0000067716false00000677162024-10-172024-10-17

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 17, 2024

MDU Resources Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| (State or other jurisdiction of | (Commission File Number) | (I.R.S. Employer Identification No.) |

| incorporation) | | |

| Delaware | 1-03480 | 30-1133956 |

1200 West Century Avenue

P.O. Box 5650

Bismarck, North Dakota 58506-5650

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including area code (701) 530-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | |

| (Title of each class) | (Trading Symbol(s)) | (Name of each exchange on which registered) |

| Common Stock, par value $1.00 per share | MDU | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On October 17, 2024, MDU Resources Group, Inc. (the “Company”) announced that, in connection with its planned separation of its wholly-owned construction services subsidiary, Everus Construction Group, Inc. (“Everus”), from the Company, Everus will host an investor day at 10:00 a.m. EDT on October 17, 2024. A copy of the materials presented at the investor day is attached hereto as Exhibit 99.1 and incorporated herein by reference. The separation is expected to be effective at 11:59 p.m. EDT on October 31, 2024. A copy of the press release is attached hereto as Exhibit 99.2 and incorporated herein by reference.

In accordance with General Instructions B.2 of Form 8-K, the information furnished pursuant to this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing. The information set forth herein will not be deemed an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are being furnished as part of this report.

| | | | | |

| Exhibit Number | Description |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* * *

Cautionary Note on Forward Looking Statement

This Current Report on Form 8-K includes certain forward-looking statements within the meaning of Section 21E of the Exchange Act. The forward-looking statements contained in this Current Report, including statements about the planned separation of Everus, the distribution of Everus common stock to the Company’s stockholders, the future state of the Company and Everus and future stock performance, are expressed in good faith and are believed by the Company to have a reasonable basis. Nonetheless, actual results may differ materially from the projected results expressed in the forward-looking statements. For a discussion of important factors that could cause actual results to differ materially from those expressed in the forward-looking statements, refer to Item 1A-Risk Factors in the Company’s most recent Form 10-Q and 10-K and the risk factors included in Everus’ registration statement on Form 10 (File No. 001-42276).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 17, 2024

| | | | | | | | |

| MDU Resources Group, Inc. |

| |

| |

| By: | /s/ Jason L. Vollmer |

| | |

| | Jason L. Vollmer |

| | Vice President, Chief Financial Officer and Treasurer |

| | |

www.EVERUS.com 1 INVESTOR DAY October 17, 2024 Exhibit 99.1

©2024 EVERUS Forward-Looking Statements 2 This presentation and other materials Everus has filed or will file with the Securities and Exchange Commission ("SEC") (and oral communications that Everus may make) contain or incorporate by reference, or will contain or incorporate by reference, certain “forward-looking statements” within the meaning of the securities laws. All statements that reflect Everus’ expectations, assumptions or projections about the future, other than statements of historical facts, including, without limitation, statements regarding business strategies, market potential, future financial performance and other matters. The words “believe,” “expect,” “estimate,” “could,” “should,” “intend,” “may,” “plan,” “seek,” “anticipate,” “project” and similar expressions generally identify forward-looking statements, which speak only as of the date the statements were made. In particular, information included within this presentation contain forward-looking statements. The matters discussed in this presentation are subject to risks, uncertainties and other factors that could cause actual results to differ materially from those projected, anticipated or implied in the forward looking statements. Although Everus believes that the expectations reflected in any forward-looking statements it makes are based on reasonable assumptions, it can give no assurance that the expectation will be attained and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include, but are not limited to: seasonality and adverse weather conditions; competition in Everus’ industry; the failure to retain current customers and obtain new customer contracts; changes in prices for commodities, labor, or other production and delivery inputs; Everus’ inability to hire, develop and retain key personnel and skilled labor forces; exposure to warranty claims; economic volatility; Everus’ inability to provide surety bonds; Everus’ backlog not accurately representing future revenue; supply chain disruptions; capital market and interest rates; increased financing costs due to possible Everus credit ratings, negative impacts from pending and/or future litigation, claims or investigations; liability resulting from Everus’ participation in multiemployer-defined benefit pension plans; increased health care plan costs; risks associated with the nonpayment and/or nonperformance of Everus’ customers and counterparties; increases or changes in income tax rates or tax- related laws; risks associated with import tariffs and/or other government mandates; new interpretations of or changes in the enforcement of the government regulatory framework; a cybersecurity incident or other disruptions in the availability of Everus’ computer systems or privacy breaches; artificial intelligence presents challenges that can impact Everus’ business by posing security risks to confidential or proprietary information and personal data; the pandemic’s potential impact on the United States, including the customer sectors Everus serves and governmental responses to the pandemic; the expected benefits and timing of the separation, and the risk that conditions to the separation will not be satisfied and/or that the separation will not be completed within the expected time frame, according to the expected terms or at all; the risk of increased costs from dis-synergies, costs of restructuring transactions and other costs incurred in connection with the separation; retention of existing management team members and the ability to obtain the necessary personnel as a result of the separation; the impact of the separation on Everus’ business, reaction of customers, employees and other parties to the separation; Everus’ leverage; risks associated with expected financing transactions undertaken in connection with the separation and risks associated with indebtedness incurred in connection with the separation; any failure by MDU Resources to perform its obligations under the various separation agreements to be entered into in connection with the separation and distribution; a determination by the IRS that the distribution or certain related transactions are taxable; the possibility that any consents or approvals required in connection with the separation will not be received or obtained within the expected time frame, on the expected terms or at all; and the impact of the separation on its businesses and the risk that the separation may be more difficult, time consuming or costly than expected, including the impact on its resources, systems, procedures and controls, diversion of management’s attention and the impact on relationships with customers, suppliers, employees and other business counterparties. The above list of factors is not exhaustive or necessarily in order of importance. For additional information on identifying factors that may cause actual results to vary materially from those stated in forward-looking statements, see the discussion under “Risk Factors” in the registration statement on Form 10 information statement. You should read this presentation completely and with the understanding that actual future results may be materially different from expectations. All forward-looking statements made in this presentation are qualified by these cautionary statements. These forward-looking statements are made only as of the date of this presentation, and Everus does not undertake any obligation, other than as may be required by law, to update or revise any forward-looking or cautionary statements to reflect changes in assumptions, the occurrence of events, unanticipated or otherwise, and changes in future operating results over time or otherwise. Comparisons of results for current and any prior periods are not intended to express any future trends, or indications of future performance, unless expressed as such, and should only be viewed as historical data. Reconciliations of the non-GAAP measures used to their respective most directly comparable GAAP measure can be found in the Appendix. All financial information presented in this presentation has been prepared in U.S. dollars in accordance with generally accepted accounting principles in the United States (“GAAP”), except for the presentation of the following non-GAAP financial measures: EBITDA, EBITDA Margin, Free Cash Flow and net leverage. EBITDA is most comparable to the GAAP measure of net income and is defined as net income or operating income before net ore interest expense, income taxes and depreciation and amortization. EBITDA Margin is most comparable to the GAAP measure of net income margin and is defined as EBITDA as a percentage of operating revenues. . Free Cash Flow is most comparable to the GAAP measure of cash flows provided by (used in) operating activities. Free Cash Flow is defined as net cash provided by (used in) operating activities less net capital expenditures. Net leverage is most comparable to the GAAP measure of debt net of cash on balance sheet divided by EBITDA, as defined. Our non- GAAP financial measures are not standardized; therefore, it may not be possible to compare them with other companies’ measures of EBITDA, EBITDA Margin, Free Cash Flow and net leverage having the same or similar names. Everus presents EBITDA, EBITDA Margin, Free Cash Flow and net leverage in this presentation because it believes such measures, in addition to corresponding GAAP measures, provide investors with additional information to measure Everus’ performance and liquidity. These non-GAAP financial measures are not intended as alternatives to GAAP financial measures. Everus uses EBITDA and EBITDA Margin, as well as the comparable GAAP measures of net income and net income margin, as indicators of Everus’ operating performance. Everus uses Free Cash Flow as well as the comparable GAAP measure of cash flows provided by (used in) operating activities, as a measure of cash available to Everus to invest in the growth of Everus’ business or that will be available to Everus to meet its obligations. Everus uses net leverage as well as the comparable GAAP measure of debt net of cash on balance sheet divided by EBITDA, as defined.

