SECURITIES

AND EXCHANGE COMMISSION

Washington

DC 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 AND 15d-16

OF

THE

SECURITIES EXCHANGE ACT OF 1934

For 20

October 2023

InterContinental Hotels Group PLC

(Registrant's

name)

1

Windsor Dials, Arthur Road, Windsor, SL4 1RS, United

Kingdom

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form

20-F

Form 40-F

EXHIBIT

INDEX

|

99.1

|

2023

Third Quarter Trading Update dated 20 October 2023

|

Exhibit

No: 99.1

20

October 2023

InterContinental

Hotels Group PLC

2023

Third Quarter Trading Update

Highlights

|

●

|

Q3

group RevPAR +10.5% vs 2022, with Americas +4.1%, EMEAA +15.9% and

Greater China +43.2%

|

|

●

|

Q3

group RevPAR +12.8% vs 2019, with Americas +13.8%, EMEAA +17.5% and

Greater China +9.3%

|

|

●

|

Average

daily rate +4.1% vs 2022, +14.8% vs 2019; occupancy +4.1%pts vs

2022, (1.3)%pts vs 2019

|

|

●

|

Gross

system size growth +6.2% YOY, +3.1% YTD; opened 7.7k rooms (50

hotels) in Q3, similar to 2022

|

|

●

|

Net

system size growth +4.7% YOY, +2.0% YTD; excluding Iberostar, +2.9%

YOY, +1.6% YTD

|

|

●

|

Global

system of 930k rooms (6,261 hotels); 67% across midscale segments,

33% across upscale and luxury

|

|

●

|

Signed

16.8k rooms (123 hotels) in Q3, +27% vs 2022; global pipeline of

292k rooms (1,978 hotels), +5.1% YOY

|

|

●

|

On

track to have returned $1.0bn to shareholders in 2023 through share

buybacks and dividend payments

|

Elie Maalouf, Chief Executive Officer, IHG Hotels & Resorts,

said:

“Travel

demand remained very healthy during the quarter, and I would like

to thank all our teams for supporting another strong trading

period. Q3 RevPAR increased 10% versus 2022 and 13% versus 2019,

representing the fifth quarter of sequential improvement exceeding

pre-pandemic highs. Greater China continued its excellent rebound

with RevPAR now above 2019, which the Americas achieved in the

second quarter of last year and EMEAA in the fourth quarter.

Group-wide occupancy was 72%, just one percentage point behind 2019

which further confirms the near-complete return to pre-Covid levels

of demand. Pricing remained very robust. As well as year-on-year

RevPAR growth in each of our three regions, it was also pleasing to

see rooms revenue growth for each of leisure, business and group

travel.

We

opened nearly eight thousand rooms across 50 hotels in the quarter,

and added 17 thousand rooms to our pipeline across 123 properties.

Year to date, signings are up by 16%. Reflecting the breadth and

attractiveness of our portfolio, ‘quicker to market’

conversions have increased this year to be over one-third of

openings and signings. This will soon be further boosted by our new

midscale conversion brand, Garner, which became franchise-ready in

September. There was good development progress across all our

categories, and our six Luxury & Lifestyle brands continue to

represent a growing proportion of IHG with over 800 open and

pipeline hotels in that category.

As IHG

powers forward to provide industry-leading advantages for our

guests and hotels owners across our brand portfolio, loyalty

programme and entire enterprise platform, we expect to close-out

2023 with very strong financial performance. Looking further ahead,

whilst there are macro-economic uncertainties and some short-term

financing challenges holding back new hotel development, I am

excited about the future for IHG and the attractive, long-term

demand drivers for our markets. As such, we’re confident in

the strengths of IHG’s business model, scale and in our

strategic priorities to capture sustainable, profitable

growth.”

