false

0000030125

N-CSRS

0000030125

2023-04-01

2023-09-30

0000030125

isif:PrincipalRisksMember

2023-04-01

2023-09-30

0000030125

isif:FixedIncomeMarketRiskMember

2023-04-01

2023-09-30

0000030125

isif:InterestRateRisksMember

2023-04-01

2023-09-30

0000030125

isif:AssetBackedSecuritiesRiskMember

2023-04-01

2023-09-30

0000030125

isif:CreditRisksMember

2023-04-01

2023-09-30

0000030125

isif:CoronavirusAndPandemicRiskMember

2023-04-01

2023-09-30

0000030125

isif:CybersecurityAndOperationalRiskMember

2023-04-01

2023-09-30

0000030125

isif:DerivativesRiskMember

2023-04-01

2023-09-30

0000030125

isif:EconomicAndMarketEventsRiskMember

2023-04-01

2023-09-30

0000030125

isif:ETFAndOtherInvestmentCompanyRiskMember

2023-04-01

2023-09-30

0000030125

isif:ForeignInvestmentRiskMember

2023-04-01

2023-09-30

0000030125

isif:GovernmentSecuritiesRiskMember

2023-04-01

2023-09-30

0000030125

isif:HighYieldSecuritiesRiskMember

2023-04-01

2023-09-30

0000030125

isif:IssuerRiskMember

2023-04-01

2023-09-30

0000030125

isif:LeverageRiskMember

2023-04-01

2023-09-30

0000030125

isif:LiquidityRiskMember

2023-04-01

2023-09-30

0000030125

isif:ManagementRiskMember

2023-04-01

2023-09-30

0000030125

isif:MarketRiskMember

2023-04-01

2023-09-30

0000030125

isif:RiskOfMarketPriceDiscountFromNetAssetValueMember

2023-04-01

2023-09-30

0000030125

isif:ValuationRiskMember

2023-04-01

2023-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-02201

Insight Select Income Fund

(Exact name of registrant as specified in charter)

200 Park Avenue, 7th Floor

New York, NY 10166

(Address of principal executive offices) (Zip code)

Gautam Khanna

200 Park Avenue, 7th Floor

New York, NY 10166

(Name and address of agent for service)

Registrant’s telephone number, including area

code: 212-527-1800

Date of fiscal year end: March

31

Date of reporting period: September

30, 2023

Item 1. Reports to Stockholders.

| |

(a) |

The Report to Shareholders is attached herewith. |

Online:

Visit www.computershare.com/investor to log into your account and select

“Communication Preferences” to set your preference.

Telephone:

Contact the Fund at 866-333-6685

Overnight Mail:

Computershare Investor Services, 462 South 4th Street, Suite 1600, Louisville,

KY, 40202

Regular Mail:

Computershare Investor Services, PO Box 505000, Louisville, KY, 40233-5000

For the Six-Month Period Ended 09/30/23

November 2, 2023

DEAR SHAREHOLDERS:

The six-month reporting period ended September 30,

2023 was marked by moderated inflation and economic growth (albeit the former remained above target) and a resilient labor market. The

Federal Reserve (the “Fed”) continued to tighten monetary policy, although at a slower pace. The Fed also projected a “higher

for longer” interest rate trajectory. As such, bond yields rose by 110 basis points across the curve during the period, first at

the short end and then at the long end.

By tightening monetary policy, the Fed increased the

upper bound of the Fed Funds rate from 5.0% to 5.5%, with pauses at its June and September meetings. However, the Fed continues to deliver

a hawkish message by projecting an additional hike by the end of the calendar year. The Fed also moderated its projected path of rate

cuts over the coming years while ratcheting up its economic growth expectations. Toward the end of the reporting period, market expectations

for interest rates moved in line with the Fed’s projections as the market seemingly accepted “higher for longer” as

the dominant narrative.

The economy remained resilient. US GDP growth for Q1

2023 came in at 1.1%, but was revised up to 1.3%, then 2.0% and then 2.2%, Consumption, particularly services spending, notably came in

better than expected. The first estimate of Q2 2023 GDP reflected growth of 2.4%, although this was later revised down to 2.1%. Business

investment and consumption were responsible for most of the growth, albeit the latter was modestly revised down.

The Fed continued to make progress in bringing

inflation down towards target levels. Headline inflation improved from 5% year-on-year to as low as 3%, before rising to 3.2% and

ending the reporting period at 3.7%. This increase in inflation at the end of the period was mainly due to “base

effects” and rising energy prices. Core inflation has been a bit more consistent moving from 5.6% to 4.3%, indicating that

wider disinflationary forces are fundamentally still in play.

Labor market conditions remain tight. The unemployment

rate rose from 3.6% to 3.8%, but this was partly driven by an increase in the participation rate. Wage growth was largely stable but remains

elevated, beginning and ending the period at 4.3% year-on-year. Additionally, job growth has remained positive. Job openings eased to

reflect 1.5 jobs per unemployed worker, the lowest in almost two years.

Politics-wise, Congress faced the looming prospect

of a federal government shutdown at the end of September. This was due to a faction of Republicans in the House of Representatives objecting

against the required appropriations bills needed to keep the federal government funded. However, at the very end of the reporting period,

Congress passed a “continuing resolution” to fund the federal government for 45 days, extending capacity until mid-November

for a comprehensive agreement, although House Speaker Kevin McCarthy subsequently left his post, adding political uncertainty.

Concerns around the banking sector crisis from earlier

in the calendar year receded. However, there was some additional turmoil in May 2023 as First Republic Bank failed (becoming the second

largest bank failure since 2008 after Silicon Valley Bank’s failure in March 2023). The Federal Deposit Insurance Company put the

bank into receivership (enforcing losses on bondholders) and sold the bulk of its assets to J.P. Morgan. The banking sector seemed to

be less of a major concern for markets after this event.

In bond markets, Treasury securities suffered due to

rising bond yields. Credit markets fared better as credit spreads narrowed, particularly across lower-rated credits. From sector perspective,

industrials and financials outperformed

utilities. The Bloomberg US Corporate (IG Corporate)

and the Bloomberg US Corporate High Yield (HY Corporate) indices delivered 2.1% and 3.2% excess returns, above like duration government

bonds, respectively. Total returns were -3.4% and 2.21% over the period for IG Corporate and HY Corporate indices.

The Fund modestly added duration at the intermediate

part of the rate curve. We believed higher yields presented an attractive entry point as we believe we are near the end of the Fed’s

rate hiking cycle. The Fund did not make significant changes to its high-level sector allocation. On one hand, we continue to seek short-dated,

high income-generating investments with attractive valuations. On the other, we seek longer-maturity, higher quality issues to maintain

balance in the portfolio. Overall, credit exposure remains slightly below the Fund’s historical average. We modestly increased high

yield energy investments, specifically midstream. The Fund also maintained a steady allocation to asset-backed securities. Our exposure

to commercial mortgage-backed securities remains very small. The Fund maintains what we view as adequate portfolio liquidity to capitalize

on idiosyncratic opportunities that may present themselves amid bouts of market volatility or market dislocation. We therefore avoid the

temptation of securing higher current yields from illiquid assets. We want to own assets with good visibility regarding credit worthiness,

stability of balance sheets, and overall staying power. We continue to focus on the parts of the credit curve we believe provide the best

tradeoff between risk and reward, amid ongoing volatility in the interest rate environment. Balance remains paramount as there are risks

on both sides of any forecast. During the reporting period, The Fund’s performance was a function of navigating a difficult rate

environment. We positioned the Fund to effectively target durable and high-quality sources of predictable income (particularly given higher

interest rates and credit spreads).

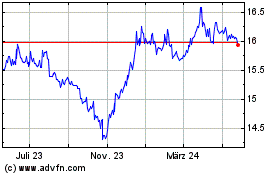

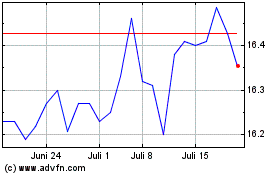

As of September 30, 2023, the Fund had a net asset

value (NAV) of $16.69 per share. This represents a 4.74% decrease from $17.52 per share on March 31, 2023. On September 30, 2023, the

Fund’s closing price on the New York Stock Exchange was $15.03 per share, representing a 9.95% discount to NAV per share, compared

with an 9.36% discount as of March 31, 2023. One of the primary objectives of the Fund is to maintain a high level of income. On September

26,2023, the Board of Trustees declared a distribution payment of $0.20 per share payable on October 25, 2023 to the shareholders of record

on October 13, 2023. On an annualized basis, including the pending dividend, the annual dividend payment from ordinary income equates

to a total of $0.76 per share, representing a 5.19% dividend yield based on the market price on November 2, 2023 of $14.63 per share.

The dividend is evaluated on a quarterly basis and is based on the income generation capability of the portfolio and is not guaranteed

for any period of time.

Yield represents the major component of return in most

fixed income portfolios. Given the Fund’s emphasis on income and the dividend, we generally will not have material exposure to low-yielding

US Treasuries and will maintain meaningful exposure to corporate bonds. When it comes to management of credit risk, we try to look through

periods of volatility to focus on an investment’s long-term creditworthiness to assess whether it will provide an attractive yield

to the Fund over time.

The Fund’s performance will continue

to be subject to trends in long-term interest rates and to corporate yield spreads. Consistent with our investment discipline, we continue

to emphasize diversification and risk management within the bounds of income stability. The pie chart below summarizes the portfolio quality

of the Fund’s assets as of September 30, 2023:

Percent of Total Investment (Lower of S&P and Moody’s

Ratings)1

| 1 | For financial reporting purposes,

credit quality ratings shown above reflect the lowest rating assigned by either Standard & Poor’s (“S&P”) or

Moody’s Investors Service (“Moody’s”) if ratings differ. These rating agencies are independent, nationally recognized

statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment

grade ratings are credit ratings of BB/Ba or lower. Investments designated NR are not rated by either rating agency. Unrated investments

do not necessarily indicate low credit quality. Credit quality ratings and the Fund’s allocation to the ratings categories are subject

to change at any time without notice. The pie chart above does not include the Fund’s derivative instruments. |

We would like to remind shareholders of the

opportunities presented by the Fund’s dividend reinvestment plan referred to in the Shareholder Information section of this report.

The dividend reinvestment plan affords shareholders a price advantage by allowing them to purchase additional shares at NAV or market

price, whichever is lower. This means that the reinvestment price is at market price when the Fund is trading at a discount to NAV, as

is currently the situation, or at NAV per share when market trading is at a premium to that value. To participate in the plan, please

contact Computershare Investor Services, the Fund’s Transfer Agent and Dividend Paying Agent, at 1-866-333-6685. The Fund’s

investment adviser, Insight North America LLC, may be reached at 1-212-527-1800.

Gautam Khanna

President

Mr. Khanna’s comments reflect the investment

adviser’s views generally regarding the market and the economy and are compiled from the investment adviser’s research. These

comments reflect opinions as of the date written and are subject to change at any time.

Opinions expressed herein are current opinions of Insight

and are subject to change without notice. Insight assumes no responsibility to update such information or to notify a client of any changes.

Any outlooks, forecasts or portfolio weightings presented herein are as of the date appearing on this material only and are also subject

to change without notice. Insight disclaims any responsibility to update such views. No forecasts can be guaranteed.