Agenda ©2024 EVERUS 3 SECTION SPEAKERS Welcome and Introduction Nicole Kivisto MDU Resources Group President & Chief Executive Officer Long-Term Value Creation Plan Jeff Thiede President & Chief Executive Officer Execution and Operational Excellence Tom Nosbusch Executive Vice President & Chief Operating Officer Break Financial Profile and Outlook Max Marcy Vice President, Chief Financial Officer & Treasurer Closing Remarks Jeff Thiede President & Chief Executive Officer Q&A

Welcome and Introduction Nicole Kivisto MDU Resources Group President & Chief Executive Officer

Everus as an Independent Public Company 5 FOCUSED STRATEGY & EXECUTION National construction services platform with a dedicated strategy and strong local brands to drive sustained long-term growth and profitability ©2024 EVERUS DEDICATED LEADERSHIP Dedicated and experienced Board of Directors and highly qualified Executive Leadership Team TARGETED & DISCIPLINED CAPITAL ALLOCATION Optimal capital structure with disciplined capital allocation for long-term value creation

Dedicated and Experienced Board of Directors ©2024 EVERUS 6 Qualified Board with diverse and relevant experience aligned with 4EVER strategy Dale Rosenthal Board Chair Former Director and CFO of Clark Construction Group Former public company Board member at MDU Resources and WGL Holdings Market President for U.S. Bank and former Managing Director at Wells Fargo Las Vegas Global Economic Alliance Board Chair Clark Wood Ed Ryan Former EVP and General Counsel of Marriott International Former public company Board member at MDU Resources Dave Sparby Former SVP at Xcel Energy, Inc. and CEO of North States Power- Minnesota Former public company Board member at MDU Resources Former SVP, CFO and Treasurer of MYR Group and SVP and CFO, Treasurer for Faith Technologies Public company Board member at Atkore Betty Wynn Former Americas CEO at AECOM and Partner at McKinsey & Company Former public company Board member at MDU Resources Mike Della RoccaJeff Thiede President & Chief Executive Officer 20 years with Everus Former President of OEG and CECC, Everus companies

Long-Term Value Creation Plan Jeff Thiede President & Chief Executive Officer

©2024 EVERUS 8 OUR MISSION Safely Building America’s Future as an industry-leading construction services provider while achieving sustained growth OUR VALUES SAFETY RESPECT TEAMWORK INTEGRITY

Experienced Leadership Team With Deep Expertise ©2024 EVERUS 9 16 Presidents responsible for day-to-day operations of 20 local brands ~13 years average executive tenure at Everus 9,000+ employees(1) ~28 years average executive tenure Paul Sanderson VP, Chief Legal Officer & Corporate Secretary Years of experience: 23 Joined MDU in 2023 as VP, CLO and secretary Former experience as an attorney in corporate law Max Marcy VP, Chief Financial Officer & Treasurer Years of experience: 21 Joined Everus in August 2024 Former VP and business unit CFO at H.B. Fuller 21 years with Everus Former VP of Accounting and EIT at Everus Jon Hunke VP & Chief Accounting Officer Years of experience: 24 25 years with Everus Former EVP of Everus 20 years with Everus Former President of OEG and CECC, Everus companies Jeff Thiede President & Chief Executive Officer Years of experience: 43 8 years with Everus Former construction services business owner/operator with extensive data center experience Ray Kelly SVP of Market Development Years of experience: 41 3 years with Everus Former VP of HR for a regional credit union Britney Hendricks VP of Human Resources Years of experience: 16 25 years with Everus Former Director of IT for Everus Jason Behring VP of Technology Years of experience: 25 Tom Nosbusch EVP & Chief Operating Officer Years of experience: 28 Note: Figures as of 6/30/2024, unless specified otherwise. (1) At peak 2023 construction season.

