance leases

(296

)

(237

)

Net cash provided by (used in) financing

activities

86,136

(2,249

)

Net increase (decrease) in cash and cash

equivalents

2,178

(6

)

Cash and cash equivalents at beginning of

period

127

118

Cash and cash equivalents at end of

period

$

2,305

$

112

Mayville Engineering Company,

Inc.

Reconciliation of Net Income

to EBITDA and Adjusted EBITDA

(in thousands)

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Net income and comprehensive income

$

1,432

$

6,596

$

5,617

$

16,346

Interest expense

3,907

830

7,533

2,163

Provision for income taxes

554

1,490

1,471

4,464

Depreciation and amortization

9,608

7,105

25,498

21,556

EBITDA

15,501

16,021

40,119

44,529

CEO transition costs

—

861

—

1,512

Loss on extinguishment of debt

—

—

216

—

MSA acquisition related costs

499

—

1,398

—

Stock-based compensation expense

1,336

141

3,756

2,855

Field replacement claim

—

—

490

—

Hazel Park transition and legal costs due

to former fitness customer

984

862

1,479

4,678

Costs recognized on step-up of MSA

acquired inventory

891

—

891

—

Impairment of long-lived assets and gain

on contracts

—

(1,737

)

—

(4,346

)

Adjusted EBITDA

$

19,211

$

16,148

$

48,349

$

49,228

Net sales

$

158,217

$

136,276

$

439,843

$

410,865

EBITDA Margin

9.8

%

11.8

%

9.1

%

10.8

%

Adjusted EBITDA Margin

12.1

%

11.8

%

11.0

%

12.0

%

Mayville Engineering Company,

Inc.

Reconciliation of Net Income

and Diluted EPS to Adjusted Net Income and Diluted EPS

(in thousands, except share

amounts and per share data)

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Earnings

Diluted EPS

Earnings

Diluted EPS

Earnings

Diluted EPS

Earnings

Diluted EPS

Net income and comprehensive income

$

1,432

$

0.07

$

6,596

$

0.32

$

5,617

$

0.27

$

16,346

$

0.80

CEO transition costs

—

—

861

0.04

—

—

1,512

0.07

Loss on extinguishment of debt

—

—

—

—

216

0.01

—

—

MSA acquisition related costs

499

0.02

—

—

1,398

0.07

—

—

Stock-based compensation expense

1,336

0.06

141

0.01

3,756

0.18

2,855

0.14

Field replacement claim

—

—

—

—

490

0.02

—

—

Hazel Park transition and legal costs due

to former fitness customer

984

0.05

862

0.04

1,479

0.07

4,678

0.23

Costs recognized on step-up of MSA

acquired inventory

891

0.04

—

—

891

0.04

—

—

Impairment of long-lived assets and gain

on contracts

—

—

(1,737

)

(0.09

)

—

—

(4,346

)

(0.21

)

Tax effect of above adjustments

(899

)

(0.04

)

(30

)

(0.00

)

(1,993

)

(0.10

)

(1,115

)

(0.05

)

Adjusted net income and comprehensive

income

$

4,243

$

0.21

$

6,693

$

0.33

$

11,854

$

0.57

$

19,930

$

0.97

Mayville Engineering Company,

Inc.

Reconciliation of Free Cash

Flow

(in thousands)

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2023

2022

2023

2022

Net cash provided by operating

activities

$

19,562

$

17,632

$

13,696

$

33,315

Less: Capital expenditures

3,494

12,457

9,814

38,808

Free cash flow

$

16,068

$

5,175

$

3,882

$

(5,493

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231031492710/en/

Stefan Neely or Noel Ryan (615) 844-6248 MEC@val-adv.com

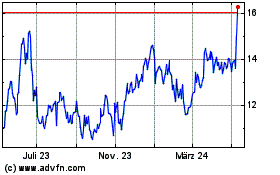

Mayville Engineering (NYSE:MEC)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

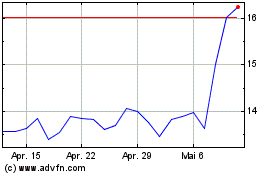

Mayville Engineering (NYSE:MEC)

Historical Stock Chart

Von Nov 2023 bis Nov 2024