Information herein may contain, include or is based

upon forward-looking statements within the meaning of the federal securities laws, specifically Section 21E of the Securities Exchange

Act of 1934, as amended. Forward-looking statements include all statements, other than statements of historical fact, that address future

activities, events or developments, including without limitation, business or investment strategy or measures to implement strategy, competitive

strengths, goals expansion and growth of our business, plans, prospects and references to future or success. You can identify these statements

by the fact that they do not relate strictly to historical or current facts. Words such as ‘anticipate,’ ‘estimate,’

‘expect,’ ‘project,’ ‘intend,’ ‘plan,’ ‘believe,’ and other similar words

are intended to identify these forward-looking statements. Forward-looking statements can be affected by inaccurate assumptions or by

known or unknown risks and uncertainties. Many such factors will be important in determining our actual future results or outcomes. Consequently,

no forward-looking statement can be guaranteed. Our actual results or outcomes may vary materially. Given these uncertainties, you should

not place undue reliance on these forward-looking statements.

Past performance is not a guide to future performance, which will vary.

The value of investments and any income from them will

fluctuate and is not guaranteed (this may partly be due to exchange rate changes). Future returns are not guaranteed and a loss of principal

may occur.

The quoted benchmarks within this presentation do not

reflect deductions for fees, expenses or taxes. These benchmarks are unmanaged and cannot be purchased directly by investors. Benchmark

performance is shown for illustrative purposes only and does not predict or depict the performance of any investment. There may be material

factors relevant to any such comparison such as differences in volatility, and regulatory and legal restrictions between the indices shown

and the strategy.

INVESTMENT RESULTS

Total Return-Percentage Change (Annualized for periods longer

than 1 year)

Per Share with All Distributions Reinvested1

| |

6 Months to 9/30/23 |

|

1 Year to 9/30/23 |

|

3 Years to 9/30/23 |

|

5 Years to 9/30/23 |

|

10 Years to 9/30/23 |

| Insight Select Income Fund (Based on Net Asset Value) |

-2.45% |

|

4.14% |

|

-3.42% |

|

1.54% |

|

3.25% |

| Insight Select Income Fund (Based on Market Value) |

-3.09% |

|

1.72% |

|

-4.26% |

|

1.07% |

|

3.58% |

| Bloomberg U.S. Credit Index2 |

-3.31% |

|

3.47% |

|

-4.83% |

|

0.86% |

|

2.12% |

| 1 − |

Total investment return based on net asset value includes management fees and all other expenses paid by the Fund. Total investment

return based on market value is calculated assuming a purchase of common shares at the market price on the first day and a sale at the

market price on the last day of the period reported. Dividends and distributions, if any, are assumed for purposes of this the calculations

to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage

commissions. The total investment return, if for less than a full year, is not annualized. Past performance is not a guarantee of future

results. |

| 2 − |

Source: Bloomberg as of September 30, 2023. Comprised primarily of US investment grade corporate bonds (Fund’s Benchmark). |

| SCHEDULE OF INVESTMENTS (Unaudited) |

|

|

September 30, 2023 |

| | |

Moody’s/ Standard & Poor’s Rating(a) | |

Principal

Amount (000’s) | |

Value

(Note1) |

| CORPORATE DEBT SECURITIES (81.25%) | |

| |

| | | |

| | |

| AEROSPACE/DEFENSE (1.98%) | |

| |

| | | |

| | |

| Boeing Co., Sr. Unsec. Notes, 4.875%, 05/01/25(b) | |

Baa2/BBB- | |

$ | 1,657 | | |

$ | 1,628,662 | |

| Boeing Co., Sr. Unsec. Notes, 5.805%, 05/01/50(b) | |

Baa2/BBB- | |

| 463 | | |

| 422,008 | |

| Northrop Grumman Corp., Sr. Unsec. Notes, 7.750%, 06/01/29 | |

Baa1/BBB+ | |

| 500 | | |

| 542,998 | |

| Rolls-Royce PLC, Co. Gty., 5.750%, 10/15/27, 144A(b) | |

Ba2/BB | |

| 369 | | |

| 356,104 | |

| RTX Corp., Sr. Unsec. Notes, 3.750%, 11/01/46(b) | |

Baa1/BBB+ | |

| 700 | | |

| 495,320 | |

| TransDigm, Inc., Sr. Sec. Notes, 6.750%, 08/15/28, 144A(b) | |

Ba3/B+ | |

| 90 | | |

| 88,609 | |

| | |

| |

| | | |

| 3,533,701 | |

| AGRICULTURE (0.88%) | |

| |

| | | |

| | |

| Altria Group, Inc., Co. Gty., 4.800%, 02/14/29(b) | |

A3/BBB | |

| 97 | | |

| 92,302 | |

| Altria Group, Inc., Co. Gty., 5.950%, 02/14/49(b) | |

A3/BBB | |

| 329 | | |

| 295,236 | |

| BAT Capital Corp., Co. Gty., 6.343%, 08/02/30(b) | |

Baa2/BBB+ | |

| 197 | | |

| 194,068 | |

| BAT Capital Corp., Co. Gty., 7.081%, 08/02/53(b) | |

Baa2/BBB+ | |

| 70 | | |

| 65,967 | |

| BAT International Finance PLC, Co. Gty., 1.668%, 03/25/26(b) | |

Baa2/BBB+ | |

| 425 | | |

| 382,945 | |

| Philip Morris International, Inc., Sr. Unsec. Notes, 5.625%, 11/17/29(b) | |

A2/A- | |

| 90 | | |

| 89,063 | |

| Philip Morris International, Inc., Sr. Unsec. Notes, 2.100%, 05/01/30(b) | |

A2/A- | |

| 580 | | |

| 462,990 | |

| | |

| |

| | | |

| 1,582,571 | |

| AIRLINES (3.60%) | |

| |

| | | |

| | |

| Air Canada, Sr. Sec. Notes, 3.875%, 08/15/26, 144A(b) | |

Ba2/BB- | |

| 246 | | |

| 223,274 | |

| Air Canada Pass Through Certs., Series 2020-2, Class A, 5.250%, 04/01/29, 144A | |

NA/A | |

| 191 | | |

| 183,978 | |

| American Airlines Group, Inc. Pass Through Certs., Series

2017-1, Class AA, 3.650%, 02/15/29 | |

A3/NA | |

| 756 | | |

| 684,933 | |

| American Airlines Group, Inc. Pass Through Certs., Series

2017-2, Class AA, 3.350%, 10/15/29 | |

A3/NA | |

| 1,158 | | |

| 1,030,864 | |

| American Airlines Group, Inc. Pass Through Certs., Series

2019-1, Class AA, 3.150%, 02/15/32 | |

A3/AA- | |

| 660 | | |

| 564,850 | |

| American Airlines, Inc., Sr. Sec. Notes, 5.500%, 04/20/26, 144A | |

Ba1/NA | |

| 325 | | |

| 316,934 | |

| American Airlines, Inc., Sr. Sec. Notes, 5.750%, 04/20/29, 144A | |

Ba1/NA | |

| 162 | | |

| 150,552 | |

| British Airways PLC Pass Through Certs., Series 2020-1, Class A, 4.250%, 11/15/32, 144A | |

NA/A | |

| 101 | | |

| 90,888 | |

| Delta Air Lines, Inc., Sr. Sec. Notes, 4.500%, 10/20/25, 144A | |

Baa1/NA | |

| 90 | | |

| 87,424 | |

| Delta Air Lines, Inc., Sr. Sec. Notes, 4.750%, 10/20/28, 144A | |

Baa1/NA | |

| 209 | | |

| 198,652 | |

| JetBlue Airways Corp. Pass Through Certs., Series 2020-1, Class A, 4.000%, 11/15/32 | |

A2/NA | |

| 898 | | |

| 808,517 | |

| United Airlines, Inc., Sr. Sec. Notes, 4.375%, 04/15/26, 144A(b) | |

Ba1/BB | |

| 65 | | |

| 60,106 | |

| United Airlines, Inc., Sr. Sec. Notes, 4.625%, 04/15/29, 144A(b) | |

Ba1/BB | |

| 318 | | |

| 274,325 | |

| United Airlines, Inc. Pass Through Certs., Series 2018-1, Class B, 4.600%, 03/01/26 | |

Baa3/NA | |

| 484 | | |

| 456,438 | |

| United Airlines, Inc. Pass Through Certs., Series 2019-1, Class AA, 4.150%, 08/25/31 | |

A2/NA | |

| 342 | | |

| 310,354 | |

| United Airlines, Inc. Pass Through Certs., Series 2019-2, Class AA, 2.700%, 05/01/32 | |

A2/NA | |

| 939 | | |

| 774,601 | |

| United Airlines, Inc. Pass Through Certs., Series 2020-1, Class A, 5.875%, 10/15/27 | |

A3/A+ | |

| 217 | | |

| 215,307 | |

| | |

| |

| | | |

| 6,431,997 | |

| AUTO MANUFACTURERS (2.32%) | |

| |

| | | |

| | |

| Ford Holdings LLC, Co. Gty., 9.300%, 03/01/30 | |

Ba1/BB+ | |

| 1,000 | | |

| 1,086,790 | |

| Ford Motor Credit Co. LLC, Sr. Unsec. Notes, 3.370%, 11/17/23 | |

Ba1/BB+ | |

| 500 | | |

| 497,139 | |

| Ford Motor Credit Co. LLC, Sr. Unsec. Notes, 2.300%, 02/10/25(b) | |

Ba1/BB+ | |

| 1,199 | | |

| 1,122,927 | |

| General Motors Co., Sr. Unsec. Notes, 6.800%, 10/01/27(b) | |

Baa2/BBB | |

| 405 | | |

| 413,387 | |

| General Motors Financial Co., Inc., Sr. Unsec. Notes, 3.600%, 06/21/30(b) | |

Baa2/BBB | |

| 1,027 | | |

| 859,739 | |

| Stellantis Finance US, Inc., Co. Gty., 2.691%, 09/15/31, 144A(b) | |

Baa2/BBB | |

| 221 | | |

| 170,354 | |

| | |

| |

| | | |

| 4,150,336 | |

| BANKS (12.94%) | |

| |

| | | |

| | |

| AIB Group PLC, Sr. Unsec. Notes, (3M LIBOR + 1.874%), 4.263%, 04/10/25, 144A(b),(c) | |

A3/BBB | |

| 582 | | |

| 573,730 | |

| Banco Santander SA, Sr. Unsec. Notes, 5.588%, 08/08/28 | |

A2/A+ | |

| 600 | | |

| 587,043 | |

| Bank of America Corp., Sr. Unsec. Notes, (SOFRRATE + 1.330%), 2.972%, 02/04/33(b),(c) | |

A1/A- | |

| 2,655 | | |

| 2,094,321 | |

| Citigroup, Inc., Jr. Sub. Notes, (H15T5Y + 3.597%), 4.000%, 12/10/25(b),(c),(d) | |

Ba1/BB+ | |

| 635 | | |

| 555,244 | |

| Citigroup, Inc., Sr. Unsec. Notes, 8.125%, 07/15/39 | |

A3/BBB+ | |

| 70 | | |

| 82,248 | |

| Citigroup, Inc., Sr. Unsec. Notes, (TSFR3M + 1.600%), 3.980%, 03/20/30(b),(c) | |

A3/BBB+ | |

| 500 | | |

| 449,118 | |

The accompanying notes are an integral part of these financial

statements.