©2024 EVERUS $2.7B Total Revenue(4) Wiring, infrastructure, fire suppression and piping National Platform of 20 Market-Leading Local Brands Electrical & Mechanical Note: Figures reflect data as of 6/30/2024, unless specified otherwise. (1) At peak 2023 construction season. (2) From full fiscal year 2019 to last twelve months ended 6/30/2024. (3) Engineering News-Record magazine. (4) Last twelve months ended 6/30/2024. Revenue excludes intersegment eliminations of $19M. Transmission & Distribution 10 Utility and communication infrastructure, and manufacturing and distribution of equipment E&M Revenue: 71% T&D Revenue: 29% Focus on Complex Projects I High-Quality Execution I Proven Track Record $2.4B all-time record backlog 9,000+ Employees(1) 82% Employees in Unions 3,700+ Customers(4) 44,000+ Projects(4) No. 10 of 600 Specialty Contractors(3) 9% Revenue CAGR(2) 10% EBITDA CAGR(2) 18% Backlog CAGR(2) Leading Construction Services Provider

COMMERCIAL (55%) SERVICE/OTHER (6%) ©2024 EVERUS 11 Construction and maintenance of electrical, communication, fire suppression and mechanical systems Deep experience with hospitality, entertainment, high-tech and data center projects Specialized expertise with complex, large and longer-term projects Electrical construction Fire protection Industrial Low voltage Mechanical Packaged controls & manufacturing Pre-construction design Renewable energy Segment Overview Services INSTITUTIONAL (17%) Market-Leading Local Brands RENEWABLES (2%) End-Markets(2) $1,916M Revenue Note: Figures reflect last twelve months ended 6/30/2024, unless specified otherwise. Revenue excludes intersegment eliminations of $19M. (1) From full fiscal year 2019 to last twelve months ended 6/30/2024. (2) Bracketed figures represent revenue as a percentage of segment revenue; reflects last twelve months ended 6/30/2024. $144.3M EBITDA 9% Revenue CAGR(1) $2,064M Backlog as of 6/30/2024 7.5% EBITDA Margin INDUSTRIAL (20%) Electrical & Mechanical (“E&M”)

©2024 EVERUS 12 Construction and maintenance services for utility and communication infrastructure Manufacturing and distribution of line equipment Expertise in small- to medium-sized projects, recurring upgrades and maintenance work Serving utility and local government customers Equipment Excavation & underground Signals & lighting Substations Transmission & distribution UTILITY (91%) TRANSPORTATION (9%) Segment Overview Services End-Markets(2) $785M Revenue $99.7M EBITDA $340M Backlog as of 6/30/2024 12.7% EBITDA Margin Market-Leading Local Brands 6% Revenue CAGR(1) Transmission & Distribution (“T&D”) 58% MSA Revenue % Note: Figures reflect last twelve months ended 6/30/2024, unless specified otherwise. Revenue excludes intersegment eliminations of $19M. (1) From full fiscal year 2019 to last twelve months ended 6/30/2024. (2) Bracketed figures represent revenue as a percentage of segment revenue; reflects last twelve months ended 6/30/2024.

Scaled National Platform of Market-Leading Local Brands ©2024 EVERUS 13 Operating and authorized to work across the United States Proven ability to deploy capital for innovation and to set industry standards Systematic platform-wide sharing of best practices and expertise Authorized states of operations National Platform Local Expertise 20 market-leading local brands Deep local knowledge and expertise for high-quality execution of complex projects Strong local relationships and market insight for disciplined bidding and project management Note: Figures as of 6/30/2024. Headquarters Transmission & Distribution Electrical & Mechanical

©2024 EVERUS 14 Commercial Transportation Renewables $1,055M LTM Revenue 39% % of Contract Revenue $48M LTM Revenue 2% % of Contract Revenue $74M LTM Revenue 3% % of Contract Revenue Service & Other $106M LTM Revenue 4% % of Contract Revenue Note: Figures reflect last twelve months ended 6/30/2024. Excludes intersegment eliminations of $19M. Data centers Hospitality and entertainment Diversified commercial projects Electric vehicle charging Solar generation Energy storage markets Traffic signalization and street lighting Smaller projects, stand-alone or recurring maintenance Industrial $382M LTM Revenue 14% % of Contract Revenue High-tech manufacturing facilities Industrial installations, renovations, upgrades and expansions Education and government buildings Airports Health care InstitutionalUtility Overhead and underground electrical, gas and communication infrastructure $711M LTM Revenue 26% % of Contract Revenue $325M LTM Revenue 12% % of Contract Revenue Strong Positioning Across Diversified End-Markets

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Capital Electric Line Builders completes biggest transmission line construction project in Everus history ©2024 EVERUS 15 Scaled for Success, Built for Growth Scaling National Platform 2005 – 2014 Foundation for Growth 1997 – 2004 Operational Excellence 2015 – 2023 No. 10 on 2023 ENR Top 600 Specialty Contractors List No. 4 on 2023 EC&M Top 50 Electrical Contractors List Completed several complex marquee projects Achieved growth through targeted entry into new geographies, including Las Vegas and 5 new states Increased ability to successfully execute large-scale marquee projects In 1997, entered Transmission & Distribution (T&D) segment via an acquisition In 2001, expanded to Electrical & Mechanical (E&M) through acquisitions Capital Electric Construction completes Arrowhead Stadium renovation for the Chiefs Resorts World Las Vegas combines expertise of two brands Las Vegas Sphere incorporates complementary skillsets of three Everus brands Everus co-founds the Electrical Transmission & Distribution Partnership

