0001862935

false

0001862935

2023-08-07

2023-08-07

0001862935

IFIN:UnitsEachConsistingOfOneClassOrdinarySharesAndOnehalfOfOneWarrantMember

2023-08-07

2023-08-07

0001862935

IFIN:ClassOrdinarySharesParValue0.0001PerShareMember

2023-08-07

2023-08-07

0001862935

IFIN:WarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member

2023-08-07

2023-08-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): August 7, 2023

INFINT

ACQUISITION CORPORATION

(Exact name of registrant as specified in its charter)

| Cayman

Islands |

|

001-41079

|

|

98-1602649 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

32

Broadway, Suite 401

New York, NY |

|

10004 |

| (Address of principal executive

offices) |

|

(Zip Code) |

(212)

287-5010

(Registrant’s telephone number, including area code)

Not

Applicable

(Former name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Units,

each consisting of one Class A ordinary shares and one-half of one Warrant |

|

IFIN.U |

|

The

New York Stock Exchange |

| |

|

|

|

|

| Class

A ordinary shares, par value $0.0001 per share |

|

IFIN |

|

The

New York Stock Exchange |

| |

|

|

|

|

| Warrants,

each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

IFIN.WS |

|

The

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

8.01. Other Events.

As

previously disclosed, INFINT Acquisition Corporation (“INFINT” or the “Company”) has called an

extraordinary general meeting of shareholders of the Company to be held at 12:00 p.m. Eastern Time on August 18, 2023 (the “Extraordinary

Meeting”) for the sole purpose of considering and voting on, among other proposals, (i) a proposal to approve, by way of special

resolution, an amendment to INFINT’s Second Amended and Restated Memorandum and Articles of Association (the “Charter”)

to extend the date by which INFINT has to consummate an initial business combination (the “Extension”) from August

23, 2023 (the “Current Termination Date”) to February 23, 2024 or such earlier date as may be determined by INFINT’s

board of directors (such date, the “Extension Date”, and such proposal, the “Extension Proposal”)

and (ii) a proposal to approve the adjournment of the Extraordinary Meeting to a later date or dates, if necessary, to permit further

solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of

the Extension Proposal (the “Adjournment Proposal”), which will only be presented at the Extraordinary Meeting if,

based on the tabulated votes, there are not sufficient votes at the time of the Extraordinary Meeting to approve the Extension Proposal,

in which case the Adjournment Proposal will be the only proposal presented at the Extraordinary Meeting. Each such proposal is described

in more detail in the definitive proxy statement related to the Extraordinary Meeting filed by the Company with the Securities and Exchange

Commission (the “SEC”) on August 2, 2023 (the “Definitive Proxy Statement”).

On

August 7, 2023, the Company issued a press release announcing that if the requisite shareholder proposals are approved at the Extraordinary

Meeting and the Extension is implemented, on the Current Termination Date, and the 23rd day of each subsequent calendar month until the

Extension Date, the lesser of (x) $160,000 and (y) $0.04 per public share multiplied by the number of public shares outstanding on such

applicable date (each date on which a Contribution is to be deposited into the trust account, a “Contribution Date”)

will be deposited into the Company’s trust account (a “Contribution”).

If

a Contribution is not made by an applicable Contribution Date, the Company will liquidate and dissolve as soon as practicable after such

date and in accordance with the Company’s Amended and Restated Memorandum and Articles of Association, as amended. Any Contribution

is conditioned on the approval of the requisite shareholder proposals at the Extraordinary Meeting and the implementation of the Extension.

No Contribution will occur if such proposals are not approved or the Extension is not implemented. If the Company has consummated an

initial business combination or announced its intention to commence winding up prior to any Contribution Date, any obligation to make

Contributions will terminate.

The

Company expects that the proceeds held in the trust account will continue to be invested in United States government treasury bills with

a maturity of 185 days or less or in money market funds investing solely in U.S. Treasuries and meeting certain conditions under Rule

2a-7 under the Investment Company Act of 1940, as amended, as determined by the Company, or in an interest bearing demand deposit account,

until the earlier of: (i) the completion of the Company’s initial business combination, and (ii) the liquidation of, and distribution

of the proceeds from, the trust account.

As

previously disclosed, on August 3, 2022, INFINT entered into a definitive business combination agreement with Seamless Group Inc., a

Cayman Islands exempted company and a global fintech platform, and FINTECH Merger Sub Corp., a Cayman Islands exempted company and a

wholly owned subsidiary of INFINT. On February 20, 2023, the parties entered into an amendment to the Business Combination Agreement,

which was amended on October 20, 2022 and November 29, 2022, as described in the Company’s Current Reports on Form 8-K filed with

the SEC on February 23, 2023.