SCHEDULE OF INVESTMENTS (Unaudited) — continued

| | |

Moody’s/ Standard & Poor’s Rating(a) | |

Principal Amount (000’s) | |

Value

(Note1) |

| CORPORATE DEBT SECURITIES (Continued) | |

| |

| | | |

| | |

| BANKS (Continued) | |

| |

| | | |

| | |

| Citigroup, Inc., Sr. Unsec. Notes, (TSFR3M + 1.825%), 3.887%, 01/10/28(b),(c) | |

A3/BBB+ | |

$ | 2,402 | | |

$ | 2,239,282 | |

| Citigroup, Inc., Sub. Notes, 4.600%, 03/09/26 | |

Baa2/BBB | |

| 988 | | |

| 953,964 | |

| Citigroup, Inc., Sub. Notes, 5.300%, 05/06/44 | |

Baa2/BBB | |

| 926 | | |

| 790,350 | |

| Citizens Bank NA, Sr. Unsec. Notes, (SOFRRATE + 1.450%), 6.064%, 10/24/25(b),(c) | |

Baa1/A- | |

| 500 | | |

| 482,436 | |

| Credit

Agricole SA, Sub. Notes, (USD 5 yr. Swap Semi 30/360 US + 1.644%), 4.000%, 01/10/33, 144A(b),(c) | |

Baa1/BBB+ | |

| 1,025 | | |

| 908,565 | |

| Credit Suisse AG, Sr. Unsec. Notes, (SOFRINDX + 1.260%), 6.603%, 02/21/25(e) | |

A3+/A+ | |

| 1,250 | | |

| 1,249,333 | |

| Goldman

Sachs Group, Inc., Sr. Unsec. Notes, (SOFRRATE + 1.725%), 4.482%, 08/23/28(b),(c) | |

A2/BBB+ | |

| 703 | | |

| 665,501 | |

| Goldman Sachs Group, Inc., Sr. Unsec. Notes, (TSFR3M + 2.012%), 7.377%, 10/28/27(b),(e) | |

A2/BBB+ | |

| 550 | | |

| 563,894 | |

| HSBC

Capital Funding Dollar 1 LP, Co. Gty., (3M LIBOR + 4.980%), 10.176%, 06/30/30, 144A(b),(c),(d) | |

Baa3/BB+ | |

| 2,180 | | |

| 2,657,257 | |

| ING Groep NV, Sr. Unsec. Notes, (SOFRRATE + 1.640%), 3.869%, 03/28/26(b),(c) | |

Baa1/A- | |

| 782 | | |

| 754,735 | |

| JPMorgan Chase & Co., Sr. Unsec. Notes, (SOFRRATE + 1.845%), 5.350%, 06/01/34(b),(c) | |

A1/A- | |

| 400 | | |

| 379,661 | |

| Morgan Stanley, Sub. Notes, 4.350%, 09/08/26 | |

Baa1/BBB+ | |

| 1,500 | | |

| 1,432,623 | |

| PNC

Financial Services Group, Inc., Jr. Sub. Notes, (TSFR3M + 3.562%), 5.000%,

11/01/26(b),(c),(d) | |

Baa2/BBB- | |

| 757 | | |

| 653,955 | |

| Santander

Holdings USA, Inc., Sr. Unsec. Notes, (SOFRRATE + 2.356%), 6.499%, 03/09/29(b),(c) | |

Baa3/BBB+ | |

| 134 | | |

| 130,790 | |

| Synchrony Bank, Sr. Unsec. Notes, 5.400%, 08/22/25(b) | |

NA/BBB | |

| 305 | | |

| 294,016 | |

| Toronto-Dominion Bank, Sr. Unsec. Notes, 5.532%, 07/17/26 | |

A1/A | |

| 644 | | |

| 639,553 | |

| Truist Financial Corp., Jr. Sub. Notes, (H15T5Y + 3.003%), 4.800%, 09/01/24(b),(c),(d) | |

Baa2-/BBB- | |

| 1,136 | | |

| 965,458 | |

| Truist Financial Corp., Sr. Unsec. Notes, (SOFRRATE + 2.361%), 5.867%, 06/08/34(b),(c) | |

A3-/A- | |

| 111 | | |

| 104,837 | |

| UBS Group AG, Sr. Unsec. Notes, (SOFRRATE + 1.560%), 2.593%, 09/11/25, 144A(b),(c) | |

A3/A- | |

| 1,242 | | |

| 1,195,452 | |

| US Bancorp, Sr. Unsec. Notes, (SOFRRATE + 2.260%), 5.836%, 06/12/34(b),(c) | |

A3-/A | |

| 161 | | |

| 152,405 | |

| Wells Fargo & Co., Jr. Sub. Notes, (H15T5Y + 3.453%), 3.900%, 03/15/26(b),(c),(d) | |

Baa2/BB+ | |

| 1,162 | | |

| 1,014,863 | |

| Westpac Banking Corp., Sub. Notes, (H15T5Y + 1.750%), 2.668%, 11/15/35(b),(c) | |

Baa1/BBB+ | |

| 753 | | |

| 564,285 | |

| | |

| |

| | | |

| 23,134,919 | |

| BEVERAGES (0.57%) | |

| |

| | | |

| | |

| Anheuser-Busch Cos. LLC, Co. Gty., 4.700%, 02/01/36(b) | |

A3/A- | |

| 645 | | |

| 591,346 | |

| Anheuser-Busch Cos. LLC, Co. Gty., 4.900%, 02/01/46(b) | |

A3/A- | |

| 446 | | |

| 392,972 | |

| Anheuser-Busch InBev Worldwide, Inc., Co. Gty., 8.200%, 01/15/39 | |

A3/A- | |

| 27 | | |

| 32,990 | |

| | |

| |

| | | |

| 1,017,308 | |

| BIOTECHNOLOGY (0.73%) | |

| |

| | | |

| | |

| Amgen, Inc., Sr. Unsec. Notes, 5.250%, 03/02/30(b) | |

Baa1/BBB+ | |

| 106 | | |

| 103,574 | |

| Amgen, Inc., Sr. Unsec. Notes, 5.650%, 03/02/53(b) | |

Baa1/BBB+ | |

| 255 | | |

| 238,111 | |

| Royalty Pharma PLC, Co. Gty., 2.200%, 09/02/30(b) | |

Baa3/BBB- | |

| 930 | | |

| 722,199 | |

| Royalty Pharma PLC, Co. Gty., 2.150%, 09/02/31(b) | |

Baa3/BBB- | |

| 326 | | |

| 244,018 | |

| | |

| |

| | | |

| 1,307,902 | |

| BUILDING MATERIALS (0.31%) | |

| |

| | | |

| | |

| Masonite International Corp., Co. Gty., 3.500%, 02/15/30, 144A(b) | |

Ba2/BB+ | |

| 53 | | |

| 43,064 | |

| Smyrna Ready Mix Concrete LLC, Sr. Sec. Notes, 6.000%, 11/01/28, 144A(b) | |

Ba3/BB- | |

| 548 | | |

| 506,045 | |

| | |

| |

| | | |

| 549,109 | |

| CHEMICALS (2.74%) | |

| |

| | | |

| | |

| Alpek SAB de CV, Co. Gty., 3.250%, 02/25/31, 144A(b) | |

Baa3/BBB- | |

| 418 | | |

| 328,121 | |

| Braskem Idesa SAPI, Sr. Sec. Notes, 7.450%, 11/15/29, 144A(b) | |

NA/B | |

| 273 | | |

| 170,102 | |

| Braskem Idesa SAPI, Sr. Sec. Notes, 6.990%, 02/20/32, 144A(b) | |

NA/B | |

| 528 | | |

| 317,456 | |

| Braskem Netherlands Finance BV, Co. Gty., 4.500%, 01/31/30, 144A | |

NA/BBB- | |

| 735 | | |

| 599,096 | |

| Braskem Netherlands Finance BV, Co. Gty., 5.875%, 01/31/50, 144A | |

NA/BBB- | |

| 245 | | |

| 176,520 | |

| Celanese US Holdings LLC, Co. Gty., 6.165%, 07/15/27(b) | |

Baa3/BBB- | |

| 787 | | |

| 776,127 | |

| Orbia Advance Corp. SAB de CV, Co. Gty., 2.875%, 05/11/31, 144A(b) | |

Baa3/BBB- | |

| 371 | | |

| 288,765 | |

| Union Carbide Corp., Sr. Unsec. Notes, 7.750%, 10/01/96 | |

Baa1/BBB | |

| 2,000 | | |

| 2,241,176 | |

| | |

| |

| | | |

| 4,897,363 | |

The accompanying notes are an integral part of these financial

statements.

SCHEDULE OF INVESTMENTS (Unaudited) — continued

| | |

Moody’s/ Standard & Poor’s Rating(a) | |

Principal Amount (000’s) | |

Value

(Note1) |

| CORPORATE DEBT SECURITIES (Continued) | |

| |

| | | |

| | |

| COMMERCIAL SERVICES (2.66%) | |

| |

| | | |

| | |

| Adani Ports & Special Economic Zone, Ltd., Sr. Unsec. Notes, 3.375%, 07/24/24, 144A | |

Baa3/BBB- | |

$ | 1,061 | | |

$ | 1,028,123 | |

| Ashtead Capital, Inc., Co. Gty., 4.000%, 05/01/28, 144A(b) | |

Baa3/BBB- | |

| 555 | | |

| 504,670 | |

| Ashtead Capital, Inc., Co. Gty., 4.250%, 11/01/29, 144A(b) | |

Baa3/BBB- | |

| 200 | | |

| 177,159 | |

| ERAC USA Finance LLC, Co. Gty., 7.000%, 10/15/37, 144A | |

Baa1/A- | |

| 1,500 | | |

| 1,624,341 | |

| Global Payments, Inc., Sr. Unsec. Notes, 3.200%, 08/15/29(b) | |

Baa3/BBB- | |

| 650 | | |

| 552,815 | |

| Global Payments, Inc., Sr. Unsec. Notes, 5.400%, 08/15/32(b) | |

Baa3/BBB- | |

| 274 | | |

| 256,900 | |

| Prime Security Services Borrower LLC, Sr. Sec. Notes, 3.375%, 08/31/27, 144A(b) | |

Ba3+/BB | |

| 559 | | |

| 489,681 | |

| Triton Container International, Ltd., Co. Gty., 3.150%, 06/15/31, 144A(b) | |

NA/BBB | |

| 167 | | |

| 125,928 | |

| | |

| |

| | | |

| 4,759,617 | |

| COMPUTERS (0.67%) | |

| |

| | | |

| | |

| Dell International LLC, Co. Gty., 3.450%, 12/15/51, 144A(b) | |

Baa2/BBB | |

| 529 | | |

| 329,225 | |

| Dell International LLC, Sr. Unsec. Notes, 5.850%, 07/15/25(b) | |

Baa2/BBB | |

| 342 | | |

| 341,572 | |

| Dell International LLC, Sr. Unsec. Notes, 8.350%, 07/15/46(b) | |

Baa2/BBB | |

| 209 | | |

| 244,144 | |

| Kyndryl Holdings, Inc., Sr. Unsec. Notes, 2.050%, 10/15/26(b) | |

Baa2/BBB- | |

| 326 | | |

| 284,764 | |

| | |

| |

| | | |

| 1,199,705 | |

| DIVERSIFIED FINANCIAL SERVICES (1.69%) | |

| |

| | | |

| | |

| AerCap Ireland Capital DAC, Co. Gty., 3.300%, 01/30/32(b) | |

Baa2/BBB | |

| 1,122 | | |

| 892,016 | |

| Discover Financial Services, Sr. Unsec. Notes, 6.700%, 11/29/32(b) | |

Baa2/BBB- | |

| 690 | | |

| 667,131 | |

| LSEGA Financing PLC, Co. Gty., 1.375%, 04/06/26, 144A(b) | |

A3/A | |

| 612 | | |

| 548,103 | |

| LSEGA Financing PLC, Co. Gty., 2.500%, 04/06/31, 144A(b) | |

A3/A | |

| 264 | | |

| 212,149 | |

| Nasdaq, Inc., Sr. Unsec. Notes, 5.350%, 06/28/28(b) | |

Baa2/BBB | |

| 147 | | |

| 144,334 | |

| Nasdaq, Inc., Sr. Unsec. Notes, 5.950%, 08/15/53(b) | |

Baa2/BBB | |

| 38 | | |

| 35,563 | |

| Synchrony Financial, Sr. Unsec. Notes, 2.875%, 10/28/31(b) | |

NA/BBB- | |

| 747 | | |

| 529,346 | |

| | |

| |

| | | |

| 3,028,642 | |

| ELECTRIC (7.26%) | |

| |

| | | |

| | |

| AES Andes SA, Jr. Sub. Notes, (H15T5Y + 4.917%), 6.350%, 10/07/79, 144A(b),(c) | |