©2024 EVERUS 16 Leading construction services provider with differentiated execution capabilities well-positioned to benefit from multiple growth drivers and industry megatrends Proven executive leadership team executing 4EVER strategy to deliver sustained profitable growth and long-term value creation Scaled national platform of market-leading local brands with long-tenured customer relationships across multiple end-markets and geographies Highly skilled workforce, people-first culture and repeatable execution playbook to deliver industry-leading safety and high-quality outcomes across complex projects Diversified revenue base, capital-light business model and disciplined capital allocation framework to support growth levers and maintain business resilience Compelling Investment Thesis

Next Phase of Growth, Disciplined Execution, Value Creation ©2024 EVERUS 17 4EVER strategy for sustained and profitable growth and long-term value creation 5%—7% Organic Revenue CAGR 7%—9% EBITDA CAGR LONG-TERM EXPECTATIONS Sustained and Profitable Growth 2024+ Foundation for Growth 1997 – 2004 Scaling National Platform 2005 – 2014 Operational Excellence 2015 – 2023

©2024 EVERUS 18 Attract, retain and train premier talent Employees Create long-term value with sustained profitable growth Value Maintain and grow customer relationships Relationships Lead the industry in safety and consistent high-quality execution Execution

Highly Skilled Employees ©2024 EVERUS 19 ~28 Years Average Executive Tenure 100% Brand Presidents’ “Building Leaders” Program Completion 82% Union Workforce 9,000+ Employees(1) Strong Union Relationships Expertise & Technical Skills Extensive Experience Training Leadership Experienced executive team with deep expertise Train and mentor top leadership talent Highly skilled and flexible workforce; long-tenured union relationships Experienced and skilled on-site project managers, general foremen and foremen ensure delivery of best-in-class field execution ~11 Years Average General Foreman Tenure Note: Figures as of 6/30/2024, unless specified otherwise. (1) At peak 2023 construction season.

Consistent High-Quality Execution ©2024 EVERUS 20 PRE-CONSTRUCTION CONSTRUCTION POST-CONSTRUCTION Bid With Discipline Deploy Repeatable Playbook Maintain Customer Relationships High-Quality Outcomes Provide post-construction services Prioritize customer retention Provide maintenance and repair services Prioritize safety and productivity culture Consistently deliver high-quality outcomes Systematically share and use best practices across brands Focus on technical and complex projects Maximize differentiated capabilities Leverage platform-wide ‘lessons learned’ and best-known methods Disciplined Processes Across Project Lifecycle Resilient Margin Profile Sustained Growth New Project Wins High Employee Retention High Customer Retention

©2024 EVERUS 21 Broad Base of Long-Tenured Marquee Customers GENERAL CONTRACTORS CORPORATE CUSTOMERS Negotiated / Competitive Bid Negotiated / Competitive Bid UTILITY CUSTOMERS Master Service Agreement 30+ Years Average Relationship with Top 10 Customers(2) 3,700+ Customers 44,000+ Projects 18% Backlog CAGR(1) Strong Customer Relationships Note: Figures reflect last twelve months ended 6/30/2024, unless specified otherwise. Logos of select Everus customers. (1) From full fiscal year 2019 to last twelve months ended 6/30/2024. (2) Based on the cohort of top 10 customers as of the last twelve months ended 6/30/2024. Confidential Data Center Owners Confidential High-Tech Customers Confidential Utility Customers

Multiple Levers to Drive Growth ©2024 EVERUS 22 Grow Share Within Existing Markets Increase local share through strong customer relationships and a proven track record of execution Further Penetrate Higher-Growth Sub-Markets Leverage expertise with critical and complex projects to expand within high-growth sub-markets Accelerate Growth With Strategic M&A Continue to build scale on the platform through strategic and targeted acquisitions of complementary businesses Geographical Expansion Via Satellite Projects Deploy advantages of national platform to grow with existing customers in new geographies

$365B 2026 TAM(2) Well-Positioned in High-Growth Industry Megatrends ©2024 EVERUS 23 GRID MODERNIZATION Upgrades and repairs of aging electrical infrastructure 6% 2023 – 2026 HIGH-TECH RESHORING Accelerating shift to domestic manufacturing 12% 2022 – 2032 ENERGY TRANSITION Government and commercial support for renewable energy 13% 2023 – 2028 DATA CENTERS AND AI Computing requirements driving investment in tech infrastructure 15% 2023 – 2030 CAGR(1) (1) US Data Center power demand per broker reports; investor-owned utility capex per Edison Electric Institute; U.S. semiconductor capacity (kwspm) per Semiconductor Industry Association; total renewable generation per U.S. Energy Information Administration. (2) Per U.S. Census, FERC, BEA, and Dodge Construction Network. Why Everus Wins 14+ years of data center experience and relationships with multiple customers and general contractors Go-to partner for grid modernization with marquee utility customers Highly skilled workforce and national scale to execute complex high-tech projects Growing momentum across company brands to win new renewables projects Large, fragmented market with opportunity to gain share E&M $299B T&D $66B

©2024 EVERUS 24 Geographic Expansion Through Satellite Projects – Data Centers Highly skilled workforce and scaled solutions for consistent execution Building Blocks of Data Center Excellence and Expansion Extensive knowledge-sharing 14+ years of significant experience in the data center industry (1) Figures reflect last twelve months ended 6/30/2024. ~2x growth in data center backlog Growing Momentum – Last Twelve Months(1) ~2x increase in size of largest project Growing momentum in data center end-market, driven by unique capabilities and high-quality execution

©2024 EVERUS 25 Geographic Expansion Through Strategic M&A (1) As per deal announcement on 2/3/2020. (2) Based on a comparison of revenue and EBITDA in the year of the acquisition (2020) versus the last twelve months ended 6/30/2024. Milestones Since Acquisition(2) Acquired PerLectric in 2020, successfully expanding footprint to the Mid-Atlantic Attractive and complementary markets M&A Philosophy Proven leadership team Strong safety and people-first culture Disciplined Acquisition & Systematic Integration Market-leading brand Specializing in government and health care services end-markets Leverage data center expertise for future projects Leading local brand ~1.6x Revenue ~2.5x EBITDA 2nd highest commercial construction starts in the US(1) Leading global data center market DC Metro Area Compelling financial return