A

copy of the accompanying press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

Forward

Looking Statements

This

Current Report on Form 8-K includes “forward-looking statements” within the meaning of the safe harbor provisions of the

United States Private Securities Litigation Reform Act of 1995. Certain of these forward-looking statements can be identified by the

use of words such as “believes,” “expects,” “intends,” “plans,” “estimates,”

“assumes,” “may,” “should,” “will,” “seeks,” or other similar expressions.

Such statements may include, but are not limited to, statements regarding the approval of certain shareholder proposals at the Extraordinary

Meeting, the implementation of the Extension or any Contributions to the trust account. These statements are based on current expectations

on the date of this Current Report on Form 8-K and involve a number of risks and uncertainties that may cause actual results to differ

significantly, including those risks set forth in the Definitive Proxy Statement, the Company’s most recent Annual Report on Form

10-K and subsequent Quarterly Reports on Form 10-Q and other documents filed with the SEC. Copies of such filings are available on the

SEC’s website at www.sec.gov. The Company does not assume any obligation to update or revise any such forward-looking statements,

whether as the result of new developments or otherwise. Readers are cautioned not to put undue reliance on forward-looking statements.

Additional

Information and Where to Find It

The

Definitive Proxy Statement has been mailed to the Company’s shareholders of record as of the record date for the Extraordinary

Meeting. Investors and security holders of the Company are advised to read the Definitive Proxy Statement because it contains important

information about the Extraordinary Meeting and the Company. Investors and security holders of the Company may also obtain a copy of

the Definitive Proxy Statement, as well as other relevant documents that have been or will be filed by the Company with the SEC, without

charge and once available, at the SEC’s website at www.sec.gov. or by directing a request to: Morrow Sodali LLC, 333 Ludlow Street,

5th Floor, South Tower, Stamford, CT; email: IFIN.info@investor.morrowsodali.com.

Participants

in the Solicitation

The

Company and certain of its directors and executive officers and other persons may be deemed to be participants in the solicitation of

proxies from the Company’s shareholders in respect of the proposals to be considered and voted on at the Extraordinary Meeting.

Information concerning the interests of the directors and executive officers of the Company is set forth in the Definitive Proxy Statement,

which may be obtained free of charge from the sources indicated above.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| INFINT ACQUISITION

CORPORATION |

|

| |

|

|

| By: |

/s/

Alexander Edgarov |

|

| Name: |

Alexander Edgarov |

|

| Title: |

Chief Executive Officer |

|

Date:

August 7, 2023

Exhibit

99.1

INFINT

ACQUISITION CORPORATION ANNOUNCES CONTRIBUTION TO TRUST ACCOUNT IN CONNECTION WITH PROPOSED EXTENSION

New

York, NY, August 7, 2023 — INFINT Acquisition Corporation (NYSE: IFIN, IFIN.WS) (“INFINT” or the “Company”)

announced today that, in connection with its previously announced extraordinary general meeting of shareholders of the Company to be

held at 12:00 p.m. Eastern Time on August 18, 2023 (the “Extraordinary Meeting”) for the purpose of considering and

voting on, among other proposals, a proposal to extend the date by which the Company must consummate an initial business combination

(the “Extension”) from August 23, 2023 (the “Current Termination Date”) to February 23, 2024 or

such earlier date as may be determined by the Company’s board of directors, in its sole discretion (such later date, the “Extension

Date”), additional contributions to the Company’s trust account will be made following the approval and implementation

of the Extension.

If

the requisite shareholder proposals are approved at the Extraordinary Meeting and the Extension is implemented, on the Current Termination

Date, and the 23rd day of each subsequent calendar month until the Extension Date, the lesser of (x) $160,000 and (y) $0.04 per public

share multiplied by the number of public shares outstanding on such applicable date (each date on which a Contribution is to be deposited

into the trust account, a “Contribution Date”) will be deposited into the Company’s trust account (a “Contribution”).

If

a Contribution is not made by an applicable Contribution Date, the Company will liquidate and dissolve as soon as practicable after such

date and in accordance with the Company’s Amended and Restated Memorandum and Articles of Association, as amended. Any Contribution

is conditioned on the approval of the requisite shareholder proposals at the Extraordinary Meeting and the implementation of the Extension.

No Contribution will occur if such proposals are not approved or the Extension is not implemented. If the Company has consummated an

initial business combination or announced its intention to commence winding up prior to any Contribution Date, any obligation to make

Contributions will terminate.

The

Company expects that the proceeds held in the trust account will continue to be invested in United States government treasury bills with

a maturity of 185 days or less or in money market funds investing solely in U.S. Treasuries and meeting certain conditions under Rule

2a-7 under the Investment Company Act of 1940, as amended, as determined by the Company, or in an interest bearing demand deposit account,

until the earlier of: (i) the completion of the Company’s initial business combination, and (ii) the liquidation of, and distribution

of the proceeds from, the trust account.