Regional performance

Americas

Q3

RevPAR was up +4.1% vs 2022 (up +13.8% vs 2019), with US RevPAR up

+3.1% (up +11.8% vs 2019). Occupancy was 72%, up +0.7%pts on last

year (down (0.6)%pts vs 2019), whilst rate was up +3.1% (up +14.8%

vs 2019). Leisure rooms revenue in Q3 for the total estate was +3%

higher than last year, and up +22% on 2019 levels, driven by

another strong summer vacation period.

Gross

system size growth was +3.9% YOY, with 2.0k rooms (18 hotels)

opened in the quarter.

Net system size growth was +2.9% YOY. A further

5.1k rooms (55 hotels) were added to the pipeline. Signings

included eight avid hotels, 16 hotels across the Holiday Inn

Brand Family, and a further 26 across our extended stay

brands.

EMEAA

Q3

RevPAR was up +15.9% vs 2022 (up +17.5% vs 2019). Occupancy was

73%, up +4.7%pts on last year (and down (4.0)%pts vs 2019), whilst

rate was up +8.6% (up +23.9% vs 2019). By major geographic markets

within the region, Q3 RevPAR vs 2019 ranged from up +31% in

Continental Europe, +18% in the UK, and +16% in Australia, to down

just (1)% in the Middle East and (4)% in Japan.

Gross

system size growth was +10.0% YOY, with 2.0k rooms (11 hotels)

opened in the quarter. Net system size growth was +8.4% YOY (+5.2%

excluding Iberostar). There were 4.8k rooms (31 hotels) added to

the pipeline, with conversions representing around 40% of these.

Luxury & Lifestyle brands performed strongly, also representing

40% of all signings.

Greater

China

Q3

RevPAR was up +43.2% vs 2022 (up +9.3% vs 2019). Occupancy was 67%,

up +14.1%pts (and up +2.3%pts vs 2019), whilst rate was up +13.0%

(up +5.6% vs 2019). Tier 1 cities saw RevPAR vs 2019 down (3)%,

reflecting the more gradual return of international travel; the

performance was stronger across Tier 2-4 cities which were up

+13%.

Gross

system size growth was +8.1% YOY, with 3.6k rooms (21 hotels)

opened in the quarter. Net system size growth was +5.5% YOY. A

further 6.9k rooms (37 hotels) were added to the pipeline. As

development activity continues to improve following the extended

period last year of Covid-related restrictions in the region, this

was the highest quarterly signings performance since

2021.

Share buyback and capital allocation update

As

announced in February 2023, a $750m share buyback programme is

returning surplus capital to shareholders. This follows the $500m

programme announced in 2022 which already reduced the total number

of voting rights in the Company by 5.0%. The current 2023 programme

is 94% complete with $704.7m (£561.2m) having been

cumulatively spent to date, repurchasing 10.1 million shares at an

average price of £55.76 per share. The 2023 programme to date

has therefore reduced the total number of voting rights in the

Company by a further 5.7% to 165.3 million as at market close on

Thursday 19 October 2023.

IHG’s

2023 share buyback programme, together with ordinary dividend

payments, will have returned $1.0bn to shareholders during the

year. This is equivalent to 10% of IHG’s $10.0bn

(£8.3bn) market capitalisation at the start of 2023, and more

than 8% of IHG’s most recent $12.4bn (£10.2bn) market

capitalisation.

IHG’s

perspectives on the uses of cash generated by the business remain

unchanged: ensuring the business is investing to optimise growth

that will drive long-term shareholder value creation, funding a

sustainably growing dividend, and then returning surplus capital to

shareholders, whilst targeting our leverage ratio within a range of

2.5-3.0x net debt:adjusted EBITDA to maintain an investment grade

credit rating. Having already returned $500m of surplus capital via

the 2022 programme and $750m which is being returned over the

course of 2023, the highly cash generative nature of our business

model means we expect to have significant ongoing capacity to

return further surplus capital to shareholders, both in the

ordinary course and as we look to move leverage into our target

range over time. The Board’s next assessment in relation to

the amounts, mechanisms and timings of future capital returns will

be carried out in early 2024, taking into account macro-economic

conditions and the trading outlook at that time. Our next capital

allocation update will therefore be communicated as part of the

2023 Full Year Results to be announced on Tuesday 20 February

2024.