©2024 EVERUS 26 LONG-TERM VALUE CREATION Employees Value Execution Relationships LONG-TERM EXPECTATIONS 7%–9% EBITDA CAGR 5%–7% Organic Revenue CAGR LONG-TERM VALUE CREATION

©2024 EVERUS 27 Leading construction services provider with differentiated execution capabilities well-positioned to benefit from multiple growth drivers and industry megatrends Proven executive leadership team executing 4EVER strategy to deliver sustained profitable growth and long-term value creation Scaled national platform of market-leading local brands with long-tenured customer relationships across multiple end-markets and geographies Highly skilled workforce, people-first culture and repeatable execution playbook to deliver industry-leading safety and high-quality outcomes across complex projects Diversified revenue base, capital-light business model and disciplined capital allocation framework to support growth levers and maintain business resilience Compelling Investment Thesis

Execution and Operational Excellence Tom Nosbusch Executive Vice President & Chief Operating Officer

Systematic application of repeatable playbook across project lifecycle enables consistent high-quality outcomes, from pre-construction and design-assist to post-construction services ©2024 EVERUS 29 Industry-leading safety-first culture attracts and retains highly skilled workforce necessary to execute complex projects Unique pre-construction capabilities and design-assist delivery enhance project efficiency and outcomes Disciplined project planning standards, scaled pre-fabrication facilities and knowledge- sharing across brands support new wins Operational excellence delivers consistent project outcomes – high employee and customer retention, new project wins, sustained growth and resilient margin profile Today’s Key Messages

Total Recordable Incident Rate 1.29 1.72 Industry Average Days Away, Restricted or Transferred 0.60 1.00 Industry Average ©2024 EVERUS 30 Founding member of Electrical Transmission & Distribution Partnership, a collaboration of industry stakeholders working to improve safety Safety controls enforced at both local brand and company-wide levels Project safety monitored and evaluated from design to build Safety incorporated into brand presidents’ performance metrics Rigorous Approach to Safety Industry-Leading Safety Record Lost-Time Incident Rate 0.33 0.66 Industry Average Leading Safety Track Record Enables New Project Wins, Stronger Customer Relationships and Employee Retention People-First Culture With Industry-Leading Safety Focus Note: Figures reflect data as of 6/30/2024.

31 Systematically Share ‘Lessons Learned’ Across Brands Leverage Unique Pre-Construction Design-Assist Capabilities Position Safety as a Core Value, Not Only a Priority Efficiently Scale Highly Skilled Workforce Continuously Train and Develop Workforce Skills ©2024 EVERUS Deploy Best Practices in Detailed Project Planning Execution Playbook for Repeatable High-Quality Results HIGH-QUALITY OUTCOMES Resilient Margin Profile New Project Wins Sustained Growth High Employee Retention High Customer Retention

Project-planning standards that identify pre-fabrication opportunities Robust communication and knowledge- sharing between BIM/CAD(2) and pre- fabrication teams National scale and local presence allowing innovation at scale with local expertise Superior pre-fabrication quality, lowering costs and strengthening ability to win new projects High exposure to complex projects benefiting the most from pre-fabrication ©2024 EVERUS 32 Early Adopter of Pre-Fabrication Improved safety Greater labor efficiency and lower labor costs Faster project completion Enhanced quality of project execution Increased ability to control project outcomes Benefits of Pre-Fabrication Why Everus Wins 14 pre-fabrication facilities Pre-Fabrication Drives Productivity and Cost Savings 21% CAGR in cost savings to customers since 2019(1) (1) Reflects CAGR between full year 2019 and last twelve months ended 6/30/2024. (2) ‘BIM’ Building Information Modeling; ‘CAD’ Computer Aided Design.

©2024 EVERUS 33 PROJECT HIGHLIGHTS Design-Assist Project Delivery Exceptional pre-construction capabilities and value analysis enabled fast start and completion in 2023 COMPETITIVE STRENGTH Flexible Highly Skilled Labor Ability to rapidly scale workforce, peaking at 650 employees across three different Everus brands, enabled expedited project completion Bidding Discipline & Operational Excellence Consistent high-quality execution strengthened customer relationship, leading to marquee projects Strong Customer Relationship Systematic application of execution playbook drove high- quality results and customer satisfaction National Transfer of Knowledge Ability to apply best practices and mobilize resources from the project enabled additional project wins 19+ Year customer relationship 65%+ Revenue CAGR with customer since 2018 +100 New projects with customer since 2018 Marquee E&M Project

©2024 EVERUS 34 PROJECT HIGHLIGHTS COMPETITIVE STRENGTH 26+ Year customer relationship 22%+ Revenue CAGR with customer since 2018 +250 New projects with customer since 2018 Strong Customer Relationship Breadth of Capabilities Expertise With Complex Projects 26+ year customer relationship with significant and predictable MSA project work Providing full scope of services across T&D, including reconductoring, pole change outs, and emergency response Partnering on multi-year strategic projects – result of large commitment to reduce wildfire risk Undergrounding power and communications knowledge transferred throughout Everus Efficient and Safe Operations Consistently exceeding PG&E’s priority KPI of contractor benchmarks for safety; 0 safety KPI incidents YTD Decades-Long T&D Relationship National Transfer of Knowledge

©2024 EVERUS 35 Disciplined Execution for Repeatable High-Quality Results PRE- CONSTRUCTION Bid With Discipline Utilizing Job Cost Data CONSTRUCTION Deploy Repeatable Playbook POST- CONSTRUCTION Maintain Customer Relationships and Service Work Opportunities High-Quality Outcomes Disciplined Processes Across Project Lifecycle Resilient Margin Profile Sustained Growth New Project Wins High Employee Retention High Customer Retention

Break

Financial Profile and Outlook Max Marcy Vice President, Chief Financial Officer & Treasurer