Ba2/BB | |

| 878 | | |

| 825,169 | |

| AES Panama Generation Holdings Srl, Sr. Sec. Notes, 4.375%, 05/31/30, 144A(b) | |

Baa3/NA | |

| 544 | | |

| 463,536 | |

| American Electric Power Co., Inc., Jr. Sub. Notes, 2.031%, 03/15/24 | |

Baa3/BBB+ | |

| 1,952 | | |

| 1,915,450 | |

| Berkshire Hathaway Energy Co., Sr. Unsec. Notes, 2.850%, 05/15/51(b) | |

A3/A- | |

| 1,000 | | |

| 576,113 | |

| Black Hills Corp., Sr. Unsec. Notes, 3.875%, 10/15/49(b) | |

Baa2/BBB+ | |

| 1,175 | | |

| 785,376 | |

| CenterPoint Energy Houston Electric LLC, 5.300%, 04/01/53(b) | |

A2/A | |

| 53 | | |

| 49,539 | |

| CMS Energy Corp., Jr. Sub. Notes, (H15T5Y + 2.900%), 3.750%, 12/01/50(b),(c) | |

Baa3/BBB- | |

| 238 | | |

| 178,750 | |

| Consorcio Transmantaro SA, Sr. Unsec. Notes, 4.700%, 04/16/34, 144A | |

Baa3/NA | |

| 200 | | |

| 178,188 | |

| Duke Energy Corp., Sr. Unsec. Notes, 5.000%, 08/15/52(b) | |

Baa2/BBB | |

| 745 | | |

| 619,453 | |

| Edison International, Jr. Sub. Notes, (H15T5Y + 4.698%), 5.375%, 03/15/26(b),(c),(d) | |

Ba1/BB+ | |

| 638 | | |

| 562,854 | |

| EDP Finance BV, Co. Gty., 6.300%, 10/11/27, 144A | |

Baa2/BBB | |

| 200 | | |

| 202,652 | |

| Electricite

de France SA, Jr. Sub. Notes, (H15T5Y + 5.411%), 9.125%, 03/15/33, 144A(b),(c),(d) | |

Ba2/B+ | |

| 200 | | |

| 208,347 | |

| Enel Finance America LLC, Co. Gty., 7.100%, 10/14/27, 144A(b) | |

Baa1/BBB+ | |

| 200 | | |

| 207,001 | |

| Enel Finance International NV, Co. Gty., 7.500%, 10/14/32, 144A(b) | |

Baa1/BBB+ | |

| 200 | | |

| 213,545 | |

| Evergy Metro, Inc., Sr. Sec. Notes, 4.200%, 06/15/47(b) | |

A2/A+ | |

| 917 | | |

| 693,759 | |

| Hydro-Quebec, 8.250%, 04/15/26 | |

Aa2/AA- | |

| 1,550 | | |

| 1,654,207 | |

| Indiana Michigan Power Co., Sr. Unsec. Notes, 5.625%, 04/01/53(b) | |

A3/A- | |

| 38 | | |

| 35,821 | |

| IPALCO Enterprises, Inc., Sr. Sec. Notes, 4.250%, 05/01/30(b) | |

Baa3/BBB- | |

| 462 | | |

| 404,974 | |

| Jersey Central Power & Light Co., Sr. Unsec. Notes, 2.750%, 03/01/32, 144A(b) | |

A3/BBB | |

| 323 | | |

| 253,033 | |

| MidAmerican Funding LLC, Sr. Sec. Notes, 6.927%, 03/01/29 | |

A2/A- | |

| 500 | | |

| 527,571 | |

| New England Power Co., Sr. Unsec. Notes, 5.936%, 11/25/52, 144A(b) | |

A3/BBB+ | |

| 356 | | |

| 337,177 | |

| Pacific Gas and Electric Co., 2.100%, 08/01/27(b) | |

Baa3/BBB- | |

| 391 | | |

| 334,398 | |

| Pacific Gas and Electric Co., 3.500%, 08/01/50(b) | |

Baa3/BBB- | |

| 617 | | |

| 367,269 | |

| Puget Energy, Inc., Sr. Sec. Notes, 2.379%, 06/15/28(b) | |

Baa3/BBB- | |

| 247 | | |

| 211,319 | |

| Transelec SA, Sr. Unsec. Notes, 4.250%, 01/14/25, 144A(b) | |

Baa1/BBB | |

| 750 | | |

| 728,123 | |

| Transelec SA, Sr. Unsec. Notes, 3.875%, 01/12/29, 144A(b) | |

Baa1/BBB | |

| 490 | | |

| 446,904 | |

| | |

| |

| | | |

| 12,980,528 | |

The accompanying notes are an integral part of these financial

statements.

SCHEDULE OF INVESTMENTS (Unaudited) — continued

| | |

Moody’s/ Standard & Poor’s Rating(a) | |

Principal Amount (000’s) | |

Value

(Note1) |

| CORPORATE DEBT SECURITIES (Continued) | |

| |

| | | |

| | |

| ENGINEERING & CONSTRUCTION (0.21%) | |

| |

| | | |

| | |

| Sydney Airport Finance Co. Pty, Ltd., Sr. Sec. Notes, 3.375%, 04/30/25, 144A(b) | |

Baa1/BBB+ | |

$ | 400 | | |

$ | 383,939 | |

| ENTERTAINMENT (0.44%) | |

| |

| | | |

| | |

| Caesars Entertainment, Inc., Sr. Sec. Notes, 7.000%, 02/15/30, 144A(b) | |

Ba3/B+ | |

| 178 | | |

| 173,196 | |

| Caesars Entertainment, Inc., Sr. Unsec. Notes, 8.125%, 07/01/27, 144A(b) | |

B3/B- | |

| 188 | | |

| 188,907 | |

| Warnermedia Holdings, Inc., Co. Gty., 3.638%, 03/15/25 | |

Baa3/BBB- | |

| 441 | | |

| 425,363 | |

| | |

| |

| | | |

| 787,466 | |

| FOOD (1.06%) | |

| |

| | | |

| | |

| Bimbo Bakeries USA, Inc., Co. Gty., 4.000%, 05/17/51, 144A(b) | |

Baa1/BBB+ | |

| 363 | | |

| 256,667 | |

| JBS USA LUX SA, Co. Gty., 3.625%, 01/15/32(b) | |

Baa3/BBB- | |

| 211 | | |

| 167,938 | |

| Kraft Heinz Foods Co., Co. Gty., 5.500%, 06/01/50(b) | |

Baa2/BBB | |

| 346 | | |

| 315,454 | |

| Kroger Co., Sr. Unsec. Notes, 5.400%, 01/15/49(b) | |

Baa1/BBB | |

| 68 | | |

| 60,679 | |

| MARB BondCo PLC, Co. Gty., 3.950%, 01/29/31, 144A(b) | |

NA/BB+ | |

| 213 | | |

| 157,930 | |

| NBM US Holdings, Inc., Co. Gty., 7.000%, 05/14/26, 144A(b) | |

NA/BB+ | |

| 885 | | |

| 877,670 | |

| US Foods, Inc., Co. Gty., 7.250%, 01/15/32, 144A(b) | |

B2/BB- | |

| 67 | | |

| 66,932 | |

| | |

| |

| | | |

| 1,903,270 | |

| FOREST PRODUCTS & PAPER (0.16%) | |

| |

| | | |

| | |

| Suzano Austria GmbH, Co. Gty., 3.750%, 01/15/31(b) | |

NA/BBB- | |

| 351 | | |

| 288,240 | |

| GAS (1.91%) | |

| |

| | | |

| | |

| NiSource, Inc., Sr. Unsec. Notes, 5.250%, 03/30/28(b) | |

Baa2/BBB+ | |

| 51 | | |

| 49,969 | |

| NiSource, Inc., Sr. Unsec. Notes, 5.400%, 06/30/33(b) | |

Baa2/BBB+ | |

| 191 | | |

| 183,130 | |

| Piedmont Natural Gas Co., Inc., Sr. Unsec. Notes, 3.500%, 06/01/29(b) | |

A3/BBB+ | |

| 1,120 | | |

| 992,679 | |

| Southern Co. Gas Capital Corp., Co. Gty., 5.875%, 03/15/41(b) | |

Baa1/BBB+ | |

| 992 | | |

| 928,901 | |

| Southern Co. Gas Capital Corp., Co. Gty., 3.950%, 10/01/46(b) | |

Baa1/BBB+ | |

| 539 | | |

| 375,926 | |

| Southern Co. Gas Capital Corp., Co. Gty., 4.400%, 05/30/47(b) | |

Baa1/BBB+ | |

| 1,164 | | |

| 879,616 | |

| | |

| |

| | | |

| 3,410,221 | |

| HEALTHCARE-PRODUCTS (0.15%) | |

| |

| | | |

| | |

| STERIS Irish FinCo UnLtd Co., Co. Gty., 2.700%, 03/15/31(b) | |

Baa2/BBB | |

| 329 | | |

| 266,879 | |

| HEALTHCARE-SERVICES (0.37%) | |

| |

| | | |

| | |

| CommonSpirit Health, Sr. Sec. Notes, 2.782%, 10/01/30(b) | |

Baa1/A- | |

| 432 | | |

| 355,225 | |

| HCA, Inc., Co. Gty., 3.125%, 03/15/27(b) | |

Baa3/BBB- | |

| 119 | | |

| 108,103 | |

| Tenet Healthcare Corp., Sr. Sec. Notes, 4.875%, 01/01/26(b) | |

B1/BB- | |

| 201 | | |

| 192,563 | |

| | |

| |

| | | |

| 655,891 | |

| INSURANCE (7.20%) | |

| |

| | | |

| | |

| Allianz SE, Jr. Sub. Notes, (H15T5Y + 2.165%), 3.200%, 10/30/27, 144A(b),(c),(d) | |

A3/A | |

| 200 | | |

| 142,061 | |

| Allianz SE, Jr. Sub. Notes, (H15T5Y + 2.973%), 3.500%, 11/17/25, 144A(b),(c),(d) | |

A3/A | |

| 400 | | |

| 329,328 | |

| Allstate Corp., Jr. Sub. Notes, (3M LIBOR + 2.120%), 6.500%, 05/15/57(b),(c) | |