Further

information related to attendance, voting and the proposals to be considered and voted on at the Extraordinary Meeting is described in

the definitive proxy statement related to the Extraordinary Meeting filed by the Company with the Securities and Exchange Commission

(the “SEC”) on August 2, 2023(the “Definitive Proxy Statement”).

About

INFINT Acquisition Corporation

INFINT

Acquisition Corporation is a Special Purpose Acquisition Corporation (SPAC) company on a mission to bring the most promising financial

technology company from North America, Asia, Latin America, Europe and Israel to the U.S. public market. As a result of the pandemic,

the world is changing rapidly, and in unique, unexpected ways. Thanks to growth and investment in the global digital infrastructure,

legal, healthcare, automotive, financial, and other fields are evolving at a faster rate than ever before. INFINT believes the greatest

opportunities in the near future lie in the global fintech space and are looking forward to merging with an exceptional international

fintech company. On August 3, 2022, INFINT entered into a definitive business combination agreement with Seamless Group Inc., a Cayman

Islands exempted company and a global fintech platform, and FINTECH Merger Sub Corp., a Cayman Islands exempted company and a wholly

owned subsidiary of INFINT.

Forward

Looking Statements

This

press release includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995. Certain of these forward-looking statements can be identified by the use of words such

as “believes,” “expects,” “intends,” “plans,” “estimates,” “assumes,”

“may,” “should,” “will,” “seeks,” or other similar expressions. Such statements may include,

but are not limited to, statements regarding the approval of certain shareholder proposals at the Extraordinary Meeting, the implementation

of the Extension or any Contributions to the trust account. These statements are based on current expectations on the date of this press

release and involve a number of risks and uncertainties that may cause actual results to differ significantly, including those risks

set forth in the Definitive Proxy Statement, the Company’s most recent Annual Report on Form 10-K and subsequent Quarterly Reports

on Form 10-Q and other documents filed with the SEC. Copies of such filings are available on the SEC’s website at www.sec.gov.

The Company does not assume any obligation to update or revise any such forward-looking statements, whether as the result of new developments

or otherwise. Readers are cautioned not to put undue reliance on forward-looking statements.

Additional

Information and Where to Find It

The

Definitive Proxy Statement has been mailed to the Company’s shareholders of record as of the record date for the Extraordinary

Meeting. Investors and security holders of the Company are advised to read the Definitive Proxy Statement because it contains important

information about the Extraordinary Meeting and the Company. Investors and security holders of the Company may also obtain a copy of

the Definitive Proxy Statement, as well as other relevant documents that have been or will be filed by the Company with the SEC, without

charge and once available, at the SEC’s website at www.sec.gov or by directing a request to: Morrow Sodali LLC, 333 Ludlow Street,

5th Floor, South Tower, Stamford, CT; email: IFIN.info@investor.morrowsodali.com.

Participants

in the Solicitation

The

Company and certain of its directors and executive officers and other persons may be deemed to be participants in the solicitation of

proxies from the Company’s shareholders in respect of the proposals to be considered and voted on at the Extraordinary Meeting.

Information concerning the interests of the directors and executive officers of the Company is set forth in the Definitive Proxy Statement,

which may be obtained free of charge from the sources indicated above.

Contacts

Alexander

Edgarov, INFINT Acquisition Corporation– sasha@infintspac.com

v3.23.2

Cover

|

Aug. 07, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 07, 2023

|

| Entity File Number |

001-41079

|

| Entity Registrant Name |

INFINT

ACQUISITION CORPORATION

|

| Entity Central Index Key |

0001862935

|

| Entity Tax Identification Number |

98-1602649

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

32

Broadway

|

| Entity Address, Address Line Two |

Suite 401

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10004

|

| City Area Code |

(212)

|

| Local Phone Number |

287-5010

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A ordinary shares and one-half of one Warrant |

|

| Title of 12(b) Security |

Units,

each consisting of one Class A ordinary shares and one-half of one Warrant

|

| Trading Symbol |

IFIN.U

|

| Security Exchange Name |

NYSE

|

| Class A ordinary shares, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class

A ordinary shares, par value $0.0001 per share

|

| Trading Symbol |

IFIN

|

| Security Exchange Name |

NYSE

|

| Warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Warrants,

each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50

|

| Trading Symbol |

IFIN.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=IFIN_UnitsEachConsistingOfOneClassOrdinarySharesAndOnehalfOfOneWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=IFIN_ClassOrdinarySharesParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=IFIN_WarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

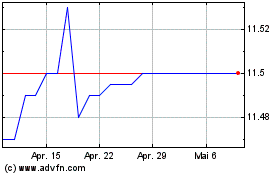

InFinT Acquisition (NYSE:IFIN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

InFinT Acquisition (NYSE:IFIN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024