Today’s Key Messages Consistent execution and disciplined strategy deliver strong financial performance spanning 27 years Strong market positions and tailwinds from megatrends provide multiple levers for expansion and sustained growth Capital-light business model and disciplined capital allocation framework support growth and resilience 4EVER strategy provides strong foundation for resilient margin performance and long-term value creation Strong balance sheet with ample liquidity allows for strategic flexibility, operational needs and opportunistic investment 38©2024 EVERUS

36% 64% END-MARKET DIVERSITY Well-positioned to capture growth from secular megatrends with comprehensive set of solutions CUSTOMER AND PROJECT DIVERSITY Long-tenured customer relationships and diversified project base enhance strong backlog and business stability ©2024 EVERUS 39 Revenue by Customer Revenue by Project Size(1) 29% 40% 30% Note: Figures reflect last twelve months ended 6/30/2024; may not add up to 100% due to rounding. (1) Large represents projects over $35 million, medium represents projects between $1 million to $35 million, and small represents projects smaller than $1 million. Diversified Customer Base Well-Balanced Project Mix MediumLarge SmallAll Other Top 10 Customers Diversified Revenue Base for Sustained Growth 39% 26% 14% 12% 4%3% 2% Revenue by End-Market Utility Transportation Commercial Industrial Institutional Service & Other Renewables 7 End-Markets With 25 Sub-Markets Across E&M and T&D

Strong Backlog and Revenue Growth ©2024 EVERUS 40 Track Record of Strong Backlog Growth … … Delivering Sustained Long-Term Revenue Growth $1,849 $2,096 $2,052 $2,699 $2,854 $2,682 2019 2020 2021 2022 2023 LTM Revenue $ in millionsBacklog $ in millions (1) Reflects last twelve months ended 6/30/2024. (1) $1,144 $1,273 $1,385 $2,131 $2,011 $2,403 2019 2020 2021 2022 2023 As of 6/30/2024

Capital-Light, Low Fixed-Cost Model For Flexibility & Resilience ©2024 EVERUS 41 Low Fixed Costs For Flexibility and Resilience(2) (1) Reflects last twelve months ended 6/30/2024. (2) Figures based on fixed and variable costs before dis-synergies. (3) Average reflects 2019-2023 metrics. 11% 12% 12% 10% 11% 12% 89% 88% 88% 90% 89% 88% 2019 2020 2021 2022 2023 LTM Fixed costs Variable costs 5-Year Avg(3): 89% 5-Year Avg(3): 11% (1) $39 $31 $27 $36 $36 $32 2.1% 1.5% 1.3% 1.3% 1.2% 1.2% 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 0 5 10 15 20 25 30 35 40 45 2019 2020 2021 2022 2023 LTM Gross CapEx Gross CapEx % of Revenue Capital-Light Business Model With Disciplined Growth Investments Gross CapEx $ in millions (1)

7.9% 8.3% 8.2% 7.2% 7.8% 8.4% 2019 2020 2021 2022 2023 LTM 5-Year Avg. EBITDA Margin: 7.9%(2) Profitable Growth With a Resilient Margin Profile ©2024 EVERUS 42 Bid Discipline and Operational Excellence Enable Resilient Margin Profile … … In Turn Driving Sustained and Profitable Growth EBITDA $ in millions EBITDA Margins(1) $145 $173 $169 $193 $223 $225 2019 2020 2021 2022 2023 LTM EBITDA(1) (1) Total EBITDA including Corporate Overhead. (2) 5-year avg. EBITDA Margin and EBITDA CAGR are based on EBITDA before dis-synergies. (3) Reflects last twelve months ended 6/30/2024. (3) (3)

©2024 EVERUS 43 Confirmed 2024 Financial Guidance Key Drivers Confirmed 2024 Guidance(2) (1) As of 6/30/2024. (2) EBITDA guidance before dis-synergies. Confidence in the business and segment guidance that MDU previously provided Strong demand for E&M data center, government and education projects, and T&D utility and transportation work Federal funding to bolster investments in domestic manufacturing and upgrades to infrastructure Strong momentum, with backlog at all-time record $2.4B(1) Revenue $2.65B – $2.85B EBITDA $220M – $240M EBITDA Margins Higher than 2023

©2024 EVERUS 44 2024 EBITDA Guidance Including Impact of Full-Year Dis-Synergies $ in millions $230 $202 $28 Midpoint of 2024 EBITDA Guidance Full-Year Net Dis-Synergies Guidance Assuming Full-Year Net Dis-Synergies 2024 EBITDA Bridge (Assuming Full-Year Dis-Synergies) Recurring dis-synergies include insurance, governance and listing costs, continuing stock exchange fees, and fees associated with public company disclosures (1) (1) Net dis-synergies calculated as dis-synergies of $29.5M – synergies of $1.1M.

Strong Balance Sheet and Strategic Flexibility ©2024 EVERUS 45 Prioritize growth investments; target long-term net leverage between 1.5x–2.0x Provide ample capacity to support growth across cycles Ensure strategic flexibility for opportunistic investments – both organic opportunities and strategic acquisitions Maintain syndicated debt facilities with mid- range maturities to finance the business Maintaining a Flexible Balance Sheet (1) 1.5x–2.0x Target Net Leverage(1) 1.3x Net Leverage at 10/31/2024 Spinoff Date (1) Net leverage ratio defined as total net debt divided by EBITDA over last twelve months ended 6/30/2024 before dis-synergies.