Baa1/BBB- | |

| 2,200 | | |

| 2,055,905 | |

| Farmers Exchange Capital, Sub. Notes, 7.200%, 07/15/48, 144A | |

Baa3-/BBB+ | |

| 2,250 | | |

| 2,098,565 | |

| Guardian Life Insurance Co. of America, Sub. Notes, 4.850%, 01/24/77, 144A | |

Aa3/AA- | |

| 148 | | |

| 110,905 | |

| Jackson National Life Global Funding, 1.750%, 01/12/25, 144A | |

A2/A | |

| 656 | | |

| 615,981 | |

| Liberty Mutual Group, Inc., Co. Gty., 3.951%, 10/15/50, 144A(b) | |

Baa2/BBB | |

| 250 | | |

| 167,701 | |

| Liberty Mutual Group, Inc., Co. Gty., (TSFR3M + 7.382%), 10.750%, 06/15/58, 144A(b),(c) | |

Baa3/BB+ | |

| 1,000 | | |

| 1,326,773 | |

| Massachusetts Mutual Life Insurance Co., Sub. Notes, 3.729%, 10/15/70, 144A | |

A2/AA- | |

| 243 | | |

| 147,733 | |

| Massachusetts Mutual Life Insurance Co., Sub. Notes, 4.900%, 04/01/77, 144A | |

A2/AA- | |

| 980 | | |

| 738,853 | |

| MetLife, Inc., Jr. Sub. Notes, 6.400%, 12/15/36(b) | |

Baa2/BBB | |

| 637 | | |

| 622,359 | |

| MetLife, Inc., Jr. Sub. Notes, 10.750%, 08/01/39(b) | |

Baa2/BBB | |

| 1,000 | | |

| 1,272,323 | |

| MetLife, Inc., Jr. Sub. Notes, 9.250%, 04/08/38, 144A(b) | |

Baa2/BBB | |

| 1,059 | | |

| 1,189,734 | |

| Nationwide Mutual Insurance Co., Sub. Notes, 8.250%, 12/01/31, 144A | |

A3/A- | |

| 500 | | |

| 544,190 | |

| Nationwide Mutual Insurance Co., Sub. Notes, 9.375%, 08/15/39, 144A | |

A3/A- | |

| 215 | | |

| 259,794 | |

The accompanying notes are an integral part of these financial

statements.

SCHEDULE OF INVESTMENTS (Unaudited) — continued

| | |

Moody’s/ Standard & Poor’s Rating(a) | |

Principal Amount (000’s) | |

Value

(Note1) |

| CORPORATE DEBT SECURITIES (Continued) | |

| |

| | | |

| | |

| INSURANCE (Continued) | |

| |

| | | |

| | |

| New York Life Insurance Co., Sub. Notes, 6.750%, 11/15/39, 144A | |

Aa2/AA- | |

$ | 103 | | |

$ | 107,696 | |

| Prudential Financial, Inc., Jr. Sub. Notes, (3M LIBOR + 2.665%), 5.700%, 09/15/48(b),(c) | |

Baa1/BBB+ | |

| 1,241 | | |

| 1,137,710 | |

| | |

| |

| | | |

| 12,867,611 | |

| INTERNET (0.53%) | |

| |

| | | |

| | |

| Meta Platforms, Inc., Sr. Unsec. Notes, 4.450%, 08/15/52(b) | |

A1/AA- | |

| 500 | | |

| 397,333 | |

| Netflix, Inc., Sr. Unsec. Notes, 5.875%, 11/15/28 | |

Baa3/BBB+ | |

| 193 | | |

| 194,494 | |

| Prosus NV, Sr. Unsec. Notes, 4.987%, 01/19/52, 144A(b) | |

Baa3/BBB | |

| 540 | | |

| 354,573 | |

| | |

| |

| | | |

| 946,400 | |

| LODGING (0.81%) | |

| |

| | | |

| | |

| Sands China, Ltd., Sr. Unsec. Notes, 3.100%, 03/08/29(b),(f) | |

Baa2/BBB- | |

| 200 | | |

| 165,495 | |

| Sands China, Ltd., Sr. Unsec. Notes, 4.875%, 06/18/30(b),(f) | |

Baa2/BBB- | |

| 260 | | |

| 224,431 | |

| Wynn Macau, Ltd., Sr. Unsec. Notes, 5.625%, 08/26/28, 144A(b) | |

B2/B+ | |

| 1,219 | | |

| 1,056,765 | |

| | |

| |

| | | |

| 1,446,691 | |

| MACHINERY-DIVERSIFIED (0.31%) | |

| |

| | | |

| | |

| TK Elevator US Newco, Inc., Sr. Sec. Notes, 5.250%, 07/15/27, 144A(b) | |

B1/B+ | |

| 600 | | |

| 552,213 | |

| MEDIA (6.28%) | |

| |

| | | |

| | |

| AMC Networks, Inc., Co. Gty., 4.250%, 02/15/29(b) | |

Ba3/BB- | |

| 621 | | |

| 381,143 | |

| CCO Holdings LLC, Sr. Unsec. Notes, 4.500%, 05/01/32(b) | |

B1/BB- | |

| 1,017 | | |

| 798,276 | |

| Charter Communications Operating LLC, Sr. Sec. Notes, 5.750%, 04/01/48(b) | |

Ba1/BBB- | |

| 389 | | |

| 310,346 | |

| Comcast Corp., Co. Gty., 7.050%, 03/15/33 | |

A3/A- | |

| 2,000 | | |

| 2,183,236 | |

| Cox Communications, Inc., Sr. Unsec. Notes, 6.800%, 08/01/28 | |

Baa2/BBB | |

| 1,500 | | |

| 1,553,888 | |

| Cox Enterprises, Inc., Sr. Unsec. Notes, 7.375%, 07/15/27, 144A | |

Baa2/BBB | |

| 500 | | |

| 515,464 | |

| CSC Holdings LLC, Co. Gty., 6.500%, 02/01/29, 144A(b) | |

B2/B | |

| 698 | | |

| 578,523 | |

| CSC Holdings LLC, Sr. Unsec. Notes, 4.625%, 12/01/30, 144A(b) | |

Caa2/CCC+ | |

| 1,336 | | |

| 710,312 | |

| Grupo Televisa SAB, Sr. Unsec. Notes, 6.625%, 01/15/40 | |

Baa2/BBB+ | |

| 159 | | |

| 154,512 | |

| Paramount Global, Sr. Unsec. Notes, 4.200%, 05/19/32(b) | |

Baa3/BBB- | |

| 641 | | |

| 509,729 | |

| Paramount Global, Sr. Unsec. Notes, 6.875%, 04/30/36 | |

Baa3/BBB- | |

| 179 | | |

| 162,732 | |

| Time Warner Cable Enterprises LLC, Sr. Sec. Notes, 8.375%, 07/15/33 | |

Ba1/BBB- | |

| 1,360 | | |

| 1,463,216 | |

| Univision Communications, Inc., Sr. Sec. Notes, 8.000%, 08/15/28, 144A(b) | |

B1/B+ | |

| 14 | | |

| 13,573 | |

| Virgin Media Finance PLC, Co. Gty., 5.000%, 07/15/30, 144A(b) | |

B2/B | |

| 200 | | |

| 157,221 | |

| VTR Finance NV, Sr. Unsec. Notes, 6.375%, 07/15/28, 144A(b) | |

Caa3/CCC- | |

| 443 | | |

| 165,469 | |

| Walt Disney Co., Co. Gty., 7.900%, 12/01/95 | |

A2/A- | |

| 1,400 | | |

| 1,569,932 | |

| | |

| |

| | | |

| 11,227,572 | |

| MINING (0.30%) | |

| |

| | | |

| | |

| AngloGold Ashanti Holdings PLC, Co. Gty., 3.750%, 10/01/30(b) | |

Baa3/BB+ | |

| 339 | | |

| 273,034 | |

| Newcrest Finance Pty, Ltd., Co. Gty., 3.250%, 05/13/30, 144A(b) | |

Baa2/BBB+ | |

| 319 | | |

| 271,299 | |

| | |

| |

| | | |

| 544,333 | |

| OIL & GAS (3.79%) | |

| |

| | | |

| | |

| Aker BP ASA, Co. Gty., 3.100%, 07/15/31, 144A(b) | |

Baa2/BBB | |

| 426 | | |

| 340,952 | |

| BP Capital Markets PLC, Co. Gty., (H15T5Y + 4.036%), 4.375%, 06/22/25(b),(c),(d) | |

Baa1/BBB | |

| 675 | | |

| 643,707 | |

| CITGO Petroleum Corp., Sr. Sec. Notes, 7.000%, 06/15/25, 144A(b) | |

B3/B+ | |

| 447 | | |

| 440,314 | |

| CITGO Petroleum Corp., Sr. Sec. Notes, 8.375%, 01/15/29, 144A(b) | |

B3/B+ | |

| 28 | | |

| 27,948 | |

| CVR Energy, Inc., Co. Gty., 5.250%, 02/15/25, 144A(b) | |

B1/B+ | |

| 387 | | |

| 377,530 | |

| Ecopetrol SA, Sr. Unsec. Notes, 8.625%, 01/19/29(b) | |

Baa3/BB+ | |

| 232 | | |

| 233,036 | |

| Endeavor Energy Resources LP, Sr. Unsec. Notes, 5.750%, 01/30/28, 144A(b) | |

Ba2/BB+ | |

| 473 | | |

| 456,428 | |

| Exxon Mobil Corp., Sr. Unsec. Notes, 4.227%, 03/19/40(b) | |

Aa2/AA- | |

| 1,402 | | |

| 1,193,590 | |

| Parkland Corp., Co. Gty., 4.500%, 10/01/29, 144A(b) | |

Ba3/BB | |

| 667 | | |

| 571,317 | |

| Petroleos Mexicanos, Co. Gty., 5.950%, 01/28/31(b) | |

B1/BBB | |

| 552 | | |

| 395,094 | |

| Petroleos Mexicanos, Co. Gty., 6.950%, 01/28/60(b) | |

B1/BBB | |

| 195 | | |

| 115,442 | |

| Saudi Arabian Oil Co., Sr. Unsec. Notes, 2.250%, 11/24/30, 144A(b) | |

A1/NA | |

| 853 | | |

| 683,292 | |

The accompanying notes are an integral part of these financial

statements.