For further information, please contact:

Investor

Relations: Stuart Ford (+44 (0)7823 828 739);

Aleksandar Milenkovic (+44 (0)7469 905 720); Joe Simpson (+44

(0)7976 862 072)

Media Relations: Neil Maidment (+44

(0)7970 668 250); Mike Ward (+44 (0)7795 257

407)

Conference

call for analysts and institutional shareholders:

Elie

Maalouf, Chief Executive Officer, and Michael Glover, Chief

Financial Officer, will host a call commencing at 9:00am (London

time) on 20 October. The live listen-only audio webcast can be

accessed directly at https://www.investis-live.com/ihg/65083b4e6dedf60c006bf2d6/xowlw

or via www.ihgplc.com/en/investors/results-and-presentations.

Analysts

and institutional shareholders wishing to ask questions should use

the following dial-in details for a Q&A facility:

|

UK

local:

|

0207

107 0613

|

|

US

local:

|

631 570

5613

|

|

Other

international numbers:

|

Click

here

|

|

Passcode:

|

42 73

27 07

|

An

audio replay will also be available for 7 days using the following

details:

|

UK

local:

|

0203

608 8021

|

|

US

local:

|

412 317

0088

|

|

Other

locations:

|

+44 203

608 8021

|

|

Passcode:

|

20 23

03 54#

|

Website:

The

full release and supplementary data will be available on our

website from 7:00am (London time) on 20 October. The web address is

www.ihgplc.com/en/investors/results-and-presentations.

About IHG Hotels & Resorts:

IHG Hotels & Resorts [LON:IHG, NYSE:IHG (ADRs)] is a

global hospitality company, with a purpose to provide True

Hospitality for Good.

With a

family of 19 hotel brands and IHG One

Rewards, one of the world’s largest hotel loyalty

programmes, IHG has over 6,200 open hotels in more than 100

countries, and nearly 2,000 in the development

pipeline.

-

Luxury & Lifestyle: Six Senses Hotels

Resorts Spas, Regent Hotels &

Resorts, InterContinental

Hotels & Resorts, Vignette

Collection, Kimpton Hotels &

Restaurants, Hotel

Indigo

-

Premium: voco

hotels,

HUALUXE

Hotels & Resorts, Crowne

Plaza Hotels

& Resorts,

EVEN

Hotels

-

Essentials: Holiday Inn Hotels

& Resorts, Holiday Inn

Express, Garner

hotels, avid

hotels

-

Suites: Atwell Suites,

Staybridge

Suites, Holiday Inn Club

Vacations, Candlewood

Suites

-

Exclusive Partners: Iberostar Beachfront

Resorts

InterContinental

Hotels Group PLC is the Group’s holding company and is

incorporated and registered in England and Wales. Approximately

345,000 people work across IHG’s hotels and corporate offices

globally.

Visit

us online for more about our hotels and

reservations and IHG One

Rewards. To download the IHG One Rewards app, visit the

Apple

App or

Google

Play stores.

For our

latest news, visit our Newsroom and

follow us on LinkedIn.

Appendix 1: RevPARa movement summary at

constant exchange rates (CER)