Disciplined Capital Allocation For Long-Term Value Creation ©2024 EVERUS 46 Prudent management through the economic cycle Target long-term net leverage ratio between 1.5x and 2.0x Complementary businesses, only if strategic and cultural fit with compelling returns Disciplined and selective approach in target markets Accelerating expansion to under-penetrated geographical U.S. markets Grow share within existing markets and higher-growth sectors Grow with existing customers in new geographies Growth and maintenance CapEx of 2.0–2.5% of revenue Provide working capital to fund operations across diverse projects Capital Return to Shareholders NEAR-TERM PRIORITIES Organic Growth Investment 1 Value-Enhancing M&A 2 Balance Sheet Optimization 3 Prioritizing growth investments in the near term over dividends and share repurchases ~40% ~40% ~10% ~25% ~40% ~25% ~20% Historical Uses of Capital Expected Go- Forward Uses of Capital USES OF CAPITAL % of total capital uses Remaining Residual Capital Working Capital Gross CapEx M&A Transfers to Parent

©2024 EVERUS 47 Employees Value Execution Relationships LONG-TERM EXPECTATIONS 2.0%–2.5% CapEx as % of Revenue Net Leverage 1.5x–2.0x 7%–9% EBITDA CAGR 5%–7% Organic Revenue CAGR

Closing Remarks Jeff Thiede President & Chief Executive Officer

Benefit From Multiple Growth Drivers and Industry Megatrends Proven Leadership Team Executing 4EVER Strategy Scaled National Platform of Market-Leading Local Brands Skilled Workforce, People-First Culture & Repeatable Playbook Diversified Revenue Base & Disciplined Capital Allocation Compelling Investment Thesis ©2024 EVERUS 49

Q&A

Please join us at 8:30 AM EST on Nov. 7th for Everus’ Q3 2024 Webcast

Appendix

Non-GAAP Financial Guidance ©2024 EVERUS 53 Our forward-looking guidance for EBITDA, EBITDA Margin and long-term net leverage are non-GAAP financial measures that exclude or otherwise have been adjusted for special items from our U.S. GAAP financial statements. We are unable to reconcile forward-looking non-GAAP guidance measures to their nearest U.S. GAAP measure because we are unable to predict the timing of these adjustments with a reasonable degree of certainty. By their very nature, special and other non-core items are difficult to anticipate with precision because they are generally associated with unexpected and unplanned events that impact our company and its financial results. Therefore, we are unable to provide a reconciliation of these non-GAAP financial metrics without unreasonable efforts.

Twelve Months Ended December 31st 2023 2024 LTM ($ in millions, except for margin values) 2019 2020 2021 2022 1H 2023 2H 2023 1H 2024 As of Q2 2024 Net Income $93.0 $109.7 $109.4 $124.8 $64.7 $72.5 $67.2 $139.7 Adjustments: Interest 5.3 4.1 3.5 6.4 8.9 8.1 6.0 14.1 Income Taxes 30.0 35.8 35.4 40.8 21.4 23.9 23.6 47.5 Depreciation & Amortization 17.0 23.5 20.3 21.5 11.3 11.8 12.1 23.9 EBITDA $145.3 $173.1 $168.6 $193.4 $106.3 $116.3 $108.9 $225.2 Net Revenues $1,849.3 $2,095.7 $2,051.6 $2,699.3 $1,501.3 $1,353.1 $1,329.1 $2,682.2 Net Income % 5.0% 5.2% 5.3% 4.6% 4.3% 5.4% 5.1% 5.2% EBITDA Margin 7.9% 8.3% 8.2% 7.2% 7.1% 8.6% 8.2% 8.4% ©2024 EVERUS Non-GAAP Reconciliation of EBITDA 54

Financial Reconciliations (E&M) ©2024 EVERUS 55 ($ in millions, except for margin values) 2019 LTM as of Q2 2024 2023 1H 2023 2H 2023 1H 2024 4.5-Year CAGR E&M Revenue $1,274.3 $1,916.0 $2,134.9 $1,163.3 $971.6 $944.9 9.5% Operating Income $64.0 $131.0 $134.4 $69.2 $65.2 $65.8 17.3% Other Income 1.1 7.0 6.1 4.4 1.7 5.3 50.7% Depreciation & Amortization 2.7 6.3 6.2 3.1 3.1 3.2 21.2% EBITDA $67.8 $144.3 146.7 76.7 70.0 74.3 18.3% Operating Margin 5.0% 6.8% 6.3% 5.9% 6.7% 7.0% EBITDA Margin 5.3% 7.5% 6.9% 6.6% 7.2% 7.9%

Financial Reconciliations (T&D) ©2024 EVERUS 56 ($ in millions, except for margin values) 2019 LTM as of Q2 2024 2023 1H 2023 2H 2023 1H 2024 4.5-Year CAGR T&D Revenue $596.3 $785.0 $734.6 $345.0 $389.6 $395.3 6.3% Operating Income $76.0 $80.1 $73.6 $28.3 $45.3 $34.8 1.2% Other Income 0.4 1.7 2.1 1.0 1.1 0.6 42.0% Depreciation & Amortization 14.4 17.9 17.1 8.3 8.8 9.1 4.9% EBITDA $90.8 $99.7 $92.8 $37.6 $55.2 $44.5 2.1% Operating Margin 12.7% 10.2% 10.0% 8.2% 11.6% 8.8% EBITDA Margin 15.2% 12.7% 12.6% 10.9% 14.2% 11.2%

©2024 EVERUS Reference for Historical Growth in Backlog ($ in millions) 2019 As of 6/30/2024 4.5-Year CAGR Backlog 1,144.0 2,403.4 17.9% 57

($ in millions, except for leverage ratios) As of Spinoff Date, October 31st, 2024 Total Debt $340 Cash $50 Net Debt $290 LTM EBITDA(1) as of Q2 2024 $225 Gross Leverage 1.5x Net Leverage(1) 1.3x ©2024 EVERUS Non-GAAP Reconciliation of Net Leverage (1) Reflects EBITDA over last twelve months ended 6/30/2024 before dis-synergies. 58

Building America’s Future. 59

Everus Construction Group Holding Investor and Analyst Information Event Today at NYSE

Bismarck, N.D. — Oct. 17, 2024 — Everus Construction Group, an industry-leading construction services provider, will hold an analyst and investor day at 10 a.m. EDT today at the New York Stock Exchange.

At the event, management will provide an overview of the company’s 4EVER strategic framework, investment highlights, operations, financial performance and anticipated growth prospects. The presentation will be followed by a question-and-answer session.

Everus also is reiterating its 2024 guidance:

•Revenue is expected to be in the range of $2.65 billion to $2.85 billion.