SCHEDULE OF INVESTMENTS (Unaudited) — continued

| | |

Moody’s/ Standard & Poor’s Rating(a) | |

Principal Amount (000’s) | |

Value

(Note1) |

| CORPORATE DEBT SECURITIES (Continued) | |

| |

| | | |

| | |

| OIL & GAS (Continued) | |

| |

| | | |

| | |

| Valero Energy Corp., Sr. Unsec. Notes, 8.750%, 06/15/30 | |

Baa2/BBB | |

$ | 1,000 | | |

$ | 1,143,641 | |

| Valero Energy Corp., Sr. Unsec. Notes, 4.000%, 06/01/52(b) | |

Baa2/BBB | |

| 215 | | |

| 147,772 | |

| | |

| |

| | | |

| 6,770,063 | |

| OIL & GAS SERVICES (0.16%) | |

| |

| | | |

| | |

| Baker Hughes Holdings LLC, Sr. Unsec. Notes, 2.061%, 12/15/26(b) | |

A3/A- | |

| 326 | | |

| 292,645 | |

| PACKAGING & CONTAINERS (0.44%) | |

| |

| | | |

| | |

| Ardagh Metal Packaging Finance USA LLC, Sr. Unsec. Notes, 4.000%, 09/01/29, 144A(b) | |

Caa1/B+ | |

| 200 | | |

| 156,518 | |

| LABL, Inc., Sr. Sec. Notes, 5.875%, 11/01/28, 144A(b) | |

B2/B- | |

| 173 | | |

| 155,344 | |

| Sealed Air Corp, Co. Gty., 6.125%, 02/01/28, 144A(b) | |

Ba2/BB+ | |

| 28 | | |

| 27,163 | |

| Sealed Air Corp., Sr. Sec. Notes, 1.573%, 10/15/26, 144A(b) | |

Baa2/BBB- | |

| 524 | | |

| 456,241 | |

| | |

| |

| | | |

| 795,266 | |

| PHARMACEUTICALS (1.11%) | |

| |

| | | |

| | |

| AbbVie, Inc., Sr. Unsec. Notes, 4.050%, 11/21/39(b) | |

A3/BBB+ | |

| 615 | | |

| 502,920 | |

| CVS Health Corp., Sr. Unsec. Notes, 5.875%, 06/01/53(b) | |

Baa2/BBB | |

| 151 | | |

| 139,568 | |

| Organon & Co, Sr. Sec. Notes, 4.125%, 04/30/28, 144A(b) | |

Ba2/BB | |

| 200 | | |

| 173,786 | |

| Pfizer Investment Enterprises Pte, Ltd., Co. Gty., 5.300%, 05/19/53(b) | |

A1/A+ | |

| 265 | | |

| 247,164 | |

| Takeda Pharmaceutical Co., Ltd., Sr. Unsec. Notes, 5.000%, 11/26/28(b) | |

Baa1/BBB+ | |

| 500 | | |

| 489,408 | |

| Takeda Pharmaceutical Co., Ltd., Sr. Unsec. Notes, 3.175%, 07/09/50(b) | |

Baa1/BBB+ | |

| 684 | | |

| 433,410 | |

| | |

| |

| | | |

| 1,986,256 | |

| PIPELINES (7.74%) | |

| |

| | | |

| | |

| Cheniere Energy Partners LP, Co. Gty., 3.250%, 01/31/32(b) | |

Ba1/BBB- | |

| 91 | | |

| 72,454 | |

| Cheniere Energy Partners LP, Co. Gty., 5.950%, 06/30/33, 144A(b) | |

Ba1/BBB- | |

| 92 | | |

| 88,731 | |

| Columbia Pipelines Holding Co. LLC, Sr. Unsec. Notes, 6.055%, 08/15/26, 144A(b) | |

Baa2/NA | |

| 70 | | |

| 70,228 | |

| Columbia Pipelines Operating Co. LLC, Sr. Unsec. Notes, 6.544%, 11/15/53, 144A(b) | |

Baa1/NA | |

| 155 | | |

| 151,369 | |

| Crestwood Midstream Partners LP, Co. Gty., 7.375%, 02/01/31, 144A(b) | |

Ba3+/BB+ | |

| 36 | | |

| 36,664 | |

| DT Midstream, Inc., Sr. Sec. Notes, 4.300%, 04/15/32, 144A(b) | |

Baa2/BBB- | |

| 432 | | |

| 367,114 | |

| EIG Pearl Holdings Sarl, Sr. Sec. Notes, 4.387%, 11/30/46, 144A | |

A1/NA | |

| 700 | | |

| 507,108 | |

| Enbridge, Inc., Sub. Notes, (TSFR3M + 4.152%), 6.000%, 01/15/77(b),(c) | |

Baa3/BBB- | |

| 750 | | |

| 685,647 | |

| Energy Transfer LP, Jr. Sub. Notes, (H15T5Y + 5.306%), 7.125%, 05/15/30(b),(c),(d) | |

Ba2/BB+ | |

| 160 | | |

| 137,637 | |

| Energy Transfer LP, Sr. Unsec. Notes, 3.750%, 05/15/30(b) | |

Baa3/BBB | |

| 398 | | |

| 346,779 | |

| Enterprise Products Operating LLC, Co. Gty., (TSFR3M + 2.832%), 5.375%, 02/15/78(b),(c) | |

Baa2/BBB | |

| 342 | | |

| 284,328 | |

| Florida Gas Transmission Co. LLC, Sr. Unsec. Notes, 9.190%, 11/01/24, 144A | |

Baa2/BBB+ | |

| 20 | | |

| 20,154 | |

| Global Partners LP, Co. Gty., 7.000%, 08/01/27(b) | |

B2/B+ | |

| 1,076 | | |

| 1,048,553 | |

| Howard Midstream Energy Partners LLC, Sr. Unsec. Notes, 6.750%, 01/15/27, 144A(b) | |

B3/B+ | |

| 110 | | |

| 104,500 | |

| Howard Midstream Energy Partners LLC, Sr. Unsec. Notes, 8.875%, 07/15/28, 144A(b) | |

B3/B+ | |

| 203 | | |

| 204,776 | |

| Kinder Morgan, Inc., Co. Gty., 8.050%, 10/15/30 | |

Baa2/BBB | |

| 1,000 | | |

| 1,088,031 | |

| Kinder Morgan, Inc., Co. Gty., 5.550%, 06/01/45(b) | |

Baa2/BBB | |

| 1,755 | | |

| 1,512,113 | |

| MPLX LP, Sr. Unsec. Notes, 4.250%, 12/01/27(b) | |

Baa2/BBB | |

| 901 | | |

| 846,440 | |

| MPLX LP, Sr. Unsec. Notes, 5.500%, 02/15/49(b) | |

Baa2/BBB | |

| 694 | | |

| 586,841 | |

| MPLX LP, Sr. Unsec. Notes, 4.900%, 04/15/58(b) | |

Baa2/BBB | |

| 561 | | |

| 416,681 | |

| NGPL PipeCo LLC, Sr. Unsec. Notes, 7.768%, 12/15/37, 144A | |

Baa3/BBB- | |

| 880 | | |

| 905,433 | |

| ONEOK, Inc., Co. Gty., 5.800%, 11/01/30(b) | |

Baa2/BBB | |

| 123 | | |

| 120,434 | |

| ONEOK, Inc., Co. Gty., 6.100%, 11/15/32(b) | |

Baa2/BBB | |

| 177 | | |

| 174,915 | |

| ONEOK, Inc., Co. Gty., 6.625%, 09/01/53(b) | |

Baa2/BBB | |

| 548 | | |

| 536,513 | |

| Panhandle Eastern Pipe Line Co. LP, Sr. Unsec. Notes, 7.000%, 07/15/29 | |

Baa3/BBB | |

| 1,000 | | |

| 1,008,508 | |

| Targa Resources Partners LP, Co. Gty., 5.500%, 03/01/30(b) | |

Baa3/BBB- | |

| 1,177 | | |

| 1,101,568 | |

| Transcontinental Gas Pipe Line Co. LLC, Sr. Unsec. Notes, 3.950%, 05/15/50(b) | |

Baa1/BBB | |

| 384 | | |

| 272,709 | |

| Western Midstream Operating LP, Sr. Unsec. Notes, 6.350%, 01/15/29(b) | |

Baa3/BBB- | |

| 131 | | |

| 131,262 | |

| Western Midstream Operating LP, Sr. Unsec. Notes, 6.150%, 04/01/33(b) | |

Baa3/BBB- | |

| 53 | | |

| 51,107 | |

| Williams Cos., Inc., Sr. Unsec. Notes, 7.500%, 01/15/31 | |

Baa2/BBB | |

| 911 | | |

| 968,945 | |

| | |

| |

| | | |

| 13,847,542 | |

The accompanying notes are an integral part of these financial

statements.

SCHEDULE OF INVESTMENTS (Unaudited) — continued

| | |

Moody’s/ Standard & Poor’s Rating(a) | |

Principal Amount (000’s) | |

Value

(Note1) |

| CORPORATE DEBT SECURITIES (Continued) | |

| |

| | | |

| | |

| REITS (2.85%) | |

| |

| | | |

| | |

| Boston Properties LP, Sr. Unsec. Notes, 3.800%, 02/01/24(b) | |

Baa1/BBB+ | |

$ | 288 | | |

$ | 285,337 | |

| Brixmor Operating Partnership LP, Sr. Unsec. Notes, 3.850%, 02/01/25(b) | |

Baa3/BBB- | |

| 161 | | |

| 155,013 | |

| EPR Properties, Sr. Unsec. Notes, 3.600%, 11/15/31(b) | |

Baa3/BBB- | |

| 533 | | |

| 395,268 | |

| Extra Space Storage LP, Co. Gty., 5.700%, 04/01/28(b) | |

Baa2/BBB+ | |

| 129 | | |

| 127,503 | |

| Extra Space Storage LP, Co. Gty., 3.900%, 04/01/29(b) | |

Baa2/BBB+ | |

| 371 | | |

| 333,309 | |

| Extra Space Storage LP, Co. Gty., 2.350%, 03/15/32(b) | |

Baa2/BBB+ | |

| 267 | | |

| 201,965 | |

| GLP Capital LP, Co. Gty., 3.250%, 01/15/32(b) | |

Ba1/BBB- | |

| 154 | | |

| 119,437 | |

| Iron Mountain, Inc., Co. Gty., 5.000%, 07/15/28, 144A(b) | |

Ba3/BB- | |

| 59 | | |

| 53,664 | |

| Iron Mountain, Inc., Co. Gty., 7.000%, 02/15/29, 144A(b) | |

Ba3/BB- | |

| 370 | | |

| 362,064 | |

| Rexford Industrial Realty LP, Co. Gty., 2.150%, 09/01/31(b) | |

Baa2/BBB+ | |

| 360 | | |

| 268,567 | |

| SBA Tower Trust, 2.593%, 10/15/31, 144A(b) | |

A2/NA | |

| 454 | | |

| 346,659 | |

| Scentre Group Trust 2, Co. Gty., (H15T5Y + 4.379%), 4.750%, 09/24/80, 144A(b),(c) | |