|

|

Q3 2023 vs 2022

|

Q3 2023 vs 2019

|

|

|

RevPAR

|

ADR

|

Occupancy

|

RevPAR

|

ADR

|

Occupancy

|

|

Group

|

10.5%

|

4.1%

|

4.1%pts

|

12.8%

|

14.8%

|

(1.3)%pts

|

|

Americas

|

4.1%

|

3.1%

|

0.7%pts

|

13.8%

|

14.8%

|

(0.6)%pts

|

|

EMEAA

|

15.9%

|

8.6%

|

4.7%pts

|

17.5%

|

23.9%

|

(4.0)%pts

|

|

Greater

China

|

43.2%

|

13.0%

|

14.1%pts

|

9.3%

|

5.6%

|

2.3%pts

|

|

|

Q3 YTD 2023 vs 2022

|

Q3 YTD 2023 vs 2019

|

|

|

RevPAR

|

ADR

|

Occupancy

|

RevPAR

|

ADR

|

Occupancy

|

|

Group

|

18.9%

|

6.1%

|

7.4%pts

|

10.2%

|

12.2%

|

(1.3)%pts

|

|

Americas

|

8.7%

|

5.0%

|

2.4%pts

|

12.6%

|

12.7%

|

0.0%pts

|

|

EMEAA

|

31.0%

|

12.8%

|

9.7%pts

|

14.1%

|

20.9%

|

(4.1)%pts

|

|

Greater

China

|

71.3%

|

17.4%

|

19.4%pts

|

0.8%

|

(0.5)%

|

0.8%pts

|

Appendix 2: RevPARa movement at CER vs

actual exchange rates (AER)

|

|

Q3 2023 vs 2022

|

Q3 2023 vs 2019

|

|

|

CER (as above)

|

AER

|

Difference

|

CER (as above)

|

AER

|

Difference

|

|

Group

|

10.5%

|

11.0%

|

0.5%pts

|

12.8%

|

10.3%

|

(2.5)%pts

|

|

Americas

|

4.1%

|

4.4%

|

0.3%pts

|

13.8%

|

13.6%

|

(0.2)%pts

|

|

EMEAA

|

15.9%

|

19.1%

|

3.2%pts

|

17.5%

|

10.4%

|

(7.1)%pts

|

|

Greater

China

|

43.2%

|

35.5%

|

(7.7)%pts

|

9.3%

|

6.1%

|

(3.2)%pts

|

|

|

Q3 YTD 2023 vs 2022

|

Q3 YTD 2023 vs 2019

|

|

|

CER (as above)

|

AER

|

Difference

|

CER (as above)

|

AER

|

Difference

|

|

Group

|

18.9%

|

18.3%

|

(0.6)%pts

|

10.2%

|

7.6%

|

(2.6)%pts

|

|

Americas

|

8.7%

|

8.8%

|

0.1%pts

|

12.6%

|

12.2%

|

(0.4)%pts

|

|

EMEAA

|

31.0%

|

30.0%

|

(1.0)%pts

|

14.1%

|

6.9%

|

(7.2)%pts

|

|

Greater

China

|

71.3%

|

61.9%

|

(9.4)%pts

|

0.8%

|

(1.4)%

|

(2.2)%pts

|

Appendix 3: Monthly RevPARa (CER)