•Earnings before interest, taxes, depreciation and amortization (EBITDA) are expected to be in the range of $220 million to $240 million.*

•Margins are expected to be higher than in 2023.

* See the table below for a reconciliation of non-GAAP financial measures.

Everus is expected to be spun off on Oct. 31 from MDU Resources Group (NYSE: MDU) through a pro rata distribution of 100% of Everus’ outstanding shares of common stock to MDU stockholders of record on Oct. 21. Everus is expected to begin trading under the ticker symbol ECG on the NYSE on Nov. 1. Additional details about the stock distribution can be found at investors.everus.com/news.

The investor day presentation will be webcast. A link to the webcast, as well as the presentation materials and more information about the anticipated spinoff, can be found at investors.everus.com. A replay of the webcast will be available on Everus’ website following the event.

MDU Resources announced in November 2023 that it intends to spin off Everus as an independent, publicly traded company to optimize value for stockholders.

Everus to Webcast Third Quarter Earnings Conference Call Nov. 7

Everus also announced today that it will webcast its third quarter 2024 earnings conference call at 8:30 a.m. EST Nov. 7. The company will release its third quarter results after U.S. financial markets close on Nov. 6. The webcast and a subsequent replay will be accessible at investors.everus.com under “Events & Presentations.”

Forward-Looking Statements

Information in this release includes certain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. The forward-looking statements in this release, including information about projections, financial guidance and the expected timing of the spinoff, are expressed in good faith and are believed by the company to have a reasonable basis. Although the company believes its expectations are based on reasonable assumptions, there is no assurance the company’s

projections, including financial guidance, will be achieved. Nonetheless, actual results may differ materially from the projected results expressed in the forward-looking statements. For a discussion of important factors that could cause actual results to differ materially, refer to Everus’ Form 10 Registration Statement and Item 1A — Risk Factors in MDU Resources' most recent Form 10-K and Form 10-Q and subsequent filings with the SEC. Changes in such factors could cause actual future results to differ materially from financial guidance. All forward-looking statements in this news release are expressly qualified by such cautionary statements and by reference to the underlying factors. Undue reliance should not be placed on forward-looking statements, which speak only as of the date they are made. Except as required by law, the company does not undertake to update forward-looking statements, whether as a result of new information, future events or otherwise.

About MDU Resources

MDU Resources Group, Inc., a member of the S&P SmallCap 600 Index, provides essential products and services through its regulated energy delivery and construction services businesses. Founded in 1924, the company is celebrating its 100th anniversary; learn more at www.mdu.com/100th-anniversary. For more information about MDU Resources, visit www.mdu.com or contact the Investor Relations Department at investor@mduresources.com.

About Everus Construction Group

Everus Construction Group, Inc. is Building America's Future™ by providing a full spectrum of construction services through its electrical and mechanical, and transmission and distribution specialty contracting services across the United States. These specialty contracting services are provided to utility, transportation, commercial, industrial, institutional, renewable and other customers. Its E&M contracting services include construction and maintenance of electrical and communication wiring and infrastructure, fire suppression systems, and mechanical piping and services. Its T&D contracting services include construction and maintenance of overhead and underground electrical, gas and communication infrastructure, as well as manufacturing and distribution of transmission line construction equipment and tools. For more information about Everus, visit everus.com.

Non-GAAP Financial Measures

Everus has provided a non-GAAP financial measure of 2024 EBITDA guidance. The company defines EBITDA from continuing operations as income (loss) from continuing operations before interest; taxes; and depreciation and amortization. The company believes this non-GAAP financial measure provides meaningful information to investors about operational efficiency compared to the company's peers by excluding the impacts of differences in tax jurisdictions and structures, debt levels and capital investment. The company's management uses the non-GAAP financial measure in conjunction with GAAP results when evaluating the company's operating results and calculating compensation packages. Non-GAAP financial measures are not standardized; therefore, it may not be possible to compare such financial measures with other companies' non-GAAP financial measures having the same or similar names. The presentation of this additional information is not meant to be considered a substitution for financial measures prepared in accordance with GAAP. The company strongly encourages investors to review the consolidated financial statements in their entirety and to not rely on any single financial measure. The following table provides a reconciliation of GAAP income from continuing operations to EBITDA for forecasted results.

| | | | | | | | |

| EBITDA Guidance Reconciliation for 2024 | | |

| Construction Services |

| Low | High |

| (In millions) |

| Income from continuing operations | $ | 140.0 | | $ | 150.0 | |

| Adjustments: | | |

| Interest expense | 10.0 | 15.0 |

| Income tax expense | 45.0 | 50.0 |

| Depreciation and amortization | 25.0 | 25.0 |

| EBITDA from continuing operations | $ | 220.0 | | $ | 240.0 | |

Investor Contact: Brent Miller, assistant treasurer and director of financial projects and investor relations, 701-530-1730

Media Contacts: Laura Lueder, Everus director of communications, 701-221-6444

Byron Pfordte, MDU Resources manager of integrated communications, 208-377-6050

v3.24.3

Cover

|

Oct. 17, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 17, 2024

|

| Entity Registrant Name |

MDU Resources Group, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-03480

|

| Entity Tax Identification Number |

30-1133956

|

| Entity Address, Address Line One |

1200 West Century Avenue

|

| Entity Address, Address Line Two |

P.O. Box 5650

|

| Entity Address, City or Town |

Bismarck

|

| Entity Address, State or Province |

ND

|

| Entity Address, Postal Zip Code |

58506-5650

|

| City Area Code |

701

|

| Local Phone Number |

530-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $1.00 per share

|

| Trading Symbol |

MDU

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000067716

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

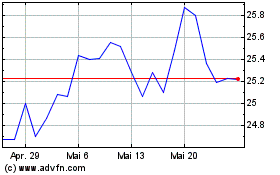

MDU Resources (NYSE:MDU)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

MDU Resources (NYSE:MDU)

Historical Stock Chart

Von Nov 2023 bis Nov 2024