Baa1/BBB+ | |

| 2,007 | | |

| 1,802,492 | |

| Simon Property Group LP, Sr. Unsec. Notes, 5.850%, 03/08/53(b) | |

A3/A- | |

| 271 | | |

| 249,987 | |

| VICI Properties LP, Co. Gty., 3.500%, 02/15/25, 144A(b) | |

Ba1/BBB- | |

| 385 | | |

| 368,364 | |

| WEA Finance LLC, Co. Gty., 4.625%, 09/20/48, 144A(b) | |

Baa2/BBB+ | |

| 36 | | |

| 22,118 | |

| | |

| |

| | | |

| 5,091,747 | |

| RETAIL (0.60%) | |

| |

| | | |

| | |

| Macy’s Retail Holdings LLC, Co. Gty., 5.875%, 03/15/30, 144A(b) | |

Ba2/BB+ | |

| 314 | | |

| 264,545 | |

| Murphy Oil USA, Inc., Co. Gty., 3.750%, 02/15/31, 144A(b) | |

Ba2/BB+ | |

| 119 | | |

| 97,194 | |

| Starbucks Corp., Sr. Unsec. Notes, 4.450%, 08/15/49(b) | |

Baa1/BBB+ | |

| 891 | | |

| 705,737 | |

| | |

| |

| | | |

| 1,067,476 | |

| SEMICONDUCTORS (1.39%) | |

| |

| | | |

| | |

| Broadcom, Inc., Co. Gty., 3.750%, 02/15/51, 144A(b) | |

Baa3/BBB- | |

| 166 | | |

| 111,222 | |

| Broadcom, Inc., Sr. Unsec. Notes, 3.469%, 04/15/34, 144A(b) | |

Baa3/BBB- | |

| 1,655 | | |

| 1,300,249 | |

| Broadcom, Inc., Sr. Unsec. Notes, 3.187%, 11/15/36, 144A(b) | |

Baa3/BBB- | |

| 1,109 | | |

| 796,559 | |

| Intel Corp., Sr. Unsec. Notes, 5.200%, 02/10/33(b) | |

A2/A | |

| 92 | | |

| 89,145 | |

| Intel Corp., Sr. Unsec. Notes, 5.700%, 02/10/53(b) | |

A2/A | |

| 61 | | |

| 57,138 | |

| Micron Technology, Inc., Sr. Unsec. Notes, 2.703%, 04/15/32(b) | |

Baa3/BBB- | |

| 164 | | |

| 125,268 | |

| | |

| |

| | | |

| 2,479,581 | |

| SOFTWARE (1.68%) | |

| |

| | | |

| | |

| Fiserv, Inc., Sr. Unsec. Notes, 5.600%, 03/02/33(b) | |

Baa2/BBB | |

| 121 | | |

| 117,245 | |

| Oracle Corp., Sr. Unsec. Notes, 2.300%, 03/25/28(b) | |

Baa2/BBB | |

| 1,130 | | |

| 979,128 | |

| Oracle Corp., Sr. Unsec. Notes, 3.650%, 03/25/41(b) | |

Baa2/BBB | |

| 1,745 | | |

| 1,244,465 | |

| Oracle Corp., Sr. Unsec. Notes, 5.550%, 02/06/53(b) | |

Baa2/BBB | |

| 80 | | |

| 70,191 | |

| VMware, Inc., Sr. Unsec. Notes, 2.200%, 08/15/31(b) | |

Baa3/BBB- | |

| 788 | | |

| 594,883 | |

| | |

| |

| | | |

| 3,005,912 | |

| TELECOMMUNICATIONS (3.08%) | |

| |

| | | |

| | |

| AT&T, Inc., Sr. Unsec. Notes, 4.500%, 05/15/35(b) | |

Baa2/BBB | |

| 515 | | |

| 441,211 | |

| AT&T, Inc., Sr. Unsec. Notes, 4.750%, 05/15/46(b) | |

Baa2/BBB | |

| 425 | | |

| 335,669 | |

| AT&T, Inc., Sr. Unsec. Notes, 3.550%, 09/15/55(b) | |

Baa2/BBB | |

| 2,195 | | |

| 1,339,010 | |

| Deutsche Telekom International Finance BV, Co. Gty., 8.750%, 06/15/30(f) | |

Baa1/BBB+ | |

| 2,000 | | |

| 2,290,882 | |

| Frontier Communications Holdings LLC, Sr. Sec. Notes, 5.000%, 05/01/28, 144A(b) | |

B3/B | |

| 255 | | |

| 217,767 | |

| T-Mobile USA, Inc., Co. Gty., 4.950%, 03/15/28(b) | |

Baa2/BBB | |

| 83 | | |

| 80,574 | |

| Verizon Communications, Inc., Sr. Unsec. Notes, 2.550%, 03/21/31(b) | |

Baa1/BBB+ | |

| 457 | | |

| 363,900 | |

| Verizon Communications, Inc., Sr. Unsec. Notes, 3.550%, 03/22/51(b) | |

Baa1/BBB+ | |

| 674 | | |

| 445,298 | |

| | |

| |

| | | |

| 5,514,311 | |

| TRANSPORTATION (0.33%) | |

| |

| | | |

| | |

| BNSF Funding Trust I, Co. Gty., (3M LIBOR + 2.350%), 6.613%, 12/15/55(b),(c) | |

Baa2/A | |

| 250 | | |

| 243,277 | |

| Union Pacific Corp., Sr. Unsec. Notes, 3.839%, 03/20/60(b) | |

A3/A- | |

| 503 | | |

| 352,040 | |

| | |

| |

| | | |

| 595,317 | |

TOTAL

CORPORATED EBT SECURITIES

(Cost of $161,731,851) | |

| |

| | | |

| 145,300,540 | |

The accompanying notes are an integral part of these financial

statements.

SCHEDULE OF INVESTMENTS (Unaudited) — continued

| | |

Moody’s/ Standard & Poor’s Rating(a) | |

Principal Amount (000’s) | |

Value

(Note1) |

| ASSET-BACKED SECURITIES (13.41%) | |

| |

| | | |

| | |

| Aligned Data Centers Issuer LLC, Series 2021-1A, Class A2, 1.937%, 08/15/46, 144A(b) | |

NA/A- | |

$ | 904 | | |

$ | 790,881 | |

| Amur

Equipment Finance Receivables XI LLC, Series 2022-2A, Class A2, 5.300%, 06/21/28, 144A(b) | |

Aaa/NA | |

| 82 | | |

| 81,315 | |

| Antares

CLO, Ltd., Series 2017-1A, Class CR, (TSFR3M + 2.962%), 8.288%, 04/20/33, 144A(b),(e) | |

NA/A | |

| 1,092 | | |

| 1,035,620 | |

| Apidos

CLO XXXIX, Ltd., Series 2022-39A, Class A1, (TSFR3M + 1.300%), 6.634%, 04/21/35, 144A(b),(e) | |

Aaa/AA+ | |

| 950 | | |

| 940,669 | |

| Avis

Budget Rental Car Funding AESOP LLC, Series 2020-1A, Class A, 2.330%, 08/20/26, 144A(b) | |

Aaa/NA | |

| 255 | | |

| 238,954 | |

| Blackbird Capital Aircraft, Series 2021-1A, Class B, 3.446%, 07/15/46, 144A(b) | |

Baa1/NA | |

| 313 | | |

| 261,430 | |

| Cerberus

Loan Funding XXXVII LP, Series 2022-1A, Class A1, (TSFR3M + 1.780%), 7.088%, 04/15/34,

144A(b),(e) | |

Aaa/NA | |

| 1,500 | | |

| 1,476,859 | |

| CF Hippolyta Issuer LLC, Series 2020-1, Class A1, 1.690%, 07/15/60, 144A(b) | |

NA/AA- | |

| 612 | | |

| 555,616 | |

| Chesapeake Funding II LLC, Series 2023-2A, Class A1, 6.160%, 10/15/35, 144A(b) | |

Aaa/NA | |

| 153 | | |

| 153,093 | |

| Daimler Trucks Retail Trust, Series 2023-1, Class A3, 5.900%, 03/15/27(b) | |

Aaa/NA | |

| 428 | | |

| 428,046 | |

| DataBank Issuer, Series 2021-2A, Class A2, 2.400%, 10/25/51, 144A(b) | |

NA/NA | |

| 583 | | |

| 502,181 | |

| DB Master Finance LLC, Series 2021-1A, Class A2I, 2.045%, 11/20/51, 144A(b) | |

NA/BBB | |

| 597 | | |

| 522,661 | |

| Domino’s Pizza Master Issuer LLC, Series 2021-1A, Class A2I, 2.662%, 04/25/51, 144A(b) | |

NA/BBB+ | |

| 540 | | |

| 454,660 | |

| Eaton

Vance CLO, Ltd., Series 2020-1A, Class AR, (TSFR3M + 1.432%), 6.740%, 10/15/34, 144A(b),(e) | |

NA/AAA | |

| 1,500 | | |

| 1,482,774 | |

| Flexential Issuer, Series 2021-1A, Class A2, 3.250%, 11/27/51, 144A(b) | |

NA/NA | |

| 555 | | |

| 486,048 | |

| Ford Credit Auto Owner Trust, Series 2022-C, Class B, 5.030%, 02/15/28(b) | |

Aaa/AA+ | |

| 565 | | |

| 552,486 | |

| Fortress

Credit Opportunities IX CLO, Ltd., Series 2017-9A, Class A1TR, (TSFR3M + 1.812%), 7.120%, 10/15/33,

144A(b),(e) | |

NA/AAA | |

| 600 | | |

| 586,696 | |

| Golub

Capital Partners CLO 36m, Ltd., Series 2018-36A, Class C, (TSFR3M + 2.362%), 7.731%, 02/05/31,

144A(b),(e) | |

NA/A | |

| 2,250 | | |

| 2,128,997 | |

| Hilton Grand Vacations Trust, Series 2023-1A, Class A, 5.720%, 01/25/38, 144A(b) | |

Aaa/AAA | |

| 99 | | |

| 98,456 | |

| ITE Rail Fund Levered LP, Series 2021-1A, Class A, 2.250%, 02/28/51, 144A(b) | |

NA/A | |

| 180 | | |

| 152,654 | |

| IVY

Hill Middle Market Credit Fund XII, Ltd., Series 12A, Class BR, (TSFR3M + 3.162%), 8.488%, 07/20/33,

144A(b),(e) | |

NA/A- | |

| 866 | | |

| 819,960 | |

| Marlette Funding Trust, Series 2022-3A, Class A, 5.180%, 11/15/32, 144A(b) | |

NA/NA | |

| 48 | | |

| 47,345 | |

| MCF

CLO IX, Ltd., Series 2019-1A, Class A1R, (TSFR3M + 1.500%), 6.808%, 07/17/31, 144A(b),(e) | |

NA/AAA | |

| 556 | | |

| 551,411 | |

| MF1, Ltd., Series 2021-FL7, Class AS, (TSFR1M + 1.564%), 6.895%, 10/16/36, 144A(b),(e) | |

NA/NA | |

| 922 | | |

| 899,538 | |

| MF1, Ltd., Series 2022-FL8, Class C, (TSFR1M + 2.200%), 7.527%, 02/19/37, 144A(b),(e) | |

NA/NA | |

| 448 | | |

| 428,653 | |

| Navient

Private Education Refi Loan Trust, Series 2021-A, Class A, 0.840%, 05/15/69, 144A(b) | |

NA/AAA | |

| 92 | | |

| 79,409 | |

| Neuberger

Berman Loan Advisers CLO 47, Ltd., Series 2022-47A, Class A, (TSFR3M + 1.300%), 6.611%, 04/14/35, 144A(b),(e) | |

Aaa/NA | |

| 937 | | |

| 928,130 | |

| New

Economy Assets Phase 1 Sponsor LLC, Series 2021-1, Class A1, 1.910%, 10/20/61, 144A(b) | |

NA/AA- | |

| 1,063 | | |

| 916,773 | |

| PMT

Issuer Trust - FMSR, Series 2021-FT1, Class A, (1M LIBOR + 3.000%), 8.434%, 03/25/26, 144A(b),(e) | |

NA/NA | |

| 566 | | |

| 551,255 | |

| Purewest Funding LLC, Series 2021-1, Class A1, 4.091%, 12/22/36, 144A(b) | |

NA/NA | |

| 164 | | |

| 155,309 | |

| Santander Drive Auto Receivables Trust, Series 2022-5, Class C, 4.740%, 10/16/28(b) | |

Aaa/A | |

| 352 | | |

| 342,106 | |

| SFS

Auto Receivables Securitization Trust, Series 2023-1A, Class A2A, 5.890%, 03/22/27, 144A(b) | |

Aaa/AAA | |

| 213 | | |

| 212,696 | |

| Slam, Ltd., Series 2021-1A, Class A, 2.434%, 06/15/46, 144A(b) | |

A1/NA | |

| 1,156 | | |

| 983,226 | |

| SMB

Private Education Loan Trust, Series 2017-B, Class A2B, (TSFR1M + 0.864%), 6.197%, 10/15/35,

144A(b),(e) | |

Aaa/AAA | |

| 225 | | |

| 222,978 | |

| Sofi Professional Loan Program LLC, Series 2017-C, Class B, 3.560%, 07/25/40, 144A(b),(e) | |

NA/AA+ | |

| 1,099 | | |

| 1,031,671 | |

| Tesla Auto Lease Trust, Series 2023-B, Class A3, 6.130%, 09/21/26, 144A(b) | |

Aaa/NA | |

| 449 | | |

| 448,833 | |

| Textainer Marine Containers VII, Ltd., Series 2021-1A, Class A, 1.680%, 02/20/46, 144A(b) | |

NA/A | |

| 817 | | |

| 689,184 | |

| TIF Funding II LLC, Series 2021-1A, Class A, 1.650%, 02/20/46, 144A(b) | |

NA/A | |

| 435 | | |

| 360,376 | |

| United States Small Business Administration, Series 2010-20F, Class 1, 3.880%, 06/01/30 | |

Aaa/AA+ | |

| 33 | | |

| 31,279 | |

The accompanying notes are an integral part of these financial

statements.