|

2023 vs 2022

|

Jan

|

Feb

|

Mar

|

Apr

|

May

|

Jun

|

Jul

|

Aug

|

Sep

|

|

Group

|

40.8%

|

33.5%

|

27.2%

|

21.7%

|

17.0%

|

13.3%

|

9.5%

|

10.4%

|

11.6%

|

|

Americas

|

24.5%

|

18.3%

|

13.8%

|

5.9%

|

6.9%

|

4.7%

|

2.8%

|

3.9%

|

5.7%

|

|

EMEAA

|

84.0%

|

71.9%

|

44.5%

|

36.7%

|

24.2%

|

22.7%

|

16.1%

|

16.1%

|

15.7%

|

|

Greater

China

|

53.3%

|

54.2%

|

125.2%

|

171.4%

|

106.9%

|

68.4%

|

40.5%

|

38.5%

|

54.2%

|

|

2023 vs 2019

|

Jan

|

Feb

|

Mar

|

Apr

|

May

|

Jun

|

Jul

|

Aug

|

Sep

|

|

Group

|

4.2%

|

6.7%

|

9.2%

|

9.5%

|

9.3%

|

10.9%

|

12.8%

|

11.1%

|

14.5%

|

|

Americas

|

8.8%

|

11.0%

|

13.1%

|

11.5%

|

11.8%

|

13.0%

|

12.5%

|

10.9%

|

18.2%

|

|

EMEAA

|

8.2%

|

7.7%

|

13.0%

|

12.6%

|

15.6%

|

16.7%

|

19.0%

|

17.0%

|

16.6%

|

|

Greater

China

|

(16.6)%

|

(3.8)%

|

(6.6)%

|

5.0%

|

(6.4)%

|

(0.1)%

|

14.0%

|

9.3%

|

3.3%

|

Appendix 4: System and pipeline summary of Q3 2023 YTD and YOY

growths, and closing positions (rooms)

|

|

System

|

Pipeline

|

|

|

Openings

|

Removals

|

Net

|

Total

|

YTD%

|

YOY%

|

Signings

|

Total

|

|

Group

|

28,688

|

(10,328)

|

18,360

|

929,987

|

+2.0%

|

+4.7%

|

50,940

|

292,467

|

|

Americas

|

6,210

|

(4,744)

|

1,466

|

516,962

|

+0.3%

|

+2.9%

|

18,416

|

106,788

|

|

EMEAA

|

14,372

|

(2,898)

|

11,474

|

241,138

|

+5.0%

|

+8.4%

|

14,766

|

79,256

|

|

Greater

China

|

8,106

|

(2,686)

|

5,420

|

171,887

|

+3.3%

|

+5.5%

|

17,758

|

106,423

|

a.

RevPAR (revenue per

available room), ADR (average daily rate) and occupancy are on a

comparable basis, based on comparability as at 30 September 2023

and includes hotels that have traded in all months in both the

current and the prior year. This same group of hotels is also used

to compare RevPAR performance for 2023 vs 2019. The principal

exclusions in deriving these measures are new openings, properties

under major refurbishments and removals. See ‘Use of key

performance measures and non-GAAP measures’ in IHG’s

full year and half year results announcements for further

information on the definitions.

Cautionary

note regarding forward-looking statements:

This

announcement contains certain forward-looking statements as defined

under United States law (Section 21E of the Securities Exchange Act

of 1934) and otherwise. These forward-looking statements can be

identified by the fact that they do not relate only to historical

or current facts. Forward-looking statements often use words such

as ‘anticipate’, ‘target’,

‘expect’, ‘estimate’, ‘intend’,

‘plan’, ‘goal’, ‘believe’ or

other words of similar meaning. These statements are based on

assumptions and assessments made by InterContinental Hotels Group

PLC’s management in light of their experience and their

perception of historical trends, current conditions, expected

future developments and other factors they believe to be

appropriate. By their nature, forward-looking statements are

inherently predictive, speculative and involve risk and

uncertainty. There are a number of factors that could cause actual

results and developments to differ materially from those expressed

in or implied by, such forward-looking statements. The main factors

that could affect the business and the financial results are

described in the ‘Risk Factors’ section in the current

InterContinental Hotels Group PLC’s Annual report and Form

20-F filed with the United States Securities and Exchange

Commission.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

|

InterContinental Hotels Group PLC

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/ C. Lindsay

|

|

|

Name:

|

C.

LINDSAY

|

|

|

Title:

|

SENIOR

ASSISTANT COMPANY SECRETARY

|

|

|

|

|

|

|

Date:

|

20

October 2023

|

|

|

|

|

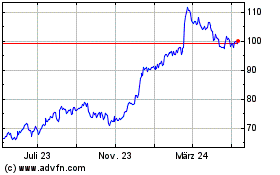

InterContinental Hotels (NYSE:IHG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

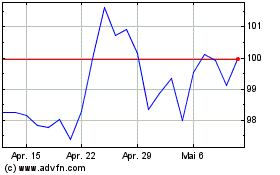

InterContinental Hotels (NYSE:IHG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024