SCHEDULE OF INVESTMENTS (Unaudited) — continued

| | |

Moody’s/ Standard & Poor’s Rating(a) | |

Principal Amount (000’s) | |

Value

(Note1) |

| ASSET-BACKED SECURITIES (Continued) | |

| |

| | | |

| | |

| Willis Engine Structured Trust IV, Series 2018-A, Class A, 4.750%, 09/15/43, 144A(b),(g) | |

NA/A | |

$ | 1,017 | | |

$ | 857,264 | |

| Willis Engine Structured Trust VI, Series 2021-A, Class A, 3.104%, 05/15/46, 144A(b) | |

NA/NA | |

| 619 | | |

| 496,765 | |

TOTAL ASSET - BACKED SECURITIES

(Cost of $25,785,243) | |

| |

| | | |

| 23,984,257 | |

| COMMERCIAL MORTGAGE-BACKED SECURITIES (0.57%) | |

| |

| | | |

| | |

| BXHPP

Trust, Series 2021-FILM, Class C, (TSFR1M + 1.214%), 6.546%, 08/15/36, 144A(e) | |

NA/NA | |

| 167 | | |

| 150,642 | |

| New

Residential Mortgage Loan Trust, Series 2021-NQ2R, Class A1, 0.941%, 10/25/58, 144A(b),(e) | |

NA/NA | |

| 178 | | |

| 157,222 | |

| New

Residential Mortgage Loan Trust, Series 2022-NQM1, Class A1, 2.277%, 04/25/61, 144A(b),(e) | |

NA/NA | |

| 877 | | |

| 718,250 | |

TOTAL

COMMERCIAL MORTGAGE - BACKED SECURITIES

(Cost of $1,222,087) | |

| |

| | | |

| 1,026,114 | |

| RESIDENTIAL MORTGAGE-BACKED SECURITIES (0.11%) | |

| |

| | | |

| | |

| FHLMC Pool #A15675, 6.000%, 11/01/33 | |

Aaa/AA+ | |

| 29 | | |

| 28,894 | |

| FNMA Pool #754791, 6.500%, 12/01/33 | |

Aaa/AA+ | |

| 111 | | |

| 111,403 | |

| FNMA Pool #763852, 5.500%, 02/01/34 | |

Aaa/AA+ | |

| 50 | | |

| 49,023 | |

| GNSF Pool #417239, 7.000%, 02/15/26 | |

Aaa/AA+ | |

| 1 | | |

| 897 | |

| GNSF Pool #780374, 7.500%, 12/15/23(h) | |

Aaa/AA+ | |

| 0 | | |

| 1 | |

TOTAL

RESIDENTIAL MORTGAGE-BACKED SECURITIES

(Cost of $182,522) | |

| |

| | | |

| 190,218 | |

| MUNICIPAL BONDS (1.23%) | |

| |

| | | |

| | |

| City of San Francisco CA Public Utilities Commission Water Revenue, Build America | |

| |

| | | |

| | |

| Bonds, 6.000%, 11/01/40 | |

Aa2/AA- | |

| 145 | | |

| 146,909 | |

| State of California, Build America Bonds, GO, 7.625%, 03/01/40 | |

Aa2/AA- | |

| 1,500 | | |

| 1,758,306 | |

| University of Michigan, 3.599%, 04/01/47 | |

Aaa/AAA | |

| 365 | | |

| 291,437 | |

TOTAL

MUNICIPAL BONDS

(Cost of $2,040,536) | |

| |

| | | |

| 2,196,652 | |

| U.S. TREASURY OBLIGATIONS (1.10%) | |

| |

| | | |

| | |

| United States Treasury Bonds, 4.375%, 08/15/43 | |

Aaa/AA+ | |

| 525 | | |

| 489,481 | |

| United States Treasury Bonds, 1.250%, 05/15/50 | |

Aaa/AA+ | |

| 236 | | |

| 110,887 | |

| United States Treasury Bonds, 1.375%, 08/15/50 | |

Aaa/AA+ | |

| 251 | | |

| 122,294 | |

| United States Treasury Notes, 1.500%, 02/29/24 | |

Aaa/AA+ | |

| 800 | | |

| 787,125 | |

| United States Treasury Notes, 4.125%, 07/31/28 | |

Aaa/AA+ | |

| 233 | | |

| 228,012 | |

| United States Treasury Notes, 3.875%, 08/15/33 | |

Aaa/AAA | |

| 240 | | |

| 226,838 | |

TOTAL

U.S. TREASURY OBLIGATIONS

(Cost of $2,022,156) | |

| |

| | | |

| 1,964,637 | |

| GOVERNMENT BONDS (0.65%) | |

| |

| | | |

| | |

| Hungary Government International Bond, Sr. Unsec. Notes, 6.750%, 09/25/52, 144A | |

Baa2/BBB- | |

| 200 | | |

| 189,580 | |

| Korea National Oil Corp., Sr. Unsec. Notes, 1.750%, 04/18/25, 144A | |

Aa2/AA | |

| 208 | | |

| 195,769 | |

| Saudi Government International Bond, Sr. Unsec. Notes, 5.500%, 10/25/32, 144A | |

A1/NA | |

| 631 | | |

| 630,962 | |

| Ukraine Government International Bond, Sr. Unsec. Notes, 7.253%, 03/15/35, 144A | |

NA/CCC | |

| 551 | | |

| 143,180 | |

TOTAL

GOVERNMENT BONDS

(Cost of $1,581,390) | |

| |

| | | |

| 1,159,491 | |

TOTAL

INVESTMENTS (98.32%)

(Cost of $194,565,785) | |

| |

| | | |

| 175,821,909 | |

| OTHER

ASSETS AND LIABILITIES(1.68%) | |

| |

| | | |

| 3,003,197 | |

| NET

ASSETS(100.00%) | |

| |

| | | |

$ | 178,825,106 | |

The accompanying notes are an integral part of these financial

statements.

SCHEDULE OF INVESTMENTS (Unaudited) — continued

At September 30, 2023, the Fund had the following open futures contracts:

| Long Futures Outstanding | |

Expiration Month | |

Number of Contracts | |

Notional Amount | |

Value | |

Unrealized Appreciation (Depreciation) |

| U.S. Treasury 2-Year Notes | |

12/23 | |

48 | |

$ | 9,772,249 | | |

$ | 9,730,125 | | |

$ | (42,124 | ) |

| U.S. Treasury 5-Year Notes | |

12/23 | |

45 | |

| 4,769,685 | | |

| 4,741,172 | | |

| (28,513 | ) |

| U.S. Treasury Long Bonds | |

12/23 | |

40 | |

| 4,740,273 | | |

| 4,551,250 | | |

| (189,023 | ) |

| U.S. Treasury Ultra Bonds | |

12/23 | |

74 | |

| 9,461,016 | | |

| 8,782,875 | | |

| (678,141 | ) |

| | |

| |

| |

| | | |

| | | |

| (937,801 | ) |

| Short Futures Outstanding | |

| |

| |

| | | |

| | | |

| | |

| U.S. Treasury 10-Year Notes | |

12/23 | |

36 | |

| (3,907,970 | ) | |

| (3,890,250 | ) | |

| 17,720 | |

| U.S. Treasury Ultra 10-Year Notes | |

12/23 | |

12 | |

| (1,381,373 | ) | |

| (1,338,750 | ) | |

| 42,623 | |

| | |

| |

| |

| | | |

| | | |

| 60,343 | |

| Net unrealized depreciation on open futures contracts | |

| |

| |

| | | |

| | | |

$ | (877,458 | ) |

| (a) | Ratings for debt securities are

unaudited. All ratings are as of September 30, 2023 and may have changed subsequently. |

| (b) | This security is callable. |

| (c) | Fixed to

floating rate security. Fixed rate indicated is rate effective at September 30, 2023. Security will convert at a future date to a floating

rate of reference rate and spread in the description above. |

| (d) | Security is perpetual. Date shown

is next call date. |

| (e) | Variable rate security. Rate

indicated is rate effective at September 30, 2023. |

| (f) | Multi-Step Coupon. Rate disclosed

is as of September 30, 2023. |

| (g) | Denotes a step-up bond. The rate

indicated is the current coupon as of September 30, 2023. |

| (h) | Principal amount less than $1,000.

|

144A Securities were purchased pursuant

to Rule 144A under the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. At

September 30, 2023, these securities amounted to $70,210,146 or 39.26% of net assets.

Legend

Certs. – Certificates

CLO – Collateralized Loan Obligation

Co. Gty. – Company Guaranty

FHLMC – Federal Home Loan Mortgage Corporation

FNMA – Federal National Mortgage Association

GNSF – Government National Mortgage Association (Single Family)

GO – Government Obligation

H15T5Y – US Treasury Yield Curve Rate T Note Constant Maturity

5 Year

Jr. – Junior

LIBOR – London Interbank Offered Rate

LLC – Limited Liability Company

LP – Limited Partnership

Ltd. – Limited

NA – Not Available

PLC – Public Limited Company

REIT – Real Estate Investment Trust

Sec. – Secured

SOFRRATE – Secured Overnight Financing Rate

Sr. – Senior

Sub. – Subordinated

SW5 – 5-year USD Swap Semiannual 30/360

TSFR1M – One Month Term Secured Overnight Financing Rate

TSFR3M – 3-month Term Secured Overnight Financing Rate

Unsec. – Unsecured

The accompanying notes are an integral part of these financial

statements.

SCHEDULE OF INVESTMENTS (Unaudited) — continued

Following is a description of the valuation techniques applied to the

Fund’s major categories of assets measured at fair value on a recurring basis as of September 30, 2023.

| Assets: | |

Total Market Value at 09/30/23 | |

Level 1 Quoted Price | |

Level 2 Significant Observable Inputs | |

Level 3 Significant Unobservable Inputs |

| LONG-TERM INVESTMENTS | |

| | | |

| | | |

| | | |

| | |

| CORPORATE DEBT SECURITIES | |

$ | 145,300,540 | | |

$ | — | | |

$ | 145,300,540 | | |

$ | — | |

| MUNICIPAL BONDS | |

| 2,196,652 | | |

| — | | |

| 2,196,652 | | |

| — | |

| ASSET-BACKED SECURITIES | |

| 23,984,257 | | |

| — | | |

| 23,984,257 | | |

| — | |

| U.S. TREASURY OBLIGATIONS | |

| 1,964,637 | | |